TSX VENTURE COMPANIES

ABITEX RESOURCES INC. ("ABE")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted the filing of the documentation with

respect to a Non-Brokered Private Placement, announced on June 12, 2009:

Number of Shares: 10,742,869 flow-through common shares

Purchase Price: $0.175 per common share

Warrants: 5,371,435 common share purchase warrants

Warrant Exercise Price: $0.25 per common share for a 24-month period

following the closing of the Private

Placement.

Finder's Fee: CIBC Wood Gundy, BMO Nesbitt Burns, MZ

Finance, and Limited Market Dealer received

$18,900, $7,800, $12,300 and $90,315,

respectively in cash. Limited Market Dealer

also received 509,714 agent options, each

entitling the holder to acquire one non flow

through unit of the Private Placement at a

price of $0.175 until June 11, 2011.

The Company has announced the closing of the Private Placement by way of

a press release.

RESSOURCES ABITEX INC. ("ABE")

TYPE DE BULLETIN : Placement prive sans l'entremise d'un courtier

DATE DU BULLETIN : Le 2 juillet 2009

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive sans l'entremise d'un courtier, tel qu'annonce le 12

juin 2009 :

Nombre d'actions : 10 742 869 actions ordinaires accreditives

Prix : 0,175 $ par action ordinaire

Bons de souscription : 5 371 435 bons de souscription

Prix d'exercice des bons : 0,25 $ par action pour une periode de 24

mois suivant la cloture du placement prive.

Frais d'intermediation : CIBC Wood Gundy, BMO Nesbitt Burns, MZ

Finance, et Limited Market Dealer ont recu

18 900 $, 7 800 $, 12 300 $, et 90 315 $,

respectivement en especes. De plus, Limited

Market Dealer a recu 509 714 options chacun

permettant d'acquerir un unite non-accreditif

du placement prive au prix de 0,175 $ par

unite jusqu'au 11 juin 2011.

La societe a annonce la cloture du placement prive precite par l'emission

d'un communique de presse.

TSX-X

---------------------------------------------------------------------------

BOWMORE EXPLORATION LTD. ("BOW")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced May 11, 2009 and May 19,

2009:

Number of Shares: 21,000,000 shares

Purchase Price: $0.20 per share

Warrants: 10,500,000 share purchase warrants to purchase

10,500,000 shares

Warrant Exercise Price: $0.35 for a four year period

Number of Placees: 32 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Osisko Mining Corporation Y 15,000,000

Sean Roosen Y 1,000,000

Robert Wares Y 1,000,000

Claude Charron Y 100,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

---------------------------------------------------------------------------

CANACOL ENERGY LTD. ("CNE")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: July 2, 2009

TSX Venture Tier 1 Company

Effective at 8:00 a.m. PST, July 2, 2009, shares of the Company resumed

trading, an announcement having been made over Marketwire.

TSX-X

---------------------------------------------------------------------------

CARAT EXPLORATION INC. ("CRZ")

BULLETIN TYPE: Shares for Bonuses

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 76,923 bonus shares at a deemed price of $0.26 per share to the

Chris Heras in consideration of a loan in the amount of $100,000.

TSX-X

---------------------------------------------------------------------------

CASSIDY GOLD CORP. ("CDY")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced June 2, 2009:

Number of Shares: 12,130,000 shares

Purchase Price: $0.05 per share

Warrants: 12,130,000 share purchase warrants to purchase

12,130,000 shares

Warrant Exercise Price: $0.10 for a one year period

Number of Placees: 11 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Floreat Fund Limited

(controlled by David Watt) Y 2,000,000

David Hamilton-Smith P 180,000

Iadarola Investments Inc.

(Osvaldo Iadorola) Y 75,000

Osvaldo (Ozzie) Iadarola Y 75,000

James T. Gillis Y 600,000

Phoenix Gold Fund Limited

(controlled by David Watt) Y 4,000,000

Alvin Ritchie P 400,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

---------------------------------------------------------------------------

D'ARIANNE RESOURCES INC. ("DAN")

(Formerly d'Arianne Resources Inc. ("DAR"))

BULLETIN TYPE: Consolidation, Symbol Change

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

Pursuant to a Special Resolution accepted by shareholders on June 11,

2009, the Company has consolidated its capital on a five old for one new

basis. The name of the Company has not been changed.

Effective at the opening Friday, July 3, 2009, the common shares of the

Company will commence trading on TSX Venture Exchange on a consolidated

basis. The Company is classified as a "Mining (Except Oil and Gas)"

company (NAICS number 212).

Post - Consolidation

Capitalization: Unlimited common shares with no par value of

which 21,118,300 common shares are issued

and outstanding.

Escrow: 105,575

Transfer Agent: Computershare Investor Services Inc. (Montreal

and Toronto)

Trading Symbol: DAN (new)

CUSIP Number: 04033X 20 9 (new)

RESSOURCES D'ARIANNE INC. ("DAN")

(Anciennement Ressources D'Arianne inc. ("DAR"))

TYPE DE BULLETIN : Regroupement, Changement de symbole

DATE DU BULLETIN : Le 2 juillet 2009

Societe du groupe 2 de TSX Croissance

En vertu d'une resolution speciale des actionnaires du 11 juin 2009, la

societe a consolide son capital-actions sur la base de cinq anciennes

actions pour une nouvelle action. La denomination sociale de la societe

n'a pas ete modifiee.

Les actions ordinaires de la societe seront admises a la negociation a la

Bourse de croissance TSX sur une base consolidee a l'ouverture des

affaires vendredi le 3 juillet 2009. La societe est categorisee comme une

societe d'"Extraction miniere (sauf l'extraction de petrole et de gaz)"

(numero SCIAN 212).

Capitalisation apres

consolidation : Un nombre illimite d'actions ordinaires sans

valeur nominale, dont 21 118 300 actions

ordinaires sont emises et en circulation.

Actions entiercees : 105 575

Agent des transferts : Computershare Investor Services Inc. (Montreal

et Toronto)

Symbole au telescripteur : DAN (nouveau)

Numero de CUSIP : 04033X 20 9 (nouveau)

TSX-X

---------------------------------------------------------------------------

DUNCASTLE GOLD CORP. ("DUN")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced May 20, 2009:

First Tranche:

Number of Shares: 3,033,333 shares

Purchase Price: $0.09 per share

Warrants: 3,033,333 share purchase warrants to purchase

3,033,333 shares

Warrant Exercise Price: $0.15 for a two year period

Number of Placees: 8 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Kirkham Geosystems Ltd.

(Garth Kirkham) Y 111,111

Manex Resource Group

(Lawrence Page) Y 1,666,667

Finders' Fees: $810 cash and (i)15,000 warrants payable to

Rayleigh Capital Ltd.

$2,160 cash and (i)40,000 warrants payable to

Ernst Pernet

(i) Finder's warrants are under the same terms as

those to be issued pursuant to the private

placement.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

---------------------------------------------------------------------------

DUNCASTLE GOLD CORP. ("DUN")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced May 20, 2009:

First Tranche:

Number of Shares: 800,000 flow-through shares

800,000 non flow-through shares

Purchase Price: $0.11 per flow-through share

$0.09 per non flow-through share

Warrants: 800,000 share purchase warrants under non

flow-through units to purchase 800,000 shares

Warrant Exercise Price: $0.15 for a two year period

Number of Placees: 7 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

David Lyall P 500,000

Scott Hunter P 100,000

Douglas Dale Warkentin Y 50,000

Finder's Fee: $3,900 cash and (i)32,500 warrants payable to

Haywood Securities Inc.

(i)Finder's fee warrants are under the same terms

as those to be issued pursuant to the private

placement.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

---------------------------------------------------------------------------

ERIN VENTURES INC. ("EV")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced May 15, 2009:

Number of Shares: 6,500,000 Units

(Each Unit consists of one common share and

one share purchase warrant.)

Purchase Price: $0.035 per Unit

Warrants: 6,500,000 share purchase warrants to purchase

6,500,000 shares

Warrant Exercise Price: $0.075 for a one year period

$0.15 in the second year

Number of Placees: 26 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Units

Mo Fazil P 200,000

Blake Fallis Y 170,000

Finder's Fee: $6,562.50 payable to Research Capital

Corporation

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s).

TSX-X

---------------------------------------------------------------------------

FIRST BAUXITE CORPORATION ("FBX")

BULLETIN TYPE: Private Placement-Non-Brokered, Convertible Debentures

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced July 4, 2009:

Convertible Debenture $8,000,000

Conversion Price: Convertible into units consisting of 9,638,555

common share of principal outstanding at $0.83

per share

Maturity date: Five years from the date of issuance

Interest rate: 0%

Number of Placees: 3 placees

Finders' Fees: $168,000 cash and (i)481,928 warrants payable

to Rory S. Godinho Law Corporation

$84,000 cash and (i)96,386 warrants payable to

Bengal Capital Corp.

$63,000 cash and (i)96,386 warrants payable to

Michael G. Thomson

- Finder's fee warrants are exercisable at $0.83

per share for two years.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

FORUM URANIUM CORP. ("FDC")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced June 22, 2009:

Number of Shares: 5,000,000 shares

Purchase Price: $0.10 per share

Number of Placees: 1 placee

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

GENOIL INC. ("GNO")

BULLETIN TYPE: Shares for Debt, Correction

BULLETIN DATE: July 2, 2009

TSX Venture Tier 1 Company

Further to the TSX Venture Exchange Bulletin dated June 30, 2009, the

number of shares issued to settle the outstanding debt should have read

1,367,319 instead of 860,997.

TSX-X

---------------------------------------------------------------------------

GOLDEN PACIFIC CAPITAL CORPORATION ("GPC.P")

BULLETIN TYPE: Suspend-Failure to Complete a Qualifying Transaction

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

Further to the TSX Venture Exchange Bulletin dated June 2, 2009,

effective at the opening Friday, July 3, 2009, trading in the shares of

the Company will be suspended, the Company having failed to complete a

Qualifying Transaction by June 30, 2009.

Members are prohibited from trading in the securities of the Company

during the period of the suspension or until further notice.

TSX-X

---------------------------------------------------------------------------

HANA MINING LTD. ("HMG")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced June 26, 2009:

Number of Shares: 2,000,000 shares

Purchase Price: $0.25 per share

Warrants: 1,000,000 share purchase warrants to purchase

1,000,000 shares

Warrant Exercise Price: $0.35 for a two year period

Number of Placees: 2 placees

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

---------------------------------------------------------------------------

KALAHARI RESOURCES INC. ("KLA")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 2, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect

to the first tranche of a Non-Brokered Private Placement announced April

16, 2009 and amended May 29, 2009:

Number of Shares: 5,600,000 flow-through shares

Purchase Price: $0.05 per flow-through share

Warrants: 5,600,000 share purchase warrants to purchase

5,600,000 shares

Warrant Exercise Price: $0.05 for a one year period

$0.10 in the second year

Number of Placees: 1 placee

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P # of Shares

Hastings Management Corp.

(Richard W. Hughes) Y 5,600,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

---------------------------------------------------------------------------

MAESTRO VENTURES LTD. ("MAP")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 1,950,895 shares to settle outstanding debt for $136,383.

Number of Creditors: 11 Creditors

Insider / Pro Group Participation:

Insider equals Y / Amount Deemed Price

Creditor Progroup equals P Owing per Share # of Shares

Unity West Capital

Markets Ltd.

(Krister Kottmeier) Y $15,750 $0.07 225,000

Allan Williams Y $3,693 $0.07 52,757

Neon Rainbos

Holdings Ltd.

(Allan Williams) Y $15,750 $0.07 225,000

Rasmussen

Exploration Inc.

(Hans Rasmussen) Y $15,000 $0.07 214,285

Ann Carpenter Y $7,500 $0.07 107,142

The Company shall issue a news release when the shares are issued and the

debt extinguished.

TSX-X

---------------------------------------------------------------------------

MAGNUM URANIUM CORP. ("MM")

BULLETIN TYPE: Delist-Offer to Purchase

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

Effective at the close of business on Thursday, July 2, 2009, the common

shares of Magnum Uranium Corp. (the "Company") will be delisted from TSX

Venture Exchange. The delisting of the Company's shares results from

Energy Fuels Inc. ("EFR") purchasing 100% of the Company's shares

pursuant to an Arrangement Agreement dated May 15, 2009. Company

shareholders will receive 0.78 shares of EFI for every one (1) share

held. For further information please refer to the Company's Notice of

Meeting and Management Information Circular dated May 21, 2009 and the

company's news release dated March 30, 2009.

TSX-X

---------------------------------------------------------------------------

PARTA SUSTAINABLE SOLUTIONS INC. ("PAS")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated June 22, 2009, effective

at 7:18 a.m. PST, July 2, 2009 trading in the shares of the Company will

remain halted pending receipt and review of acceptable documentation

regarding the Change of Business and/or Reverse Takeover pursuant to

Listings Policy 5.2.

TSX-X

---------------------------------------------------------------------------

POPLAR CREEK RESOURCES INC. ("PCK")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

Effective at the opening, July 2, 2009, shares of the Company resumed

trading, an announcement having been made over Market News Publishing.

TSX-X

---------------------------------------------------------------------------

ROCK TECH RESOURCES INC. ("RCK")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for expedited filing documentation

pertaining to a Letter of Intent dated June 24, 2009 between Rock Tech

Resources Inc. (the 'Company') and Jenna Carlson, Frank Pun, 0853998 B.C.

Ltd., pursuant to which the Company will purchase all of the outstanding

common shares of 0853998 B.C. Ltd. from Jenna Carlson and Frank Pun.

0853998 B.C. Ltd. owns a mineral exploration property comprised of 123

map designated claims covering an approximate area of 6,497.69 hectares

located in James Bay area of Quebec. In consideration, the Company will

issue a total of 2,500,000 shares and assume an outstanding promissory

note in the amount of $350,000 which will be due upon demand at closing.

TSX-X

---------------------------------------------------------------------------

SAHA PETROLEUM LTD. ("SPZ")

BULLETIN TYPE: Property-Asset or Share Disposition Agreement

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing final documentation in

respect of the arm's length sale by the Company of certain of its oil and

gas assets consisting of its oil and natural gas interests in 5 wells

located in the Golden Lake area of western Saskatchewan and 2 wells

located inn the Rush Lake area of western Saskatchewan, as set forth in

an asset purchase agreement dated June 12, 2009, as entered into between

the Company and a private company, where the total consideration paid for

the Assets was $2,700,000 in cash.

For further details on the sale, please refer to the Company's news

releases dated June 15 and June 29, 2009.

TSX-X

---------------------------------------------------------------------------

SATURN MINERALS INC. ("SMI")

BULLETIN TYPE: Warrant Term Extension

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has consented to the extension in the expiry date of

the following warrants:

Private Placement:

# of Warrants: 1,000,000

Original Expiry Date of Warrants: August 3, 2009

New Expiry Date of Warrants: August 3, 2010

Exercise Price of Warrants: $0.30

These warrants were issued pursuant to a private placement of 1,000,000

shares with 1,000,000 share purchase warrants attached, which was

accepted for filing by the Exchange effective August 3, 2007.

TSX-X

---------------------------------------------------------------------------

SATURN MINERALS INC. ("SMI")

BULLETIN TYPE: Warrant Term Extension

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has consented to the extension in the expiry date of

the following warrants:

Private Placement:

# of Warrants: 1,150,000

Original Expiry Date of Warrants: July 9, 2009

New Expiry Date of Warrants: July 9, 2010

Exercise Price of Warrants: $0.25

These warrants were issued pursuant to a private placement of 2,500,000

flow-through shares with 1,250,000 share purchase warrants attached,

which was accepted for filing by the Exchange effective July 9, 2007.

TSX-X

---------------------------------------------------------------------------

SELWYN RESOURCES LTD. ("SWN")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 2, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect

to the second tranche of a Non-Brokered Private Placement announced May

8, 2009:

Number of Shares: 15,000,000 non-flow through shares

Purchase Price: $0.10 per share

Warrants: 7,500,000 share purchase warrants to purchase

7,500,000 shares

Warrant Exercise Price: $0.15 for a two year period

Number of Placees: 1 placee

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Pan Pacific Metal

Mining Corporation Y 15,000,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

SHOREHAM RESOURCES LTD. ("SMH")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for expedited filing documentation of

an Option Agreement dated June 12, 2009 between the Issuer and Micael

Desmeules and Garry Smith (the "Optionors") whereby the Issuer may

acquire a 100% interest in the Beren's River Property (the "Property"),

consisting of 1 claim, totaling 15 units located in the Red Lake mining

district in Ontario.

In order to acquire a 100% interest in the Property the Issuer is to pay

the Optionors an aggregate of $480,000 cash and an aggregate of 1,000,000

common shares over a period of five years.

The Property is subject to a 2% net smelter return (NSR) royalty payable

to the Optionors. The Issuer will have the option to reduce the NSR

royalty to 1% upon paying the Optionors the aggregate amount of

$2,000,000 at anytime prior to commercial production.

For further information, please refer to the Company's news release dated

June 23, 2009

TSX-X

---------------------------------------------------------------------------

SHOREHAM RESOURCES LTD. ("SMH")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for expedited filing documentation of

an Option Agreement dated June 12, 2009 between the Issuer and Micael

Desmeules and Garry Smith (the "Optionors") whereby the Issuer may

acquire a 100% interest in the Bearhead Trend Property (the "Property"),

consisting of 8 claims, totaling 128 units located in the Red Lake mining

district in Ontario.

In order to acquire a 100% interest in the Property the Issuer is to pay

the Optionors an aggregate of $480,000 cash and an aggregate of 1,000,000

common shares over a period of five years.

The Property is subject to a 2% net smelter return (NSR) royalty payable

to the Optionors. The Issuer will have the option to reduce the NSR

royalty to 1% upon paying the Optionors the aggregate amount of

$2,000,000.

TSX-X

---------------------------------------------------------------------------

SILEX VENTURES LTD. ("SXX.P")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated June 26, 2009, effective

at the opening, July 2, 2009 trading in the shares of the Company will

remain halted pending receipt and review of acceptable documentation

regarding the Qualifying Transaction pursuant to Listings Policy 2.4.

TSX-X

---------------------------------------------------------------------------

STETSON OIL AND GAS LTD. ("SSN")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue $75,000 in cash and 1,439,355 shares to settle outstanding debt for

$362,871.

Number of Creditors: 4 Creditors

No Insider / Pro Group Participation

The Company shall issue a news release when the shares are issued and the

debt extinguished.

TSX-X

---------------------------------------------------------------------------

TERRAX MINERALS INC. ("TXR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced June 2, 2009:

Number of Shares: 1,750,000 shares

Purchase Price: $0.10 per share

Warrants: 1,750,000 share purchase warrants to purchase

1,750,000 shares

Warrant Exercise Price: $0.15 for a two year period

Number of Placees: 15 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Tony Frakes P 250,000

Mary Monk P 100,000

Brian Butterworth P 50,000

Fred Hoffman P 50,000

Paul Reynolds Y 200,000

Geovector Management Inc.

(J. Campbell, T. Setterfield) Y 250,000

Finder's Fee: $600 payable to Union Securities Ltd.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

TNR GOLD CORP. ("TNR")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for expedited filing documentation of

an Option Agreement dated June 24, 2009 between the Issuer and GeoXplor

Corp. (the "Optionor". Insiders: C. Ashworth, J. Rudd) whereby the Issuer

may acquire a 100% interest in the Mud Lake lithium property (the

"Property") located 16 kilometers southwest of Tonopah in the Ralston

Valley, Nevada.

TNR has agreed to make payments totaling US$260,000 over a four-year

period, issue 1,000,000 common shares of the Company over a three-year

period and commit to work expenditures totaling US$1,000,000 over a four-

year period.

The Issuer has agreed to pay a royalty of 3% to the Optionor and has the

right to purchase the royalty for US$3,000,000 at any time. The Issuer

has the option to reduce the royalty by paying the Optionor US$1,000,000

for each 1% (one-third) at any time.

For further information, please refer to the Company's news release dated

June 25, 2009.

TSX-X

---------------------------------------------------------------------------

TRUE NORTH GEMS INC. ("TGX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 2, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced June 10, 2009:

Number of Shares: 13,700,000 shares

Purchase Price: $0.10 per share

Warrants: 13,700,000 share purchase warrants to purchase

13,700,000 shares

Warrant Exercise Price: $0.20 for a two year period

In the event the closing market price of the shares of the Issuer on the

Exchange is $0.30 or higher over a period of ten consecutive trading days

at any time after the date that is four months from the date of issuance

of the warrants, the Issuer will be entitled to accelerate the warrants

upon notice given to the warrantholders that the warrants will expire on

the 21st calendar day after the date of delivery of such notice.

Number of Placees: 108 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Thomas Seltzer P 100,000

Iron Mask Explorations

(A. Lee Smith) Y 500,000

Cadiam Investments

(N. Houghton) Y 250,000

Dave Parsons Y 175,000

Robert Boyd Y 70,000

William Anderson Y 50,000

John Ryder Y 50,000

Greg Fekete Y 150,000

John Comi P 150,000

Angelo Comi P 150,000

Daryl Hodges P 100,000

David Lawson P 250,000

Christine Cappuccitti P 75,000

Ronald Crowe Y 2,000,000

Justus Parmar P 50,000

Gary Hartwell P 30,000

David Hamilton Smith P 100,000

Brad Birada P 200,000

Brad Birada P 300,000

Robert Boyd Y 30,000

Finder's Fee: $11,135 and 111,353 finder's warrants payable

to Global Securities Corp.

$16,303 and 163,030 finder's warrants payable

to Jennings Capital Inc.

$7,500 payable to Canaccord Capital Corp.

$3,000 payable to Haywood Securities Inc.

$1,980 payable to Emerging Equities Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

NEX COMPANIES

GTO RESOURCES INC. ("GTR.H")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: July 2, 2009

NEX Company

Further to TSX Venture Exchange Bulletin dated June 30, 2009, effective

at the opening, July 2, 2009 trading in the shares of the Company will

remain halted pending receipt and review of acceptable documentation

regarding the Change of Business and/or Reverse Takeover pursuant to

Listings Policy 5.2.

TSX-X

---------------------------------------------------------------------------

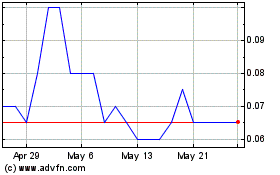

SuperBuzz (TSXV:SPZ)

Historical Stock Chart

From Apr 2024 to May 2024

SuperBuzz (TSXV:SPZ)

Historical Stock Chart

From May 2023 to May 2024