Asian Shares Gain on Talk of OPEC Meeting

09 August 2016 - 2:30PM

Dow Jones News

Asian shares traded in positive territory Tuesday as gains in

commodity stocks helped offset weakness overnight in U.S.

markets.

The Nikkei Stock Average rose 0.2% with the S&P/ASX 200 up

0.2% and Korea's Kospi up 0.3%. Hong Kong's Hang Seng Index was

down 0.1% while the Shanghai Composite was flat.

Traders sent U.S. oil prices up 2.9% to US$43.02 a barrel

following news that the Organization of the Petroleum Exporting

Countries planned to hold informal talks in September that could

lead to production cuts.

ANZ Research said traders shrugged off the disappointing China

July crude import data and were focusing on the OPEC meeting,

lifting sentiment for commodities prices generally.

"China's weak commodity imports data had little impact on

prices, with investors focused on positive economic data in the

G-8. The strong rise in oil prices should support the wider sector

today," ANZ said.

China's crude imports in July fell to a six-month low on slowing

demand from small independent refiners.

"China's July trade data released yesterday further underscored

the improved global demand for commodities," said IG market analyst

Angus Nicholson, adding that the volume of copper and iron ore

imported by China continued to grow at strong levels in July.

In China, consumer inflation moderated for a third month in a

row in July, well within the government's comfort zone. China's

consumer-price index climbed 1.8% in July from a year earlier,

compared with a 1.9% increase in June.

July's rise was in line with market expectations, with Beijing

planning to cap consumer inflation at 3% this year. Tuesday's data

showed that the central bank doesn't have to worry on the price

front, at least for now, as it seeks to manage interest rates and

the yuan rate.

"Coal and steel prices picked up significantly on speculation

that increased government spending on infrastructure projects will

lift demand for hard commodities," said Zhou Hao, senior emerging

markets economist for Asia at Commerzbank AG.

Elsewhere, preliminary data from South Korea's finance ministry

showed retail sales continued to pick up.

Sales at the country's top department stores rose 10.5% in July

from a year earlier after the previous month's 13.5% gain. Sales at

leading discount-store chains rose 5.8% in July from a year ago

after a 2.9% rise in the preceding month. The trade ministry will

release confirmed July retail-sales data later this month.

Meanwhile, China Vanke Co. disclosed late Monday that a

consortium of seven investment firms controlled by China Evergrande

Group had acquired a 5% stake in the company over a span of two

weeks from July 25 to Aug. 8.

Debt-laden China Evergrande has increased its total position in

China Vanke to 9.68%, making it the company's third-largest

shareholder after Baoneng Group and state-run China Resources.

China Vanke fell on news, dropping about 1% in Shenzhen trade.

Gold was trading 0.1% lower. Oil gave up its overnight gains to

trade slightly lower in Asian trade. Nymex is down 23 cents at

$42.79 a barrel with Brent trading down 24 cents at $45.15 a

barrel.

Jenny Hsu, Liyan Qi, Kwanwoo Jun, Robb Stewart and Dominique

Fong contributed to this article.

Write to Kenan Machado at kenan.machado@wsj.com

(END) Dow Jones Newswires

August 09, 2016 00:15 ET (04:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

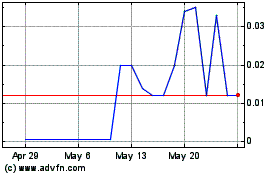

China Evergrande (CE) (USOTC:EGRNF)

Historical Stock Chart

From Jan 2025 to Feb 2025

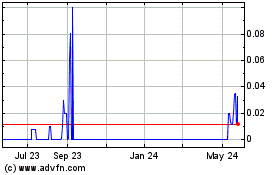

China Evergrande (CE) (USOTC:EGRNF)

Historical Stock Chart

From Feb 2024 to Feb 2025