IC Potash Corp. Appoints Mitsubishi UFJ Financial Group as Financial Advisor for the Ochoa Project

23 April 2014 - 9:30PM

Marketwired

IC Potash Corp. Appoints Mitsubishi UFJ Financial Group as

Financial Advisor for the Ochoa Project

TORONTO, ON--(Marketwired -

April 23, 2014) - IC Potash Corp. (TSX: ICP) (OTCQX:

ICPTF) ("ICP" or the "Company") announced today the

appointment of Mitsubishi UFJ Financial Group, acting through its

wholly-owned banking subsidiaries, the Bank of Tokyo-Mitsubishi

UFJ, Ltd. and Union Bank, N.A. (collectively "MUFG" or the "Bank"),

as financial advisor for its 100%-owned Sulphate of Potash ("SOP")

Ochoa Project located in southeast New Mexico.

MUFG will provide advice with respect to project financing,

including both debt and equity. MUFG is one of the most active

project finance banks in the world, covering a variety of

industries including mining. The Bank has been the number one

project finance arranger in the Americas since 2009, and was

recognized as Project Finance International's Global Bank of the

Year for 2013.

Sidney Himmel, President and Chief Executive Officer of IC

Potash Corp. stated: "We are very pleased to be working with

Mitsubishi UFJ Financial Group, one of the most active banks in the

world for resource project finance, as we expand our business

relationships with current strategic investors and look to

additional funders. Our New Mexico Sulphate of Potash Ochoa Project

should provide a strong supply of SOP in a market where shortages

have appeared. The current pricing of SOP continues to be excellent

from the perspective of producers. We anticipate being one of the

lowest cost producers of SOP in the world."

MUFG will advise ICP in the development of financing plans,

including the determination of appropriate commercial engineering

contractual models, off-take arrangements, and equity and debt

models. They will also provide banking due diligence with respect

to capital costs, operating costs, and pricing.

It is expected that Lead Arrangers for project finance will be

selected by the third quarter of 2014. Other financing

relationships may involve various export credit agencies, equipment

leasing arrangements, and mezzanine finance.

About IC Potash Corp. ICP has demonstrated a low-cost method to

produce Sulphate of Potash ("SOP") from its 100%-owned Ochoa

polyhalite deposit in southeast New Mexico. The Company goal is to

become a primary, long-term producer of SOP. The global market for

SOP is 5.5 million tons per year, with producers benefiting from

substantial price premiums over regular potash, known as Muriate of

Potash ("MOP"). SOP is a non-chloride potash fertilizer widely used

in the horticultural industry and for high value crops, such as

fruits, vegetables, tobacco and potatoes. It is applicable for

soils where there are substantial agricultural activity, high soil

salinity, and in arid regions. The Ochoa Project has access to

excellent local labor resources, low-cost electricity and natural

gas, water, rail lines, and the Port of Galveston, Texas. ICP's

land holdings consist of nearly 90,000 acres of federal subsurface

potassium prospecting permits and State of New Mexico potassium

mining leases. For more information, please visit

www.icpotash.com.

Forward-Looking Statements Certain information set forth in this

news release may contain forward-looking statements that involve

substantial known and unknown risks and uncertainties and other

factors which may cause the actual results, performance or

achievements of ICP to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statements. Forward-looking statements include

statements that use forward-looking terminology such as "may",

"will", "expect", "anticipate", "believe", "continue", "potential"

or the negative thereof or other variations thereof or comparable

terminology. Such forward-looking statements include, without

limitation, reserve estimates, ICP's expected position as one of

the lowest cost producers of SOP in the world, the timing of

receipt and publication of ICP's environmental permits, the

sufficiency of ICP's cash balances, the timing of production, and

other statements that are not historical facts. These

forward-looking statements are subject to numerous risks and

uncertainties, certain of which are beyond the control of ICP,

including, but not limited to, risks associated with mineral

exploration and mining activities, the impact of general economic

conditions, industry conditions, dependence upon regulatory

approvals, the uncertainty of obtaining additional financing, and

risks associated with turning reserves into product. Readers are

cautioned that the assumptions used in the preparation of such

information, although considered reasonable at the time of

preparation, may prove to be imprecise and, as such, undue reliance

should not be placed on forward-looking statements.

FOR MORE INFORMATION, PLEASE CONTACT: Mr. Mehdi Azodi Investor

Relations Director Phone: 416-779-3268

Email: mazodi@icpotash.com

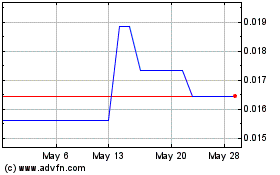

Belgravia Hartford Capital (PK) (USOTC:BLGVF)

Historical Stock Chart

From Nov 2024 to Dec 2024

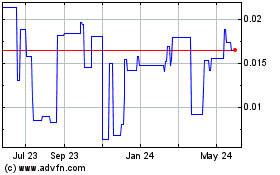

Belgravia Hartford Capital (PK) (USOTC:BLGVF)

Historical Stock Chart

From Dec 2023 to Dec 2024