KGHM To Complete Canadian Project Feasibility Study By Dec '11

05 May 2010 - 6:32PM

Dow Jones News

Polish copper miner KGHM Polska Miedz (KGH.WA) will complete a

feasibility study of its copper and gold field project in western

Canada by December 2011, the company said Wednesday.

After that, KGHM will decide whether to execute its option of

buying a further 29% in the joint venture with Canada's Abacus

Mining & Exploration Corp. (AME.V).

Both companies signed an agreement Tuesday, in which KGHM will

pay $37 million for 51% of the joint venture. Abacus will

contribute its rights to the Afton Ajax field, located in the

Canadian province of British Columbia, into the business.

KGHM has the option to buy a further 29% in the joint venture

for up to $35 million and, if it exercises the option, it will be

required to organize financing of $535 million for the joint

venture's investment in the field.

According to estimates, the Afton Ajax field can produce 50,000

metric tons of copper and 100,000 troy ounces of gold a year. The

field is expected to produce for 23 years starting in 2013, KGHM

said.

-By Malgorzata Halaba, Dow Jones Newswires; +4822 447-2432;

malgorzata.halaba@dowjones.com

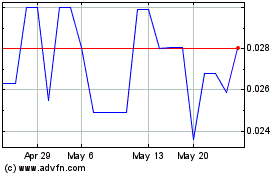

Abacus Mining and Explor... (PK) (USOTC:ABCFF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Abacus Mining and Explor... (PK) (USOTC:ABCFF)

Historical Stock Chart

From Feb 2024 to Feb 2025