UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14C

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

(Amendment No. )

Check the appropriate box:

| ☐ |

Preliminary Information Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| ☒ |

Definitive Information Statement |

| Cosmos

Group Holdings, Inc. |

| (Name of Registrant as Specified In Its Charter) |

37th Floor, Singapore Land Tower

50 Raffles Place

Singapore 048623

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and 0-11 |

NOTICE OF CORPORATE ACTIONS TAKEN BY WRITTEN

CONSENT

OF MAJORITY STOCKHOLDERS WITHOUT SPECIAL MEETING

OF THE STOCKHOLDERS

Dear Stockholders:

We are writing to advise you that, on March 22,

2024, the board of directors of Cosmos Group Holdings, Inc., or Coinllectibles Inc. pending approval of name change in the trading market

from FINRA, a Nevada corporation (“Cosmos Group”, “Coinllectibles,” “the Company,” “we”

or “us”), and certain stockholders holding a majority of the voting rights of our common stock approved by written consent

in lieu of a special meeting the taking of all steps necessary to effect the following action (collectively, the “Corporate Actions”):

| 1. |

Amend the Articles of Incorporation to increase the Company’s authorized capital from 5,030,000,000 to 505,030,000,000 shares, consisting of 505,000,000,000 shares of common stock, par value $0.001, and 30,000,000 shares of preferred stock, par value $0.001. |

The accompanying information statement, which

describes the Corporate Actions in more detail, is being furnished to our stockholders for informational purposes only, pursuant to Section

14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations prescribed thereunder.

The consent that we have received constitutes the only stockholder approval required for the Corporate Actions under the Nevada Revised

Statutes, our Amended and Restated Articles of Incorporation and Bylaws. Accordingly, the Corporate Actions will not be submitted to the

other stockholders of the Company for a vote.

The record date for the determination of stockholders

entitled to notice of the action by written consent is March 22, 2024. Pursuant to Rule 14c-2 under the Exchange Act, the Corporate Actions

will not be implemented until at least twenty (20) calendar days after the mailing of this information statement to our stockholders.

This information statement will be mailed on or about April 14, 2024, to stockholders of record on March 22, 2024. As such, we expect

that the Corporate Actions will be effective no earlier than May 4, 2024.

No action is required by you to effectuate this

action. The accompanying information statement is furnished only to inform our stockholders of the action described above before it takes

effect in accordance with Rule 14c-2 promulgated under the Exchange Act.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED NOT TO SEND US A PROXY.

PLEASE NOTE THAT THE HOLDERS OF A MAJORITY OF

OUR OUTSTANDING SHARES OF COMMON STOCK HAVE VOTED TO AUTHORIZE THE CORPORATE ACTIONS. THE NUMBER OF VOTES RECEIVED IS SUFFICIENT TO SATISFY

THE STOCKHOLDER VOTE REQUIREMENT AND NO ADDITIONAL VOTES WILL CONSEQUENTLY BE NEEDED TO APPROVE THIS MATTER.

By order of the Board of Directors,

| |

By: |

/s/ Man Chung Chan |

| |

|

Man Chung Chan |

| |

|

Chief Executive Officer, Chief Financial Officer, Secretary and Director |

| |

|

May 24, 2024 |

COSMOS GROUP HOLDINGS, INC.

INFORMATION STATEMENT REGARDING

CORPORATE ACTIONS TAKEN BY WRITTEN CONSENT OF

OUR BOARD OF DIRECTORS AND HOLDERS OF

A MAJORITY OF OUR VOTING CAPITAL STOCK

IN LIEU OF SPECIAL MEETING

Cosmos Group Holdings, Inc.,

or Coinllectibles Inc. pending approval of name change in the trading market from FINRA, a Nevada corporation (“Cosmos Group”,

“Coinllectibles,” “the Company,” “we” or “us”) is furnishing this information statement

to you to provide a description of actions taken by our Board of Directors and the holders of a majority of our outstanding voting capital

stock on March 22, 2024, in accordance with the relevant sections of Nevada Revised Statutes of the State of Nevada (the “NRS”).

This information statement

is being mailed on or about April 14, 2024 to stockholders of record on March 22, 2024 (the “Record Date”). The information

statement is being delivered only to inform you of the corporate actions described herein before such actions take effect in accordance

with Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). No action is requested

or required on your part.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED NOT TO SEND US A PROXY.

THIS IS NOT A NOTICE OF A

MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

PLEASE NOTE THAT THE HOLDERS

OF A MAJORITY OF OUR OUTSTANDING SHARES OF COMMON STOCK HAVE VOTED TO AUTHORIZE THE CORPORATE ACTIONS. THE NUMBER OF VOTES RECEIVED IS

SUFFICIENT TO SATISFY THE STOCKHOLDER VOTE REQUIREMENT AND NO ADDITIONAL VOTES WILL CONSEQUENTLY BE NEEDED TO APPROVE THESE MATTERS.

GENERAL DESCRIPTION OF CORPORATE ACTION

On March 22, 2024, the board

of directors of the Company, a Nevada corporation, and certain stockholders holding a majority of the voting rights of our common stock

approved by written consent in lieu of a special meeting the taking of all steps necessary to effect the following actions (collectively,

the “Corporate Actions”):

| |

1. |

Amend the Articles of Incorporation to increase the Company’s authorized capital from 5,030,000,000 to 505,030,000,000 shares, consisting of 505,000,000,000 shares of common stock, par value $0.001, and 30,000,000 shares of preferred stock, par value $0.001. |

VOTING AND VOTE REQUIRED

Pursuant to the Company’s

Bylaws and the NRS, a vote by the holders of at least a majority of the Company’s outstanding capital stock is required to effect

the actions described herein. Each common stockholder is entitled to one vote for each share of common stock held by such stockholder.

As of the Record Date, the Company had 4,585,973,082 shares of common stock issued and outstanding. The voting power representing not

less than 2,292,986,541 shares of common stock is required to pass any stockholder resolutions. Pursuant to Section 78.320 of the NRS,

the following stockholders holding an aggregate of 2,309,678,641 shares of common stock, or approximately 50.36% of the issued and outstanding

shares of our common stock on the Record Date (the “Majority Stockholders”), delivered an executed written consent dated March

22, 2024, authorizing the Corporate Actions.

| Name | |

Common

Shares

Beneficially

Held | | |

Percentage

of Issued

and

Outstanding | |

| LEE Ying Chiu Herbert | |

| 404,861,256 | | |

| 8.83 | % |

| Tan Mei San Delphone | |

| 77,124,557 | | |

| 1.68 | % |

| So Han Meng Julian | |

| 624,918,375 | | |

| 13.63 | % |

| So Hui Fang Megan | |

| 69,227,081 | | |

| 1.51 | % |

| Woo Peter Ping | |

| 51,756,274 | | |

| 1.13 | % |

| Tan Jin Thong | |

| 75,000,000 | | |

| 1.64 | % |

| Total Chase Limited | |

| 80,000,000 | | |

| 1.74 | % |

| Xtreme Metaverse Fund | |

| 108,939,246 | | |

| 2.38 | % |

| Fonics Group Ltd. | |

| 80,000,000 | | |

| 1.74 | % |

| Linking Concept Ltd. | |

| 85,000,000 | | |

| 1.85 | % |

| Yuan Xiao Feng | |

| 196,296,296 | | |

| 4.28 | % |

| Ho Wan Leong | |

| 456,555,556 | | |

| 9.96 | % |

| TOTAL | |

| 2,309,678,641 | | |

| 50.36 | % |

NO APPRAISAL RIGHTS

Under the NRS, stockholders

are not entitled to dissenters’ or appraisal rights with respect to the Corporate Actions, and we will not provide our stockholders

with such rights.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE

ACTED UPON

Except in their capacity as

stockholders, none of our officers, directors or any of their respective affiliates has any interest in the Corporate Actions.

CORPORATE ACTION NO. 1

INCREASE IN AUTHORIZED CAPITAL

On March 22, 2024, the Board

and the Majority Stockholders authorized, adopted and approved by written consent in lieu of a special meeting an amendment to the Articles

of Incorporation to increase its authorized share capital from 5,030,000,000 to 505,030,000,000 shares, consisting of 505,000,000,000

shares of common stock, par value $0.001, and 30,000,000 shares of preferred stock, par value $0.001. The proposed amendment to our Articles

of Incorporation is included in the Certificate of Amendment, which is attached hereto as Exhibit 1. The general purpose and effect

of this amendment to our Articles of Incorporation is to increase our authorized share capital, which we believe will enhance our ability

to finance the development and operation of our business.

Reasons For The Increase

In Authorized Capital

Our Board authorized and approved

the proposed amendment to our Articles of Incorporation to increase our authorized share capital so that such shares will be available

for issuance for general corporate purposes, including financing activities, without the requirement of further action by our stockholders.

Potential uses of the additional authorized shares may include, but are not limited to, public or private offerings, conversions of convertible

securities, issuance of options pursuant to employee stock option plans, acquisition transactions and other general corporate purposes.

Increasing the authorized number of shares of our common stock will give us greater flexibility and will allow us to issue such shares,

in most cases, without the expense or delay of seeking stockholder approval. We are at all times investigating additional sources of financing,

business candidates and other opportunities which our Board believes will be in our best interests and in the best interests of our stockholders.

We may also conduct one or more private placements of our securities to secure additional working capital for the Company. Except as set

forth above and in our other disclosures filed with the Securities and Exchange Commission, as of the date of this filing we do not have

any definitive plans, proposals or arrangements to issue any of the newly available authorized shares of common stock for any purpose

or which may result in a change in control of the Company.

Action by Written Consent;

No Further Vote Required

Pursuant to Section 78.320

of the Nevada Revised Statutes and in accordance with our Bylaws, any action required or permitted to be taken at any annual or special

meeting of stockholders may be taken without a meeting, without prior notice and without a vote of stockholders, if a consent in writing,

setting forth the action so taken, shall be signed by the holders of outstanding stock having not less than the minimum number of votes

that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted.

Pursuant to Nevada law, the

Charter Amendment must be approved by a majority of the outstanding shares of Common Stock, and therefore the Company elected to obtain

stockholder approval of the Charter Amendment by written consent of the Majority Stockholders. Because the requisite stockholder approval

for the Charter Amendment has been received, all corporate approvals by or on behalf of the Company required for the Charter Amendment

have been obtained and no further votes will be needed.

Effect of the Increase

in Authorized Capital; Anti-Takeover Implications

The amendment to our Articles

of Incorporation to increase our authorized share capital will not have any immediate effect on the rights of existing stockholders. However,

our Board will have the authority to issue shares of our Common Stock and Preferred Stock without requiring future stockholder approval

of such issuances, except as may be required by applicable law or exchange regulations. To the extent that additional shares of Common

Stock are issued in the future, such issuance will decrease the existing stockholders’ percentage equity ownership, dilute the earnings

per share and book value per share of outstanding shares of Common Stock and, depending upon the price at which they are issued, could

be dilutive to the existing stockholders.

Although the increase in authorized

capital is prompted by business and financial considerations, stockholders nevertheless should be aware that such increase could facilitate

future efforts by our management to deter or prevent a change in control of the Company. By way of example, our management could issue

additional shares to dilute the stock ownership and the voting power of persons seeking to obtain control of the Company or shares could

be issued to purchasers who would support the Board in opposing a takeover proposal. In addition, the increase in authorized shares may

have the effect of delaying or discouraging a challenge for control or make it less likely that such a challenge, if attempted, would

be successful, including challenges that are favored by a majority of the stockholders or in which the stockholders might otherwise receive

a premium for their shares over then-current market prices or benefit in some other manner. The Board and executive officers of the Company

have no knowledge of any current effort to obtain control of the Company or to accumulate large amounts of Common Stock.

We may also conduct one or

more private placements of our securities to secure additional working capital for the Company. Except as set forth above and in our other

disclosures filed with the Securities and Exchange Commission, the Board has no current plans to use any of the additional shares of Common

Stock that will become available when the increase in authorized capital occurs to deter or prevent a change of control of the Company.

The amendment to increase

our authorized capital will not be effective until 20 calendar days after we send this Information Statement to our stockholders of record

as of the Record Date. No further action on the part of stockholders is required to authorize or effect the amendments to the Articles

of Incorporation.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth

certain information with respect to the beneficial ownership of our common stock, as of March 22, 2024, for: (i) each of our named executive

officers; (ii) each of our directors; (iii) all of our current executive officers and directors as a group; and (iv) each person, or group

of affiliated persons, known by us to be the beneficial owner of more than 5% of our outstanding shares of common stock.

Except as indicated in footnotes

to this table, we believe that the stockholders named in this table will have sole voting and investment power with respect to all shares

of common stock shown to be beneficially owned by them, based on information provided to us by such stockholders. Unless otherwise indicated,

the address for each director and executive officer listed is: c/o Coinllectibles Inc., 37th Floor, Singapore Land Tower, 50 Raffles Place,

Singapore 048623.

| | |

Common Stock

Beneficially Owned | |

| Name and Address of Beneficial Owner | |

Number of Shares and

Nature of

Beneficial

Ownership | | |

Percentage of

Total Common

Equity (1) | |

| CHAN Man Chung, 6/F, 16 Science Park East Avenue, Hong Kong (2) | |

| 14,380,288 | | |

| 0.31 | % |

| TAN Tee Soo, 37/F Singapore Land Tower, Singapore 048623 (2) | |

| 2,007,647 | | |

| 0.04 | % |

| | |

| | | |

| | |

| All executive officers and directors as a Group (2 persons) | |

| 16,387,935 | | |

| 0.35 | % |

| (1) |

Applicable percentage ownership is based on 4,585,973,082 shares of common stock outstanding as of March 21, 2024, together with securities exercisable or convertible into shares of common stock within 60 days of December 29, 2021. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of common stock that a person has the right to acquire beneficial ownership of upon the exercise or conversion of options, convertible stock, warrants or other securities that are currently exercisable or convertible or that will become exercisable or convertible within 60 days of March 22, 2024, are deemed to be beneficially owned by the person holding such securities for the purpose of computing the number of shares beneficially owned and percentage of ownership of such person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. |

| (2) |

On June 28, 2021, Messrs. Chan Man Chung and Tan Tee Soo were appointed to the Company’s Board of Directors and Chan Man Chung was appointed to serve as the CEO, CFO and Secretary of the Company. |

INTEREST OF CERTAIN PERSONS IN THE MATTERS TO

BE ACTED UPON

Although our officers and

directors directly or indirectly hold shares of Company common stock, none of the Company’s officers or directors have an substantial

direct or indirect interest in the Charter Amendment that differs from those of other Company stockholders.

FORWARD-LOOKING STATEMENTS

This Information Statement

may contain certain “forward-looking” statements (as that term is defined in the Private Securities Litigation Reform Act

of 1995 or by the U.S. Securities and Exchange Commission in its rules, regulations and releases) representing our expectations or beliefs

regarding our company. These forward- looking statements include, but are not limited to, statements regarding our business, anticipated

financial or operational results and objectives. For this purpose, any statements contained herein that are not statements of historical

fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as “may,”

“will,” “expect,” “believe,” “anticipate,” “intend,” “could,”

“estimate,” “might,” or “continue” or the negative or other variations thereof or comparable terminology

are intended to identify forward-looking statements. These statements, by their nature, involve substantial risks and uncertainties, certain

of which are beyond our control, and actual results may differ materially depending on a variety of important factors, including factors

discussed in this and other filings of ours with the Securities and Exchange Commission.

HOUSEHOLDING

Regulations regarding the

delivery of copies of information statements to stockholders permit us, banks, brokerage firms and other nominees to send one information

statement to multiple stockholders who share the same address under certain circumstances. This practice is known as “householding.”

Stockholders who hold their shares through a bank, broker or other nominee may have consented to reducing the number of copies of materials

delivered to their address. In the event that a stockholder wishes to revoke a “householding” consent previously provided

to a bank, broker or other nominee, the stockholder must contact the bank, broker or other nominee, as applicable, to revoke such consent.

If a stockholder wishes to receive a separate information statement, we will promptly deliver a separate copy to such stockholder that

contacts us by mail at Coinllectibles Inc., 37th Floor, Singapore Land Tower, 50 Raffles Place, Singapore 04862. The Secretary may also

be reached by telephone at +65 68297017 Any stockholders of record sharing an address who now receive multiple copies of our annual reports,

proxy statements and information statements, and who wish to receive only one copy of these materials per household in the future should

also contact the Company’s Secretary by mail or telephone as instructed above. Any stockholders sharing an address whose shares

of our common stock are held by a bank, broker or other nominee who now receive multiple copies of our annual reports, proxy statements

and information statements, and who wish to receive only one copy of these materials per household, should contact the bank, broker or

other nominee to request that only one set of these materials be delivered in the future.

GENERAL INFORMATION

the Company will pay all costs

associated with the distribution of this Information Statement, including the costs of printing and mailing. The Company will reimburse

brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending this Information Statement

to the beneficial owners of Cosmos Group’s common stock.

The Company will deliver only

one Information Statement to multiple security holders sharing an address unless The Company has received contrary instructions from one

or more of the security holders. Upon written or oral request, the Company will promptly deliver a separate copy of this Information Statement

and any future annual reports and information statements to any security holder at a shared address to which a single copy of this Information

Statement was delivered, or deliver a single copy of this Information Statement and any future annual reports and information statements

to any security holder or holders sharing an address to which multiple copies are now delivered. You should direct any such requests to

the following address: Coinllectibles Inc., 37th Floor, Singapore Land Tower, 50 Raffles Place, Singapore 048623. The Secretary may also

be reached by telephone at +65 68297017.

ADDITIONAL AND AVAILABLE INFORMATION

The Company is subject to

the informational filing requirements of the Exchange Act and, in accordance therewith, is required to file periodic reports, proxy statements

and other information with the SEC relating to its business, financial condition and other matters. Such reports, proxy statements and

other information can be inspected and copied at the public reference facility maintained by the SEC at 100 F Street, N.E., Washington,

D.C. 20549. Information regarding the public reference facilities may be obtained from the SEC by telephoning 1-800-SEC-0330. Our filings

are also available to the public on the SEC’s website (www.sec.gov).

| Dated: May 24, 2024 |

By order of the Board of Directors |

| |

|

|

| |

By: |

/s/ Man Chung CHAN |

| |

|

Man Chung CHAN |

| |

|

Chief Executive Officer, Chief Financial Officer,

Secretary and Director |

6

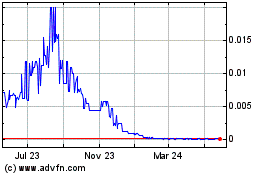

Cosmos (PK) (USOTC:COSG)

Historical Stock Chart

From Dec 2024 to Jan 2025

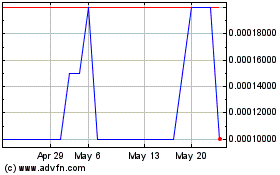

Cosmos (PK) (USOTC:COSG)

Historical Stock Chart

From Jan 2024 to Jan 2025