Premium Exploration Makes Multiple New Gold Discoveries at Idaho Gold Project

02 December 2011 - 5:20AM

Marketwired Canada

Premium Exploration Inc. (TSX VENTURE:PEM)(OTCQX:PMMEF) ("Premium" or the

"Company") is pleased to announce that the first six of nine holes drilled in

the 35 km2 Deadwood Zone have resulted in four widely-spaced gold discoveries in

host rocks identical to the Friday Zone. These discoveries are located 12 km

north of the Friday Zone, which hosts a current NI 43-101 compliant resource of

343,000 oz indicated (11.8 Mt @ 0.90 g/t Au) and 879,000 oz inferred (26.4 Mt @

1.04 g/t Au) at a 0.5 g/t cut-off along 1,400m of a 5,000m coincident

geophysical and gold-in-soil trend.

Key Points:

-- Encountered gold-bearing host rocks and structures identical to the

Friday Zone in multiple locations throughout the Deadwood Zone.

-- Premium has now made eight gold discoveries along 20 km of the Idaho

Gold Project ("IGP"). Geological similarities between all zones and at

all scales suggest that these zones are related to the same mineralizing

event and, as a result, are potentially connected along trend and at

depth.

-- DW2011-1,3,4,5,6 intercepted three separate mineralised zones and

together demonstrate potential continuity along 1.3 km of strike length.

-- DW2011-2 discovered a high-grade vein system, intersecting gold-bearing

host rocks identical to those found at the Friday Zone in close

proximity to the historic Grangeville Mine approx. 4 km from DW2011-

1,3,4,5,and 6

"We are very pleased to have confirmed the existence of the regional gold

bearing system in multiple locations at Deadwood. The discoveries confirm we are

on track with our exploration strategy and provide us with an excellent starting

point for follow-up drilling to unlock Deadwood's potential." stated Michael

Ostenson VP Exploration.

Central Deadwood Discoveries

Drill-holes DW2011-1,3,4,5, and DW2011-6 were spaced over 1.3 km along trend in

the central Deadwood Zone on a 12 km long coincident geophysical and

gold-in-soil trend. For an updated Plan View Map of Deadwood Zone please click

http://bit.ly/DWdrillingnov2011.

Central Intercept #1

DW2011-1: 1.0 g/t gold over 1.8 m as well as

0.3 g/t gold over 3.7 m

DW2011-3: 0.3 g/t gold over 7.0 m as well as

0.5 g/t gold over 4.9 m

The first two holes were collared from the same location with one being drilled

west and the second being drilled east in order to locate the preferred

structural corridor for gold mineralization. Drilling encountered alternating

intervals of older gneiss/schist and granite of the Idaho Batholith.

As with all mineralized zones discovered at the Idaho Gold Project to date, gold

mineralization is associated with a low sulfidation system primarily hosted

within sheared and brecciated granites of the Idaho Batholith accompanied by

sericite alteration, silica flooding and disseminated pyrite.

The granite of the Idaho Batholith is now interpreted as being the preferred

host rock for gold mineralization at the IGP. It covers a vast regional extent

in central Idaho and also hosts gold mineralization at Midas Gold's Golden

Meadows Project located approximately 90 km due south along a large structural

and geological trend coincident with Premium's Idaho Gold Project.

DW2011-5: Central Intercept #2

DW2011-5: 1.4 g/t gold over 3.1 m within

0.9 g/t gold over 7.6 m within

0.5 g/t gold over 18.0 m as well as

1.2 g/t gold over 4.6 m within

0.8 g/t gold over 10.1 m

DW2011-4,6: Central Intercept #3

DW2011-4: 1.6 g/t gold over 2.7 m within

1.0 g/t gold over 8.5 m within

0.7 g/t gold over 17.1 m within

0.3 g/t gold over 100.9 m

DW2011-6: 0.3 g/t gold over 13.1 m as well as

1.3 g/t gold over 0.9 m

These drill-holes are located 800m to 1,300m, respectively, along trend to the

north of DW2011-1 & 3.

The anomalous gold mineralization encountered in DW2011-1,3,4,5, and 6 is

interpreted to have intercepted the outer edge of a potentially large zone of

mineralization, similar to the anomalous mineralization surrounding the

Friday-Petsite resource.

Early on in the development of the Friday-Petsite resource many drill-holes

encountered anomalous gold mineralization in very close proximity to

higher-grade material within a broad envelope of low grade. The new discoveries

along the Deadwood zone may reflect the same type of situation where anomalous

gold mineralization is proximal to a much larger zone of mineralization.

Example: Corebox Section 01010 where PZ64 encounters sporadic intercepts of:

2.01 g/t over 9.0 m, 0.67 g/t over 7.62m, and 0.90 g/t over 6 meters. This hole

is very close to the Friday-Petsite indicated and inferred resources where

drill-holes PFR2010-5, 6, & 21 encountered 0.9 g/t over 267m, 0.5 g/t over 226m,

and 1.5 g/t over 330.4m respectively. To view Corebox Section 01010 please click

http://bit.ly/CoreboxFP3DModel and click on the "Section" tab.

DW2011-2: Grangeville Vein System Intercept #4

DW2011-2: 4.5 g/t gold over 2.7 m as well as

11.2 g/t gold over 0.6 m within

2.0 g/t gold over 4.6 m as well as

3.5 g/t gold over 0.6 m

This drill-hole was targeted on a potential cross-cutting structural vein system

interpreted by geophysics near the historic Grangeville Mine in the eastern

portion of the Deadwood Zone. The historic Grangeville Mine was focused on an

east-west approximately 10 meter thick sheered and brecciated quartz vein system

with historically reported grades of up to 15 g/t gold.

A new vein system was discovered proximal to the Grangeville zone and is

interpreted to strike in a parallel east-west orientation. This previously

unknown vein system consists of three brecciated quartz veins and demonstrates

the potential of these higher grade cross-cutting targets along the Idaho Gold

Project.

Cross-cutting east-west vein systems have been historically mined in a number of

locations. These vein systems intersect the north-south Orogrande Shear Zone and

potentially represent a high-grade component to the main low-grade bulk tonnage

target.

Deadwood Zone Follow Up Drilling:

First pass drilling in multiple locations along the Deadwood Zone has revealed a

structural environment and gold bearing host rocks identical to the Friday Zone.

The key to unlocking the potential to host Friday-like deposits is by predicting

the trend of the gold bearing host rocks, structures, and cross-cutting dilatant

zones.

Gold bearing structures with cross-cutting dilatant zones are the optimum

targets where gold deposition is typically enhanced in both size and grade. The

Friday-Petsite resource is interpreted to be hosted within one of these complex

structural intersections.

A comprehensive structural study of the Idaho Gold Project has been initiated

with the object of relating the gold bearing structures to the airborne

geophysics, gold-in-soil trends, and known deposits.

The focus of this work will identify locations of potential dilatant zones and

provide information that can be used to guide the remainder of the Company's

25,000 meter drill program.

Premium's vision is to discover multiple deposits along its 30 km Idaho Gold

Project (180 km2), a re-emerging gold district in Idaho, USA. Approximately

24,000 m have been drilled since the Company's first program in mid-2009,

resulting in 8 gold discoveries along 20 km of strike of the IGP while

encountering gold mineralization in 99.9% of all drilling; results are in line

with the Company's objectives.

----------------------------------------------------------------------

Interval

Drill-Hole Zone From (m) To (m) (m) Au g/t

----------------------------------------------------------------------

DW2011-1 Deadwood 35.1 36.9 1.8 1.0

----------------------------------------------------------------------

as well as 72.9 76.5 3.7 0.3

----------------------------------------------------------------------

DW2011-2 Deadwood 170.1 172.8 2.7 4.5

----------------------------------------------------------------------

as well as 194.5 195.1 0.6 11.2

----------------------------------------------------------------------

within 191.1 195.7 4.6 2.0

----------------------------------------------------------------------

as well as 492.9 493.5 0.6 3.5

----------------------------------------------------------------------

DW2011-3 Deadwood 98.8 105.8 7.0 0.3

----------------------------------------------------------------------

as well as 112.5 117.4 4.9 0.5

----------------------------------------------------------------------

DW2011-4 Deadwood 339.9 342.6 2.7 1.6

----------------------------------------------------------------------

within 336.8 345.3 8.5 1.0

----------------------------------------------------------------------

within 336.8 353.9 17.1 0.7

----------------------------------------------------------------------

within 267.6 368.5 100.9 0.3

----------------------------------------------------------------------

DW2011-5 Deadwood 70.1 73.2 3.1 1.4

----------------------------------------------------------------------

within 68.3 75.9 7.6 0.9

----------------------------------------------------------------------

within 68.3 86.3 18.0 0.5

----------------------------------------------------------------------

as well as 171.6 176.2 4.6 1.2

----------------------------------------------------------------------

within 166.1 176.2 10.1 0.8

----------------------------------------------------------------------

DW2011-6 Deadwood 98.8 111.9 13.1 0.3

----------------------------------------------------------------------

as well as 219.5 220.4 0.9 1.3

----------------------------------------------------------------------

(i)The gold grade calculation is a weighted mean with no top cut and no

bottom cut. The grade calculation includes internal waste and low grade

sections. True Widths are unknown at this time.

The Company wishes to state that potential additional resources are conceptual

in nature only, and that there has been insufficient exploration to define an

increased mineral resource outside of the current NI 43-101 compliant resource.

Furthermore, it is uncertain if further exploration will result in additional

mineral resources. Estimates for potential additional resources are reported as

exploration targets based on the presence of step-out mineralized drill holes,

known mineralized zones open along strike and depth and geophysically anomalous

areas from data received by the Company.

NI 43-101

Premium's current NI 43-101 on the Friday-Petsite Zone along the Company's Idaho

Gold Project, was prepared for Premium by Mark I. Pfau, MSc. of Tellurian

Exploration, Inc. Mr. Pfau is an Independent Qualified Person as defined under

NI 43-101. The technical report has an effective date of March 28, 2011 and was

filed on SEDAR on May 12, 2011.

Quality Assurance

The Company has implemented a rigorous QA/QC program using best industry

practices at the Friday-Petsite Property. As described in the Company's News

Releases of July 9th, 2009 and December 29th, 2009 the program includes chain of

custody of samples, drill core sawn in half and shipped in sealed bags, blind

duplicates, blank samples and certified standards are inserted in the sample

stream. The samples are then boxed and couriered to Acme Analytical Laboratories

of Vancouver, B.C. a lab certified for the provision of assays and geochemical

analyses (ISO 9001:2008). In Phase-Three, as with Phase-Two and Phase-One,

samples with gold values greater than 10 g/t are re-analyzed via the metallic

screen procedure. Samples with visible gold were also analyzed initially using

the metallic screen analysis, as were the samples immediately preceding and

following the sample with visible gold. ALS Chemex is the check laboratory for

the program.

Qualified Person

The Phase-Four exploration program is being directed by Michael Ostenson,

P.Geo., VP Exploration of Premium Exploration Inc. Mr. Ostenson is a Qualified

Person as defined by NI 43-101. Mr. Ostenson prepared, and approves of the

content in this release.

About Premium Exploration Inc.

Premium Exploration Inc. (TSX VENTURE:PEM)(OTCQX:PMMEF) is focused on gold

exploration at its district-sized Idaho Gold Project along the Orogrande Shear

Zone in North-Central Idaho, USA. The "OSZ" is a +30 km regionally-significant

trending structure with multiple known zones of gold mineralization, similar to

many large gold belts, like the Carlin Trend in Nevada. For additional

information, please visit us at www.premiumexploration.com.

This press release contains certain "Forward-Looking Statements" within the

meaning of Section 21E of the United States Security Exchange Act of 1934, and

involves a number of risks and uncertainties. Important factors that could cause

actual results to differ materially from the Company's expectations are

disclosed in the Company's documents filed from time to time with the TSX

Venture Exchange and the British Columbia Securities Commission. All statements,

other than of historical fact, included herein are forward-looking statements

that involve various risks and uncertainties. There can be no assurance that

such statements will prove to be accurate, and actual results and future events

could differ materially from those anticipated in such statements.

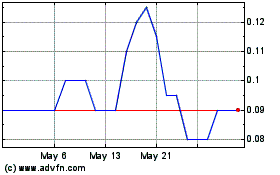

Imperial Ginseng Products (TSXV:IGP)

Historical Stock Chart

From May 2024 to Jun 2024

Imperial Ginseng Products (TSXV:IGP)

Historical Stock Chart

From Jun 2023 to Jun 2024