Leonovus Inc. (TSXV:LTV) (the “

Company” or

“

Leonovus”), is pleased to announce that it has

filed and been receipted for a preliminary short form prospectus

with the securities regulatory authorities in all provinces of

Canada (except Québec) in connection with a marketed public

offering (the “

Offering”) of units of the Company

(“

Units”) priced in the context of the market, at

an indicative price of $0.68 per Unit, for gross proceeds of up to

$4,000,000. The Offering is being led by Mackie Research Capital

Corporation as lead agent and sole bookrunner (the “

Lead

Agent”), on behalf of a syndicate of agents, including

Canaccord Genuity Corp. (collectively with the Lead Agent, the

“

Agents”).

Each Unit will consist of one common share of

the Company (“Common Share”) and one Common Share

purchase warrant (a “Warrant”). Each Warrant shall

entitle the holder thereof to purchase one Common Share (a

“Warrant Share”) at an indicative exercise price

of $0.84, to be determined in the context of the market for an

indicative period of 36 months following closing of the

Offering.

The final pricing of each Unit, the exercise

price of each Warrant, and the term of each Warrant will be

determined in the context of the market prior to the filing of the

final short form prospects in respect of the Offering.

The Company has granted the Agents an option

(the “Over-Allotment Option”) to cover

over-allotments and for market stabilization purposes, exercisable

in whole or in part at the sole discretion of the Agent, at any

time up to 30 days from the closing of the Offering, to increase

the size of the Offering by up to 15% of the number of Units

(and/or the components thereof) sold pursuant to the Offering, on

the same terms and conditions of the Offering.

The net proceeds raised under the Offering will

be used for product development and management, sales and

marketing, operating expenses, and general and administrative

expenses as well as for working capital requirements and other

general corporate purposes.

The closing of the Offering is currently

expected to be on or about the week of April 26, 2021, or on such

date as the Lead Agent and the Company may agree upon, and is

subject to certain conditions including, but not limited to the

execution of an agency agreement and the receipt of all necessary

regulatory approvals including the approval of the TSX Venture

Exchange (the “Exchange”).

The Company will use commercially reasonable

efforts to list the Common Shares, the Warrants and the Warrant

Shares on the Exchange, subject to the Company fulfilling all of

the listing requirements of the Exchange.

The Units are to be sold on a "best efforts"

basis through the Agents by way of short form prospectus to be

filed in each of the provinces of Canada (except Québec) and in

other jurisdictions outside of Canada and the United States on an

exempt basis in accordance with applicable securities laws. The

securities described in this press release have not been and will

not be registered under the United States Securities Act of 1933,

as amended (“U.S. Securities Act”) or any state

securities laws. Accordingly, the securities may not be offered or

sold in the United States (as such term is defined in Regulation S

under the U.S. Securities Act) or to, or for the account or benefit

of, a U.S. person (as such term is defined in Regulation S under

the U.S. Securities Act) except pursuant to transactions exempt

from registration under the U.S. Securities Act and under the

securities laws of any applicable state. This press release does

not constitute an offer to sell or a solicitation of an offer to

buy any of these securities in the United States. Any public

offering of securities in the United States must be made by means

of a prospectus containing detailed information about the company

and management, as well as financial statements.

About Leonovus

Leonovus is a secure data management software

company. The Leonovus suite of data management tools offer an

organization what it needs for a complete end-to-end data-centric

solution. This solution can stand on its own, or it can easily

integrate with the organization's zero-trust strategy and

architecture. It takes seamless advantage of the organization's

existing storage infrastructure and network architecture, working

on-premises, in the cloud, or both. It extends the data-centric

controls across the entire architecture, including cloud resources.

And it supplies these cybersecurity capabilities for the full

lifespan of the data and beyond.

The flexible and straightforward solution does

not require changes in the method of data use. Applications,

services, and users all interact with the data the same way they

always have. The system ensures the right users get access to the

correct data at the right time, but securely.

In addition to working with existing systems,

the Leonovus solution aids in the organization's digital

transformation by enabling ultramodern data concepts necessary for

the data-driven world. These capabilities are included in an

automated solution requiring little operations effort and no new

skills or expertise needed.

The main elements of the Leonovus Unified Smart

Data Management suite are:

Data Discovery - classification and understanding of your

existing data sets.Smart Filer - transparent file-based data

controls for cost, flexibility, and scalability.Vault - multi-cloud

data management for data lifespan.Data View Gateways - controlled

repository internal/external data sharing.Smart Secure Data Lake -

a multi-sourced context-rich repository for advanced

analytics.Consolidata - multi-sourced data collation and

aggregation for near real-time insights.XVault – protocol

independent, ultra-secure remote data sharing solution; coming

soon.

Each is available independently or together as a

comprehensive solution set. To learn more, please

visit www.leonovus.com.

For More Information, please contact:George

PretliChief Financial Officer

+1.613.319.3540gpretli@leonovus.com

Caution regarding forward-looking

information

This press release contains forward-looking

statements and information, which may involve risks and

uncertainties, including in relation to pricing and terms of the

Offering, receipt of regulatory and Exchange approval of the

Offering, the issuance of a receipt for the final short form

prospectus, the use of proceeds from the Offering, and the closing

of the Offering and timing thereof. The results or events predicted

in these statements may differ materially from actual results or

events. Factors that might cause a difference include, but are not

limited to, competitive developments, risks associated with

Leonovus' growth, the state of the financial markets, regulatory

risks and other factors. There can be no assurance or guarantees

that any statements of forward-looking information contained in

this release will prove to be accurate. Actual results and future

events could differ materially from those anticipated in such

statements. These and all subsequent written and oral statements

containing forward-looking information are based on the estimates

and opinions of management on the dates they are made and expressly

qualified in their entirety by this notice. Unless otherwise

required by applicable securities laws, Leonovus disclaims any

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. Readers should not place undue reliance on any

statements of forward-looking information that speak only as of the

date of this release. Further information on Leonovus' public

filings, including its most recent audited consolidated financial

statements, are available at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

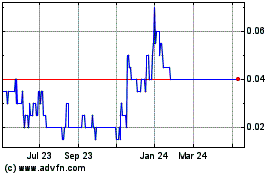

LeoNovus (TSXV:LTV)

Historical Stock Chart

From Dec 2024 to Jan 2025

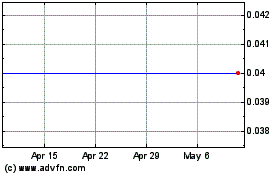

LeoNovus (TSXV:LTV)

Historical Stock Chart

From Jan 2024 to Jan 2025