Rodeo Creek Project Update

27 August 2010 - 11:15PM

Marketwired

Amarok Resources, Inc. (OTCBB: AMOK) --

Amarok Resources, Inc. (the "Company" or "Amarok") announces the

conclusion of the Phase I drill program at the Rodeo Creek property

located on the prolific Carlin gold trend in Elko County, Nevada. A

total of seven drill holes, totalling 11,749 ft, were completed

during this phase of the program. Four holes totalling 2,277 ft

were drilled in the "Flower" target to probe two auriferous fault

structures that are believed to have acted as conduits for

"leakage" from a deep-seated gold source. Two holes, totalling

6,005 ft, were drilled in the "West" target, and one hole (3,467

ft) was drilled in the centre of the "Look" target. The last three

holes targeted the Popovich Formation, which is currently host to

85% of the gold deposits found along the Carlin Trend.

Hole AMK10-03 targeted the Arturo fault system in the "Look"

target area. The Arturo fault has long been recognized as an

important structure at the Dee-Storm group of deposits located

1.5km southeast of the property. AMK10-03 encountered more than

1,100 ft of Popovich Fm, the basal 500 ft of which is variably

silicified and decalcified, in common with the alteration types

which typically accompany Carlin-type deposits. Results from

AMK10-03 are pending.

At the "West" target, hole AMK10-01 was completed to a depth of

2,978 ft. Hole AMK10-02 reached a depth of 3,027 ft. Both holes

encountered more than 800 ft of Popovich Fm. In AMK10-01, 90 ft of

extremely sheared and graphitic Popovich mudstone was penetrated

from 2,855 to 2,945 ft. This section averages 0.15 gm/T Au, which

is highly anomalous for this area. It also contains strongly

anomalous silver, arsenic and antimony, all of which are extremely

important ore indicators elsewhere on the Carlin Trend. In

AMK10-02, located 800 ft south of AMK10-01, the Popovich Fm

includes a 460 ft thick section of highly silicified mudstone from

a depth of 2,510 ft to 2,972 ft. A large fault zone intercepted

immediately above the silicified section, averages 0.22 gm/T gold

and more than 1033 ppm arsenic over more than 75 ft, suggestive of

proximity to Carlin-type mineralization. After detailed review of

both AMK10-01 and AMK10-02 management has determined that the next

phase of drilling on the "West" target will consist of re-entering

the AMK10-01 hole and wedging off in a west and southwest direction

to test for proximity to higher grade mineralization. Phase II will

also include reentering AMK10-02 and completing a series of wedges

towards the north, west and southwest to test for proximity to

higher grade mineralization.

In the Flower target area hole AMK-FZ-1 encountered a five foot

section grading 0.55 gm/T Au (0.016 oz/t) at 265 ft, and hole

AMK-FZ-2 assayed 0.81gm/T Au (0.024 oz/t) over a 30 ft interval at

315 ft including 2.06 gm/T gold (0.06 oz/t) over five feet. Both of

these intervals are in breccia on the Rodeo fault. Hole AMK-FZ-3

encountered an 85 ft interval, beginning at 315 ft, assaying 1.64

gm/T gold (0.05 oz/t) including a 20 ft section grading 4.22 gm/T

(0.12 oz/t). This intercept is in fault-breccia within the Flower

fault. The fourth hole, AMK-FZ-4 penetrated 150 ft of intense

brecciation from 340 to 488 ft, including a 43 ft section grading

1.33 gm/T (0.04 oz/t) starting at 340 ft. This includes 14 ft

section grading 2.37 gm/T (0.07 oz/t). The Flower fault is

underlain by 50 ft of highly fractured siltstone to 540 ft. The

entire 200 ft fault/fracture structure is strongly anomalous in

arsenic, antimony and thallium, all of which are very closely

linked to Carlin-type mineralization. The results obtained from the

drill program in the Flower target solidify the theory that the

gold mineralization in this area represents "leakage" from a

deep-seated structure and that leakage was controlled by the Flower

fault. The results have also expanded the area of known gold

mineralization within the Flower Target and based on this data, it

is possible that a viable shallow gold resource can be defined

within the Flower target. A Phase II drilling program consisting of

10 to 12 shallow holes is now being developed to test this

resource-potential within the Flower target with a strong focus on

the downward projection of the Flower fault to identify the

potential for a deep seated resource.

Amarok Resources is a US based exploration and development

Company, focusing on the acquisition and development of Gold and

Silver projects which demonstrate high probability for near term

production. Amarok is a fully reporting public company quoted on

the OTCBB under the symbol AMOK.

AMOK encourages those interested in our Company to rely only on

information included in our filings with the United States

Securities and Exchange Commission which can be found at

www.sec.gov. Statements released by Amarok Resources, Inc. that are

not purely historical are forward-looking within the meaning of the

"Safe Harbor" provisions of the Private Securities Litigation

Reform Act of 1995, including statements regarding the company's

expectations, hopes, intentions, and strategies for the future.

Investors are cautioned that forward-looking statements involve

risk and uncertainties that may affect the company's business

prospects and performance. The company's actual results could

differ materially from those in such forward-looking statements.

Risk factors include but are not limited to general economic,

competitive, governmental, and technological factors as discussed

in the company's filings with the SEC on Forms 10-K, 10-Q, and 8-K.

The company does not undertake any responsibility to update the

forward-looking statements contained in this release.

Visit the Amarok Resources, Inc. web site at

www.amarokresources.com. Information included on the Company's

website is not incorporated herein by reference or otherwise.

For additional information please contact: Amarok Resources,

Inc. 30021 Tomas Street, Suite 300 Rancho Santa Margarita, CA 92688

Telephone: 949-682-7889 Email: info@amarokresources.com

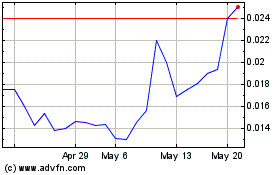

3DX Industries (PK) (USOTC:DDDX)

Historical Stock Chart

From Jan 2025 to Feb 2025

3DX Industries (PK) (USOTC:DDDX)

Historical Stock Chart

From Feb 2024 to Feb 2025