9 Capital Corp. (the “Company”) announces that it has entered into

a binding agreement dated December 23, 2020 (the “Letter

Agreement”) with Churchill Diamond Corporation (“Churchill”), an

arm’s length, Ontario based mineral exploration company which

currently holds three mineral exploration projects in Canada, to

effect a business combination of the two companies (the “Proposed

Transaction”). The Proposed Transaction will be a reverse takeover

of the Company by Churchill and its shareholders.

Churchill is a private Ontario company managed

by career mining industry professionals which currently holds three

exploration projects, namely Taylor Brook in Newfoundland, Pelly

Bay in Nunavut and White River in Ontario. All three projects are

at the evaluation stage, with known mineralized Ni-Cu-Co showings

at Taylor Brook and Pelly Bay, and diamondiferous kimberlitic

intrusives at White River.

The Company is a Capital Pool Company (“CPC”)

and intends the Proposed Transaction to constitute its Qualifying

Transaction (the “Qualifying Transaction”) under the policies of

the TSX Venture Exchange (the “Exchange”).

The Transaction

It is currently anticipated that the Proposed

Transaction will be effected by way of a three-cornered

amalgamation, share exchange, merger, amalgamation, arrangement or

other similar form of transaction as is acceptable to the

parties.

On or immediately prior to the completion of the

Proposed Transaction, it is anticipated that: (i) the Company will

effect a name change to such name as may be determined by

Churchill; and (ii) the Company will consolidate the issued and

outstanding common shares in the capital of the Company (the “9

Capital Shares”) on the basis of one “new” 9 Capital Share for

every 1.7 “old” 9 Capital Shares issued and outstanding (the

“Consolidation”).

Pursuant to the Proposed Transaction, holders of

the issued and outstanding common shares of Churchill (the

“Churchill Shares”) will receive one 9 Capital Share (as they exist

on a post-Consolidation basis) for each Churchill Share held (the

“Exchange Ratio”). Pursuant to the Proposed Transaction, all

existing securities convertible into Churchill Shares shall be

exchanged, based on the Exchange Ratio, for similar securities to

purchase 9 Capital Shares on substantially similar terms and

conditions.

There are currently an aggregate of 11,920,501 9

Capital Shares issued and outstanding, as well as 1,192,050 stock

options, each exercisable to acquire one 9 Capital Share at an

exercise price of $0.10 per share. As at the date hereof there are

currently 24,576,550 Churchill Shares issued and outstanding, as

well as 1,800,000 stock options, each exercisable at a price $0.25

to acquire one Churchill Share.

If the Proposed Transaction is completed, it is

anticipated that the board of directors of the Company shall be

reconstituted to consist of such directors as Churchill shall

determine, subject to the minimum residency requirements of the

Business Corporations Act (Ontario), and all existing officers of

the Company shall resign and be replaced with officers appointed by

the new slate of board of directors.

It is expected that following the completion of

the Proposed Transaction, shareholders of the Company will hold

approximately 20.4% of the 9 Capital Shares, the current

shareholders of Churchill will hold approximately 65.4% of the 9

Capital Shares, and purchases in the Offering (as defined below)

will hold approximately 14.2% of the 9 Capital Shares (assuming the

minimum amount of the Offering is raised).

The Proposed Transaction is conditional upon the

completion of the Offering, as further described below.

Taylor Brook and Other

Properties

The Taylor Brook Property is located 60 km north

of Deer Lake, Newfoundland, and is comprised of two contiguous

map-staked licenses containing 226 claims totalling 56.5 km2, which

has known high grade Ni-Cu-Co mineralization at surface and shallow

drilled depths from work carried out between 1999-2012. The

property is under option from Altius Resources Inc. to acquire an

undivided 100% interest.

Other Properties

The Pelly Bay Property consists of 153 mineral

claims totalling 170.75 km2 on tidewater near the town of Kugaaruk

in central Nunavut, covers the entire diamondiferous Pelly Bay

kimberlite field, as well as areas prospective for Ni-Cu-Co and

gold mineralization. The White River Property is located

approximately 30 km east of the Hemlo Gold Mine along the

Trans-Canada Highway and consists of 1,355 claims totalling

approximately 28.9 km2 covering the White River diamondiferous

melnoitic kimberlite intrusive field.

Officers and Directors

Subject to applicable shareholder and Exchange

approval, it is anticipated that the officers and directors of

the combined company will be:

Paul Sobie, President and Chief Executive

Officer and Director

Mr. Sobie has over 30 years of discovery and

evaluation experience with MPH Consulting Limited, an internal

exploration and mining consultancy, for major, mid-tier and junior

mining companies in Canada, Africa, South America and Russia. Mr.

Sobie is an economic geologist specializing in the design and

management of exploration and evaluation programmes. He has

extensive project development experience, including several gold,

diamond and base metal ventures that have attained advanced and/or

achieved production status. Mr. Sobie has also held senior

managerial positions in the past with diamond, base metal and iron

ore junior exploration issuers.

Paul Robertson, Chief Financial Officer and

Corporate Secretary

Mr. Robertson is a Certified Professional

Accountant (CPA) and is based in Vancouver, British Columbia, is

the founding partner of Quantum Advisory Partners LLP and has over

20 years of accounting, auditing and tax experience. He has

developed extensive experience in the mining sector and provides

financial reporting, regulatory compliance, internal controls and

taxation advisory services to a number of junior resource

companies. Prior to founding Quantum Advisory Partners LLP, he was

a tax manager with Ernst & Young LLP in Vancouver providing tax

consulting and compliance services primarily to corporate clients

in the high-technology and biotechnology industries as well as

several multi-national mining companies. He is currently the Chief

Financial Officer of GoldQuest Mining Corp. (TSXV: GQC), and

previously served as Chief Financial Officer of Grayd Resource

Corporation (until its acquisition by Agnico Eagle Mines Limited in

2011) and Orla Mining Ltd. (TSX: OLA) from 2015 to 2019. Mr.

Robertson holds a BA from the University of Western Ontario (1993)

and obtained his Chartered Accountant designation from the British

Columbian Institute of Chartered Accountants in 1997.

Bill Fisher, Director

Mr. Fisher is a trained geologist and has

extensive industry experience including a number of residential

posts in Africa, Australia, Europe and Canada in both exploration

and mining positions. Under his leadership, Karmin Exploration

discovered the Aripuanã base metal massive sulphide deposits in

Brazil. From 1997 to 2001 Mr. Fisher was Vice President,

Exploration for Boliden AB, a major European mining and smelting

company where he was responsible for 35 projects in nine countries.

From 2001 to 2008 Mr. Fisher led GlobeStar Mining Corp. from an

exploration company to an emerging precious and base metal producer

in the Dominican Republic, developing and operating the Cerro de

Maimon copper/gold mine until it was sold to Perilya for $186

million. Mr. Fisher was also Chairman of Aurelian Resources which

was sold to Kinross Gold in 2008 for $1.2 Billion after the

discovery of the Fruta del Norte gold deposit in Ecuador. Mr.

Fisher currently serves as Executive Chairman of GoldQuest Mining

Corp. (TSXV: GQC), and an independent director of Horizonte

Minerals (AIM: HZM), Treasury Metals Inc. (TSX: TML) and London, UK

based firms Andiamo Exploration and RAME Energy.

Alec Rowlands, Director

Mr. Rowlands has over 25 years of experience in

mining finance. He is the former managing director of First

Marathon Securities (London) and former Head of Sales for Gordon

Capital (NYC). Since 1999, Mr. Rowlands has held several senior

finance positions, including with Yorkton Securities, Westwind

Partners, Jennings Capital and PowerOne Capital Markets Ltd. Mr.

Rowlands has been an active investor and founding shareholder in

several mining ventures, notably Auryx Gold, which was acquired by

B2Gold for its Otjikoto project in Namibia in 2011. He is currently

Vice-President, Investor Relations and Corporate Development for

Cardinal Resources Inc. (TSX: CDV).

Financing Matters

In connection with the Proposed Transaction,

Churchill proposes to issue and sell, on a non-brokered private

placement basis, Churchill Shares at a price per share of $0.25 for

aggregate gross proceeds of a minimum of $1,000,000 and a maximum

of $1,500,000 (the “Offering”). Completion of the

proposed Offering is a condition to the closing of the Proposed

Transaction.

Arm’s Length Transaction

The Proposed Transaction is an arm’s length

transaction in accordance with the policies of the Exchange and is

not subject to the approval of the shareholders of the Company,

except as required by applicable corporate law.

No Control Persons

All 24,576,550 Churchill Shares are widely held

an no individual or entity owns, nor will any entity or individual

own on completion of the Offering or immediately prior the

completion of the Proposed Transaction, more than 10% of the issued

and outstanding Churchill Shares.

Selected Financial

Information

The following selected financial information is

taken from the financial statements of Churchill for the year ended

August 30, 2020, which are expected to be included in the filing

statement being prepared in connection with the Proposed

Transaction:

|

Total Assets |

$1,102,223 |

|

Total Liabilities |

$310,000 |

|

Net Loss |

$(558,688) |

Readers are cautioned that the above figures

have not been audited and are based on calculations prepared

by management. Actual results may differ from those reported in

this release once these figures have been audited.

Sponsorship

Sponsorship of a Qualifying Transaction of a CPC

is required by the Exchange, unless exempt in accordance with

Exchange policies or waived by the Exchange. The Proposed

Transaction may require sponsorship and the Company plans to

provide a news release update should a sponsor be retained. Trading

in the 9 Capital Shares was suspended on September 28, 2020 as a

result of the Company not completing its Qualifying Transaction

within 24 months following its original date of listing on the

Exchange. 9 Capital expects that trading in the 9 Capital Shares

will remain suspended pending closing of the Proposed Transaction,

subject to the earlier re-commencement of trading only upon

Exchange approval and the filing of required materials with the

Exchange as contemplated by Exchange policies.

Filing Statement

In connection with the Proposed Transaction and

pursuant to the requirements of the Exchange, the Company will file

a filing statement on its issuer profile on SEDAR (www.sedar.com),

which will contain details regarding the Proposed Transaction, any

financing completed prior to closing of the Proposed Transaction,

the Company, Churchill and the resulting issuer company following

completion of the Proposed Transaction.

The obligations of the Company and Churchill

pursuant to the Letter Agreement shall terminate in certain

specified circumstances, including in the event that a definitive

business combination agreement with respect to the Proposed

Transaction is not entered into among the parties by January 31,

2021.

About the Company

The Company is a CPC within the meaning of the

policies of the Exchange that has not commenced commercial

operations and has no assets other than cash. Except as

specifically contemplated in the CPC policies of the Exchange,

until the completion of its Qualifying Transaction, the Company

will not carry on business, other than the identification and

evaluation of companies, business or assets with a view to

completing a proposed Qualifying Transaction.

For further information please

contact:

9 Capital Corp.Mr. Ben Cubitt, President and

Chief Executive Officer Tel. (416) 479-5048

Completion of the Proposed Transaction is

subject to a number of conditions including, but not limited to,

Exchange acceptance and shareholder approval. The Proposed

Transaction cannot close until all required shareholder approvals

are is obtained. There can be no assurance that the Proposed

Transaction will be completed as proposed or at all. Investors are

cautioned that, except as disclosed in the filing statement to be

prepared in connection with the Proposed Transaction, any

information released or received with respect to the Proposed

Transaction may not be accurate or complete and should not be

relied upon. Trading in the securities of a CPC should be

considered highly speculative. A comprehensive press release with

further particulars relating to the Proposed Transaction will

follow in accordance with the policies of the Exchange.

The Exchange has in no way passed upon the

merits of the Proposed Transaction and has neither approved nor

disapproved the contents of this news release.

Cautionary Note Regarding Forward

Looking Information

This news release contains statements about the

Company’s expectations regarding any proposed future Qualifying

Transaction of the Company which are forward-looking in nature and,

as a result, are subject to certain risks and uncertainties.

Although the Company believes that the expectations reflected in

these forward-looking statements are reasonable, undue reliance

should not be placed on them as actual results may differ

materially from the forward-looking statements. Factors that could

cause the actual results to differ materially from those in

forward-looking statements include general business, economic,

competitive, political and social uncertainties; and the delay or

failure to receive board, shareholder or regulatory approvals. The

forward-looking statements contained in this press release are made

as of the date hereof, and the Company undertakes no obligation to

update publicly or revise any forward-looking statements or

information, except as required by law.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE.

GoldQuest Mining (TSXV:GQC)

Historical Stock Chart

From Nov 2024 to Dec 2024

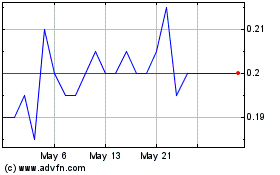

GoldQuest Mining (TSXV:GQC)

Historical Stock Chart

From Dec 2023 to Dec 2024