Petro-Reef Resources Ltd. (TSX VENTURE:PER), ("Petro-Reef" or the "Company") is

pleased to release its year end 2011 financial and operating results and its

December 31, 2011 reserve report.

This press release should be read in conjunction with the Company's 2011 annual

filings on Sedar.

For the twelve month period ended December 31, 2011, Petro-Reef generated cash

flow from operations of $3,150,536 ($0.05 per basic share), a decrease of 29%

compared to $4,447,326 ($0.11 per basic share) for the twelve month period ended

December 31, 2010. Lower natural gas prices and production volumes were major

factors in the cash flow decrease.

Daily production volumes decreased by 21.4% to 652 boe/d in the year ended

December 31, 2011 as compared to 829 boe/d for the same period in 2010.

The decrease in volumes was mainly due to natural gas production declines and

the shut-in of two new Detrital oils wells at Alexander (6-7-56-26W4 and

11-7-56-26W4) due to overproduction related to the gas/oil ratio. The two oil

wells did not produce for the entire fourth quarter under the ERCB penalty which

reduced daily volumes by 300 boe/day. Effective January 1, 2012 the production

restrictions were lifted and average daily production volumes increased to over

900 boe/day.

Capital expenditures for 2011 totaled $7.7 million decreasing 3% from the $7.9

million expended in 2010. Total net debt at year end was $12.8 million.

Production and operating expenses increased 13.4% to $3,318,587 for the year

ended December 31, 2011 compared to $2,925,862 for the same period ended

December 31, 2010. The increase of $392,725 is related to increases in oil

trucking and treating charges, fuel and power expenses and freehold surface

lease rentals offset by decreases in gas processing charges and repairs and

maintenance.

Production and operating expenses on a per unit of production basis increased

44.3% to $13.95 for the year ended December 31, 2011 compared to $9.67 for the

same period in 2010.

For the year ended December 31, 2011 cash flow netbacks per boe decreased by

9.9% over the same period in 2010.

Financial

Effective September 30, 2011 the Corporation renewed its credit facilities with

a Canadian Chartered Bank. Facility A is a revolving operating demand loan with

a maximum limit of $14,000,000. Facility B is a non -revolving

acquisition/development demand loan that provides an additional $6,000,000 of

financing. Interest is at prime plus 1.0% per annum for Facility A and prime

plus 1.5% per annum for Facility B. Petro-Reef has the ability to borrow by way

of Bankers Acceptances.

The Company has the ability to draw on the development loan for the drilling of

new wells subject to certain working capital ratio restrictions.

At December 31, 2011 the balance owing on Facility A was $12,511,275 (December

31, 2010 - $9,627,691). At December 31, 2011 the balance owing on Facility B was

$nil (December 31, 2010 - $nil). Net debt was $12,832,932 at December 31, 2011

as compared to $10,560,062 at December 31, 2010.

Effective February 2, 2012 the Corporation renewed its operating facilities with

a Canadian Chartered Bank. Facility A was reduced to a maximum limit of

$13,000,000. There were no other changes to the facility.

In August, 2011 Petro-Reef Resources Ltd. closed a private placement financing

of Flow -through Shares for gross proceeds of $2,391,200. Pursuant to the

offering, Petro-Reef issued 5,978,000 common shares on a flow- through basis at

a purchase price of 40 cents per common share.

Reserves

Petro-Reef's evaluation of gross proved plus probable reserves at December 31,

2011 indicated a net increase of 6% to 1,674,867 BOE from 1,579,900 BOE at

December 31, 2010, after extensions, technical revisions, discoveries,

acquisitions, economic factors, and production. After considering the production

for the period January 1 to December 31, 2011 of 237,980 BOE, the 2011 reserve

additions totalled 332,946 BOE which represents an increase of 21% over the 2010

year end reserves.

Using a 10% net present value ("NPV"), the value of proved plus probable

reserves at forecast prices and costs (before income taxes) was $32,792,300 as

compared with proved plus probable reserves of $34,741,400 as at December 31,

2010.

Petro-Reef's gross proved, probable plus possible reserves at December 31, 2011

totaled 2,521,567 BOE. Using a 10% NPV, the value of proved, probable plus

possible reserves at forecast prices and costs (before income taxes) totaled

$54,498,800. The possible reserves include four potential development locations

targeting the Detrital zone offsetting the Company's recent 09-12-56-27W4 well.

Proved plus probable reserves were comprised of 47% natural gas and 53% crude

oil and natural gas liquids (December 31, 2010 - 54% natural gas and 46% crude

oil and natural gas liquids).

Of the total proved plus probable reserves reported (using forecast prices)

Petro-Reef's reserves are 56% proved and 44% probable.

Based on proved plus probable reserves and 2011 average production volume,

Petro-Reef's reserve life index was 5.1 years (38.7 years remaining life) on a

proved plus probable basis at December 31, 2011 compared with 4.2 years (39.8

years remaining life) at the end of 2010. Petro-Reef's reserve life index (RLI)

is an indication of the number of years it would take to deplete the Company's

reserves.

----------------------------------------------------------------------------

SUMMARY OF FINANCIAL AND OPERATIONAL RESULTS

Three Months Ended December 31

----------------------------------------------------------------------------

$ 2011 2010 % Change

----------------------------------------------------------------------------

FINANCIAL

Oil and gas revenue 2,293,360 2,634,503 -13

Realized financial instrument

gains (losses) (48,075) 451,364 -111

Cash flow from operations (34,841) 1,478,452 -102

Per share - basic 0.00 0.04 -100

Net loss (5,635,296) (1,351,334) 317

Per share- basic (0.09) (0.03) 200

Total net debt 12,832,932 10,560,062 22

Shares outstanding - end of

year 62,239,477 55,943,157 11

Capital expenditures 423,000 1,698,201 -75

Wells drilled (net)

Oil 0.00 1.79 -

Gas 0.00 0.00 -

Dry 0.00 0.00 -

----------------------------------------------------------------------------

Total net wells drilled 0.00 1.79 -

----------------------------------------------------------------------------

OPERATIONAL

Daily production

Oil & NGL (bbl) 182 223 -18

Natural gas (mcf) 2,559 3,796 -33

----------------------------------------------------------------------------

Oil equivalent (boe @ 6:1)^ 608 856 -29

----------------------------------------------------------------------------

Commodity prices ($Cdn)

Oil & NGL (bbl) 88.59 66.96 32

Natural gas (mcf) 3.45 3.61 -4

----------------------------------------------------------------------------

Oil equivalent (boe @ 6:1) 40.98 33.47 22

----------------------------------------------------------------------------

Operating netback ($ per boe)

Revenue 40.98 33.47 22

Royalty (3.04) (3.64) -16

Operating cost (16.29) (9.59) 70

----------------------------------------------------------------------------

Operating netback per boe 21.65 20.24 7

General and administrative (18.16) (5.24) 247

Finance charges and fees (3.26) (1.95) 67

Realized financial instrument

gains (losses) (0.85) 5.73 -115

----------------------------------------------------------------------------

Cash flow per Boe (0.62) 18.78 -103

----------------------------------------------------------------------------

----------------------------------------------------------------------------

SUMMARY OF FINANCIAL AND OPERATIONAL RESULTS

Year Ended December 31

----------------------------------------------------------------------------

$ 2011 2010 % Change

---------------------------------------------------------------------------

FINANCIAL

Oil and gas revenue 9,744,553 9,777,127 -

Realized financial instrument

gains (losses) 344,542 996,822 -65

Cash flow from operations 3,150,536 4,447,326 -29

Per share - basic 0.05 0.11 -55

Net loss (6,515,846) (2,335,998) 179

Per share- basic (0.11) (0.06) 83

Total net debt 12,832,932 10,560,062 22

Shares outstanding - end of

year 62,239,477 55,943,157 11

Capital expenditures 7,691,000 7,920,000 -3

Wells drilled (net)

Oil 2.52 1.79 41

Gas 0.00 0.94 -

Dry 0.79 0.00 -

----------------------------------------------------------------------------

Total net wells drilled 3.31 2.73 21

---------------------------------------------------------------------------

OPERATIONAL

Daily production

Oil & NGL (bbl) 207 148 40

Natural gas (mcf) 2,670 4,086 -35

----------------------------------------------------------------------------

Oil equivalent (boe @ 6:1)^ 652 829 -21

---------------------------------------------------------------------------

Commodity prices ($Cdn)

Oil & NGL (bbl) 79.61 69.92 14

Natural gas (mcf) 3.83 4.02 -5

----------------------------------------------------------------------------

Oil equivalent (boe @ 6:1) 40.96 32.31 27

---------------------------------------------------------------------------

Operating netback ($ per boe)

Revenue 40.96 32.31 27

Royalty (5.59) (4.06) 38

Operating cost (13.95) (9.67) 44

----------------------------------------------------------------------------

Operating netback per boe 21.42 18.58 15

General and administrative (7.57) (5.14) 47

Finance charges and fees (2.06) (2.03) 1

Realized financial instrument

gains (losses) 1.45 3.29 -56

----------------------------------------------------------------------------

Cash flow per Boe 13.24 14.70 -10

----------------------------------------------------------------------------

(1) "Funds from operations", "funds from operations per share", "netbacks"

and "netbacks per boe" are not defined by Generally Accepted Accounting

Principles (''GAAP") in Canada and are regarded as non-GAAP measures.

Funds from operations and funds from operations per share are calculated

as cash provided by operating activities before changes in non-cash

working capital and asset retirement expenditures. Funds from operations

is used to analyze the Company's operating performance, the ability of

the business to generate the cash flow necessary to fund future growth

through capital investment and to repay debt. Funds from operations does

not have a standardized measure prescribed by GAAP and therefore may not

be comparable with the calculations of similar measures for other

companies. The Company also presents funds from operation per share

whereby per share amounts are calculated using the weighted average

number of common shares outstanding consistent with the calculation of

net income or loss per share.

(2) The term barrels of oil equivalent ("boe") may be misleading,

particularly if used in isolation. A boe conversion ratio of six

thousand cubic feet per barrel (6 mcf/bbl) of natural gas to barrels of

oil equivalence is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a value

equivalency at the wellhead. All boe conversions in the report are

derived from converting gas to oil in the ratio mix of six thousand

cubic feet of gas to one barrel of oil.

Reserves Summary

The December 31, 2011 evaluation was prepared in accordance with National

Instrument 51-101. The reserve report reflects current proved and probable

reserves, and proved, probable and possible reserves. The December 31, 2011

report and the December 31, 2010 reports were prepared by McDaniel & Associates

Consultants Ltd.

----------------------------------------------------------------------------

Reserves Gross and Net (Forecast Prices and Costs) - December 31, 2011

Light / Medium

Oil Natural Gas BOE

Gross Net Gross Net Gross Net

(Mbbl) (Mbbl) (MMcf) (MMcf) (MBOE) (MBOE)

Reserves Category

Proved

Developed Producing 331.3 278.1 2,642.9 2,293.6 771.8 660.4

Developed Non-

Producing 23.4 21.2 207.7 185.1 58.0 52.1

Undeveloped 74.1 65.2 156.4 139.6 100.2 88.5

------------------------------------------------------

Total Proved 428.8 364.5 3,007.0 2,618.3 930.0 800.9

Probable 460.0 376.9 1,709.4 1,495.9 744.9 626.2

------------------------------------------------------

Total Proved &

Probable 888.8 741.4 4,716.4 4,114.2 1,674.9 1,427.1

Possible 587.6 499.3 1,554.6 1,359.0 846.7 725.8

------------------------------------------------------

Total Proved, Probable

& Possible 1,476.4 1,240.7 6,271.0 5,473.2 2,521.6 2,152.9

----------------------------------------------------------------------------

N1 51-101 Summary of Net Present Values of Future Net Revenue as of December

31, 2011 Forecast Prices and Costs

----------------------------------------------------------------------------

0% DCF 5% DCF 10% DCF 15% DCF

Reserves Category (M$) (M$) (M$) (M$)

----------------------------------------------------------------------------

Proved Developed Producing 17,898 16,7556 15,769 14,910

Developed Non-Producing 1,330 854 584 425

Undeveloped 2,717 2,419 2,166 1,949

Total Proved 21,944 20,030 18,519 17,284

Probable 25,032 18,236 14,273 11,728

Total Proved Plus Probable 46,980 38,266 32,792 29,011

----------------------------------------------------------------------------

Using a ten percent (10%) NPV, the estimated value of proved plus probable

reserves at forecast prices and costs (before Income Taxes) decreased by 6% to

$32,792,300 as compared with last year's estimated value of $34,741,400. The

estimated values disclosed do not represent fair market value.

Forecast Prices Used in Estimates

McDaniel employed the following pricing, exchange rate and inflation rate

assumptions in estimating Petro-Reef reserve data as of December 31, 2011:

----------------------------------------------------------------------------

Year Edmonton

Par Cromer

Price Medium Natural Gas

WTI 40 degrees 29.3 degrees AECO Gas

Crude Oil API API Prices

($US/bbl) ($Cdn/bbl) ($Cdn/bbl) ($Cdn/MMBtu)

----------------------------------------------------------------------------

Historical

2005 56.56 68.72 57.47 8.58

2006 66.23 72.80 61.25 7.16

2007 72.30 76.35 65.40 6.65

2008 99.60 102.20 93.20 8.15

2009 61.80 65.90 62.80 4.20

2010 79.50 77.50 73.80 4.15

2011 94.80 95.20 88.35 3.70

Forecast

2012 97.50 99.00 91.00 3.50

2013 97.50 99.00 91.00 4.20

2014 100.00 101.50 93.30 4.70

2015 100.80 102.30 94.10 5.10

2016 101.70 103.20 94.90 5.55

Thereafter 2.0% Escalation Rates

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Year Edmonton Edmonton Inflation Exchange

Condensate Butane Rate Rate

($Cdn/bbl) ($Cdn/bbl) (%/Yr) ($US/$Cdn)

----------------------------------------------------------------------------

Historical

2005 69.63 52.58 2.1 0.83

2006 75.06 60.10 2.2 0.88

2007 77.36 63.75 2.0 0.94

2008 104.75 75.25 2.4 0.94

2009 68.15 49.25 2.0 0.88

2010 84.25 66.05 2.0 0.97

2011 104.20 75.50 2.0 1.01

Forecast

2012 106.00 76.20 2.0 0.98

2013 104.10 79.80 2.0 0.98

2014 104.60 81.80 2.0 0.98

2015 105.50 82.40 2.0 0.98

2016 106.40 83.20 2.0 0.98

Thereafter 2.0% Escalation Rates

----------------------------------------------------------------------------

Reconciliation of Changes in Reserves

----------------------------------------------------------------------------

Light, Medium Oil and NGL Natural Gas

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Gross Gross

Proved Proved

Gross Gross Plus Gross Gross Plus

Proved Probable Probable Proved Probable Probable

Factors (Mbbl) (Mbbl) (Mbbl) (MMcf) (MMcf) (MMcf)

----------------------------------------------------------------------------

December

31, 2010 372.8 330.1 702.9 3,467.2 1,794.6 5,261.8

Extensions 107.9 271.9 379.8 163.8 609.5 773.3

Technical

Revisions 26.2 (139.0) (112.8) 450.6 (662.0) (211.4)

Economic

Factors (2.6) (3.0) (5.6) (108.0) (32.4) (140.4)

Production (75.5) - (75.5) (966.6) (0.3) (966.9)

December

31, 2011 428.8 460.0 888.8 3,007.0 1,790.4 4,716.4

----------------------------------------------------------------------------

----------------------------------------------------------------------------

BOE

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Gross

Proved

Gross Gross Plus

Proved Probable Probable

Factors (BOE) (BOE) (BOE)

----------------------------------------------------------------------------

December

31, 2010 950.7 629.2 1,579.9

Extensions 135.2 373.5 508.7

Technical

Revisions 101.2 (249.2) (148.0)

Economic

Factors (20.6) (8.4) (29.0)

Production (236.6) (0.1) (236.7)

December

31, 2011 929.9 745.0 1,674.9

----------------------------------------------------------------------------

Forward-Looking Statements: All statements, other than statements of historical

fact, set forth in this news release, including without limitation, assumptions

and statements regarding reservoirs, resources and reserves, future production

rates, exploration and development results, financial results, and future plans,

operations and objectives of the Corporation are forward-looking statements that

involve substantial known and unknown risks and uncertainties. Some of these

risks and uncertainties are beyond management's control, including but not

limited to, the impact of general economic conditions, industry conditions,

fluctuation of commodity prices, fluctuation of foreign exchange rates,

environmental risks, industry competition, availability of qualified personnel

and management, availability of materials, equipment and third party services,

stock market volatility, timely and cost effective access to sufficient capital

from internal and external sources. The reader is cautioned that assumptions

used in the preparation of such information, although considered reasonable by

the Corporation at the time of preparation, may prove to be incorrect. There can

be no assurance that such statements will prove to be accurate and actual

results and future events could differ materially from those anticipated in such

statements.

Reference is made to barrels of oil equivalent (BOE). Barrels of oil equivalent

may be misleading, particularly if used in isolation. In accordance with

National Instrument 51-101, a BOE conversion ratio for natural gas of 6 Mcf: 1

bbl has been used, which is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a value

equivalency at the wellhead.

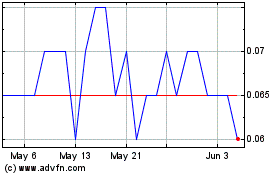

Peruvian Metals (TSXV:PER)

Historical Stock Chart

From Feb 2025 to Mar 2025

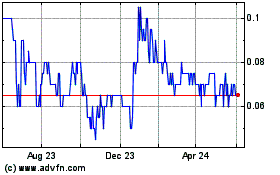

Peruvian Metals (TSXV:PER)

Historical Stock Chart

From Mar 2024 to Mar 2025