- Current report filing (8-K)

22 November 2011 - 10:13PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

|

Date of Report (Date of earliest event reported):

|

November 17, 2011

|

|

|

|

AURI, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

Delaware

|

|

0-281617

|

|

33-0619264

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

1200 N. Coast Hwy., Laguna Beach, CA

|

|

92651

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

(949) 793-4045

|

|

|

|

|

|

|

(Former name or former address, if changed since last report)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01.

|

Entry Into a Material Definitive Agreement.

|

Effective November 17, 2011, Auri Footwear, Inc. (the “Company”) entered into a License Agreement (the “License Agreement”) with Robert Graham Holdings, LLC (“RG”) whereby the Company was granted an exclusive license to use the mark “Robert Graham” in the United States (the “Territory”) in connection with the manufacture, marketing, display, advertising, promotion, distribution and sale of men’s dress and casual footwear (the “Articles”). The Articles will be targeted for the so-called “designer” market segment.

The term of the License Agreement is month to month. Either party can terminate the License Agreement upon 90 days written notice to the other party. RG has the right to terminate the License Agreement immediately upon the happening of certain events including, among others, the Company’s failure to present Articles for sale by January 31. 2012, the Company’s failure to ship full-price, in-season Articles to customers in reasonable commercial quantities in a material portion of the Territory by September 1, 2012, the bankruptcy of the Company or the Company breaches certain material provisions of the License Agreement.

Under the terms of the License Agreement, the Company’s designers will collaborate with RG’s designers to develop seasonal collections of the Articles. The License Agreement provides that the Company will produce and sell three seasonal collections of Articles, a Spring collection, a Fall collection and a Holiday/Resort collection.

The License Agreement provides that the Company can sell the Articles only through a carefully selected network of retail customers, with all retail customers being selected by the Company based upon their compatibility with the reputation, image and prestige of RG. In addition, the Company is responsible for ensuring that the Articles are supported by cooperative advertising and other retailer-related marketing activities and that appropriate marketing activities are conducted throughout the Territory.

The License Agreement provides that the Company shall pay RG a royalty equal to 15% of Net Sales with an advance royalty of $25,000, which amount was paid upon execution of the License Agreement and which amount shall be applied as a credit against the first sales royalties due under the License Agreement. The term “Net Sales” is generally defined in the License Agreement to mean

the invoiced or shipped amount of Articles sold by the Company, less the amount of any discounts actually earned and taken by customers, any markdown allowances and any authorized returns including for damaged or defective Articles, but only to the extent that such discounts, markdown allowances and returns during an annual period do not exceed in the aggregate 10% of gross sales during such annual period, or part thereof if the Agreement is terminated before the end of any annual period. The License Agreement does not provide for any minimum royalty amount.

The description of the License Agreement does not purport to be complete and is qualified in its entirety by reference to the License Agreement, which is filed as Exhibit 10.1 to this report and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

|

|

(d)

|

Exhibits

.

|

|

|

|

|

|

|

|

|

|

Number

|

Description

|

|

|

|

|

|

|

|

|

10.1

|

License Agreement dated as of November 17, 2011 by and between Auri Footwear, Inc. and Robert Graham Holdings, LLC*

|

|

|

|

|

|

|

|

|

___________

|

|

|

|

|

* Filed herewith.

|

|

|

|

|

|

|

|

|

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: November 21, 2011

|

AURI, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ ORI ROSENBAUM

|

|

|

|

|

Ori Rosenbaum

|

|

|

|

|

President and CEO

|

|

|

|

|

|

|

AURI, INC.

EXHIBITS FILED WITH THIS REPORT

|

10.1

|

License Agreement dated as of November 17, 2011 by and between Auri Footwear, Inc. and Robert Graham Holdings, LLC

|

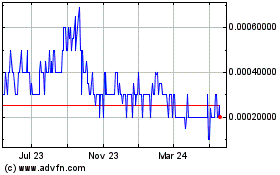

Auri (PK) (USOTC:AURI)

Historical Stock Chart

From Nov 2024 to Dec 2024

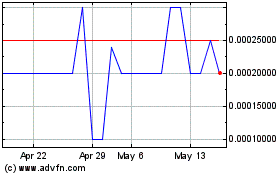

Auri (PK) (USOTC:AURI)

Historical Stock Chart

From Dec 2023 to Dec 2024