Greek Banks Need up to $15.8 Billion

02 November 2015 - 12:20PM

Dow Jones News

ATHENS—Greece's top four lenders will need to inject up to €14.4

billion ($15.8 billion) in fresh funds to strengthen their capital

base, according to the results of a health check performed by the

European Central Bank released on Saturday.

The amount, which was determined by an examination of lenders

National Bank of Greece (NBG) SA, Piraeus Bank SA, Eurobank

Ergasias SA and Alpha Bank AS., is in line with market

expectations. The banks are now required to say how they plan to

raise this capital by November 6.

The checks were carried out using baseline and more-adverse

scenarios for the course of the Greek economy up until the end of

2017 to project possible credit losses.

Under the baseline scenario, the banks will need €4.4 billion,

while under the adverse scenario, the capital shortfall reaches

€14.4 billion, the ECB said.

"Covering the shortfalls by raising capital will result in the

creation of prudential buffers at the four Greek banks, which will

improve the resilience of their balance sheets and their capacity

to withstand potential adverse macroeconomic shocks," the ECB said

in a statement.

This will be the third capital increase for the country's

battered lenders since Greece's debt crisis erupted in 2010, and it

must be completed by the end of the year. From January, European

rules on bank recapitalization potentially require bank depositors

to take a hit.

The country's state-owned recapitalization fund, the Hellenic

Financial Stability Fund, will cover any capital gap beyond the

baseline scenario if it cannot be raised in the market, by buying a

mix of new shares and contingent convertible bonds that banks will

issue. The new shares will have full voting rights.

A breakdown of figures shows Piraeus Bank, the country's

second-largest lender, has the biggest recapitalization

requirement, needing to meet a shortfall of €4.93 billion.

Eurobank, the only lender that isn't majority owned by the Greek

state, has the smallest need at €2.12 billion. Alpha Bank needs

€2.74 billion in fresh capital, while the country's largest lender

NBG requires €4.60 billion.

According to Greece's third bailout agreement reached in

mid-July with international creditors, eurozone countries and the

International Monetary Fund, some €25 billion of public money was

earmarked to recapitalize Greece's banks. The framework for the

bank recapitalization got the backing of the majority Greece's

lawmakers on Saturday.

The banks are likely to raise these amounts, according to

analysts, as they wrestle with a massive pile of nonperforming

loans, a key challenge for the sector. With the economy slipping

back into recession this year, albeit at a milder rate than

initially expected, about one in two loans held by Greek banks are

nonperforming.

The management of those loans is also proving to be a major

obstacle in continuing talks between Greece and international

creditors over the country's next tranche of aid, raising policy

issues on how the banks should recover their outstanding loans.

They also pose problems for helping to finance the recovery.

With funds tied up in bad loans, Greek banks have been severely

restricted in their ability to provide fresh finance to companies

and households. Demand for credit has also plummeted amid the

downturn that wiped about a quarter of the size of the economy

since 2010.

"The next big challenge for [Greek] banks will be to get back to

normal," said Ricardo Garcia, European Economist at UBS Wealth

Management. "Now everything depends on the first review; despite

some hiccups, overall things are moving in the right direction,

obviously helped by the better than expected economy."

Provisions taken for bad loans continue to take a heavy toll on

earnings, according to the latest batch of profit figures released

by Greek lenders on Saturday. Banks had held off from revealing

these figures until the completion of the asset review performed by

the ECB.

Piraeus Bank reported a net loss of €635 million for the first

nine months of the year, narrowing from a loss of €1.6 billion in

the same period a year earlier. Alpha Bank was also in the red for

January to September by €838.4 million versus a year earlier profit

of €129.3 million. NBG unveiled second quarter figures showing a

loss of €1.6 billion, which compares with a €159 million loss in

the first three months of the year.

Other problems faced by the sector include restoring liquidity

conditions for the domestic banks that have been relying heavily on

emergency funding from the ECB. Lenders suffered a major flight of

deposits during the six-month-long negotiations between the Greek

government and the country's international creditors, that prompted

the introduction of capital controls over the summer.

In a bid to finally restore confidence in the Greek financial

system, regulators set a high bar for the stress tests this time

round.

The banks are required to have a common-equity Tier 1 ratio of

9.5% after the baseline stress and 8% after the extreme stress.

That is much more than the respective 8% and 5.5% hurdles in the

previous health check up.

Write to Stelios Bouras at stelios.bouras@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 01, 2015 20:05 ET (01:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

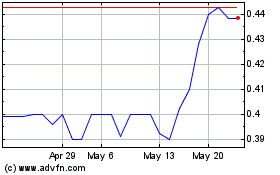

Alpha Services (PK) (USOTC:ALBKY)

Historical Stock Chart

From Dec 2024 to Jan 2025

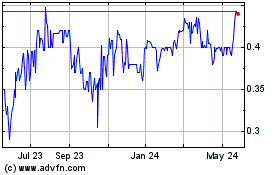

Alpha Services (PK) (USOTC:ALBKY)

Historical Stock Chart

From Jan 2024 to Jan 2025