CloudMD Software & Services Inc. (TSXV: DOC, OTCQX: DOCRF,

Frankfurt: 6PH) (the “

Company” or

“

CloudMD”), a healthcare technology company

revolutionizing the delivery of care, announced its financial

results for the second quarter ended June 30, 2022. All financial

information is presented in Canadian dollars unless otherwise

indicated.

“Our Q2 results reflect the strength of our core

Enterprise Health Solutions (“EHS”) business in the face of

headwinds and distractions from our non-core business and overhang

from previously made acquisitions. There is an incredible

opportunity for our EHS division as industry trends converge with

our differentiated product offering. We are taking the necessary

steps to enable the performance of our core business to shine,”

said Karen Adams, CEO of

CloudMD. We will continue to execute on

our strategic priorities of driving additional organic growth,

integrating and optimizing our cost structure, and achieving

financial sustainability and profitability with an emphasis on

prudent cash management.”

John Plunkett, CFO of CloudMD,

added, “As a team, we are focused on reaching

profitability and positive operating cash flow. We are taking steps

across the organization to align costs with each division’s revenue

and to divest non-core assets which will provide some near-term

capital. The team has made progress in cleaning up our cost

structure, balance sheet, and outstanding issues from past

transactions. We will continue to focus on further optimization for

the remainder of the year. There is work to be done, but I’m

encouraged by the steps taken to date and am pleased with the

organic growth that our EHS business is starting to generate which

will provide positive contributions in the second half of the

year.”

Second Quarter 2022 Financial Highlights

- Q2 2022 revenue was $40.3 million,

compared to $41.4 million in Q1 2022 and $15.7 million in Q2 2021.

The growth was driven by the five acquisitions completed since the

start of the second quarter of 2021, coupled with organic growth

and customer momentum within the EHS division. The Company’s Q2

revenue was impacted by one-time COVID contracts ending, which are

expected to be replaced moving forward.

- Q2 2022 gross profit margin was

31.0% compared to 32.5% Q1 2022 and 35.5% in the second quarter of

2021. The lower gross profit margin percentage was due to shift in

revenue mix and performance in the IDYA4 business which is expected

to return to a normal level in the third quarter.

- Adjusted EBITDA was negative $3.2

million in Q2 2022, compared to negative $1.6 million in Q1 2022

and a loss of $0.6 million in Q2 2021. Net loss in Q2 2022 was

$44.2 million or $0.15 per share, compared to a loss of $6.6

million or $0.03 per share in Q2 2021. The larger loss per share

was driven by a $33.0 million impairment of goodwill and $5.5

million of other non-recurring one-time costs.

- Cash and cash equivalents were

$29.7 million as of June 30, 2022, compared to $45.1 million on

December 31, 2021. Cash outflows4 in the second quarter were $17.2

million, which was unusually high for the Company. The normalized

cash outflows4 were $6.9 million. During the quarter the Company

incurred expenses related to restructuring costs, professional

fees, legal and settlements from past acquisitions.

________________________1 Gross margin is a non-GAAP financial

measure. Refer to the “Non-GAAP Financial Measures” section of this

news release for further information.2 Adjusted EBITDA is a

non-GAAP financial measure. Refer to the “Non-GAAP Financial

Measures” section of this news release for further information and

the “Selected Financial Information” section of this news release

for a detailed reconciliation to the most directly comparable

measure under IFRS.3 Net new lives include employees and dependants

as per industry standards.4 Cash outflow and Normalized cash

outflow are a non-GAAP financial measures. Refer to the “Non-GAAP

Financial Measures” section of this news release for further

information and the “Selected Financial Information” section of

this news release for a detailed reconciliation to the most

directly comparable measure under IFRS.

Second Quarter & Subsequent

Corporate Highlights

- On May 26, 2022, the Company

announced the launch of Kii, Personalized & Connected Care, the

new brand identity for its integrated, health services offering.

Kii, is the Company’s flagship offering which integrates several of

its best-in-class technologies and services into one exceptional,

connected, and personalized experience for employees that will

continue to disrupt the traditional employer healthcare

industry.

- On June 6, 2022, the Company

reported the results of an evidence-based study proving iCBT as a

highly effective treatment for depression and anxiety. Over 5,000

individuals with clinical levels of depression and comorbid anxiety

who completed CloudMD’s Therapist Assisted iCBT program experienced

reliable symptom improvement.

- On June 15, 2022, the Company

provided an update on strategic priorities to drive organic growth

through new sales and cross selling. It also appointed senior

customer success and sales leadership to accelerate expansion and

growth.

- On July 13, 2022, the Company added

telemedicine services for primary care health navigation to Kii

personalized & connected care offering. The services are led by

nurses and nurse practitioners which provide fast access to a wide

variety of primary care services and treatments and overall health

and wellness support for employees and their family members, all

from one connected offering.

- On July 22, 2022, the Company

announced that it finalized the review and settlement of

VisionPros, its online vision care platform. The settlement was

reached with the former owners of VisionPros and reduces the

purchase consideration paid for VisionPros by $12.6 million and

also removes any future earnout payments. The Company has received

$3.3 million in cash from the settlement in the third quarter of

2022.

- On August 11, 2022, the Company

appointed Karen Adams as Chief Executive Officer and John Plunkett

as Chief Financial Officer.

- On August 17, 2022, the Company

provided a business update on customer momentum and the TAiCBT

Ontario Government contract. In the second quarter, CloudMD signed

several multi-year contracts which will contribute new organic

annual recurring revenue (“ARR”) of $4.2 million.

CloudMD’s TAiCBT provider, MindBeacon, was one of two companies

chosen to provide TAiCBT services for Ontario citizens under the

new Ontario Health Contract. This new contract represents a

reduction of approximately 85% in the number of guided iCBT cases

that will be funded but is expected to expand over time. The

Company is currently in discussions with the Government on how to

continue to expand access to mental health services for all

Ontarians.

- To offset the revenue impact of

Ontario Health, CloudMD is in the process of eliminating the direct

delivery costs associated with providing the services, as well as

identifying further cost synergies to offset the gross contribution

from the contract. Subsequent to quarter end, CloudMD has

identified an additional $4.0 million annualized of optimization

cost savings from continued organizational re-design and

integration. This is in addition to the direct delivery cost

elimination.

Outlook

The Company continues to deliver on the value

proposition of offering comprehensive solutions that create access

to care, leading to better health outcomes. Through its team-based,

patient-centric approach, CloudMD provides a connected platform for

patients, healthcare practitioners, and enterprise clients to

address whole-person, coordinated care.

CloudMD remains focused on its strategic

priorities for the remainder of the year: (1) through its strong

sales pipeline, continuing to diversify and grow its client base

within its EHS and DHS divisions by direct sales to new customers,

enhancing relationships with channel partners and cross selling its

established suite of products; (2) driving continuous operational

excellence and improvement across the organization to improve

productivity, product quality and consistency, and lower customer

acquisition costs; (3) delivering a diligent path to profitable

financial sustainability and focus on delivering consistent

financial performance across all divisions of the organization; and

(4) continuing to develop the Company’s corporate governance to

support the it’s growth.

For the remainder of the year, the Company will

remain focused on driving profit from the core business, aligning

costs to its revenue profile, and identifying further cost

optimization to improve Adjusted EBITDA and gross margins. The

Company is working on divesting its Clinics and Pharmacies business

which will provide some near-term capital. It expects to provide an

update on progress next month.

CloudMD has a robust sales pipeline and will

continue to drive organic growth and client adoption, through

direct sales to new clients, expanding distribution partners and

cross selling its connected suite of products. The Company expects

to achieve consistent double digit organic growth rates in its core

business moving forward, as previously guided.

Selected Financial

Information

All results were prepared in accordance with

International Financial Reporting Standards

(“IFRS”) as issued by the International Accounting

Standards Board.

|

(In thousands of Canadian dollars, except

per share amounts) |

|

Three months ended |

|

| |

June 30, |

|

|

|

2022 |

|

|

2021 |

|

(%) |

|

Revenue |

$ |

40,301 |

|

$ |

15,659 |

|

157 |

% |

|

Cost of sales |

|

(27,813 |

) |

|

(10,102 |

) |

175 |

% |

|

Gross profit (1) |

|

12,488 |

|

|

5,557 |

|

125 |

% |

|

Gross margin (1) |

|

31.0 |

% |

|

35.5 |

% |

|

|

|

|

|

|

|

|

|

Expenses |

|

26,526 |

|

|

12,156 |

|

118 |

% |

|

Loss before other items |

|

(14,038 |

) |

|

(6,599 |

) |

113 |

% |

|

Other items and taxes |

|

(30,176 |

) |

|

(33 |

) |

|

|

Net loss |

|

(44,214 |

) |

|

(6,632 |

) |

567 |

% |

|

Loss per share, basic and diluted |

$ |

(0.15 |

) |

$ |

(0.03 |

) |

400 |

% |

Note:(1) Gross profit and Gross

margin are non-GAAP financial measures. Refer to the “Non-GAAP

Financial Measures” section of this news release for further

information.

|

(In thousands of Canadian dollars) |

|

Three months ended |

|

| |

June 30, |

|

|

|

2022 |

|

|

2021 |

|

(%) |

|

Net loss for the period |

$ |

(44,214 |

) |

$ |

(6,632 |

) |

567 |

% |

|

Add: |

|

|

|

|

|

|

Interest and accretion expense |

|

564 |

|

|

112 |

|

404 |

% |

|

Income taxes |

|

(32 |

) |

|

115 |

|

(128 |

%) |

|

Depreciation and amortization |

|

4,723 |

|

|

1,452 |

|

225 |

% |

|

Impairment |

|

33,109 |

|

|

0 |

|

100 |

% |

|

EBITDA (1)

for the period |

|

(5,940 |

) |

|

(4,953 |

) |

20 |

% |

|

Share-based compensation |

|

532 |

|

|

1,438 |

|

(63 |

%) |

|

Financing-related costs |

|

- |

|

|

122 |

|

(100 |

%) |

|

Acquisition-related, integration and restructuring costs |

|

5,049 |

|

|

2,860 |

|

77 |

% |

|

Litigation costs |

|

452 |

|

|

(57 |

) |

893 |

% |

|

Change in fair value of liability to NCI |

|

39 |

|

|

- |

|

100 |

% |

|

Change in fair value of contingent consideration |

|

(3,315 |

) |

|

11 |

|

NM (2) |

|

Adjusted EBITDA for the period

(1) |

$ |

(3,183 |

) |

$ |

(579 |

) |

450 |

% |

Notes:(1) EBITDA and Adjusted EBITDA are

non-GAAP financial measures. Refer to the “Non-GAAP Financial

Measures” section of this news release for further

information.(2) Not meaningful

The cash outflows in the second quarter of 2022

were unusually high and are not expected to recur in the third

quarter or fourth quarter of 2022. The table below provides a

reconciliation of the one-time cash outflows in the three months

ended June 30, 2022:

|

(In thousands of Canadian dollars) |

|

(unaudited) |

|

Cash and cash equivalents as at March 31, 2022 |

$ |

46,889 |

|

|

Cash and cash equivalents as at June 30, 2022 |

|

29,703 |

|

|

Cash outflow (1) |

|

17,196 |

|

|

|

|

|

|

Net Cash used in operating activities |

|

(13,249 |

) |

|

Adjustments |

|

|

|

Net changes in non-cash working capital |

|

3,599 |

|

|

Adjustments to EBITDA |

|

5,501 |

|

|

Adjusted net cash used in operating

activities |

|

(4,149 |

) |

|

|

|

|

|

Net cash used in investing activities |

|

(2,121 |

) |

|

Adjustments |

|

|

|

Payment of contingent consideration |

|

1,183 |

|

|

Adjusted Net cash used in investing

activities |

|

(938 |

) |

|

|

|

|

|

Net cash used in financing activities |

|

(1,818 |

) |

|

Normalized cash outflow (1) |

$ |

6,905 |

|

Note:(1) Cash outflow and

Normalized cash outflow are a non-GAAP measures. Refer to the

“Non-GAAP Financial Measures” section of this news release for

further information.

Second Quarter Earnings Conference

Call

Date and Time: Tuesday, August 23, 2022, at 9:00am Eastern Time

(6:00am Pacific Time)

Webcast link: https://edge.media-server.com/mmc/p/stmigy4p

A link to the live event, as well as the financial statements

and MD&A will be available on the Financial Statements page of

the Company’s website.

Financial Statements and Management’s

Discussion and Analysis

This news release should be read in conjunction

with the Company’s condensed interim consolidated financial

statements and related notes, and management’s discussion and

analysis (“MD&A”) for the three and six months

ended June 30, 2022 and 2021, copies of which can be found under

the Company’s profile at www.sedar.com.

Non-GAAP Financial Measures

In addition to the results reported in

accordance with IFRS, the Company uses various non-GAAP financial

measures and ratios which are not recognized under IFRS, as

supplemental indicators of the Company’s operating performance and

financial position. These non-GAAP financial measures and ratios

are provided to enhance the user’s understanding of the Company’s

historical and current financial performance and its prospects for

the future. Management believes that these measures provide useful

information in that they exclude amounts that are not indicative of

the Company’s core operating results and ongoing operations and

provide a more consistent basis for comparison between quarters and

years. Details of such non-GAAP financial measures and ratios and

how they are derived are provided below as well as in conjunction

with the discussion of the financial information reported.

Since non-GAAP financial measures do not have

any standardized meanings prescribed by IFRS, other companies may

calculate these non-IFRS measures differently, and our non-GAAP

financial measures may not be comparable to similar titled measures

of other companies. Accordingly, investors are cautioned not to

place undue reliance on them and are also urged to read all IFRS

accounting disclosures presented in the audited consolidated

financial statements and the related notes for the year ended

December 31, 2021 and 2020.

EBITDAEBITDA is a non-GAAP

financial measure that does not have a standard meaning and may not

be comparable to a similar measure disclosed by other issuers.

EBITDA referenced herein relates to earnings before interest,

taxes, impairment, and depreciation and amortization. This measure

does not have a comparable IFRS measure and is used by the Company

to assess its capacity to generate profit from operations before

taking into account management’s financing decisions and costs of

consuming intangible and tangible capital assets, which vary

according to their vintage, technological currency, and

management’s estimate of their useful life.

Adjusted EBITDAAdjusted EBITDA

is a non-GAAP financial measure that does not have a standard

meaning and may not be comparable to a similar measure disclosed by

other issuers. Adjusted EBITDA referenced herein relates to

earnings before interest; taxes; depreciation; amortization;

share-based compensation; financing-related costs;

acquisition-related and integration costs, net; litigation costs;

and change in fair value of contingent consideration. This measure

does not have a comparable IFRS measure and is used by the Company

to assess its capacity to generate profit from operations before

taking into account management’s financing decisions and costs of

consuming intangible and tangible capital assets, which vary

according to their vintage, technological currency, and

management’s estimate of their useful life, adjusted for factors

that are unusual in nature or factors that are not indicative of

the operating performance of the Company.

Gross ProfitGross Profit is a

non-GAAP financial measure that does not have a standard meaning

and may not be comparable to a similar measure disclosed by other

issuers. Gross Profit referenced herein relates to revenues less

cost sales. This measure does not have a comparable IFRS measure

and is used by the Company to manage and evaluate the operating

performance of the business.

Gross MarginGross Margin is a

non-GAAP financial ratio that has Gross Profit, which is a non-GAAP

financial measure as a component. Gross Margin referenced herein is

defined as gross profit as a percent of total revenue. This measure

does not have a comparable IFRS measure and is used by the Company

to manage and evaluate the operating performance of the

business.

Cash outflow and Normalized cash

outflowCash outflow and Normalized cash outflow are

non-GAAP financial measures that do not have a standard meaning and

may not be comparable to a similar measure disclosed by other

issuers. Cash outflow, as referenced herein, is defined as the

decrease in cash and cash equivalents for the applicable period.

Normalized cash outflow, as referenced herein, is defined as cash

outflows, adjusted for certain unusual expenditures. For the

purpose of calculating Normalized cash flow, unusual expenditures

include non-operational one-time payments and payments related to

EBITDA adjustments. These measures do not have a comparable IFRS

measure and are used to ensure that we have sufficient liquidity to

meet our liabilities as they become due.

About CloudMD Software &

Services

CloudMD is transforming the delivery of

healthcare using technology and by providing a patient-centric

approach, with an emphasis on continuity of care. By leveraging

healthcare technology, the Company is building one, connected

platform that addresses all points of a patient’s healthcare

journey and provides better access to care and improved outcomes.

Through CloudMD’s proprietary technology, the Company delivers

quality healthcare through a holistic offering including hybrid

primary care clinics, specialist care, telemedicine, mental health

support, healthcare navigation, educational resources, and

artificial intelligence (AI). CloudMD’s business is separated into

three main divisions: Clinics and Pharmacies, Digital Solution and

Enterprise Health Solutions, the Company’s fastest growing

division. CloudMD’s Enterprise Health Solutions Division has built

a leading employer healthcare solutions, including its

Comprehensive Integrated Health Services Platform, which offers one

comprehensive, digitally connected platform for educational

institutions, corporations, insurers, and advisors to better manage

the health and wellness of their students, employees, and

customers.

CloudMD currently services a direct ecosystem of

over 5,700 clinicians including, 1,800+ mental health

practitioners, 1,600+ allied health professionals, 1,400+ doctors

and nurses and covers 12 million individual lives across North

America. For more information

visit: https://investors.cloudmd.ca.

ON BEHALF OF THE BOARD OF DIRECTORS

“Karen Adams”Chief Executive Officer

FOR ADDITIONAL INFORMATION, CONTACT:

Julia BeckerVP, Investor

Relations julia@cloudmd.ca(604) 785-0850

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Forward Looking Statements

This news release contains certain statements

that may constitute forward-looking information under applicable

securities laws. All statements, other than those of historical

fact, which address activities, events, outcomes, results,

developments, performance or achievements that CloudMD anticipates

or expects may or will occur in the future (in whole or in part)

should be considered forward-looking information. Often, but not

always, forward-looking information can be identified by the use of

words such as “plans”, “expects”, “is expected”, “budget”,

“scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or

“believes” or variations (including negative variations) of such

words and phrases, or statements formed in the future tense or

indicating that certain actions, events or results “may”, “could”,

“would”, “might” or “will” (or other variations of the forgoing) be

taken, occur, be achieved, or come to pass. Forward-looking

statements in this news release include, but are not limited to,

statements regarding strategic priorities, new contracts,

additional annualized savings, alignment of costs with revenue and

divestiture of non-core assets, positive contributions of the EHS

business, and the IDYA4 business returning to normal. These

statements are based upon information currently available to

CloudMD’s management. All information that is not clearly

historical in nature may constitute forward‐looking statements. In

some cases, forward‐looking statements may be identified by the use

of terms such as “forecast”, “assumption” and other similar

expressions or future or conditional terms such as “anticipate”,

“believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”,

“predict”, “project”, “will”, “would”, and “should”.

Forward-looking statements contained in this news release are based

on certain factors and assumptions made by management of CloudMD

based on their current expectations, estimates, projections,

assumptions and beliefs regarding their business and CloudMD does

not provide any assurance that actual results will meet

management’s expectations. While management considers these

assumptions to be reasonable based on information currently

available to them, they may prove to be incorrect. Such

forward‐looking statements are not guarantees of future events or

performance and by their nature involve known and unknown risks,

uncertainties and other factors, including those risks described in

the Company’s MD&A (which is filed under the Company’s issuer

profile on SEDAR and can be accessed at www.sedar.com), that may

cause the actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by such forward‐looking

statements. Although CloudMD has attempted to identify important

factors that could cause actual actions, events or results to

differ materially from those described in forward‐looking

statements, other factors may cause actions, events or results to

be different than anticipated, estimated or intended. There can be

no assurance that such statements will prove to be accurate as

actual results and future events could vary or differ materially

from those anticipated in such forward‐looking statements.

Accordingly, readers should not place undue reliance on

forward‐looking information. CloudMD does not undertake to update

any forward-looking information, whether as a result of new

information or future events or otherwise, except as may be

required by applicable securities laws.

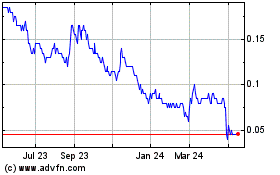

CloudMD Software & Servi... (TSXV:DOC)

Historical Stock Chart

From Dec 2024 to Jan 2025

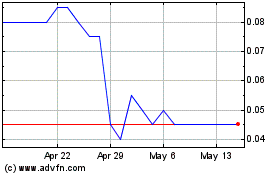

CloudMD Software & Servi... (TSXV:DOC)

Historical Stock Chart

From Jan 2024 to Jan 2025