Amanda Staveley's PCP Looks to Invest $2 Billion in Greek Bank Loans

08 August 2016 - 7:10PM

Dow Jones News

PCP Capital Partners LLP is looking to spend around $2 billion

snapping up nonperforming loans from Greek banks, according to a

person familiar with the matter.

PCP, run by Amanda Staveley, a financier known for her close

ties to Gulf investors, is aiming to lead a recapitalization of

Pancretan Cooperative Bank, this person said. The small Greek

lender could then be used as a vehicle to buy assets that other

local banks want to shed over the next 12 months or so. PCP's push

into Greece is being backed by sovereign investors, this person

added. Pancreten couldn't be reached for comment.

Cleaning up the roughly €110 billion ($122 billion) of soured

loans festering on Greek bank balance sheets is becoming a priority

for the government as it tries to get credit flowing through the

economy again. As part of its latest bailout package the Greek

parliament had to vote through laws making it easier to restructure

loans or reclaim assets.

Foreign investors are being encouraged to help out. Earlier this

year U.S. private equity group KKR & Co. signed an agreement

with Greece's Alpha Bank and Eurobank to manage up to €1.2 billion

of their problem loans. The country's largest lender, Piraeus, is

planning to strike a similar deal with KKR. National Bank of Greece

SA, is expected to follow suit, according to analysts.

Ms. Staveley, who is best known for orchestrating a £ 3.5

billion ($4.57 billion) investment from Abu Dhabi to prop-up

Barclays PLC at the height of the financial crisis, has already put

in place a management team in Greece, according to a person

familiar with the matter. PCP is will work with a local group to

collect or restructure debts. The fund will also look at acquiring

Greek businesses.

How private equity groups fare will be a key test of the

structural reforms the Greek government has put in place. Greek

banks have dragged their feet selling loans to private equity

groups at steep discounts, arguing they just need time to

restructure them. The European Central Bank is now turning the

screws, keeping detailed data on how much progress each bank makes

in getting rid of bad loans and setting explicit targets,

executives at several banks say.

In July the top management of Greece's bank rescue fund—the

Hellenic Financial Stability Fund—was forced out for not pressuring

banks to get rid of bad loans fast enough.

Still some complain the legal system in Greece is too sclerotic.

Pushing through bankruptcies remains slow, hampering the cleanup of

bank balance sheets. If even the private-equity firms fail to grind

out returns this could buy the banks some respite from regulators,

one senior executive at a major bank says.

Stelios Bouras contributed to this article.

Write to Max Colchester at max.colchester@wsj.com

(END) Dow Jones Newswires

August 08, 2016 04:55 ET (08:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

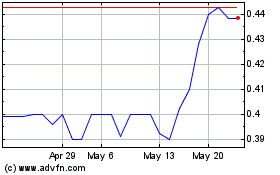

Alpha Services (PK) (USOTC:ALBKY)

Historical Stock Chart

From Nov 2024 to Dec 2024

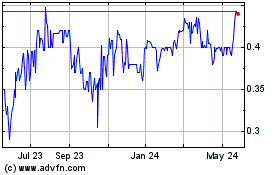

Alpha Services (PK) (USOTC:ALBKY)

Historical Stock Chart

From Dec 2023 to Dec 2024