Regulatory News:

EUTELSAT S.A. (Paris:ETL) (LSE:ETL):

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION DIRECTLY OR

INDIRECTLY TO ANY U.S. PERSON (AS DEFINED IN REGULATION S OF THE

UNITED STATES SECURITIES ACT OF 1993, AS AMENDED (THE “SECURITIES

ACT”)) OR ANY PERSON LOCATED OR RESIDENT IN THE UNITED STATES OF

AMERICA, ITS TERRITORIES AND POSSESSIONS (INCLUDING PUERTO RICO,

THE US VIRGIN ISLANDS, GUAM, AMERICAN SAMOA, WAKE ISLAND AND THE

NORTHERN MARIANA ISLANDS), ANY STATE OF THE UNITED STATES OR THE

DISTRICT OF COLUMBIA OR IN ANY OTHER JURISDICTION WHERE IT IS

UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE THIS

ANNOUNCEMENT.

EUTELSAT S.A. (a joint-stock company

(société anonyme) established under the laws of the Republic of

France) (THE “COMPANY”)

ANNOUNCES THE RESULTS OF THE TENDER

OFFER

TO THE QUALIFYING HOLDERS OF ITS

OUTSTANDING

€800,000,000 2.00 PER CENT. BONDS DUE 2025

(OF WHICH €800,000,000 ARE CURRENTLY OUTSTANDING) (ISIN:

FR0013369493) (THE “EXISTING NOTES”);

TO TENDER ANY AND ALL OF THE EXISTING NOTES

FOR PURCHASE FOR CASH ON THE TERMS AND SUBJECT TO THE CONDITIONS

SET OUT IN FULL IN THE TENDER OFFER MEMORANDUM

This notice must be read in conjunction with the tender offer

memorandum dated 25 March 2024 (the “Tender Offer

Memorandum”). Capitalised terms used in this notice and not

otherwise defined herein shall have the meanings ascribed to them

in the Tender Offer Memorandum.

On 25 March 2024, the Company announced the launch of a Tender

Offer to Qualifying Holders (as defined in the Tender Offer

Memorandum). Under the terms of the Tender Offer, Qualifying

Holders (subject to offer restrictions) were invited to tender

their Existing Notes for purchase by the Company for a cash amount,

equal to the Tender Consideration and the Accrued Interest Amount

upon the terms and conditions of the Tender Offer as described in

the Tender Offer Memorandum.

The Tender Offer expired at 5.00 p.m. Paris time on 3 April

2024.

Final results of the Tender Offer

The Company is pleased to announce the final results of the

Tender Offer as follows:

Aggregate principal amount of Existing Notes tendered and

accepted for purchase: €623,400,000

Accrued Interest in respect of Existing Notes tendered and

accepted for purchase: 1.03279%

Aggregate principal amount of Existing Notes that remains

outstanding after the Settlement Date: €176,600,000

Any charges, costs and expenses charged by the Qualifying

Holders intermediary shall be borne by such Qualifying Holders.

The acceptance for purchase by the Company of Existing Notes

validly tendered pursuant to the Tender Offer is at the sole

discretion of the Company and is subject, without limitation, to,

and conditional upon, on or before the Settlement Date, the

settlement of the issue of the New Notes to the satisfaction of the

Company (the “Transaction Condition”). The Company is

entitled to waive the Transaction Condition at its sole and

absolute discretion.

Settlement

The Settlement Date is expected to take place on 8 April 2024,

on which date the Company will pay the Tender Consideration and the

Accrued Interest Amount to the Qualifying Holders who have validly

tendered for purchase their Existing Notes under the Tender Offer

and whose tenders have been accepted.

Contact Information

The Company:

Eutelsat S.A. 32 Boulevard Gallieni

92130 Issy-les-Moulineaux France

The Dealer Managers of the Tender Offer are:

BNP Paribas

16, boulevard des Italiens 75009

Paris France

Attention: Liability Management

Group

Telephone: +33 1 55 77 78 94

Email:

liability.management@bnpparibas.com

Crédit Agricole Corporate and

Investment Bank 12 place des États-Unis

CS 70052 92 547 Montrouge

Cedex

France

Attn: Liability Management

Tel: +44 207 214 5903

Email:

liability.management@ca-cib.com

Société Générale

Immeuble Basalte

17 Cours Valmy, CS 50318, 92972

Paris

La Défense Cedex

France

Attn: Liability Management

Tel: +33 1 42 13 32 40

Email:

liability.management@sgcib.com

The Information Agent for the Tender Offer will be:

BNP Paribas Securities

Services Business Line

Les Grands Moulins de Pantin

9, rue du Débarcadère

93500 Pantin

France

Tel: +33 1 40 14 14 30

Email:

paris.bp2s.information.agent@bnpparibas.com

The Tender Agent for the Tender Offer will be:

BNP Paribas Securities

Services Business Line

9, rue du Débarcadère

93500 Pantin

France

Attn: Corporate Trust

Services

Tel: +33 1 40 14 14 30

Fax: +33 1 57 43 31 38

Email:

paris.bp2s.offers@bnpparibas.com

OFFER RESTRICTIONS

The distribution of this notice or the Tender Offer Memorandum

in certain jurisdictions may be restricted by law. Persons into

whose possession this notice comes are required by each of the

Company, the Dealer Managers, the Tender Agent and the Information

Agent to inform themselves about, and to observe, any such

restrictions. Please also see the Tender Offer Memorandum for a

fuller description of such restrictions.

No action has been or will be taken in any jurisdiction in

relation to the Tender Offer that would permit a public offering of

securities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240404866782/en/

EUTELSAT S.A.

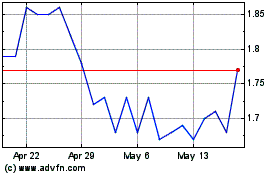

E3 Lithium (TSXV:ETL)

Historical Stock Chart

From Apr 2024 to May 2024

E3 Lithium (TSXV:ETL)

Historical Stock Chart

From May 2023 to May 2024