Hunter Technology Corp. (TSX-V: HOC; OTCQB: HOILF; WKN: A2QEYH,

FSE: RWPM, ISIN: CA4457371090) (“

Hunter” or the

“

Company”) is pleased to announce that it has

entered into a letter agreement (the “

Letter

Agreement”) with FinFabrik Limited of Hong Kong

(“

FinFabrik”) and the holders of a majority of

FinFabrik’s outstanding share capital (the

“

Principals”) pursuant to which the parties to the

Letter Agreement have agreed to use reasonable commercial efforts

to negotiate and agree on a definitive purchase and sale agreement

(the “

Purchase Agreement”) for a transaction (the

“

Transaction”) in which Hunter will acquire all of

the issued and outstanding shares of FinFabrik for aggregate gross

consideration of USD $12,000,000, payable through the issuance of

13,333,333 common shares of Hunter (“

Hunter

Shares”) at a deemed price of USD $0.90 per Hunter Share.

"We are very pleased to be partnering with the

team at FinFabrik," said Andrew Hromyk, Hunter's CEO. "Their proven

track record in developing commercial software will enable Hunter

to bring our OilEx and OilExchange platforms to market at an

accelerated pace, while driving new revenue growth across the

existing, mature IP that FinFabrik has developed."

About FinFabrikFounded in 2016,

FinFabrik is a Hong-Kong based financial technology company,

powering institutions, professional investors, and managed capital

in a new era of digital marketplaces.

FinFabrik has a history of building software

solutions designed to increase efficiency in complex markets. Its

scalable applications integrate issuance, deal matching and

settlement in one end-to-end compliant process. This improves

access and experience for counterparties, automates manual

processes, and accelerates closings by enabling marketplaces with

deep liquidity and broad participation.

FinFabrik’s core platform CrossPool is a

marketplace as a service, supporting a standardized lifecycle in

both conventional and alternative assets. CrossPool enables fully

digital, real-time transactions in an environment of transparency,

security, and trust. The system leverages distributed ledger

technology for identity management, process compliance, provenance

tracing, record immutability and enforceability of contracts.

The FinFabrik team combines decades of

experience in finance and technology with experts in asset

management, trading systems, enterprise software and cryptography.

The Principals of FinFabrik are Mr. Alex Medana, CEO, and Dr.

Florian M. Spiegl, COO.

"We are thrilled to combine forces with seasoned

executives who share a common vision to enter a new era in physical

oil trading. There is strong synergy in combining Hunter’s

expertise and network in the traditional oil industry with our

leadership in marketplace technology. For FinFabrik this opens our

next chapter and confirms our strategy to partner with

industry-leading innovators," said Alex Medana.

"The oil industry as market essential to the

global economy is at an inflection point," added Florian Spiegl.

"Intense competition, shifting supply and demand and the need to be

more sustainable create one of the industry’s most transformative

moments. This offers the tremendous opportunity for competitive

players to be at the forefront of a new age. I’m excited about our

partnership with Hunter to build an agile, technology-led provider

of global market access for independent producers."

Transaction TermsThe Letter

Agreement provides that the parties will use reasonable commercial

efforts to negotiate and agree on the Purchase Agreement for the

Transaction by Dec. 18, 2020, and sets forth the general terms of

the Transaction to be reflected in the definitive Purchase

Agreement. These terms include the issuance of 13,333,333 Hunter

Shares to the holders of FinFabrik ordinary shares (the

“FinFabrik Shareholders”) at a deemed price of USD

$0.90 per Hunter Share for gross consideration of USD $12,000,000.

The Hunter Shares issued to the FinFabrik Shareholders in

connection with the Transaction will be subject to contractual hold

periods of up to one year. The Purchase Agreement will

include usual and customary representations and warranties and

pre-closing covenants to conduct the business of FinFabrik in the

ordinary course until closing. Closing of the Transaction will be

subject to approval by the respective boards of Hunter and

FinFabrik as well as standard closing conditions, including

completion of Hunter's due diligence review of FinFabrik,

settlement of certain related party debts of FinFabrik prior to

closing, and the delivery of audited financial statements of

FinFabrik to Hunter. It is anticipated that the Principals will be

appointed as directors and/or officers of Hunter at Closing, in

roles and on terms to be negotiated by the Principals and

Hunter. No finder's fees will be paid in respect of the

Transaction.

The Letter Agreement also provides that the

FinFabrik Shareholders and other parties may, concurrent with the

execution of the Purchase Agreement, subscribe for additional

Hunter Shares in a non-brokered private placement (the

"Private Placement") with gross proceeds to Hunter

of not more than USD $3,000,000 and at a price of USD $0.75 per

Hunter Share. Proceeds of the Private Placement would be used

for general working capital purposes. Hunter Shares issued

pursuant to the Private Placement will be subject to both a

statutory and Exchange hold period of four months and a day from

the date of closing. The Transaction and the Private Placement are

expected to close on or before Dec. 31, 2020. The Transaction

and the Private Placement are subject to receipt of all required

approvals, including approval of the TSX Venture Exchange.

About Hunter Technology Corp.

Hunter Technology Corp. is an oil industry service provider

developing interactive platforms to enable the facilitation of

physical oil transactions throughout the trade lifecycle, with more

favourable economics for producers and access to a fair market for

all. Through oilex.com Hunter will operate a physical oil

marketplace to facilitate the buying and selling of physical oil by

independent producers to corporate consumers, traders and sovereign

purchasers. And through oilexchange.com, Hunter will offer robust

supply chain management tools that track physical oil throughout

the supply chain and automate the reporting process.

ON BEHALF OF THE BOARD OF DIRECTORS Andrew

Hromyk

Chief Executive Officer(888) 977-0970

For further information, visit our

website at

www.huntertechnology.com

NEITHER TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES

OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE

ADEQUACY OR ACCURACY OF THIS RELEASE.

THIS PRESS RELEASE, REQUIRED BY

APPLICABLE CANADIAN LAWS, IS NOT FOR DISTRIBUTION TO U.S. NEWS

SERVICES OR FOR DISSEMINATION IN THE UNITED STATES, AND DOES NOT

CONSTITUTE AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO SELL

ANY OF THE SECURITIES DESCRIBED HEREIN IN THE UNITED STATES. THESE

SECURITIES HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE

UNITED STATES SECURITIES ACT OF 1933, AS AMENDED, OR ANY STATE

SECURITIES LAWS, AND MAY NOT BE OFFERED OR SOLD IN THE UNITED

STATES OR TO U.S. PERSONS UNLESS REGISTERED OR EXEMPT

THEREFROM.

Cautionary Statement Regarding

Forward-Looking Information.This news release contains

certain statements which may constitute forward-looking statements

or information regarding Hunter’s business development plans. Such

forward-looking statements are subject to numerous risks and

uncertainties, some of which are beyond Hunter's control, including

execution risk, market risk, industry risk, the impact of general

economic conditions and competition from other industry

participants, stock market volatility, the ability to access

sufficient capital from internal and external sources, the ability

of Hunter and FinFabrik to agree to terms for a Purchase Agreement,

If at all, the FinFabrik Shareholders agreeing to the Purchase

Agreement in a timely manner, Hunter completing a satisfactory due

diligence review of FinFabrik, Hunter reaching an agreement with

the Principals to serve with Hunter following Closing, receipt of

any required corporate and regulatory approvals, and closing of the

Transaction. In addition, there Is no guarantee that any FinFabrik

Shareholders will subscribe to the Private Placement.

Although Hunter believes that the expectations in its

forward-looking statements are reasonable, they are based on

factors and assumptions concerning future events which may prove to

be inaccurate. Those factors and assumptions are based upon

currently available information. Such forward-looking statements

are subject to known and unknown risks, uncertainties and other

factors that could influence actual results or events and cause

actual results or events to differ materially from those stated,

anticipated or implied in the forward-looking statements. As such,

readers are cautioned not to place undue reliance on the

forward-looking statements, as no assurance can be provided as to

future results, levels of activity or achievements. The

forward-looking statements contained in this news release are made

as of the date of this news release and, except as required by

applicable law, Hunter does not undertake any obligation to

publicly update or to revise any of the included forward-looking

statements, whether as a result of new information, future events

or otherwise. The forward-looking statements contained in this

document are expressly qualified by this cautionary statement.

Trading in the securities of Hunter should be considered highly

speculative. There can be no assurance that Hunter will be able to

achieve all or any of its proposed objectives. Please review

Hunter’s Filing Statement dated October 21, 2020 and filed under

the Company's SEDAR profile at www.sedar.com for a more

fulsome discussion of risk factors affecting Hunter.

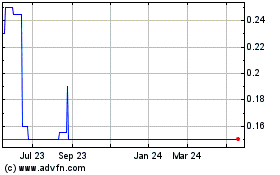

Hunter Technology (TSXV:HOC)

Historical Stock Chart

From Oct 2024 to Nov 2024

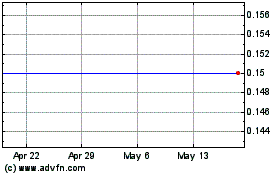

Hunter Technology (TSXV:HOC)

Historical Stock Chart

From Nov 2023 to Nov 2024