Hampton Financial Corporation

(“

Hampton” or the “

Company”,

TSXV:HFC) today announced its financial results for the 4th Quarter

and full year ended August 31, 2023.

“The fourth quarter and full year

results reflect continued pressures on Revenues and Earnings across

our industry that began in the fall of 2022 and continued well into

calendar 2023. Capital Markets activity continued to be weak into

the fourth quarter, but we are seeing signs of an initial recovery

that should be reflected in Q2 of fiscal 2024,” said

Hampton Executive Chairman & CEO Peter Deeb.

Fourth Quarter fiscal

highlights:

Fourth Quarter ended August

31st, 2023;

- Q4 Revenues of $1,360,000;

a decrease of 42.9% year-over-year

- Q4 Net Losses of ($405,000)

or $(0.01) per share;

- Q4 EBITDA of $34,000 vs

$50,000 in the comparative quarter last year

Full Year fiscal

highlights:

Fiscal Year ended August

31st, 2023;

- FY Revenues of $8,727,000;

a decrease of 49.2% year-over-year

- FY Net Losses of

($2,920,000) or $(0.09) per share;

- FY EBITDA of ($1,395,000)

vs $2,548,000 for the fiscal year 2022

Summary of Corporate

Developments:

Our 4th Quarter and full year results reflect

the challenging year that 2023 was for our industry. Rising

interest rates and global uncertainty delayed many financings and

broader financial decisions on the part of issuers. While 2024 is

showing some signs of improvement, the year ahead for our core

business remains unclear. That said we intend to move ahead with a

number of initiatives to further expand our business portfolio,

while growing our existing Wealth Management and Capital Markets

businesses. We are hopeful of improvements in Q2 and beyond.

Copies of Hampton’s audited annual financial

statements and its Management’s Discussion & Analysis for the

fiscal year ended August 31st, 2023 can be accessed on SEDAR at

www.sedar.com.

About Hampton Financial

Corporation

Hampton is a unique private equity firm that

seeks to build shareholder value through long-term strategic

investments.

Through HSL, Hampton is actively engaged in

family office, wealth management, institutional services and

capital markets activities. HSL is a full-service investment

dealer, regulated by IIROC and registered in Alberta, British

Columbia, Manitoba, Saskatchewan, Nova Scotia, Northwest

Territories, Ontario, and Quebec. In addition, the Company provides

investment banking services, which include assisting companies with

raising capital, advising on mergers and acquisitions, and aiding

issuers in obtaining a listing on recognized securities exchanges

in Canada and abroad and HSL’s Corporate Finance Group provides

early stage, growing companies the capital, they need to create

value for investors. HSL’s Treasury Group works to maximize returns

from its balance sheet and strengthen its competitive position as

one of Canada’s leading independent financial institutions. HSL

continues to develop its Wealth Management, Advisory Team and

Principal-Agent programs which offers to the industry’s most

experienced wealth managers a unique and flexible operating

platform that provides additional freedom, financial support, and

tax effectiveness as they build and manage their professional

practice.

The Company is also exploring opportunities to

diversify its sources of revenue by way of strategic investments in

both complimentary business and non-core sectors that can leverage

the expertise of its Board and the diverse experience of its

management team.

For more information, please contact:

Olga JuravlevChief Financial OfficerHampton

Financial Corporation(416) 862-8701

Or

Peter M. DeebExecutive Chairman & CEOHampton

Financial Corporation(416) 862-8651

The TSXV has in no way approved nor

disapproved the contents of this press release. Neither

the TSXV nor its Regulation Services Provider

(as that term is defined in the policies of the

TSXV) accepts responsibility for the adequacy

or accuracy of this press release.

No securities regulatory authority has

either approved or disapproved of the contents of

this press release. This press release does

not constitute or form a part of any offer or solicitation

to buy or sell any securities in the United

States or any other jurisdiction outside of Canada.

The securities being offered have not been

and will not be registered under the United

States Securities Act of 1933, as amended

(the "U.S. Securities Act"), or the securities laws of any

state of the United States and may not be

offered or sold within the United States or to a U.S.

person absent registration or pursuant to an

available exemption from the registration requirements

of the U.S. Securities Act and applicable

state securities laws. There will be no public offering

of securities in the United

States.

Forward-Looking Statements

This press release contains certain

forward-looking statements and forward-looking information

(collectively referred to herein as "forward-looking

statements") within the meaning of applicable Canadian

securities laws, which may include, but are not limited to,

information and statements regarding or inferring the future

business, operations, financial performance, prospects, and other

plans, intentions, expectations, estimates, and beliefs of the

Company. All statements other than statements of present or

historical fact are forward-looking statements. Forward-looking

statements are often, but not always, identified by the use of

words such as “should”, “hopeful”, “recovery”, "anticipate",

"achieve", "could", "believe", "plan", "intend", "objective",

"continuous", "ongoing", "estimate", "outlook", "expect", "may",

"will", "project" or similar words, including negatives thereof,

suggesting future outcomes.

Forward-looking statements involve and are

subject to assumptions and known and unknown risks, uncertainties,

and other factors beyond the Company’s ability to predict or

control which may cause actual events, results, performance, or

achievements of the Company to be materially different from future

events, results, performance, and achievements expressed or implied

by forward-looking statements herein. Forward-looking statements

are not a guarantee of future performance. Although the Company

believes that any forward-looking statements herein are reasonable,

in light of the use of assumptions and the significant risks and

uncertainties inherent in such statements, there can be no

assurance that any such forward-looking statements will prove to be

accurate. Actual results may vary, and vary materially, from those

expressed or implied by the forward-looking statements herein.

Accordingly, readers are advised to rely on their own evaluation of

the risks and uncertainties inherent in forward-looking statements

herein and should not place undue reliance upon such

forward-looking statements. All forward-looking statements herein

are qualified by this cautionary statement. Any forward-looking

statements herein are made only as of the date hereof, and except

as required by applicable laws, the Company assumes no obligation

and disclaims any intention to update or revise any forward-looking

statements herein or to update the reasons that actual events or

results could or do differ from those projected in any

forward-looking statements herein, whether as a result of new

information, future events or results, or otherwise, except as

required by applicable laws.

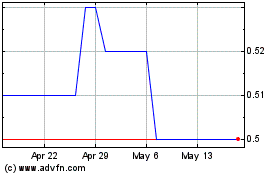

Hampton Financial (TSXV:HFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

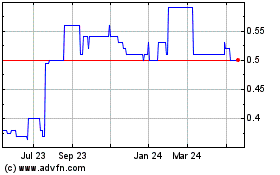

Hampton Financial (TSXV:HFC)

Historical Stock Chart

From Apr 2023 to Apr 2024