- Includes Phase 3 product candidate APL-130277

in development for OFF episodes associated with Parkinson’s disease

-

- Complements Sunovion’s robust portfolio and

expands the Company’s leadership in treatments for central nervous

system disorders -

Sunovion Pharmaceuticals Inc. (Sunovion) and Cynapsus

Therapeutics Inc. (Cynapsus) (NASDAQ: CYNA) (TSX: CTH) today

announced that the companies have signed a definitive agreement

under which Sunovion will acquire Cynapsus for US$40.50 per share

in cash. The transaction has received unanimous approval by the

Board of Directors of both companies and values Cynapsus at

approximately US$624 million (or approximately CAN$820 million).

The acquisition will be funded with cash on hand. The transaction

is expected to close in the fourth quarter of 2016 (third quarter

of Sunovion’s fiscal year). This agreement reflects Sunovion’s

global strategy to expand and diversify its portfolio in key

therapeutic areas, including neurology.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20160831006494/en/

Through this transaction, Sunovion would acquire Cynapsus’

product candidate, APL-130277, which is designed to be a

fast-acting, easy-to-use, on-demand treatment option for managing

OFF episodes associated with Parkinson’s disease (PD).

“Parkinson’s disease is a chronic, progressive neurodegenerative

disease that affects more than four million people around the

world, and there is a significant need for new options to treat the

OFF episodes associated with it,” said Nobuhiko Tamura, Chairman

and Chief Executive Officer, Sunovion. “We believe that APL-130277

is a novel late-stage candidate with the potential to make a real

difference for patients and their families.”

“The acquisition of Cynapsus is well-aligned with Sunovion’s

focus on the innovative application of science and medicine to help

people with serious medical conditions and complements our robust

product pipeline,” added Mr. Tamura. “We have high regard for the

Cynapsus team and their work with the APL-130277 program.”

“With its leadership in therapies for central nervous system

disorders and commercial experience specific to neurology, we

believe Sunovion is best suited to advance APL-130277 in the United

States and other key markets,” said Anthony J. Giovinazzo,

President and CEO, Cynapsus. “This transaction culminates years of

dedicated work by the Cynapsus team and represents significant

value creation for our securityholders.”

The board of directors of Cynapsus, after consultation with its

financial and legal advisors and based, in part, upon the unanimous

recommendation of an independent special committee of the board of

directors, has determined that the arrangement is in the best

interest of Cynapsus and the consideration to be received by

shareholders of Cynapsus is fair to such shareholders. The board of

directors unanimously recommends that Cynapsus shareholders and

warrantholders vote in favour of the transaction at a special

meeting expected to be held on or about October 13, 2016.

The proposed sale of Cynapsus follows a full consideration of

alternatives aimed at optimizing shareholder value for the company.

“We believe that the proposed transaction with Sunovion results in

the best outcome for our shareholders,” said Rochelle Stenzler,

chair of the board of Cynapsus. “The transaction with Sunovion

represents a significant premium to the current share price and we

are recommending that our shareholders and warrantholders vote in

favour of the transaction.”

Pursuant to the terms of the definitive agreement, upon closing

of the proposed transaction, shareholders of Cynapsus will receive

US$40.50 per common share in cash, and holders of warrants and

stock options will receive a cash payment equal to the difference

between US$40.50 and the exercise price of such warrant or stock

option. The offer of US$40.50 per common share in cash represents a

premium of 123 percent based on the volume weighted average closing

price of Cynapsus’ common shares on the NASDAQ Global Market for

the last twenty trading days. The companies expect to close the

transaction following required securityholder, court and regulatory

approvals and satisfaction of certain other customary closing

conditions.

The transaction will be completed by way of a plan of

arrangement under the Canada Business Corporations Act. The

arrangement will require approval of at least two-thirds of the

votes cast by Cynapsus shareholders and warrantholders voting

together as a single class at a special meeting of such

securityholders of Cynapsus. Voting and Support Agreements in

support of the transaction have been signed by all directors and

officers of Cynapsus and the company’s largest shareholder

representing in the aggregate, approximately 18.33 percent of the

Cynapsus securities entitled to vote to approve the

transaction.

Full details of the transaction will be included in the

management information circular to be filed with the applicable

securities regulatory authorities and mailed to Cynapsus

shareholders and warrant holders within approximately two weeks.

Assuming receipt of all required regulatory approvals, the parties

expect to close the arrangement in the fourth quarter of 2016.

BofA Merrill Lynch serves as financial advisor, and Borden

Ladner Gervais LLP and Troutman Sanders LLP serve as legal advisors

to Cynapsus. Stifel, Nicolaus & Company, Incorporated serves as

financial advisor and Fasken Martineau DuMoulin LLP serves as a

legal advisor to the Special Committee of Cynapsus. Nomura

Securities International, Inc. serves as exclusive financial

advisor, and Goodmans LLP, Reed Smith LLP, and Gibbons PC serve as

legal advisors to Sunovion.

Adagio Amending AgreementCynapsus and the former

shareholders of Adagio Pharmaceuticals Ltd. (“Adagio”) entered into

a share purchase agreement dated as of December 22, 2011, as

subsequently amended as of January 28, 2015 (the “Share Purchase

Agreement”), pursuant to which Cynapsus acquired Adagio.

Cynapsus and the former shareholders of Adagio have amended the

Share Purchase Agreement to provide, among other things, that if a

change of control of Cynapsus, which would include the transaction

with Sunovion, occurs before the successful completion and the

first public announcement of the top-line data of the Final Safety

Study (as defined in the Share Purchase Agreement), the

CDN$2,500,000 of the purchase price still potentially payable to

the former shareholders of Adagio shall be paid in cash (not common

shares, as was originally contemplated in the Share Purchase

Agreement) by Cynapsus, on the date on which the change of control

transaction is completed.

As Anthony Giovinazzo, President and Chief Executive Officer of

Cynapsus, is also a director, officer and majority shareholder of

Adagio, the amendment of the Share Purchase Agreement constitutes a

related party transaction pursuant to Multilateral Instrument

61-101 and the policies of the TSX. The amendment was necessary,

and appropriate, as it ensures that if Sunovion acquires all of the

common shares of Cynapsus, it would not have an obligation to

potentially issue shares to the former Adagio shareholders

post-closing of such acquisition. The amendment was entered into at

the same time as the arrangement agreement with Sunovion and

therefore was not announced more than 21 days before its

execution.

About APL-130277APL-130277, a novel formulation of

apomorphine, a dopamine agonist, is being developed as a

fast-acting, easy-to-use, sublingual thin film for the on-demand

management of debilitating OFF episodes associated with Parkinson’s

disease. Apomorphine is the only molecule approved for acute,

intermittent treatment of OFF episodes for advanced PD patients,

but is currently only approved as a subcutaneous injection in the

United States. APL-130277 is designed to rapidly, safely and

reliably convert a PD patient from the OFF to the ON state while

avoiding many of the issues associated with subcutaneous delivery

of apomorphine. It has been studied in all types of OFF episodes,

including morning OFF episodes. APL-130277 is in Phase 3 clinical

trials and has not been approved by the U.S. Food and Drug

Administration (FDA).

In the ongoing Phase 3 trial, CTH-300, the blinded safety data

was corroborated by the DSMB findings, which were announced in the

press release dated August 15, 2016. If the ongoing pivotal Phase 3

clinical trials are successful, it is expected that a New Drug

Application (NDA) for APL-130277 will be submitted to the U.S. Food

and Drug Administration (FDA) during the first half of 2017 under

the abbreviated Section 505(b)(2) regulatory pathway. A pivotal

European clinical program evaluating the safety and efficacy of

APL-130277 in PD patients is expected to be initiated in the fourth

quarter of 2016.

About Parkinson’s Disease and OFF EpisodesMore than 1

million people in the U.S. and an estimated 4 to 6 million people

worldwide suffer from PD. The European Parkinson's disease

Association estimates that 1.2 million people have PD in the

European Union. PD is a chronic, progressive neurodegenerative

disease characterized by motor symptoms, including tremor at rest,

rigidity and impaired movement, as well as significant non-motor

symptoms, including cognitive impairment and mood disorders. It is

the second most common neurodegenerative disease behind Alzheimer’s

disease, and PD’s prevalence is increasing with the aging of the

population. OFF episodes are a complication of the disease. Up

to 40 percent of all people with PD whose symptoms are otherwise

managed with ongoing drug therapy experience OFF episodes at least

once daily and up to six times daily, with each episode typically

lasting between 30 and 120 minutes.1,2

About Sunovion Pharmaceuticals Inc. (Sunovion)Sunovion is

a global biopharmaceutical company focused on the innovative

application of science and medicine to help people with serious

medical conditions. Sunovion’s spirit of innovation is driven by

the conviction that scientific excellence paired with meaningful

advocacy and relevant education can improve lives. The Company has

charted new paths to life-transforming treatments that reflect

ongoing investments in research and development and an unwavering

commitment to support people with psychiatric, neurological, and

respiratory conditions. Sunovion’s track record of discovery,

development and commercialization of important therapies has

included Brovana® (arformoterol tartrate), Latuda® (lurasidone

HCI), and most recently Aptiom® (eslicarbazepine acetate).

Headquartered in Marlborough, Mass. Sunovion is an indirect,

wholly owned subsidiary of Sumitomo Dainippon Pharma Co., Ltd.

Sunovion Pharmaceuticals Europe Ltd., based in London, England, and

Sunovion Pharmaceuticals Canada Inc., based in Mississauga,

Ontario, are wholly-owned direct subsidiaries of Sunovion

Pharmaceuticals Inc. Additional information can be found on the

Company’s web sites: www.sunovion.com, www.sunovion.eu and

www.sunovion.ca. Connect with Sunovion on Twitter @Sunovion and

LinkedIn.

About Sumitomo Dainippon Pharma Co., Ltd.Sumitomo

Dainippon Pharma is among the top-ten listed pharmaceutical

companies in Japan operating globally in major pharmaceutical

markets, including Japan, the United States, China and the European

Union. Sumitomo Dainippon Pharma aims to create innovative

pharmaceutical products in the Psychiatry & Neurology area and

the Oncology area, which have been designated as the focus

therapeutic areas. Sumitomo Dainippon Pharma is based on the merger

in 2005 between Dainippon Pharmaceutical Co., Ltd., and Sumitomo

Pharmaceuticals Co., Ltd. Today, Sumitomo Dainippon Pharma has

about 7,000 employees worldwide. Additional information about

Sumitomo Dainippon Pharma is available through its corporate

website at www.ds-pharma.com.

BROVANA is a registered trademark of Sunovion Pharmaceuticals

Inc.LATUDA is a registered trademark of Sumitomo Dainippon Pharma

Co., Ltd.APTIOM is used under license from BIAL.

Sunovion Pharmaceuticals Inc. is a U.S. subsidiary of Sumitomo

Dainippon Pharma Co., Ltd.© 2016 Sunovion Pharmaceuticals Inc.

Sunovion Forward-Looking StatementThis press release

includes forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995 that are subject

to risks, uncertainties and other factors. All statements other

than statements of historical fact are statements that could be

deemed forward-looking statements, including all statements

regarding the intent, belief or current expectation of the

companies' and members of their senior management team.

Forward-looking statements include, without limitation statement

associated with the following: the timing of the closing of

Sunovion’s acquisition of Cynapsus; Sunovion’s ability to expand

and diversify its portfolio in key therapeutic areas, including

neurology; APL-130277’s ability to be a fast-acting, easy-to-use,

on-demand treatment option for managing OFF episodes associated

with Parkinson’s disease (PD) or make a real difference for

patients and their families; Sunovion’s ability to advance

APL-130277 in the United States and other key markets; whether the

transaction will result in the best outcome for Cynapsus’

shareholders; the parties’ ability to receive the required

securityholder, court and regulatory approvals, satisfy other

customary closing conditions and close the transaction; whether

APL-130277 will be the first treatment for OFF episodes associated

with PD that is administered sublingually (under the tongue);

whether APL-130277 will avoid many of the issues associated with

the currently available injectable formulation; whether APL-130277

will be easier for patients and caregivers to use; the timing of

the data from the ongoing Cynapsus pivotal Phase 3 clinical trials;

the potential success of the trials and the timing of a New Drug

Application (NDA) for APL-130277, if any, to the U.S. Food and Drug

Administration (FDA) during the first half of 2017 under the

abbreviated Section 505(b)(2) regulatory pathway; the timing of a

pivotal European clinical program evaluating the safety and

efficacy of APL-130277 in PD patients; the timing and content of

the details of the transaction included in the management

information circular to be filed with the securities regulatory

authorities and mailed to Cynapsus shareholders and warrant holders

in advance of the special meeting; the ability to receive all

required regulatory approvals, and the ability of the parties to

close the arrangement in the fourth quarter of 2016. Investors are

cautioned that any such forward-looking statements are not

guarantees of future performance and involve risks and

uncertainties and are cautioned not to place undue reliance on

these forward-looking statements. Actual results may differ

materially from those currently anticipated due to a number of

risks and uncertainties. Risks and uncertainties that could cause

the actual results to differ from expectations contemplated by

forward-looking statements include: the effects of the transaction

on relationships with employees, customers, other business partners

or governmental entities; other business effects, including the

effects of industry, economic or political conditions outside of

the companies' control; actual or contingent liabilities; and other

risks and uncertainties detailed by Sunovion’s parent company

Sumitomo Dainippon Pharma in the Summary of Consolidated Financial

Results [Japanese GAAP] (Unaudited) for quarterly earnings. All

forward-looking statements are based on information currently

available to Sunovion, and Sunovion assumes no obligation to update

any such forward-looking statements.

About CynapsusCynapsus is a specialty central nervous

system pharmaceutical company that has been developing a

fast-acting, easy-to-use, sublingual thin film for the on-demand

management of debilitating OFF episodes associated with PD. For

additional company information, please visit

http://www.cynapsus.ca.

For more information about the Phase 3 studies, including

enrollment criteria, please visit the following

website: http://cth300and301trials.cynapsus.ca/

Cynapsus Forward-Looking StatementsThis press release

contains “forward-looking statements” within the meaning of

applicable securities laws, including, without limitation,

Cynapsus’s expectation for filing an NDA in the first half of 2017;

expectations regarding Cynapsus’s clinical and regulatory

activities, including the anticipated timing, completion and

results of Phase 3 and other clinical studies; beliefs related to

potential benefits, effectiveness and demand for, Cynapsus’s

product candidate; statements relating to the proposed acquisition

of Cynapsus, including (i) receipt of securityholder, court and

regulatory approvals of, and the satisfaction of other conditions

for, such transaction and (ii) the anticipated benefits, timing and

closing of such transaction; and beliefs regarding Sunovion’s

ability to advance APL-130277 in the United States and other

markets. These forward-looking statements include information about

possible or assumed future events or results of Cynapsus’s

business, products, plans and objectives. These forward-looking

statements are based on current expectations and beliefs and

inherently involve significant risks and uncertainties. Actual

results and the timing of events could differ from those

anticipated in such forward-looking statements as a result of risks

and uncertainties, and include, but are not limited to, shareholder

and warrantholder approval of the proposed transaction; Cynapsus’

ability to obtain court, regulatory and other approvals in

connection with the proposed transaction; uncertainties as to the

timing of the completion of the transaction, including that a

governmental entity may prohibit, delay or refuse to grant approval

for the consummation of the transaction and those factors

identified under the caption “Risk Factors” in Cynapsus’s Form 10-Q

for the quarter ended June 30, 2016 filed with the United States

Securities and Exchange Commission (the “SEC”) on August 10, 2016,

and its other filings and reports in the United States with the SEC

available on the SEC’s web site at www.sec.gov, and in Canada with

the various Canadian securities regulators, which are available

online at www.sedar.com. Furthermore, unless otherwise stated, the

forward-looking statements contained in this press release are made

as of the date of this press release, and Cynapsus has no intention

and undertakes no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events, changes or otherwise, except as required by law.

Additional Information and Where to Find ItFurther

information regarding the transaction will be contained in an

information circular that Cynapsus will prepare and mail to its

shareholders and warrantholders in connection with the Cynapsus

shareholders’ and warrantholders’ meeting, with closing expected to

occur in the fourth quarter of 2016. Cynapsus securityholders are

urged to read the information circular once it becomes available,

as it will contain important information concerning the proposed

transaction. Cynapsus securityholders may obtain a copy of the

arrangement agreement, information circular and other meeting

materials when they become available at http://www.sec.gov and

www.sedar.com.

This press release is for informational purposes only. It does

not constitute an offer to purchase securities of Cynapsus or a

solicitation or recommendation statement under the rules and

regulations of the SEC or other applicable United States laws.

1 Denny 1999 J Neurolog Sci, v165, p18-23, table 3.2 Schrag 2000

Brain v123, p2297-2305

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160831006494/en/

Sunovion Pharmaceuticals Inc.Patrick Gaffey,

508-787-4565Executive Director, Corporate

Communicationspatrick.gaffey@sunovion.comorCynapsus Therapeutics

Inc.Andrew Williams, 416-703-2449 x253COO &

CFOawilliams@cynapsus.ca

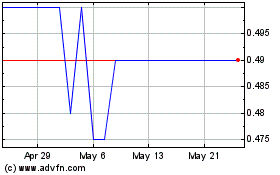

Cotec (TSXV:CTH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Cotec (TSXV:CTH)

Historical Stock Chart

From Feb 2024 to Feb 2025