IBEX Technologies Inc. (TSX VENTURE:IBT), today reported its financial results

for the third quarter and nine months ended April 30, 2008.

FINANCIAL RESULTS

Solely for the convenience of the reader, selected financial results expressed

in Canadian dollars on the financial statements, have been translated into U.S.

dollars at the April 30, 2008 month-end rate C$1.00 equals US$ 0.9928. This

translation should not be construed as an application of the recommendations

relating to the accounting for foreign currency translation, but rather as

supplemental information for the reader.

Results for the Quarter

Sales for the three-month period ended April 30, 2008 totaled $712,997

(US$707,860) compared to $551,768 in the third quarter of fiscal 2007,

representing an increase of 29%.

Net profit for the third quarter of fiscal 2008 was $259,269 (US$257,400) or

$0.01 per share, compared to a net loss of $815,603 or ($0.04) per share for the

same period in fiscal 2007.

In addition to sales gains, the Company's profit improvement can be traced to

significantly reduced operating costs, from $1,367,765 in the prior year to

$453,752 in the current quarter, due to a cost reduction program which included,

among other things, the decision to terminate the research and development

activities related to its arthritis and cancer programs.

"The results for the quarter were enhanced by the recent industry crisis

regarding heparin, leading to an increase in sales of the Company's heparinase

products useful in the identification of heparin contaminants" said Paul Baehr,

President and CEO.

The heparin contamination issue presents a unique opportunity for the use of

IBEX pure recombinant enzymes and as a result IBEX has commenced development of

an easy-to-use enzyme-based assay to measure chondroitin contamination.

Results for the Nine Months

Sales for the nine-month period ended April 30, 2008 totaled $1,816,800

(US$1,803,720) compared to $1,454,113 for the same period in the prior year,

representing an increase of 25%.

Net profit for the nine-months ended April 30, 2008 was $158,622 (US$157,480) or

($0.01) per share compared to a net loss of $1,900,938 or ($0.08) per share for

the same period in fiscal 2007.

A significant contributor to the year to date profit (versus the net loss same

period of the prior year) is a reduction of the company's operating expenses

from $3,567,237 to $1,655,261 due to the previously mentioned cost reduction

program.

Working Capital

The Company's working capital was $1,629,408 as at the end of the quarter,

in-line with the guidance provided at the time of the restructuring announcement

and up from $1,338,625 as at the end of the prior quarter ending January 31,

2008 (and compared to $1,403,321 as at July 31, 2007).

LOOKING FORWARD

IBEX has been successful in bringing its existing business to profitability and

is now turning its attention to growth opportunities, including opportunities to

maximize shareholders' value through discussions with companies interested in

the IBEX infrastructure and its accumulated tax loss carry-forwards.

ABOUT IBEX

The Company markets a series of proprietary enzymes (heparinases and

chondroitinases) for research use, as well Heparinase I, which is used in many

leading hemostasis monitoring devices.

IBEX also markets a series of arthritis assays which are widely used in

pharmaceutical research. These assays are based on the discovery of a number of

specific molecular biomarkers associated with collagen synthesis and

degradation.

Safe Harbor Statement

All of the statements contained in this news release, other than statements of

fact that are independently verifiable at the date hereof, are forward-looking

statements. Such statements, based as they are on the current expectations of

management, inherently involve numerous risks and uncertainties, known and

unknown. Some examples of known risks are: the impact of general economic

conditions, general conditions in the pharmaceutical industry, changes in the

regulatory environment in the jurisdictions in which IBEX does business, stock

market volatility, fluctuations in costs, and changes to the competitive

environment due to consolidation or otherwise. Consequently, actual future

results may differ materially from the anticipated results expressed in the

forward-looking statements. IBEX disclaims any intention or obligation to update

these statements.

CONSOLIDATED BALANCE SHEETS

--------------------------------------------------------------------------

April 30, July 31,

unaudited 2008 2007

--------------------------------------------------------------------------

$ $

ASSETS

Current assets

Cash and cash equivalents 1,398,745 348,752

Marketable securities (note 3) - 1,099,673

Accounts receivable 345,138 500,509

Inventories 173,121 164,384

Prepaid expenses 133,065 135,014

--------------------------------------------------------------------------

Sub-total Current Assests 2,050,069 2,248,332

--------------------------------------------------------------------------

Property and equipment 255,919 303,271

--------------------------------------------------------------------------

TOTAL ASSETS 2,305,988 2,551,603

--------------------------------------------------------------------------

--------------------------------------------------------------------------

LIABILITIES

Current liabilities

Accounts payable and accrued liabilities 420,661 845,011

--------------------------------------------------------------------------

Sub-total Current Liabilities 420,661 845,011

--------------------------------------------------------------------------

TOTAL LIABILITIES 420,661 845,011

--------------------------------------------------------------------------

SHAREHOLDERS' EQUITY

Capital stock (note 4) 52,660,078 52,660,078

Contributed surplus (note 4) 399,975 375,151

Profit (Deficit) (51,174,727) (51,328,637)

--------------------------------------------------------------------------

TOTAL SHAREHOLDER'S EQUITY 1,885,327 1,706,592

--------------------------------------------------------------------------

--------------------------------------------------------------------------

TOTAL LIABILITIES & SHAREHOLDER'S EQUITY 2,305,988 2,551,603

--------------------------------------------------------------------------

--------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF DEFICIT

--------------------------------------------------------------------------

For the nine months ended April 30 (unaudited) 2008 2007

--------------------------------------------------------------------------

$ $

Balance - Beginning of period (51,328,637) (43,918,975)

Transition adjustment on adoption of financial

instrument standard (note 2) (4,711) -

--------------------------------------------------------------------------

Restated balance - Beginning of period (51,333,348) (43,918,975)

Net profit (Net loss) year to date 158,622 (7,409,662)

--------------------------------------------------------------------------

Balance - End of period (51,174,727) (51,328,637)

--------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF EARNING (LOSS)

Three months ended Nine months ended

April 30th April 30th

--------------------------------------------------------------------------

(unaudited) 2008 2007 2008 2007

--------------------------------------------------------------------------

$ $ $ $

Revenue 712,997 551,768 1,816,800 1,454,113

--------------------------------------------------------------------------

Operating expenses

Cost of good solds (200,821) (228,527) (735,318) (643,542)

Net research and

development expenditure

(note 7) 39,427 (372,938) 39,427 (986,805)

Selling, general and

administrative expenses (265,704) (723,584) (926,200) (1,925,728)

Amortization of property

and equipment (15,763) (33,497) (49,677) (100,409)

Amortization of

identifiable intangible

assets - (809) - (2,427)

Other interest and bank

charges (3,266) (8,435) (7,703) (24,266)

Foreign exchange loss

(note 6) (15,749) (48,872) (22,646) (27,785)

Investment income 8,124 48,897 36,857 143,725

--------------------------------------------------------------------------

Total operating expenses (453,752) (1,367,765) (1,665,261) (3,567,237)

--------------------------------------------------------------------------

259,245 (815,997) 151,540 (2,113,124)

Current Income taxes (24) (394) (7,082) (212,186)

--------------------------------------------------------------------------

Net profit (loss) 259,269 (815,603) 158,622 (1,900,938)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Net profit (loss) per

share

Basic and diluted $0.01 $(0.04) $0.01 $(0.08)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

CONSOLIDATED CASH FLOW STATEMENTS

Three months ended Nine months ended

April 30th April 30th

--------------------------------------------------------------------------

(unaudited) 2008 2007 2008 2007

--------------------------------------------------------------------------

$ $ $ $

Cash flows provided by

(used in):

Operating activities

Net profit (loss) for the

period 259,269 (815,603) 158,622 (1,900,938)

Items not affecting cash -

Amortization of property and

equipment 15,763 42,270 49,678 126,726

Amortization of identifiable

intangible assets - 71,308 - 213,922

Stock-based compensation

costs 17,150 4,520 24,824 21,040

Accretion of interest on

balance of payments - 4,550 - 13,650

--------------------------------------------------------------------------

Cash flow relating to

operating activities 292,182 (692,955) 233,124 (1,525,600)

--------------------------------------------------------------------------

Net changes in non-cash

working capital items -

Decrease in accounts

receivable 26,770 52,917 155,371 109,845

Decrease (increase) in

inventories (58,963) 22,595 (8,737) 63,790

(Increase) decrease in

prepaid expenses (45,903) (48,174) 1,949 (19,932)

(Decrease) increase in

accounts payable and

accrued liabilities 119,689 358,827 (429,061) 56,117

--------------------------------------------------------------------------

Net changes in non-cash

working capital balances

relating to operations 41,593 386,165 (280,478) 209,820

--------------------------------------------------------------------------

Cash flow relating to

operating activities 333,775 (306,790) (47,354)(1,315,780)

--------------------------------------------------------------------------

Investing activities

Additions to marketable

securities - (2,001,239) - (5,640,573)

Proceeds on disposal of

marketable securities - 4,290,850 1,099,673 9,315,062

Additions to property and

equipment (1,400) (550) (2,326) (8,573)

Increase in other assets - (360,371) - (1,000,000)

--------------------------------------------------------------------------

Cash flow relating to

financing activities (1,400) 1,928,690 1,097,347 2,665,916

--------------------------------------------------------------------------

Increase in cash and cash

equivalents during the year 332,375 1,621,900 1,049,993 1,350,136

Cash and cash equivalents -

Beginning of period 1,066,370 544,688 348,752 816,452

--------------------------------------------------------------------------

Cash and cash equivalents -

End of period 1,398,745 2,166,588 1,398,745 2,166,588

--------------------------------------------------------------------------

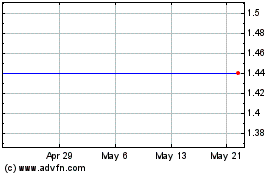

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Nov 2024 to Dec 2024

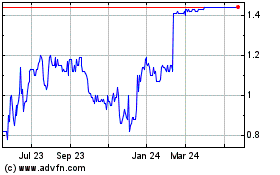

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Dec 2023 to Dec 2024