Icahn Offers to Buy Rest of Federal-Mogul

01 March 2016 - 12:40AM

Dow Jones News

Federal-Mogul Holdings Corp. said Monday it has gotten a merger

proposal from majority shareholder Icahn Enterprises L.P. valuing

the auto-parts maker at $1.18 billion.

Icahn, which already owns 82% of the Southfield, Mich., company,

offered to purchase the remaining stock for $7 a share, a 41%

premium to Friday's closing price.

In a Feb. 28 letter to the board, Icahn said the deal would be

contingent on approval from a special committee of independent

directors as well as approval by an informed vote of a majority of

shareholders who aren't affiliated with Icahn.

The move to take ownership of Federal-Mogul would be Mr. Icahn's

latest in the automotive space—in December, he won a takeover

battle to buy Pep Boys for about $1 billion, outbidding Japanese

tire maker Bridgestone Corp.

In June, Icahn Enterprises spent about $340 million to buy Auto

Plus, the U.S. arm of Canadian parts distributor Uni-Select

Inc.

Shares in the company, which have fallen 39% over the past three

months and 62% over the past year, were halted premarket at

$4.98.

Last month, Federal-Mogul Holdings Corp. said it terminated a

previously announced spinoff of its motor-parts division.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

February 29, 2016 08:25 ET (13:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

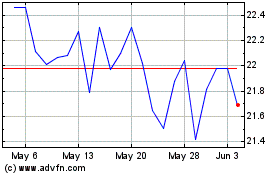

Bridgestone (PK) (USOTC:BRDCY)

Historical Stock Chart

From Nov 2024 to Dec 2024

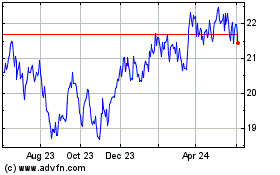

Bridgestone (PK) (USOTC:BRDCY)

Historical Stock Chart

From Dec 2023 to Dec 2024