China's Cosco Shipping Expects Profit Surge as Industry Flourishes

07 April 2021 - 8:53PM

Dow Jones News

By Joanne Chiu

A bullish profit forecast from China's largest

container-shipping company sent its stock soaring and offered fresh

evidence of how the industry is thriving thanks to robust global

trade flows.

Freight rates have surged over the past year, with shipping

groups reaping the benefits of earlier capacity cuts combined with

stronger-than-expected demand. And while the recent Suez Canal

blockage has created huge logistical headaches, it hasn't spoiled

that positive picture. If anything, port backlogs and other snarls

have provided further support to freight rates.

Late Tuesday, Cosco Shipping Holdings Co. said it expected this

year's first-quarter net profit to total 15.41 billion yuan, or the

equivalent of $2.3 billion. That compares with $44 million for the

first three months of 2020.

Shipping rates rose nearly 54% compared with the fourth quarter,

Cosco Shipping said, citing the widely tracked China Containerized

Freight Index. The company controls the world's third-largest

container carrier by capacity.

The company's Hong Kong shares jumped 29% on Wednesday to their

highest since August 2008. Its Shanghai-traded stock halted trading

after it rose by the daily trading limit of 10%.

Chen Shuai, deputy managing director at Cosco Shipping said at a

briefing Wednesday that inventory levels at U.S. retailers remain

low. The $1.9 trillion relief plan recently signed by President

Biden will trigger restocking, boosting imports, he said.

Global trade has rebounded rapidly from the early stage of the

pandemic, with China and other Asian manufacturing countries

grabbing a bigger slice of exports including masks and

bicycles--market share they are expected to keep after the

public-health crisis fades.

That has helped buoy shares in container-shipping groups such as

Denmark's A.P. Moeller-Maersk, South Korea's HMM Co., Taiwan's

Evergreen Marine Corp. and Yang Ming Marine Transport Corp., and

Cosco Shipping.

"It will be another strong year for the container-shipping

industry after a robust 2020," said Maggie Wang, a transportation

analyst at Bocom International, the investment banking arm of Bank

of Communications Co.

Ms. Wang said that among other things, the industry had

benefited from tight shipping supply and healthy demand for goods

underpinned by huge government spending.

This year, she said, e-commerce would remain strong, as social

distancing and travel restrictions dents demand for vacations,

movies and dining out. Meanwhile, tight shipping capacity and

issues such as container-box shortages and port congestion would

continue to support freight rates, she said.

"It will take weeks to clear the backlogs left by hundreds of

once-trapped container ships which are now moving through the Suez

Canal to their destinations," she said.

The Evergreen-operated container ship that got stuck in the

canal left hundreds of ships stranded and delayed sailing schedules

for goods such as furniture, electronic appliances and automobile

parts.

Much of what operators transport is typically covered by annual

contracts. In a note to clients, Jefferies analyst Andrew Lee said

Cosco Shipping had secured better-than-expected increases for its

trans-Pacific annual contracts. The bank had expected these rates

to rise 25%.

Write to Joanne Chiu at joanne.chiu@wsj.com

(END) Dow Jones Newswires

April 07, 2021 06:38 ET (10:38 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

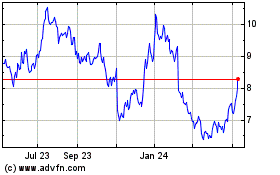

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Nov 2024 to Dec 2024

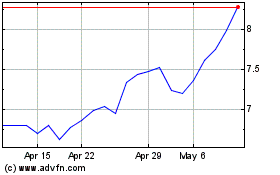

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Dec 2023 to Dec 2024