Dutton Associates Announces Investment Opinion: Chilco River Holdings Neutral Rating In Update Coverage By Dutton Associates

05 December 2006 - 4:49AM

Business Wire

Dutton Associates updates its coverage of Chilco River Holdings

(OTCBB:CRVH) maintaining a neutral rating. The 9-page report by

Dutton senior analyst Gerald F. LaKarnafeaux, CFA, is available at

www.jmdutton.com as well as from First Call, Bloomberg, Zacks,

Reuters, Knobias, and other leading financial portals. The core

business and assets of Chilco River Holdings, Inc. is the Bruce

Hotel and Casino (Bruce) located in Lima, Peru. Prior to the merger

with the publicly traded shell company, Chilco, on July 15, 2005,

Bruce was owned and operated by the private company Kubuk

International. In contemplation of the merger with Chilco and the

resultant access to the public capital markets, the Kubuk

management, we opine prematurely, closed the Bruce casino

operations to undergo an expansion and renovation (the project) of

the highly profitable gaming facility. The project was estimated to

cost $5 million. By closing the casino operations before securing a

financing on favorable terms, the Company�s cash flow from Bruce

has been substantially reduced. In 2005, casino revenues contracted

by 70% to $2.6 million from the 2004 level of $8.8 million.

Clearly, the premature closing of the Bruce casino and management�s

misplaced optimism regarding the aborted financing proposal has

undermined the stock�s investment potential over the short term.

About Dutton Associates Dutton Associates is one of the largest

independent investment research firms in the U.S. Its 31 senior

analysts are primarily CFAs are have expertise in many industries.

Dutton Associates provides continuing analyst coverage of over 140

enrolled companies, and its research, estimates, and ratings are

carried in all the major databases serving institutions and online

investors. The cost of enrollment in our one-year continuing

research program is US $35,000 prepaid for 4 Research Reports,

typically published quarterly, and requisite Research Notes. Dutton

Associates received $35,000 from the Company for 4 Research Reports

with coverage commencing on 8/29/2006. We do not accept payment of

our fees in company stock. Our principals and analysts are

prohibited from owning or trading in securities of covered

companies. The views expressed in this research report accurately

reflect the analyst's personal views about the subject securities

or issuer. Neither the analyst's compensation nor the compensation

received by us is in any way related to the specific ratings or

views contained in this research report or note. Please read full

disclosures and analyst background at www.jmdutton.com before

investing. Dutton Associates updates its coverage of Chilco River

Holdings (OTCBB:CRVH) maintaining a neutral rating. The 9-page

report by Dutton senior analyst Gerald F. LaKarnafeaux, CFA, is

available at www.jmdutton.com as well as from First Call,

Bloomberg, Zacks, Reuters, Knobias, and other leading financial

portals. The core business and assets of Chilco River Holdings,

Inc. is the Bruce Hotel and Casino (Bruce) located in Lima, Peru.

Prior to the merger with the publicly traded shell company, Chilco,

on July 15, 2005, Bruce was owned and operated by the private

company Kubuk International. In contemplation of the merger with

Chilco and the resultant access to the public capital markets, the

Kubuk management, we opine prematurely, closed the Bruce casino

operations to undergo an expansion and renovation (the project) of

the highly profitable gaming facility. The project was estimated to

cost $5 million. By closing the casino operations before securing a

financing on favorable terms, the Company's cash flow from Bruce

has been substantially reduced. In 2005, casino revenues contracted

by 70% to $2.6 million from the 2004 level of $8.8 million.

Clearly, the premature closing of the Bruce casino and management's

misplaced optimism regarding the aborted financing proposal has

undermined the stock's investment potential over the short term.

About Dutton Associates Dutton Associates is one of the largest

independent investment research firms in the U.S. Its 31 senior

analysts are primarily CFAs are have expertise in many industries.

Dutton Associates provides continuing analyst coverage of over 140

enrolled companies, and its research, estimates, and ratings are

carried in all the major databases serving institutions and online

investors. The cost of enrollment in our one-year continuing

research program is US $35,000 prepaid for 4 Research Reports,

typically published quarterly, and requisite Research Notes. Dutton

Associates received $35,000 from the Company for 4 Research Reports

with coverage commencing on 8/29/2006. We do not accept payment of

our fees in company stock. Our principals and analysts are

prohibited from owning or trading in securities of covered

companies. The views expressed in this research report accurately

reflect the analyst's personal views about the subject securities

or issuer. Neither the analyst's compensation nor the compensation

received by us is in any way related to the specific ratings or

views contained in this research report or note. Please read full

disclosures and analyst background at www.jmdutton.com before

investing.

Chilco River (CE) (USOTC:CRVH)

Historical Stock Chart

From Dec 2024 to Jan 2025

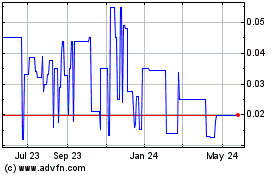

Chilco River (CE) (USOTC:CRVH)

Historical Stock Chart

From Jan 2024 to Jan 2025