Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) ("Monument" or

the "Company") is pleased to update the progress at the Selinsing

Sulphide Project. The ramp-up of the flotation plant has made great

headway, with the mill feed rate of 113 dry tonnes per hour

achieved, being 95% of the design capacity of 119 dry tonnes per

hour. The plant construction and mine development consumed a total

of $18 million, in line with the budget.

President and CEO Cathy Zhai commented, “We are

very pleased with the flotation plant ramp-up progress as we head

towards full commercial production. We have commenced sulphide

production in January 2023 and continue testing and adjusting to

improve plant performance through the action plan. Despite several

incidental plant shutdowns during March to May, the plant is

expected to reach its near or full production level by June 2023,

within the planned ramp up period of three to six months. To date,

the flotation plant has produced approximately 3,450 dry metric

tonnes (“DMT”) of concentrate with an average gold grade of 36.20

g/t, containing 4,015 troy ounces of gold. Several export permits

have been recently granted by the relevant authority and

concentrate shipments are currently in progress.”

Figure 1. Concentrate in

Tent is available

at https://www.globenewswire.com/NewsRoom/AttachmentNg/f39acde0-f30d-4cb5-ba04-acfcffe21613

Figure 2. Concentrate Storage

Construction is available

at https://www.globenewswire.com/NewsRoom/AttachmentNg/616859ef-54ec-4981-af79-7bf9dbeb3575

Flotation Plant Production

Ramp-up

The ramp-up of the flotation plant continued,

with the mill feed rate of 113 dry tonnes per hour achieved, being

95% of the design capacity of 119 dry tonnes per hour. During this

ramp-up process bottlenecks have been identified and the team has

been working to correct them in order to ramp up to commercial

production. The ramp-up period is expected to be completed in June

2023.

Certain design deficiencies have been detected

and revision of designs have been received to improve performance

efficiencies including design of a new rougher flotation tailings

hopper and associated pipework, structural and civils drawings and

specifications for the new concentrate thickener overflow pumps.

Pump suction and delivery lines will be upgraded as well as the

power supply to the bigger motors required. None of the above works

has material impact on our current flotation plant operations.

The flotation plant experienced major shutdowns

from early March to first week of May. The Metso-Outotec

concentrate thickener rake drive gearbox was broken, replaced by a

new gear box assembled in Australia, airfreighted to Malaysia, and

installed. The concentrate thickener was then recommissioned, and

all concentrates were recovered to the circuit. Further loss of

production occurred in April until May as the filter press cloths

started failing prematurely due to manufacturing defects; the

supplier has accepted the defects and will supply two new sets of

higher permeability filter cloths. In the meantime, replacement

filter press cloths were sourced and delivered from local

suppliers. Management is focused on reviewing all critical parts

and in advancing the procurement plan.

Construction of the new concentrate shed

continued with the concrete floor poured and the erection of

structural steelwork commencing. The shed is expected to be

completed by mid-June and will hold enough capacity for over 4,500

tonnes of concentrate or one month’s production.

Construction of the 100-tonne capacity

weighbridge was completed, and the unit was calibrated and

certified by the Metrology Corporation of Malaysia.

Manufacture of the 1 tonne bulk bagging system

has been completed in the UK and is ready to be shipped to

Malaysia.

Figure 3: Weighbridge is

available

at https://www.globenewswire.com/NewsRoom/AttachmentNg/184810b7-a354-4785-a5d4-e65d2c2e99d0

Figure 4: Ammonium Nitrate Storage

Area is available

at https://www.globenewswire.com/NewsRoom/AttachmentNg/a0da4743-e701-4cae-8553-f15f6ce7be1f

Mining

Mining of the first stages of Buffalo Reef pits

BRC2 and BRC3 continued, transition sulphide ore was delivered to

the ROM pad and oxide ore to stockpiles elsewhere. The stockpile of

around one month of process plant feed of 80,000 tonnes was

maintained, with mining production over the next six months

expected to boost this to at least three months or 240,000 tonnes

of ore. The arrival of the new mining fleet will help enhance the

mining rates.

Unexpected heavy rain in February 2023 slowed

down the mining rates and explosives delivery shortages were

experienced from supplier Austin Powders due to their

implementation of a stricter explosive trucking policy. The

explosive supply situation will be helped by the opening of a new

storage facility at Bentong, which is much closer than the current

supply from Kuala Lumpur. In addition, a new depot for raw

materials including ammonium nitrate is being constructed at the

Selinsing mine site. These developments will ensure the

availability of explosives in the future by providing alternatives.

Construction of this facility is ongoing and scheduled for initial

use in June 2023.

Government Permits

Recently, several export permits and

transportation permits have been granted to Selinsing which enable

Selinsing to initiate the shipment for its first sales.

Around the Hari Raya holiday on April 21st, the

new operational mining scheme (OMS) expired on April 16th, 2023 and

was renewed on April 20th, 2023. The annual and monthly blasting

permits expired along with the OMS and there was insufficient time

for the requisite approvals for these permits before the Hari Raya

holiday period. The two blasting permits were issued on May 11th,

2023 when mining activities resumed.

Concentrate Sales

Preparation

Off take agreements or business confirmation

letters for off-take of Selinsing gold concentrate have been signed

with several concentrate buyers under competitive commercial terms.

Several buyers have received export permits and the shipments are

underway. The first 2,000 DMT of gold concentrate production is now

available for sale and the royalties for this concentrate have been

paid to the parastatal Pahang Mining Corporation.

Risks

The Company closely monitors uncontrollable risk

factors with building and operation the flotation plant including:

change of market conditions, change of gold prices, operation risks

including critical parts shortages which may cause a longer than

expected ramp up period, and changes in regulatory restrictions in

relation to arsenic level contained in gold concentrate.

About Monument

Monument Mining Limited (TSX-V: MMY, FSE: D7Q1)

is an established Canadian gold producer that 100% owns and

operates the Selinsing Gold Mine in Malaysia and the Murchison Gold

Project in the Murchison area of Western Australia. It has 20%

interest in Tuckanarra Gold Project jointly owned with Odyssey Gold

Ltd in the same region. The Company employs approximately 200

people in both regions and is committed to the highest standards of

environmental management, social responsibility, and health and

safety for its employees and neighboring communities.

Cathy Zhai, President and CEOMonument Mining

LimitedSuite 1580 -1100 Melville StreetVancouver, BC V6E 4A6

FOR FURTHER INFORMATION visit the company web

site at www.monumentmining.com or contact:

Richard Cushing, MMY Vancouver T:

+1-604-638-1661 x102 rcushing@monumentmining.com

"Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release."

Disclaimer Regarding Forward-Looking

Statements

This news release includes statements containing

forward-looking information about Monument, its business and future

plans ("forward-looking statements"). Forward-looking statements

are statements that involve expectations, plans, objectives or

future events that are not historical facts and include the

Company's plans with respect to its mineral projects, expectations

regarding the completion of the ramp-up period to target production

level at Selinsing and the timing thereof, expectations regarding

the Company’s continuing ability to source explosives from

suppliers, expectations regarding completion of the proposed

storage shed and ammonium nitrate depot and the timing thereof, and

the timing and results of the other proposed programs and events

referred to in this news release. Generally, forward-looking

information can be identified by the use of forward-looking

terminology such as "plans", "expects" or "does not expect", "is

expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates" or "does not anticipate", or "believes",

or variations of such words and phrases or state that certain

actions, events or results "may", "could", "would", "might" or

"will be taken", "occur" or "be achieved". The forward-looking

statements in this news release are subject to various risks,

uncertainties and other factors that could cause actual results or

achievements to differ materially from those expressed or implied

by the forward-looking statements. These risks and certain other

factors include, without limitation: risks related to general

business, economic, competitive, geopolitical and social

uncertainties; uncertainties regarding the results of current

exploration activities; uncertainties in the progress and timing of

development activities, including those related to the ramp-up

process at Selinsing and the completion of the proposed storage

shed and ammonium nitrate depot; uncertainties and risks related to

the Company’s ability to source explosives from suppliers; foreign

operations risks; other risks inherent in the mining industry and

other risks described in the management discussion and analysis of

the Company and the technical reports on the Company's projects,

all of which are available under the profile of the Company on

SEDAR at www.sedar.com. Material factors and assumptions used to

develop forward-looking statements in this news release include:

expectations regarding the estimated cash cost per ounce of gold

production and the estimated cash flows which may be generated from

the operations, general economic factors and other factors that may

be beyond the control of Monument; assumptions and expectations

regarding the results of exploration on the Company's projects;

assumptions regarding the future price of gold of other minerals;

the timing and amount of estimated future production; assumptions

regarding the timing and results of development activities,

including the ramp-up process at Selinsing and the completion of

the proposed storage shed and ammonium nitrate depot; expectations

that the Company will continue to be able to source explosives from

suppliers in a timely manner; costs of future activities; capital

and operating expenditures; success of exploration activities;

mining or processing issues; exchange rates; and all of the factors

and assumptions described in the management discussion and analysis

of the Company and the technical reports on the Company's projects,

all of which are available under the profile of the Company on

SEDAR at www.sedar.com. Although the Company has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. The Company does not

undertake to update any forward-looking statements, except in

accordance with applicable securities laws.

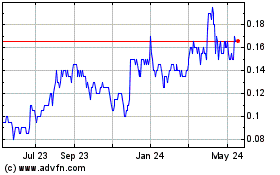

Monument Mining (TSXV:MMY)

Historical Stock Chart

From Nov 2024 to Dec 2024

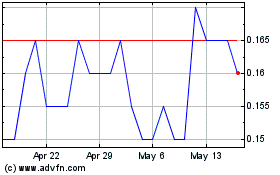

Monument Mining (TSXV:MMY)

Historical Stock Chart

From Dec 2023 to Dec 2024