Golconda Gold Ltd. Releases Financial and Operating Results for Q2 2023

23 August 2023 - 9:30PM

Golconda Gold Ltd. (“

Golconda

Gold” or the “

Company”) (TSX-V:

GG; OTCQB: GGGOF) is pleased to announce the release of its

financial results for the three and six months ended June 30, 2023.

A copy of the unaudited condensed consolidated

interim financial statements for the three and six months ended

June 30, 2023, prepared in accordance with International Financial

Reporting Standards, and the corresponding management’s discussion

and analysis (the “MD&A”), are available under

the Company’s profile on www.sedarplus.ca. All references to “$” in

this press release refer to United States dollars.

Second Quarter 2023 Highlights (“Q2

2023”):

- mined 19,171 tonnes of ore from its Galaxy and Princeton ore

bodies, with an average grade of 3.11 grammes per tonne (g/t) an

increase of 14% compared to 16,754 tonnes at 3.30 g/t in the three

months ended March 31, 2023 (“Q1 2023”);

- produced 1,422 tonnes of concentrate at an average grade of

37.0 g/t containing 1,689 ounces of gold compared to 1,449 tonnes

at 34.0 g/t containing 1,584 ounces of gold in Q1 2023, an increase

of 7% in gold production quarter on quarter; and

- generated revenue of US$2.5 million from the sale of 1,639

contained ounces (1,308 payable ounces) of gold at an operating

cash cost of US$1,571 per payable ounce compared to US$2.0 million

revenue in Q1 2023 from the sale of 1,434 contained ounces (1,114

payable ounces) of gold at an operating cash cost of US$1,790 per

payable ounce, representing a 25% increase in revenue and 12%

reduction in operating cash cost quarter on quarter.(1)

Golconda Gold CEO, Nick Brodie commented: “The

second quarter of 2023 saw improvements in material mined and gold

produced, despite a difficult operating environment while the team

worked through the challenges presented in the first quarter of

2023. Equipment availabilities continue to increase, and we are

confident that production will continue to ramp up as we further

develop the Galaxy and Princeton ore bodies. Discussions are

ongoing regarding securing further financial capacity at Galaxy

which is expected to enable a dedicated development crew allowing

the existing crew and fleet to focus purely on stoping, and to also

fund development to a second level at the Galaxy ore body. (2)

At Summit, a full engineering survey of the

in-situ mining equipment was conducted in April 2023 which has

identified approximately US$1 million of expected savings on the

capital re-start cost of the project as a result of the good

condition of the majority of the equipment. The Company continues

to work with financing providers and off-take partners to put in

place a non-dilutive financing package to facilitate the re-start

of operations at the Summit Property as soon as possible.”(2)

About Golconda Gold

Golconda Gold is an un-hedged gold producer and

explorer with mining operations and exploration tenements in South

Africa and New Mexico. Golconda Gold is a public company and its

shares are quoted on the TSX Venture Exchange under the symbol “GG”

and the OTCQB under the symbol “GGGOF”. Golconda Gold’s management

team is comprised of senior mining professionals with extensive

experience in managing mining and processing operations and

large-scale exploration programmes. Golconda Gold is committed to

operating at world-class standards and is focused on the safety of

its employees, respecting the environment, and contributing to the

communities in which it operates.

Notes:

(1)

Cash cost is a non-GAAP measure. Refer to below and to

“Supplemental Information to Management’s Discussion and Analysis”

in the MD&A, for reconciliation to measures reported in the

Company’s financial statements.

|

|

Q2 2023 |

Q1 2023 |

YTD 2023 |

|

Operating costs |

2,327,861 |

|

2,459,339 |

|

4,787,200 |

|

|

Adjust for: |

|

|

|

|

Impairment, depreciation and amortization |

(182,188 |

) |

(189,106 |

) |

(371,294 |

) |

|

Inventory movement |

(21,566 |

) |

(57,287 |

) |

(78,853 |

) |

|

Total operating cash cost |

2,124,107 |

|

2,212,946 |

|

4,337,053 |

|

|

Royalties |

(11,898 |

) |

(8,663 |

) |

(20,561 |

) |

|

Total operating cash cost excluding royalties |

2,112,209 |

|

2,204,283 |

|

4,316,493 |

|

|

Gold production (ounces) |

1,689 |

|

1,584 |

|

3,273 |

|

|

Gold production (ounces payable) |

1,344 |

|

1,231 |

|

2,575 |

|

|

Total operating cash cost excluding royalties per payable oz. |

1,571 |

|

1,790 |

|

1,676 |

|

| |

|

|

|

|

|

|

(2)

This is forward-looking information and is based on a number of

assumptions. See “Cautionary Notes”.

Cautionary Notes

Certain statements contained in this press

release constitute “forward-looking statements”. All statements

other than statements of historical fact contained in this press

release, including, without limitation, the Company’s projection

that equipment availability and mining volumes will continue to

improve, the Company’s ability to secure additional financing, and

the impact of any additional financing on operations at Galaxy and

Summit, the Company’s future financial position and results of

operations, strategy, proposed acquisitions, plans, objectives,

goals and targets, and any statements preceded by, followed by or

that include the words “believe”, “expect”, “aim”, “intend”,

“plan”, “continue”, “will”, “may”, “would”, “anticipate”,

“estimate”, “forecast”, “predict”, “project”, “seek”, “should” or

similar expressions or the negative thereof, are forward-looking

statements. These statements are not historical facts but instead

represent only the Company’s expectations, estimates and

projections regarding future events. These statements are not

guarantees of future performance and involve assumptions, risks and

uncertainties that are difficult to predict. Therefore, actual

results may differ materially from what is expressed, implied or

forecasted in such forward-looking statements.

Additional factors that could cause actual

results, performance or achievements to differ materially include,

but are not limited to: the Company’s dependence on two mineral

projects; gold price volatility; risks associated with the conduct

of the Company’s mining activities in South Africa and New Mexico;

regulatory, consent or permitting delays; risks relating to the

Company’s exploration, development and mining activities being

situated in South Africa and New Mexico; risks relating to reliance

on the Company’s management team and outside contractors; risks

regarding mineral resources and reserves; the Company’s inability

to obtain insurance to cover all risks, on a commercially

reasonable basis or at all; currency fluctuations; risks regarding

the failure to generate sufficient cash flow from operations; risks

relating to project financing and equity issuances; risks arising

from the Company’s fair value estimates with respect to the

carrying amount of mineral interests; mining tax regimes; risks

arising from holding derivative instruments; the Company’s need to

replace reserves depleted by production; risks and unknowns

inherent in all mining projects, including the inaccuracy of

reserves and resources, metallurgical recoveries and capital and

operating costs of such projects; contests over title to

properties, particularly title to undeveloped properties; laws and

regulations governing the environment, health and safety; the

ability of the communities in which the Company operates to manage

and cope with the implications of COVID-19; the economic and

financial implications of COVID-19 to the Company; operating or

technical difficulties in connection with mining or development

activities; lack of infrastructure; employee relations, labour

unrest or unavailability; health risks in Africa; the Company’s

interactions with surrounding communities and artisanal miners; the

Company’s ability to successfully integrate acquired assets; risks

related to restarting production; the speculative nature of

exploration and development, including the risks of diminishing

quantities or grades of reserves; development of the Company’s

exploration properties into commercially viable mines; stock market

volatility; conflicts of interest among certain directors and

officers; lack of liquidity for shareholders of the Company; risks

related to the market perception of junior gold companies; and

litigation risk. Management provides forward-looking statements

because it believes they provide useful information to investors

when considering their investment objectives and cautions investors

not to place undue reliance on forward-looking information.

Consequently, all of the forward-looking statements made in this

press release are qualified by these cautionary statements and

other cautionary statements or factors contained herein, and there

can be no assurance that the actual results or developments will be

realized or, even if substantially realized, that they will have

the expected consequences to, or effects on, the Company. These

forward-looking statements are made as of the date of this press

release and the Company assumes no obligation to update or revise

them to reflect subsequent information, events or circumstances or

otherwise, except as required by law.

Neither the TSX Venture Exchange nor its

regulation services provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For further information please

contact:Nick BrodieCEO, Golconda Gold Ltd.+ 44 7905

089878Nick.Brodie@golcondagold.comwww.golcondagold.com

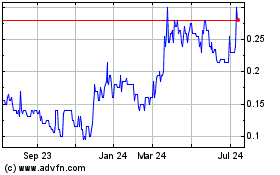

Golconda Gold (TSXV:GG)

Historical Stock Chart

From Dec 2024 to Jan 2025

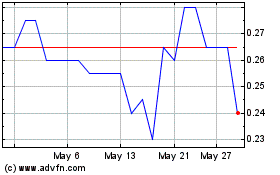

Golconda Gold (TSXV:GG)

Historical Stock Chart

From Jan 2024 to Jan 2025