California Business Bank Announces Second Quarter Financial Results

21 July 2009 - 6:07AM

Business Wire

California Business Bank (OTCBB:CABB) announces financial

results today for the second quarter ended, June 30, 2009.

Highlights:

- The Bank returned to

profitability in the second quarter of 2009, posting net income of

$11,414, compared to a loss of $172,807 for the first quarter of

2009. This represents the first profitable quarter for the Bank

since second quarter 2008.

- Second quarter 2009 net interest

income was up by 3.41% over first quarter 2009

- Second quarter 2009 total loans

increased by 2.13% or $1.882MM over first quarter 2009

- Second quarter 2009 deposits

decreased by 8.12% or $8.081MM compared to first quarter 2009, as

the bank continued its progress toward a reduction in wholesale

funding sources

- Second quarter asset quality

metrics:

- Total provision for loan losses

remained at $2.035MM since December 2008

- Non-performing assets were

$5.54MM or 4.95% of total assets at quarter-end

- Other Real Estate Owned was

$3.34MM or 2.99% of total assets at quarter-end

- Allowance for credit losses to

non-accrual loans was 36.73% at quarter-end

- Tangible common equity capital

was 13.44% at March 31, 2009

California Business Bank offers a wide range of financial

services to individuals, small and medium size businesses in Los

Angeles, and the surrounding communities in Southern California.

Our commitment is to deliver the highest quality financial services

and products. We offer mobile banking and on-line account

origination for our customers� convenience. Please visit our

web-page to open-up your personal account on line, or add mobile

banking to your existing personal or business accounts.

Forward Looking Statements

Certain matters discussed in this press release constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, and are subject to the

safe harbors created by the act. These forward-looking statements

refer to the Company�s current expectations regarding future

operating results, and growth in loans, deposits, and assets. These

forward looking statements are subject to certain risks and

uncertainties that could cause the actual results, performance, or

achievements to differ materially from those expressed, suggested,

or implied by the forward looking statements. These risks and

uncertainties include, but are not limited to (1) the impact of

changes in interest rates, a decline in economic conditions, and

increased competition by financial service providers on the

Company�s results of operation, (2) the Company�s ability to

continue its internal growth rate, (3) the Company�s ability to

build net interest spread, (4) the quality of the Company�s earning

assets, and (5) governmental regulations.

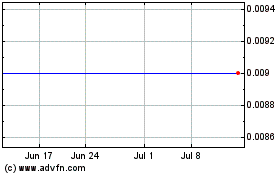

California Business Bank (CE) (USOTC:CABB)

Historical Stock Chart

From Oct 2024 to Nov 2024

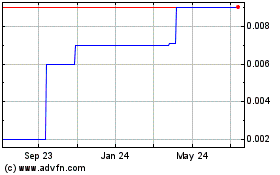

California Business Bank (CE) (USOTC:CABB)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about California Business Bank (CE) (OTCMarkets): 0 recent articles

More California Business Bank News Articles