By Eric Uhlfelder

With interest rates rising and stock prices falling, 2019 is

setting up to be one of the most challenging environments investors

have faced in some time.

To get a sense of what some high-profile investors are thinking

for the year ahead, The Wall Street Journal interviewed several

hedge-fund managers with some of the most consistent long-term

performances.

The managers have a variety of ideas, from being bullish on

commodities and Turkish banks, to shorting U.S. leveraged loans and

U.K. gilts. Their fears included rising global trade tensions,

geopolitical risks surrounding the European Union and the euro, and

a potential slide in investor confidence. Other hedge-fund managers

say they fear the unrecognized costs of climate change. Here are

four of the managers' outlooks.

Natural Gas, Oil and Gold (buy)

Nigol Koulajian -- AlphaQuest

Strategy: Systematic macro

Assets: $1.7 billion

Launch Date: 1999

Annualized Net Returns: 11%

Nigol Koulajian runs a purely systematic shop, an industry term

meaning he uses various proprietary programs that identify when the

character of an asset's price movement is changing. Often, when

prices are bouncing all over the place, that can indicate when a

high is being formed, or now, as in the case of natural gas, crude

oil and gold, when a rebound appears to be set to take off. That's

what Mr. Koulajian's programs say is now happening.

"We are currently seeing an unwinding of short positions on

natural-gas contracts which had been built up by hedge funds and

other institutional investors," Mr. Koulajian says. "Price

volatility is revealing larger swings on the upside and smaller

movement on the downside, suggesting a bottom is forming on

natural-gas prices and rising prices likely in 2019."

To Mr. Koulajian, this also indicates oil prices will soon stop

falling and start rising. He expects gold prices will start moving

upward, too.

The biggest risk he sees in the coming year: stagflation, where

inflation and interest rates rise while GDP growth slows.

Leveraged loans (sell)

Hanif Mamdani -- PH&N Absolute Return

Strategy: Multistrategy/credit

Assets: $1.3 billion

Launch date: 2002

Annualized Net Returns: 13.5%

With the credit market having peaked and a bear market likely

under way, Canadian hedge-fund manager Hanif Mamdani says a key

area of concern to him is the market for leveraged loans -- senior

loans made to largely below-investment-grade borrowers.

The leveraged-loan market is now the second-largest corporate

debt class in the U.S., behind investment grade, standing at $1.3

trillion. Exceeding high-yield debt issuance, leveraged loans have

become the go-to market for highly indebted firms, says Mr.

Mamdani.

Insatiable investor demand for high-coupon, floating-rate debt,

fueled by how well leveraged loans held up during the financial

crisis, has led to the doubling in size of these loans over the

past six years. Mr. Mamdani figures that upward of 80% of these

loans are issued based on optimistic projections, excessive

leverage, and with minimal covenants. With interest rates rising

and global growth ebbing, he expects these loans could sell off by

10% or more over the next 18 months.

A simple way that individual investors can play this thesis is

by shorting -- betting against Invesco Senior Loan ETF (BKLN), an

exchange-traded fund that tracks leveraged loans. Because such a

short requires payment of the 5% interest yield that the ETF spins

off, Mr. Mamdani recommends partially covering that liability by

simultaneously being long one-year Treasury bills. He projects net

return in 2019 on this defensive hedge to be from 5 and 7%.

Turkish Banks (buy)

Carl Tohme -- Jabcap EMEA

Strategy: Emerging markets

Assets: $270 million

Launch Date: 2010

Annualized Net Returns: 9.96%

With emerging-markets valuations bouncing around like a pinball

for years, Carl Tohme may have the toughest job of all our

managers.

"We have been negative on Turkey since the beginning of 2018,"

says Mr. Tohme. "But we believe rate increases by the Central Bank

of Turkey, which has doubled its benchmark rates to 24% in

September, are beginning to address some of the country's financial

challenges." This has helped the Turkish lira to rally back more

than halfway from its 40% decline against the greenback in

2018.

Although he doesn't expect to see a V-shaped recovery, Mr. Tohme

thinks the Turkish economy and market are on the mend, especially

if energy prices stabilize and the Federal Reserve eases up on

interest-rate increases.

Because he believes Turkish banks will be recapitalized by the

end of the first quarter of 2019, Mr. Tohme considers them to be

trading cheap, below 0.5 times book value and around 3.5 times

forward earnings, which prices in a projected recession in

2019.

He likes Akbank and Garanti Bank (the latter majority-owned by

the Spanish bank BBVA). "These are well-regulated, conservatively

managed, private institutions," says Mr. Tohme, "with solid capital

and liquidity ratios, which should help them weather the recession

and thrive in the subsequent recovery."

Mounting trade tensions worry Mr. Tohme, especially if they

continue to fuel volatility across all markets. But if China and

the U.S. begin to work out their differences, and if the U.S. holds

off on further rate increases, Mr. Tohme thinks emerging-markets

shares and their underlying currencies should outperform developed

markets in 2019.

Gilts (sell)

Bob Treue -- Barnegat

Strategy: Fixed-income relative value

Assets: $661 million

Launch Date: 2001

Annualized Net Returns: 15.9%

Relative-value trades are where managers look for financial

instruments that should trade in lockstep with one another but

whose values have deviated. Managers bet these spreads will

close.

"Government bond yields should be higher than inflation," says

Bob Treue. "But at the end of the year, the 30-year British gilt

yielded 1.95% while an equivalently termed U.K. inflation swap was

at 3.30%."

While the Bank of England's unwinding of quantitative easing

should help boost yields on long-term U.K. government bonds, Mr.

Treue says it isn't clear when this correction will occur. But he

says the market will make it happen.

Mr. Treue is short the long-term gilt, believing its yield will

rise and price will fall, and he is long inflation swaps, believing

the inverse will happen. He has structured the trade as to

currently earn money as he waits. The carry costs of the trade can

be offset by the yield that part of the transaction generates.

Because the inflation swaps are so mispriced, compared with the

gilts, the yield currently exceeds costs.

The manager sees significant dislocation from quantitative

tightening that's now under way in the U.S., creating mispricing in

the debt market. What he fears most is a rapid meltdown in market

confidence as global trade tensions and deglobalization produces a

"free-for-all" mentality.

Mr. Uhlfelder writes about global capital markets from New York.

He can be reached at reports@wsj.com.

(END) Dow Jones Newswires

January 06, 2019 22:18 ET (03:18 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

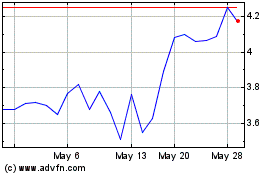

Akbank Turk Anonim Sirketi (QX) (USOTC:AKBTY)

Historical Stock Chart

From Oct 2024 to Nov 2024

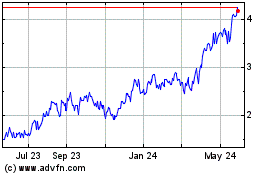

Akbank Turk Anonim Sirketi (QX) (USOTC:AKBTY)

Historical Stock Chart

From Nov 2023 to Nov 2024