LSL Pharma Group Announces Closing of First Tranche of Convertible Debentures Offering

02 November 2023 - 2:50AM

LSL Pharma Group Inc. (TSXV: LSL) – (the “

Company”

or “

LSL Pharma Group”), a Canadian integrated

pharmaceutical company, is pleased to announce that further to its

press release of September 21, 2023, the Company has closed the

first tranche of its brokered private placement (the

“

Offering”) through the issuance of 229,300

unsecured convertible debentures (each a

“

Debenture”) at a price of $10 per Debenture for

gross proceeds of $2,293,000 out of a maximum of $5,000,000

(assuming the full exercise of the agent's option to increase the

size of the Offering by up to $1.0 million). The net proceeds of

the Offering will be used for working capital, capital

expenditures, and for general corporate purposes.

The Offering was led by iA Capital Markets as

sole agent and sole bookrunner (the “Agent”). In

connection with the first tranche of the Offering, the Company paid

to the Agent a cash commission of $160,510 and issued 229,300

broker warrants (the “Broker Warrants”). The

Broker Warrants are exercisable to acquire one Class A Share of the

Company at a price of $0.70 for a period of 24 months from the date

of issuance. The Company and the Agent are dealing at arm’s

length.

All securities issued pursuant to the Offering

are subject to the applicable statutory hold period of four months

and one day from November 1, 2023 (the “Initial Closing

Date”). The Offering is subject to the final approval of

the TSX Venture Exchange (the “TSXV”).

The Company has received conditional approval to

list the Debentures on the TSXV after the expiry of each applicable

hold period. The Debentures are expected to trade under the symbol

LSL.DB. The listing of the Debentures is subject to final approval

by the TSXV at the time of listing and the Company fulfilling the

requirements as outlined in Policy 2.8 of the TSXV’s policies.

Each Debenture will, at the option of the

holder, be convertible in its entirety into Class A shares of the

capital stock of the Company (the “Class A

Shares”) at any time prior to the close of business on the

earlier of: (i) the last business day immediately preceding the

Maturity Date, and (ii) the date fixed for redemption, at a

conversion price of $0.70 per Class A Share (the

“Conversion Price”), subject to adjustment in

certain events.

The Debentures will, subject to any prior

conversion or redemption, mature on October 31st, 2028

(“Maturity Date”) and are payable on the Maturity

Date in cash. The outstanding principal amount will bear interest

at the rate of 11.00% (the “Base Rate”) per year,

payable in cash semi-annually on the last day of April and October

of each year with the first interest payment to be paid on October

31, 2024 (“First Interest Payment Date”). Interest

will accrue from the Initial Closing Date up to the First Interest

Payment Date at the Base Rate, compounding semi-annually on the

last day of April and October of each year (the “Interest

Period”).

The annual interest rate will be recalculated

twice every year on April 30th and October 31st of each year,

starting April 30th, 2025 (each an “Interest Rate Review

Date”) until the Maturity Date, and shall be equal to the

Base Rate less 100 basis points (1.0%) for each Business Objective

(as defined below) achieved (the “Amended Base

Rate”). Upon achievement of a Business Objective, the

Amended Base Rate will be effective as of the following interest

payment date of the Debentures (after April 30, 2025) until the

next interest payment date thereafter if Business Objective 3 (as

defined below) is achieved or until the Maturity Date if a Business

Objective 1 or 2 (as defined below) is achieved.

Business Objectives (each a “Business

Objective”):

- the obtention by the Company of FDA

approval for its Steri-Med plant (one-time business

objective);

- the completion by the Company of

the acquisition of a business which: 1) complements the Company’s

existing product offering and/or creates synergies with the

Company’s existing business operations and 2) generated a minimum

of CAD$5.0 million in revenue during the last twelve-month (12)

period preceding the acquisition (one-time business objective);

or

- the Company generates a minimum of

CAD$30 million of revenue with a 20% EBITDA margin during the

fiscal period preceding the Interest Rate Review Date (annual

business objective). With respect to (3), the Company’s financial

performance and revenue shall be calculated based on its audited

financial statements and the Company’s EBITDA margin shall be

calculated as EBITDA (not adjusted EBITDA), as calculated in its

audited financial statements, divided by its revenue (the

“Business Objective 3”, and the “Business

Objective 1 or 2” means the Business Objective other than

Business Objective 3).

If, at any time following the date that is 24 months from the

Initial Closing Date, for the preceding 20 consecutive trading days

(i) the daily volume weighted average trading price of the Class A

Shares on the TSXV is greater than 175% of the Conversion Price;

and (ii) the average daily volume of the Class A Shares traded on

the TSXV is no less than the number obtained when dividing the

number of shares issued upon conversion of the total amount of

Debentures outstanding by twenty (20), the Company will have the

option to convert all of the principal amount outstanding of the

Debentures at the Conversion Price with at least 30 days’ prior

written notice.

Disclaimers

The securities issued in connection with the

Offering mentioned herein have not been and will not be qualified

for sale to the public under applicable Canadian securities laws

and, accordingly, any offer and sale of securities in Canada will

be made on a basis which is exempt from the prospectus and, when

applicable, dealer registration requirements of such securities

laws. Furthermore, none of the securities issued in connection with

the Offering will be registered under the United States Securities

Act of 1933, as amended (the "1933 Act") or of any

other jurisdiction, and none of them may be offered or sold in the

United States or in any other jurisdiction absent registration or

an applicable exemption from the registration requirements of the

1933 Act or of any other jurisdiction. This press release shall not

constitute an offer to sell or a solicitation of an offer to buy

nor shall there be any sale of any of the securities in any

jurisdiction in which such an offer, solicitation, or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction.

Forward-Looking Statements

Information provided and statements contained in

this press release that are not purely historical, such as those on

the revenue and the EBITDA, are forward-looking statements within

the meaning of the applicable securities laws. Certain statements

in this press release may constitute forward-looking information

within the meaning of securities laws. Forward-looking information

may relate to LSL Pharma Group’s future outlook and anticipated

events, business, operations, financial performance, financial

condition or results and, in some cases, can be identified by

terminology such as “may”; “will”; “should”; “expect”; “plan”;

“anticipate”; “believe”; “intend”; “estimate”; “predict”;

“potential”; “continue”; “foresee”, “ensure” or other similar

expressions concerning matters that are not historical facts. The

reader should not place undue importance on forward-looking

information and should not rely upon this information as of any

other date. LSL Pharma Group will not update these statements

unless applicable securities laws require LSL Pharma Group to do

so.

ABOUT LSL PHARMA GROUP

INC.

LSL Pharma Group is a Canadian integrated

pharmaceutical company specializing in the development,

manufacturing and distribution of high-quality natural health

products and dietary supplements in solid dosage forms, as well as

high quality sterile ophthalmic pharmaceutical products. For more

information, please visit www.laboratoirelsl.com and

www.sterimedpharma.com.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

CONTACT:François Roberge,

President and Chief Executive Officer Telephone: 514-664-7700Email:

Investors@groupelslpharma.com

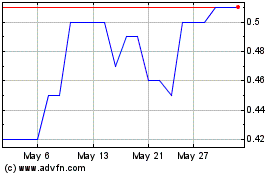

LSL Pharma (TSXV:LSL)

Historical Stock Chart

From Nov 2024 to Dec 2024

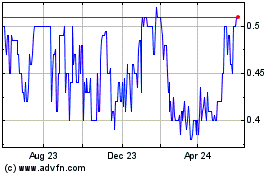

LSL Pharma (TSXV:LSL)

Historical Stock Chart

From Dec 2023 to Dec 2024