Juggernaut Increases Financing From $2,800,000 to $5,300,000 Due to Strong Demand From Institutions, Strategic Investors and ...

01 March 2021 - 11:45PM

Juggernaut Exploration Ltd. (TSX-V: JUGR) (OTCQB: JUGRF)

(FSE: 4JE) (the “Company” or “Juggernaut”) is pleased

to report that it has received Conditional Approval from

the TSX Venture Exchange (the “Exchange”) for its previously

announced (see news releases dated February 8, 2021 and February

22, 2021) private placement financing (the “Financing”).

The company will have in excess

of $6,000,000 in cash no debt and less than 39MM share

issued and outstanding post financing. The significant investment

of $5,300,000 by Institutions, Strategic investors, insiders

coupled with interest from senior miners is a strong testament to

Juggernauts properties and planned 2021 exploration programs.

Juggernauts 4 properties are 100% controlled containing

original discoveries with exposure to gold, silver and base metals

located in world class geologic terrain of North Western British

Columbia Canada.

Juggernaut’s previously announced a expanded

non-brokered flow through financing consisting of units priced at

$0.355 with a two year warrant priced at $0.375 of up to $2,800,000

on February 22nd. The company has now received $2,500,000 in a

fully subscribed hard dollar financing consisting of units priced

at $0.25 with a two year warrant priced at $0.375. Crescat Capital

LLC (“Crescat”) has agreed to make a strategic investment

representing a 9.90% ownership of the Company post funding. As part

of the terms, they will also have an option to participate in

future financings to maintain their 9.90% interest for a three-year

period from the date of closing scheduled for March 5 2021.

“Crescat is taking an activist approach to

investing in the precious metals mining industry today. Our goal at

this stage of the cycle is to identify and invest in a portfolio of

potentially big, high-grade discoveries in the hands of undervalued

juniors where we can help unlock value. We are excited about

Juggernaut and the discovery potential of its assets,” remarked

Kevin Smith, Crescat’s founder and Chief Investment Officer.

Dr. Quinton Hennigh has taken on the role as

special technical advisor to the Company. He is the technical

consultant for all Crescat’s gold and silver mining investments.

Dr. Hennigh is a world-renowned exploration geologist with more

than 30 years of experience including with major gold mining firms

Homestake Mining, Newcrest Mining, and Newmont Mining.

Dr. Hennigh stated “Juggernaut has a portfolio

of promising early stage projects in and around the Golden

Triangle, British Columbia. Funds from this placement will be used

to undertake some fundamental exploration work with the aim of

quickly generating new drill targets at some of its projects. In

particular, the Midas property displays good potential for precious

metal-rich volcanogenic massive sulfide discovery of “Eskay Creek”

style. Although a fair amount of geologic work was undertaken at

Midas over the past couple years, it is clear that the area of

exploration interest is far larger than previously perceived and

that the lion’s share of prospectivity remains untested. This is a

classic opportunity whereby Crescat applies its friendly activist

strategy toward building exploration strategy and helping to

capitalize it.”

View Juggernaut video by

Clicking Here.

On receipt of final approval from the Exchange,

the Company will issue up to 7,888,324 Flow-Through Units (“FT

Units”), each FT Unit consisting of 1 flow-through common share of

the Company at $0.355, and 1 common share purchase warrant

exercisable for an additional common share at $0.375 for 2 years.

Also 10,000,000 $0.25 Non-Flow-Through Units (“NFT Units”), each

NFT Unit consisting of 1 common share of the Company and 1 common

share purchase warrant exercisable for an additional common share

at $0.375 for 2 years.

Directors and officers of the company may

acquire securities under the placement, which participation would

be considered to be a “related party transaction” as defined under

Multilateral Instrument 61-101 (“MI 61-101”). Such participation is

expected to be exempt from the formal valuation and minority

shareholder approval requirements of MI 61-101.

Mr. Dan Stuart, Director, President and

CEO of Juggernaut states:

“We are pleased to welcome both Crescat Capital

as a strategic investor and Dr. Hennigh as a Special Technical

Advisor and investor. I look forward to working with our new

partners who bring a proven track record of both financial and

technical strength. This will enable Juggernaut to unlock the full

potential of its assets over the long term, building value for all

shareholders. This investment and strategic partnership, coupled

with the ongoing institutional support and interest from senior

miners, is a strong endorsement that clearly demonstrates the

significant near term discovery potential of four 100% controlled

properties. With a very tight capital structure, no debt and a

strong cash position, we are well positioned to move forward with

exploration and drilling programs on our properties this summer.

With much anticipation, we look forward to executing the inaugural

drill and exploration programs and reporting results.”

The Company will pay finder's fees of the gross

proceeds from the financing in cash, and compensation options on

the same terms and pricing as the units being sold. This

non-brokered private placement is subject to TSX Venture Exchange

approval. All shares issued pursuant to this offering and any

shares issued pursuant to the exercise of warrants will be subject

to a four-month hold period from the closing date.

About Crescat Capital LLC

Crescat is a global macro asset management firm

headquartered in Denver, Colorado. Crescat’s mission is to grow and

protect wealth over the long term by deploying tactical investment

themes based on proprietary value-driven equity and macro models.

Crescat’s goal is industry leading absolute and risk-adjusted

returns over complete business cycles with low correlation to

common benchmarks. The company’s investment process involves a mix

of asset classes and strategies to assist with each client’s unique

needs and objectives and includes Global Macro, Long/Short, Large

Cap and Precious Metals funds.

Crescat is advised by its technical consultant,

Dr. Quinton Hennigh on investments in gold and silver resource

companies. Dr. Hennigh became an economic geologist after obtaining

his PhD in Geology/Geochemistry from the Colorado School of Mines.

He has more than 30 years of exploration experience with major gold

mining firms that include Homestake Mining, Newcrest Mining and

Newmont Mining. Among his notable project involvements are First

Mining Gold’s Springpole gold deposit in Ontario, Kirkland Lake

Gold’s acquisition of the Fosterville Gold Mine in Australia, the

Rattlesnake Hills gold deposit in Wyoming, and Lion One’s Tuvatu

gold project on Fiji, among many others.

About Juggernaut Exploration

Ltd.

Juggernaut Exploration Ltd. is a precious metals

project generator in the geopolitically stable jurisdiction of

Canada, focused on the prolific geologic setting of northwestern

British Columbia.

For more information, please contact

Juggernaut Exploration Ltd.

Dan StuartPresident, Director and Chief

Executive Officer

604-559-8028

www.juggernautexploration.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE.FORWARD LOOKING

STATEMENT

Certain disclosure in this release may

constitute forward-looking statements that are subject to numerous

risks and uncertainties relating to Juggernaut’s operations that

may cause future results to differ materially from those expressed

or implied by those forward-looking statements, including its

ability to complete the contemplated private placement. Readers are

cautioned not to place undue reliance on these statements. NOT FOR

DISSEMINATION IN THE UNITED STATES OR TO U.S. PERSONS OR FOR

DISTRIBUTION TO U.S. NEWSWIRE SERVICES. THIS PRESS RELEASE DOES NOT

CONSTITUTE AN OFFER TO SELL OR AN INVITATION TO PURCHASE ANY

SECURITIES DESCRIBED IN IT.

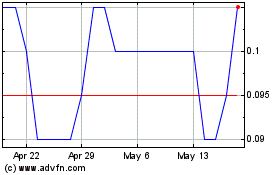

Juggernaut Exploration (TSXV:JUGR)

Historical Stock Chart

From Feb 2025 to Mar 2025

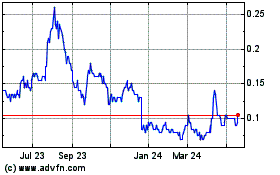

Juggernaut Exploration (TSXV:JUGR)

Historical Stock Chart

From Mar 2024 to Mar 2025