Abraxas Power Corp. (“

Abraxas”), a leading energy

transition developer is pleased to announce its subsidiary Abraxas

Power Maldinvest Ltd. has entered into a loan agreement with RE

Royalties Ltd. (TSX.V: RE) (OTCQX: RROYF) (“

RE

Royalties”), a global leader in renewable energy

royalty-based financing, to receive a secured loan facility of up

to $10 Million (the “

Loan”) to support the

construction of solar projects in the Maldives.

The Loan will have multiple tranches, with the

first tranche of approximately $1.4 Million that closed on November

18, 2024, to be used for construction of two rooftop solar projects

(the “Projects”) with a combined generation

capacity of 0.77 MWDC. Subsequent tranches will be used for the

construction of additional solar projects in the Maldives and will

be advanced if certain conditions are met, such as the completion

of satisfactory due diligence and approval by RE Royalties’ board

of directors.

The Projects are located at a hospital in Malé,

the capital of the Maldives, and an island resort approximately

50km north of Malé. They will generate revenue from power purchase

agreements (“PPAs”) with the co-located

businesses. Currently, both businesses rely primarily on

electricity produced by diesel generators. By entering into the

PPAs, they are expected to save on operating expenses and

significantly reduce the environmental impacts of their

operations.

The first tranche of the Loan has an 18-month

term and an interest rate of 13% per annum on advanced funds,

compounded monthly. RE Royalties received an arrangement fee of

$200,000 at closing to cover legal and due diligence expenses. RE

Royalties will receive a gross revenue royalty of 2.0% on the

Projects for the term of the PPAs.

J. Colter Eadie, CEO of Abraxas, commented:

“This investment has been a significant catalyst for initiating the

energy transition in the Maldives, aligning with Abraxas’ broader

mandate from the Government of Maldives to decarbonize under its

Nationally Determined Contributions (NDC) commitment. The RE

Royalties investment facilitates the development of a distributed

generation portfolio in the Maldives, focusing on decarbonizing

critical economic sectors like healthcare and tourism.

Tourism accounts for 28% of the country's GDP

and generates 60% of all foreign exchange income. The Maldives'

ability to achieve its sustainability goals within the tourism

industry will be vital for its ongoing success as one of the

world’s premier destinations. Abraxas has identified a pipeline of

over 100 MW of potential fossil fuel capacity that can be replaced

with clean and renewable energy at some of the world's largest

hotel brands.

Additionally, Abraxas has been granted a

first-of-its-kind Special Economic Zone permit to develop an energy

efficiency project, which will enable the government of the

Maldives to replace up to 50% of its fossil-derived energy in the

capital with 100% green energy. This project will be one of the

largest ocean-floating solar installations in the world and

demonstrates Abraxas’s capability to facilitate the global energy

transition for governments and industries with unique and

innovative solutions.

RE Royalties has played a crucial role in

addressing these challenges, and we look forward to continuing our

partnership with RE Royalties in the Maldives and other

regions.”

Bernard Tan, CEO of RE Royalties, stated:

“This transaction allows RE Royalties to

establish a foothold in a new jurisdiction with a clear pathway to

deploy more capital. We are thrilled to be working with the

management of Abraxas again and we look forward to collaborating

with them in the future to further grow their portfolio of

renewable energy projects.”

About Abraxas Power Corp.:

Abraxas Power is a pioneering energy transition

developer focused on decarbonizing hard-to-abate sectors and

creating value by solving the current and future challenges of the

energy transition. Abraxas Power’s broad mandate allows it to see

opportunities across technologies and geographies to transform the

global energy industry. Our team has extensive experience in

leading, financing, and solving the challenges associated with

energy transition, and a proven track record of delivering complex,

large-scale development projects across various disciplines,

including renewable power and storage, hydrogen and ammonia

production, industrial and precious metals, large-scale project

construction, and operations at scale. The team possesses strong

project finance and capital markets experience and has a history of

creating value for shareholders, stakeholders, and the communities

they live in. Abraxas has signed strategic partnerships with

various global strategics and technology providers.

Abraxas has secured over US$9 billion in capital

projects through competitive government awards over the past year

in furtherance of the energy transition, including its marquis

Exploits Valley Renewable Energy Corporation project in

Newfoundland, Canada.

To learn more, visit www.abraxaspower.com.

About RE Royalties Ltd.

RE Royalties Ltd. acquires revenue-based

royalties over renewable energy facilities and technologies by

providing non-dilutive financing solutions to privately held and

publicly traded companies in the renewable energy sector. RE

Royalties is the first to apply this proven business model to the

renewable energy sector. The Company currently owns over 100

royalties on solar, wind, battery storage, energy efficiency and

renewable natural gas projects in Canada, the United States,

Mexico, and Chile. The Company’s business objectives are to provide

shareholders with a strong growing yield, robust capital

protection, high rate of growth through re-investment and a

sustainable investment focus.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange), nor any other regulatory

body or securities exchange platform, accepts responsibility for

the adequacy or accuracy of this release.

This news release shall not constitute an offer

to sell or the solicitation of an offer to buy the securities in

any jurisdiction, nor shall there be any offer or sale of the

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful. The securities being offered have not been

approved or disapproved by any regulatory authority nor has any

such authority passed upon the accuracy or adequacy of the short

form base shelf prospectus or the prospectus supplement. The offer

and sale of the securities has not been and will not be registered

under the United States Securities Act of 1933, as amended (the

“U.S. Securities Act”) or any state securities laws and may not be

offered or sold in the United States or to United States persons

absent registration or an applicable exemption from the

registration requirements of the U.S. Securities Act and applicable

state securities laws.

Forward Looking Statements

This news release includes forward-looking

information and forward-looking statements (collectively,

"forward-looking information") with respect to RE Royalties and

within the meaning of Canadian securities laws. Forward looking

information is typically identified by words such as: believe,

expect, anticipate, intend, estimate, postulate, and similar

expressions, or are those, which, by their nature, refer to future

events. This information represents predictions and actual events

or results may differ materially. Forward-looking information may

relate to RE Royalties’ future outlook and anticipated events or

results and may include statements regarding RE Royalties’

financial results, future financial position, expected growth of

cash flows, business strategy, budgets, projected costs, projected

capital expenditures, taxes, plans, objectives, industry trends and

growth opportunities including financing. The reader is referred to

the RE Royalties’ most recent filings on SEDAR as well as other

information filed with the OTC Markets for a more complete

discussion of all applicable risk factors and their potential

effects, copies of which may be accessed through RE Royalties’

profile page at www.sedar.com.

For further information, please contact:

RE Royalties Ltd.

Talia Beckett, VP of Communications and Sustainability

T: (778) 374‐2000

E: taliabeckett@reroyalties.com

www.reroyalties.com

Abraxas Power Corp.

J. Colter Eadie, CEO

T: +40 736-372-724

E: jceadie@abraxaspower.com

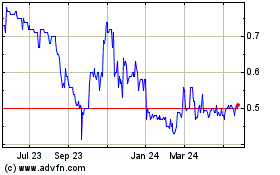

RE Royalties (TSXV:RE)

Historical Stock Chart

From Dec 2024 to Jan 2025

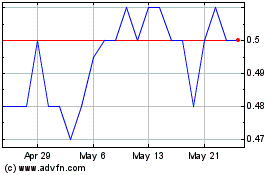

RE Royalties (TSXV:RE)

Historical Stock Chart

From Jan 2024 to Jan 2025