Aviva 2015 Adjusted Operating Profit +20%; Raises Dividend

10 March 2016 - 7:15PM

Dow Jones News

By Ian Walker

LONDON--Aviva PLC (AV.LN) Thursday raised its dividend and said

it remains focused on transforming the business as it reported a

20% rise in 2015 adjusted operating profit.

The world's sixth-largest insurance company measured by net

premium income, added that the integration of Friends Life has gone

faster and better than expected. It expects to achieve the target

of 225 million pounds ($313.62 million) integration synergies in

2016, one year ahead of schedule.

Aviva, which has around 34 million customers across 16

countries, added that its economic capital surplus--a measure of

financial stability--rose to GBP11.6 billion, from GBP8.0 billion.

Its net asset value rose to 389 pence a share, from 340 pence at

Dec. 31, 2014. This compares with consensus forecasts of 389 pence

based on 11 analysts forecasts supplied by the company.

The insurer had a solvency II ratio of 180% and a surplus of

GBP9.7 billion.

For the year ended Dec. 31, 2015 Aviva made an adjusted

operating profit, stripping out amortization and impairments and

other items, of GBP2.67 billion, compared with GBP2.21 billion a

year earlier. Net profit fell to GBP918 million from GBP1.57

billion in 2014.

The value of new business rose 24% to GBP1.19 billion, making 12

consecutive quarters of growth, Aviva said.

The board has raised the final dividend 15% to 14.05 pence a

share, making a total payout for the year of 20.8 pence, compared

with 18.1 pence in 2014.

Last June, Aviva completed its GBP5.6 billion purchase of

Friends Life Group Ltd., creating the U.K.'s largest insurance,

savings and asset-management company.

Aviva has also been selling off businesses as part of its

strategy to focus on markets where it has scale or a sustainable

competitive advantage to maximize return on capital. It has sold

its 47% stake in South Korean business Woori Aviva Life Insurance

and U.S. equity manager River Road Asset Management LLC, both for

undisclosed sums.

The firm has also restructured its Italian businesses in deals

with UBI Banca and UniCredit SpA.

Shares closed Wednesday at 459.60 pence. They are currently down

18% over the past 12 month

-Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

(END) Dow Jones Newswires

March 10, 2016 03:00 ET (08:00 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

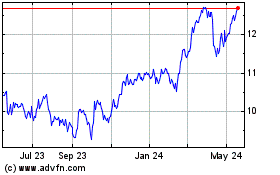

Aviva (PK) (USOTC:AVVIY)

Historical Stock Chart

From Mar 2024 to May 2024

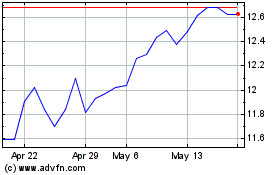

Aviva (PK) (USOTC:AVVIY)

Historical Stock Chart

From May 2023 to May 2024