Avidbank Holdings, Inc. ("the Company") (OTCBB: AVBH), sole

owner of Avidbank ("the Bank"), an independent full-service

commercial bank serving businesses and consumers in Northern

California, announced unaudited net income of $514,000 for the

first quarter of 2013, compared to $771,000 during the same period

in 2012.

Financial Highlights

- Net income was $514,000 for the first

quarter of 2013

- Diluted earnings per common share were

$0.16 for the first quarter, compared to $0.26 for the first

quarter of 2012

- Total assets grew by 22% over the

previous 12 months, ending the first quarter at $417 million

- Total loans outstanding grew by 9% over

the previous 12 months, ending the first quarter at $242

million

- Total deposits grew by 25% over the

previous 12 months, ending the first quarter at $375 million

- The Bank continues to be well

capitalized with a Tier 1 Leverage Ratio of 8.9% and a Total Risk

Based Capital Ratio of 12.3%

Mark D. Mordell, Chairman and Chief Executive Officer, stated,

"We are pleased to announce that Avidbank Holdings, Inc. recorded

its fifteenth consecutive profitable quarter for the three months

ended March 31, 2013. As expected, net income for the first quarter

of 2013 decreased by 33% compared to the first quarter of 2012 due

to significant investments in key loan production personnel and new

infrastructure and facilities. These investments are very important

to the Bank’s long term plans as we continue to grow and gain

market share. The Bank's loans, deposits and total assets all

showed growth over the balances a year earlier. We have

strategically added several highly experienced bankers to our team

which has enabled us to open new loan production offices in San

Jose and Redwood City."

For the three months ended March 31, 2013, net interest income

before provision for loan losses was $3.9 million, an increase of

more than $160,000 or 4% compared to the first quarter of 2012. The

growth in net interest income was the result of growth in loans

outstanding. Due in large part to the competitive market, net

interest margin was 3.93% for the first quarter of 2013, compared

to 4.48% for the first quarter of 2012. The decline in margin was

mitigated by a reduction in our overall cost of funds from 0.64% in

2012 to 0.34% for the same period in 2013.

Non-interest expense grew by $557,000 to $3.1 million in the

first quarter of 2013, compared to $2.5 million for the first

quarter of 2012 and $2.9 million for the fourth quarter of 2012.

These expense outlays are part of the Bank’s strategic initiative

to deepen our current lending expertise while broadening our market

footprint. These investments will lead to future growth in both

loan and fee income.

Non-interest income excluding gains from the sale of investment

securities was $125,000 in the first quarter of 2013; an increase

of $18,000 or 17% over the first quarter of 2012 and $3,000 or 3%

over the fourth quarter of 2012.

About Avidbank

Avidbank Holdings, Inc., headquartered in Palo Alto, California

offers innovative financial solutions and services. We specialize

in the following markets: commercial & industrial, corporate

finance, asset-based lending, real estate construction and

commercial real estate lending, and real estate bridge financing.

Avidbank advances the success of our clients by providing them with

financial opportunities and serving them as we wish to be served –

with mutual effort, ingenuity and trust – creating long-term

banking relationships.

Forward-Looking Statement:

This news release contains statements that are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements are based on current

expectations, estimates and projections about Avidbank's business

based, in part, on assumptions made by management. These statements

are not guarantees of future performance and involve risks,

uncertainties and assumptions that are difficult to predict.

Therefore, actual outcomes and results may differ materially from

what is expressed or forecasted in such forward-looking statements

due to numerous factors, including those described above and the

following: Avidbank's timely implementation of new products and

services, technological changes, changes in consumer spending and

savings habits and other risks discussed from time to time in

Avidbank's reports and filings with banking regulatory agencies. In

addition, such statements could be affected by general industry and

market conditions and growth rates, and general domestic and

international economic conditions. Such forward-looking statements

speak only as of the date on which they are made, and Avidbank does

not undertake any obligation to update any forward-looking

statement to reflect events or circumstances after the date of this

release.

Avidbank Holdings, Inc.Balance

Sheet(Unaudited) ($000 except per share amounts)

Assets

3/31/2013

12/31/2012

3/31/2012

Cash and due from banks $ 11,381 $ 21,493 $ 13,174 Fed funds sold

102,070 85,510 18,365 Total cash and cash

equivalents 113,451 107,003 31,539 Investment securities -

available for sale 54,767 55,343 80,971 Loans, net of

deferred loan fees 242,225 247,269 221,564 Allowance for loan

losses (4,736) (4,480) (4,359) Loans, net of

allowance for loan losses 237,489 242,789 217,205 Premises

and equipment, net 1,334 1,291 711 Accrued interest receivable

& other assets 10,201 9,296 10,250 Total

assets

$ 417,242 $

415,721 $ 340,676

Liabilities

Non-interest-bearing demand deposits $ 101,386 $ 105,518 $ 64,669

Interest bearing transaction accounts 15,990 17,293 14,765 Money

market and savings accounts 197,639 185,664 152,870 Time deposits

60,931 66,520 67,856 Total deposits 375,946

374,994 300,159 Other liabilities 2,884 2,864

5,429 Total liabilities 378,830 377,858 305,588

Shareholders'

equity

Preferred stock 5,963 5,952 5,918 Common stock 29,647 29,556 29,373

Retained earnings (accumulated deficit) 1,599 1,171 (544)

Accumulated other comprehensive income 1,204 1,184

340 Total shareholders' equity 38,412 37,863 35,088

Total liabilities and shareholders' equity

$

417,242 $ 415,721

$ 340,676 Tier 1 leverage ratio

8.87% 8.88% 9.96% Tier 1 risk-based capital ratio 11.01% 10.78%

11.35% Total risk-based capital ratio 12.26% 12.03% 12.68% Book

value per share (excluding TARP) $ 12.37 $ 12.22 $ 11.16

Avidbank Holdings, Inc.Condensed

Statements of Income(Unaudited) ($000 except per share amounts)

For the Quarter

Ended

3/31/2013

3/31/2012

Interest and fees on loans $ 3,722 $ 3,655 Interest on investment

securities 404 529 Other interest income 54 20 Total

interest income 4,180 4,203 Interest expense 318 501

Net interest income 3,862 3,702 Provision for loan losses

- - Net interest income after provision for loan

losses 3,862 3,702 Service charges, fees and other income

125 107 Compensation and benefit expenses 1,838 1,494

Occupancy and equipment expenses 971 792 Other operating expenses

286 253 Total non-interest expense 3,096 2,539

Income before income taxes 891 1270 Provision for income taxes

377 499 Net income

$ 514

$ 771 Preferred dividends &

warrant amortization 84 84 Net income applicable to

common shareholders

$

430

$ 687 Basic earnings per common

share $ 0.16 $ 0.26 Diluted earnings per common share $ 0.16 $ 0.26

Weighted average shares outstanding 2,616,099 2,603,827

Weighted average diluted

sharesoutstanding

2,695,340 2,628,127 Total shares outstanding at period end

2,623,852 2,611,018 Return on average assets (annualized)

0.49% 0.88% Return on average common equity (annual.) 6.37% 10.67%

Net interest margin 3.93% 4.48% Cost of funds 0.34% 0.64%

Efficiency ratio 78% 67%

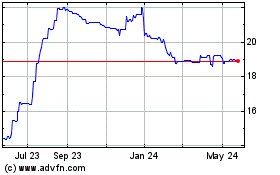

Avidbank (PK) (USOTC:AVBH)

Historical Stock Chart

From Jan 2025 to Feb 2025

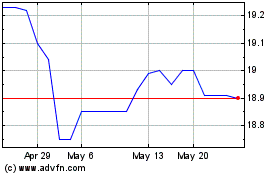

Avidbank (PK) (USOTC:AVBH)

Historical Stock Chart

From Feb 2024 to Feb 2025