false

Q1

--12-31

0001752372

Yes

Yes

0001752372

2024-01-01

2024-03-31

0001752372

2024-05-15

0001752372

2024-03-31

0001752372

2023-12-31

0001752372

us-gaap:RelatedPartyMember

2024-03-31

0001752372

us-gaap:RelatedPartyMember

2023-12-31

0001752372

2023-01-01

2023-03-31

0001752372

us-gaap:CommonStockMember

2023-12-31

0001752372

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001752372

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0001752372

us-gaap:RetainedEarningsMember

2023-12-31

0001752372

us-gaap:CommonStockMember

2022-12-31

0001752372

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001752372

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001752372

us-gaap:RetainedEarningsMember

2022-12-31

0001752372

2022-12-31

0001752372

us-gaap:CommonStockMember

2024-01-01

2024-03-31

0001752372

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-03-31

0001752372

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-01-01

2024-03-31

0001752372

us-gaap:RetainedEarningsMember

2024-01-01

2024-03-31

0001752372

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001752372

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001752372

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-03-31

0001752372

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001752372

us-gaap:CommonStockMember

2024-03-31

0001752372

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0001752372

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-03-31

0001752372

us-gaap:RetainedEarningsMember

2024-03-31

0001752372

us-gaap:CommonStockMember

2023-03-31

0001752372

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001752372

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001752372

us-gaap:RetainedEarningsMember

2023-03-31

0001752372

2023-03-31

0001752372

EZOO:TanXiaohaoMember

us-gaap:RestrictedStockMember

2018-05-08

2018-05-09

0001752372

EZOO:TanXiaohaoMember

us-gaap:RestrictedStockMember

2018-05-09

0001752372

EZOO:ZhangQianwenMember

us-gaap:RestrictedStockMember

2018-06-29

2018-06-30

0001752372

EZOO:GreenproAsiaStrategicSPCMember

us-gaap:RestrictedStockMember

2018-06-28

2018-06-30

0001752372

EZOO:GreenproAsiaStrategicSPCMember

us-gaap:RestrictedStockMember

2018-06-30

0001752372

EZOO:ZhangQianwenMember

EZOO:GreenproAsiaStrategicSPCMember

us-gaap:RestrictedStockMember

2018-06-29

2018-06-30

0001752372

EZOO:EzagooHoldingLimitedMember

2018-06-06

0001752372

EZOO:EzagooHoldingLimitedMember

2018-06-25

0001752372

EZOO:ChangshaEzagooTechnologyLimitedMember

EZOO:ManagementServicesAgreementMember

2018-07-20

0001752372

EZOO:ChangshaEzagooTechnologyLimitedMember

EZOO:ManagementServicesAgreementMember

2018-07-20

2018-07-20

0001752372

EZOO:ChangshaEzagooTechnologyLimitedMember

EZOO:ManagementServicesAgreementMember

2018-07-20

0001752372

EZOO:ChangshaEzagooTechnologyLimitedMember

EZOO:LoanAgreementMember

2018-07-20

0001752372

EZOO:ChangshaEzagooTechnologyLimitedMember

EZOO:LoanAgreementMember

2018-07-20

2018-07-20

0001752372

EZOO:BeijingEzagooZhichengInternetTechnologyLimitedMember

EZOO:CallOptionAgreementMember

2021-01-18

0001752372

EZOO:TanXiaohaoMember

2021-01-18

0001752372

EZOO:PeriodEndRMBMember

2024-03-31

0001752372

EZOO:PeriodEndRMBMember

2023-03-31

0001752372

EZOO:PeriodAverageRMBMember

2024-03-31

0001752372

EZOO:PeriodAverageRMBMember

2023-03-31

0001752372

EZOO:PeriodEndHKMember

2024-03-31

0001752372

EZOO:PeriodEndHKMember

2023-03-31

0001752372

EZOO:PeriodAverageHKMember

2024-03-31

0001752372

EZOO:PeriodAverageHKMember

2023-03-31

0001752372

us-gaap:OfficeEquipmentMember

srt:MinimumMember

2024-03-31

0001752372

us-gaap:OfficeEquipmentMember

srt:MaximumMember

2024-03-31

0001752372

EZOO:RelatedPartyIMember

EZOO:BeijingEzagooIndustrialDevelopmentGroupHoldingLimitedMember

2024-03-31

0001752372

EZOO:RelatedPartyIMember

EZOO:HunanKuaileMotorsCampingSiteInvestmentDevelopmentLtdMember

2024-03-31

0001752372

EZOO:RelatedPartyAMember

2024-03-31

0001752372

EZOO:RelatedPartyAMember

2023-12-31

0001752372

EZOO:RelatedPartyBMember

EZOO:HuiDuMember

2024-03-31

0001752372

EZOO:RelatedPartyBMember

2024-03-31

0001752372

EZOO:RelatedPartyBMember

2023-12-31

0001752372

EZOO:RelatedPartyCMember

2024-03-31

0001752372

EZOO:RelatedPartyCMember

2023-12-31

0001752372

EZOO:RelatedPartyDMember

2024-03-31

0001752372

EZOO:RelatedPartyDMember

2023-12-31

0001752372

EZOO:RelatedPartyEMember

2024-03-31

0001752372

EZOO:RelatedPartyEMember

2023-12-31

0001752372

EZOO:RelatedPartyGMember

EZOO:MrXiaohaoTanMember

2024-03-31

0001752372

EZOO:RelatedPartyGMember

EZOO:MrXiaohaoTanMember

2023-12-31

0001752372

EZOO:RelatedPartyGMember

2024-03-31

0001752372

EZOO:RelatedPartyGMember

2023-12-31

0001752372

EZOO:RelatedPartyJMember

2024-03-31

0001752372

EZOO:RelatedPartyJMember

2023-12-31

0001752372

EZOO:RelatedPartyJMember

2024-03-31

0001752372

EZOO:RelatedPartyJMember

2023-12-31

0001752372

EZOO:RelatedPartyKMember

2024-03-31

0001752372

EZOO:RelatedPartyKMember

2023-12-31

0001752372

EZOO:RelatedPartyLMember

EZOO:MrXiaohaoTanMember

2024-03-31

0001752372

EZOO:RelatedPartyLMember

2024-03-31

0001752372

EZOO:RelatedPartyLMember

2023-12-31

0001752372

EZOO:MrXiaohaoTanMember

EZOO:RelatedPartyMMember

2024-03-31

0001752372

EZOO:RelatedPartyMMember

2024-03-31

0001752372

EZOO:RelatedPartyMMember

2023-12-31

0001752372

EZOO:RelatedPartyNMember

EZOO:MrXiaohaoTanMember

2024-03-31

0001752372

EZOO:RelatedPartyNMember

2024-03-31

0001752372

EZOO:RelatedPartyNMember

2023-12-31

0001752372

EZOO:RelatedPartyOMember

EZOO:ChangshaLittlePenguinCultureCommunicationCoLimitedMember

2024-03-31

0001752372

EZOO:RelatedPartyOMember

EZOO:ChangshaLittlePenguinCultureCommunicationCoLimitedMember

2023-12-31

0001752372

EZOO:RelatedPartyOMember

2024-03-31

0001752372

EZOO:RelatedPartyOMember

2023-12-31

0001752372

EZOO:RelatedPartyPMember

2024-03-31

0001752372

EZOO:RelatedPartyPMember

2024-03-31

0001752372

EZOO:RelatedPartyPMember

2023-12-31

0001752372

srt:DirectorMember

2024-01-01

2024-03-31

0001752372

srt:DirectorMember

2023-01-01

2023-03-31

0001752372

us-gaap:RelatedPartyMember

2024-01-01

2024-03-31

0001752372

us-gaap:RelatedPartyMember

2023-01-01

2023-03-31

0001752372

EZOO:OfficeSpacesMember

srt:MinimumMember

2024-03-31

0001752372

EZOO:OfficeSpacesMember

srt:MaximumMember

2024-03-31

0001752372

EZOO:FirstChangshaOfficeRentRelatedPartyMember

2024-01-01

2024-03-31

0001752372

EZOO:FirstChangshaOfficeRentRelatedPartyMember

2024-03-31

0001752372

EZOO:SecondBeijingOfficeRentRelatedPartyMember

2024-01-01

2024-03-31

0001752372

EZOO:SecondBeijingOfficeRentRelatedPartyMember

2024-03-31

0001752372

EZOO:ThirdBeijingOfficeRentRelatedPartyMember

2024-01-01

2024-03-31

0001752372

EZOO:ThirdBeijingOfficeRentRelatedPartyMember

2024-03-31

0001752372

us-gaap:NonrelatedPartyMember

2024-01-01

2024-03-31

0001752372

us-gaap:NonrelatedPartyMember

2023-01-01

2023-03-31

0001752372

us-gaap:RelatedPartyMember

2023-03-31

0001752372

us-gaap:NonrelatedPartyMember

2024-03-31

0001752372

us-gaap:NonrelatedPartyMember

2023-03-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

iso4217:CNY

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the Quarterly Period Ended March 31, 2024

or

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from _________ to _________

Commission

File Number 333-228681

EZAGOO

LIMITED

(Exact

name of registrant issuer as specified in its charter)

| Nevada |

|

30-1077936 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

Rm

205, 2/F, Building 17, Yard 1, Li Ze Road, Feng Tai District, Beijing 100073, China

(Address

of principal executive offices, including zip code)

Registrant’s

phone number, including area code (+86) 139 751 09168

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

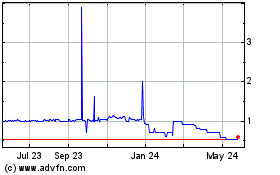

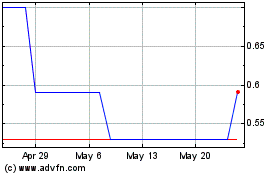

EZOO |

|

OTC

Markets |

Securities

registered pursuant to Section 12(g) of the Act: Common stock, par value $0.0001 per share

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes

☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

YES

☒ NO ☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding

twelve months (or shorter period that the registrant was required to submit and post such files).

YES

☒ NO ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

or an “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

☐ No ☒

Indicate

the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Class |

|

Outstanding

at May 15, 2024 |

| Common

Stock, $.0001 par value |

|

119,956,826 |

TABLE

OF CONTENTS

PART

I – FINANCIAL INFORMATION

Item

1. Financial statements

EZAGOO

LIMITED

CONDENSED

CONSOLIDATED BALANCE SHEETS

AS

OF MARCH 31, 2024 (UNAUDITED) AND DECEMBER 31, 2023

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

| | |

March

31, 2024 | | |

December 31, 2023 | |

| | |

| | | |

| (Reclassified) | |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 249,853 | | |

$ | 266,542 | |

| Amount due from the related party | |

| 138 | | |

| 141 | |

| Deposits, prepayments and other receivables | |

| 38,607 | | |

| 28,763 | |

| Income tax receivables | |

| 2,073 | | |

| 2,073 | |

| Total current assets | |

| 290,671 | | |

| 297,519 | |

| | |

| | | |

| | |

| NON-CURRENT ASSETS | |

| | | |

| | |

| Right-of-use assets | |

| 16,012 | | |

| 21,603 | |

| Total non-current assets | |

| 16,012 | | |

| 21,603 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 306,683 | | |

$ | 319,122 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable | |

$ | 10,532 | | |

$ | 13,527 | |

| Accrual, other payables and deposits received | |

| 136,729 | | |

| 172,718 | |

| Amounts due to the related parties | |

| 3,306,366 | | |

| 3,243,063 | |

| Lease liabilities | |

| 22,693 | | |

| 21,603 | |

| Total current liabilities | |

| 3,476,320 | | |

| 3,450,911 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES | |

$ | 3,476,320 | | |

$ | 3,450,911 | |

| | |

| | | |

| | |

| STOCKHOLDERS’ DEFICIT | |

| | | |

| | |

| Preferred stocks, $0.0001 par value, 200,000,000 shares authorized, none issued and outstanding | |

$ | - | | |

$ | - | |

| Common stocks, $0.0001 par value, 600,000,000 shares authorized, 119,956,826 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | |

| 11,996 | | |

| 11,996 | |

| Additional paid-in capital | |

| 1,469,166 | | |

| 1,469,166 | |

| Accumulated other comprehensive income | |

| 182,780 | | |

| 125,963 | |

| Accumulated deficit | |

| (4,833,579 | ) | |

| (4,738,914 | ) |

| TOTAL STOCKHOLDERS’ DEFICIT | |

| (3,169,637 | ) | |

| (3,131,789 | ) |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT | |

$ | 306,683 | | |

$ | 319,122 | |

See

accompanying notes to the unaudited condensed consolidated financial statements.

EZAGOO

LIMITED

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

FOR

THE THREE MONTHS ENDED MARCH 31, 2024 AND 2023

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

| | |

| | |

| |

| | |

Three months ended March 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

(Reclassified) | |

| REVENUES | |

$ | 43,516 | | |

$ | 76,236 | |

| | |

| | | |

| | |

| COSTS OF REVENUES | |

| (37,461 | ) | |

| (65,117 | ) |

| | |

| | | |

| | |

| GROSS PROFIT | |

| 6,055 | | |

| 11,119 | |

| | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | |

| Sales and marketing expenses | |

| (34,400 | ) | |

| (19,980 | ) |

| General and administrative expenses | |

| (101,826 | ) | |

| (215,453 | ) |

| TOTAL OPERATING EXPENSE | |

| (136,226 | ) | |

| (235,433 | ) |

| | |

| | | |

| | |

| OPERATING LOSS | |

| (130,171 | ) | |

| (224,314 | ) |

| | |

| | | |

| | |

| OTHER INCOME (EXPENSES) | |

| | | |

| | |

| Other income | |

| 35,507 | | |

| 56 | |

| Other expenses | |

| (1 | ) | |

| (5 | ) |

| Imputed interest expenses, net | |

| - | | |

| (27,489 | ) |

| TOTAL OTHER INCOME (EXPENSES), NET | |

| 35,506 | | |

| (27,438 | ) |

| | |

| | | |

| | |

| | |

| | | |

| | |

| INCOME TAX EXPENSES | |

| - | | |

| - | |

| | |

| | | |

| | |

| NET LOSS | |

$ | (94,665 | ) | |

$ | (251,752 | ) |

| | |

| | | |

| | |

| Other comprehensive income (loss) | |

| | | |

| | |

| Foreign exchange adjustment income (loss) | |

| 56,817 | | |

| (12,744 | ) |

| COMPREHENSIVE LOSS | |

$ | (37,848 | ) | |

$ | (264,496 | ) |

| | |

| | | |

| | |

| Net loss per share - Basic and diluted | |

$ | (0.00 | ) | |

$ | (0.00 | ) |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding – Basic and diluted | |

| 119,956,826 | | |

| 119,956,826 | |

See

accompanying notes to the unaudited condensed consolidated financial statements.

EZAGOO

LIMITED

CONDENSED

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT

FOR

THE THREE MONTHS ENDED MARCH 31, 2024 AND 2023

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

For

the three months ended March 31, 2024

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

COMMON STOCKS | | |

| | |

ACCUMULATED | | |

| | |

| |

| | |

NUMBERS OF SHARES | | |

AMOUNT | | |

ADDITIONAL

PAID-IN CAPITAL | | |

OTHER

COMPREHENSIVE LOSS | | |

ACCUMULATED DEFICIT | | |

TOTAL

STOCKHOLDERS’ DEFICT | |

| Balance as of January 1, 2024 (Audited) | |

| 119,956,826 | | |

$ | 11,996 | | |

$ | 1,469,166 | | |

$ | 125,963 | | |

$ | (4,738,914 | ) | |

$ | (3,131,789 | ) |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (94,665 | ) | |

| (94,665 | ) |

| Other comprehensive loss | |

| - | | |

| - | | |

| - | | |

| 56,817 | | |

| - | | |

| 56,817 | |

| Balance as of March 31, 2024 (Unaudited) | |

| 119,956,826 | | |

$ | 11,996 | | |

$ | 1,469,166 | | |

$ | 182,780 | | |

$ | (4,833,579 | ) | |

$ | (3,169,637 | ) |

For

the three months ended March 31, 2023

| | |

COMMON

STOCKS | | |

| | |

ACCUMULATED | | |

| | |

| |

| | |

NUMBERS

OF SHARES | | |

AMOUNT | | |

ADDITIONAL

PAID-IN CAPITAL | | |

OTHER

COMPREHENSIVE LOSS | | |

ACCUMULATED DEFICIT | | |

TOTAL

STOCKHOLDERS’ DEFICT | |

| Balance as of January 1, 2023 (Audited) | |

| 119,956,826 | | |

$ | 11,996 | | |

$ | 1,467,490 | | |

$ | 76,280 | | |

$ | (3,831,788 | ) | |

$ | (2,276,022 | ) |

| Balance | |

| 119,956,826 | | |

$ | 11,996 | | |

$ | 1,467,490 | | |

$ | 76,280 | | |

$ | (3,831,788 | ) | |

$ | (2,276,022 | ) |

| Imputed interest expenses | |

| - | | |

| - | | |

| 27,489 | | |

| - | | |

| - | | |

| 27,489 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (251,752 | ) | |

| (251,752 | ) |

| Other comprehensive

loss | |

| - | | |

| - | | |

| - | | |

| (12,744 | ) | |

| - | | |

| (12,744 | ) |

| Balance as of March 31, 2023 (Unaudited) | |

| 119,956,826 | | |

$ | 11,996 | | |

$ | 1,494,979 | | |

$ | 63,536 | | |

$ | (4,083,540 | ) | |

$ | (2,513,029 | ) |

| Balance | |

| 119,956,826 | | |

$ | 11,996 | | |

$ | 1,494,979 | | |

$ | 63,536 | | |

$ | (4,083,540 | ) | |

$ | (2,513,029 | ) |

See

accompanying notes to the unaudited condensed consolidated financial statements.

EZAGOO

LIMITED

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR

THE THREE MONTHS ENDED MARCH 31, 2024 AND 2023

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

| | |

| | |

| |

| | |

Three months ended March 31, | |

| | |

2024 | | |

2023 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net loss | |

$ | (94,665 | ) | |

$ | (251,752 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities | |

| | | |

| | |

| Depreciation of property and equipment | |

| - | | |

| 2,507 | |

| Imputed interests, net | |

| - | | |

| 27,489 | |

| | |

| | | |

| | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Deposits, prepayments and other receivables | |

| (10,402 | ) | |

| 33,643 | |

| Accounts payable | |

| (2,782 | ) | |

| (9,443 | ) |

| Accrual and other payables | |

| (33,545 | ) | |

| (62,317 | ) |

| Receipts in advance | |

| (361 | ) | |

| (45,681 | ) |

| Income tax payables | |

| - | | |

| 1,803 | |

| Right-of-use assets | |

| (5,591 | ) | |

| 48,551 | |

| Lease liabilities | |

| (1,090 | ) | |

| (30,488 | ) |

| Net cash used in operating activities | |

| (148,436 | ) | |

| (285,688 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Funds advanced from the related parties, net | |

| 128,403 | | |

| 297,698 | |

| Funds advanced from (repayments to) a director, net | |

| 3,742 | | |

| (3,933 | ) |

| Net cash provided by financing activities | |

| 132,145 | | |

| 293,765 | |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | |

| (398 | ) | |

| 529 | |

| | |

| | | |

| | |

| Net change in cash and cash equivalents | |

| (16,689 | ) | |

| 8,606 | |

| Cash and cash equivalents, beginning of period | |

| 266,542 | | |

| 454,980 | |

| CASH AND CASH EQUIVALENTS, END OF PERIOD | |

$ | 249,853 | | |

$ | 463,586 | |

| | |

| | | |

| | |

| SUPPLEMENTAL CASH FLOWS INFORMATION | |

| | | |

| | |

| Cash paid for income taxes | |

$ | - | | |

$ | - | |

| Cash paid for interest paid | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| NON-CASH INVESTING AND FINANCING ACTIVITY | |

| | | |

| | |

| Right-of-use assets obtained in exchange for lease liabilities | |

$ | - | | |

$ | 43,693 | |

See

accompanying notes to the unaudited condensed consolidated financial statements.

EZAGOO

LIMITED

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

NOTE

1 – ORGANIZATION AND BUSINESS BACKGROUND

Ezagoo

Limited, a Nevada corporation (“the Company”) was incorporated under the laws of the State of Nevada on May 9, 2018.

On

May 9, 2018 Tan Xiaohao was appointed as President, Secretary, Treasurer, and Director of the Company.

On

May 9, 2018, our President, Tan Xiaohao, purchased 90,050,500 shares of restricted common stock at a purchase price of $0.0001 (par value)

per share. The proceeds from the sale, which were in the amount of $9,005 have gone directly to the Company for initial working capital.

On

June 30, 2018 Zhang Qianwen and Greenpro Asia Strategic SPC- Greenpro Asia Strategic Fund SP purchased 3,591,000 and 1,358,500 shares

of restricted common stock respectively at a purchase price of $0.0001 (par value) per share. The proceeds from the sale, which were

in the amount of $495, have gone directly to the Company for initial working capital.

On

June 6, 2018 Ezagoo Holding Limited, a Seychelles Company, acquired Ezagoo Limited, A Hong Kong Company, in consideration of $0.13.

Ezagoo

Limited, a Nevada Company, acquired Ezagoo Holding Limited, a Seychelles Company, on June 25, 2018 in consideration of $1. Ezagoo Holding

Limited is now a wholly owned subsidiary of the Company.

On

July 20, 2018, Ezagoo Limited, a Hong Kong Company, incorporated a new subsidiary in Changsha, China, called Changsha Ezagoo Technology

Limited, whereas it is owned entirely (100%) by Ezagoo Limited, the Hong Kong Company. There was no consideration exchanged per the transaction.

The

three companies above are under common control Mr. Tan Xiaohao, the director of the Company, so they are related parties.

On

July 20, 2018, Changsha Ezagoo Technology Limited, the Hong Kong Company, also referred to herein as “CETL”, entered into

and consummated an agreement with Beijing Ezagoo Shopping Holding Limited, also referred to herein as “BESH”, and Ruiyin

(Shenzhen) Financial Leasing Limited, also referred to herein as “RFLL”, whereas CETL has the option to purchase all of the

equity interests of Beijing Ezagoo Zhicheng Internet Technology Limited, a Chinese, “PRC” Company, from RFLL and BESH. These

equity interests would make up 100% of the equity interests of Beijing Ezagoo Zhicheng Internet Technology Limited. Beijing Ezagoo Zhicheng

Internet Technology Limited is considered to be a variable interest entity, also referred to herein as a “VIE”, to Changsha

Ezagoo Technology Limited, and therefore a VIE of the issuer, Ezagoo Limited, a Nevada Company. More information regarding this agreement

can be found in exhibit 10.1, titled, “Call Option Agreement” on the Form S-1 Amendment No.3, filed on May 3, 2019.

On

July 20, 2018, CETL entered into and consummated an agreement with BESH and RFLL whereas BESH and RFLL have given CETL the right to appoint

management of CETL to act as proxy to existing shareholders of Beijing Ezagoo Zhicheng Internet Technology Limited. This gives management

of CETL the ability to conduct and control company affairs of Beijing Ezagoo Zhicheng Internet Technology Limited. Actions which management

of CETL may be able to carry out include, but are not limited to, exercising voting rights as proxy of the existing shareholder(s), appointing

new directors, hiring new management, and carrying out corporate actions. More information regarding this agreement can be found in exhibit

10.2, titled, “Shareholder’ Voting Rights Proxy Agreement” on the Form S-1 Amendment No.3, filed on May 3, 2019.

On

July 20, 2018 CETL entered into and consummated an agreement with BESH and RFLL whereas BESH and RFLL have engaged CETL to provide management,

financial, and other business services to Beijing Ezagoo Zhicheng Internet Technology Limited (formerly named as Hunan Ezagoo Zhicheng

Internet Technology Limited that change the company name on December 2, 2020). CETL is to be compensated with 100% of all profits generated

by Beijing Ezagoo Zhicheng Internet Technology Limited. This Agreement is effective as of July 20, 2018 and will continue in effect for

a period of ten (10) years (the “Initial Term”), and for succeeding periods of the same duration (each, “Subsequent

Term”), until terminated by one of the following means either during the Initial Term or thereafter: Mutual Consent, Termination

by CETL, Breach or Insolvency. Beijing Ezagoo Zhicheng Internet Technology Limited is considered to be a variable interest entity to

Changsha Ezagoo Technology Limited, and therefore a VIE of the issuer, Ezagoo Limited, a Nevada Company. More information regarding this

agreement can be found in exhibit 10.3, titled, “Management Services Agreement” on the Form S-1 Amendment No.3, filed on

May 3, 2019.

On

July 20, 2018, CETL entered into and consummated an agreement with BESH and RFLL whereas BESH and RFLL have pledged their equity interests

in Beijing Ezagoo Zhicheng Internet Technology Limited, to CETL. More information regarding this agreement can be found in exhibit 10.4,

titled, “Equity Pledge Agreement” on the Form S-1 Amendment No.3, filed on May 3, 2019.

On

July 20, 2018, CETL entered into a loan agreement with BESH and RFLL wherein CETL will loan the amount of approximately CNY$100,000 (Chinese

Yuan) to BESH and RFLL, all of which shall be used for the benefit of Beijing Ezagoo Zhicheng Internet Technology Limited. The total

amount of the loan is due on, or before, December 31, 2018. More information regarding this agreement can be found in exhibit 10.5, titled,

“Loan Agreement” on the Form S-1 Amendment No.3, filed on May 3, 2019.

On

July 31, 2018, Xin Yang was appointed Chief Financial Officer of the Company.

On

January 18, 2021, RFLL, one of the Equity owners of BEZL, had transferred their 20% equity of BEZL, including the rights and duties of

the five agreements mentioned above that CETL entered and consummated with BEID and them, were transferred to and inherited by, Hunan

Wangcheng Xingyi Industrial Development Co., Ltd. (herein as “WCXYID”, which the Company is 100% owned by Mr. Tan, Xiaohao).

Therefore, on January 18, 2021, CETL entered and consummated the Call Option Agreement Amendment No.1 (exhibit 10.1A, that can be found

on the Form 10-K for the year ended December 31, 2023, filed on April 8, 2024) with BEID and WCXYID, the Shareholder Voting Rights Proxy

Agreement Amendment No.1 (exhibit 10.2A, that can be found on the Form 10-K for the year ended December 31, 2023, filed on April 8, 2024)

with BEID and WCXYID, the Management Services Agreement Amendment No.1 (exhibit 10.3A, hat can be found on the Form 10-K for the year

ended December 31, 2023, filed on April 8, 2024) with BEZL, the Equity Pledge Agreement Amendment No.1 (exhibit 10.4A, that can be found

on the Form 10-K for the year ended December 31, 2023, filed on April 8, 2024) with BEID and WCXYID, and the Loan Agreement Amendment

No.1 (exhibit 10.5A, that can be found on the Form 10-K for the year ended December 31, 2023, filed on April 8, 2024) with BEID and WCXYID.

On

March 3, 2021, the Company incorporated a branch company of Beijing Ezagoo Zhicheng Internet Technology Limited, named Changsha Branch

of Beijing Ezagoo Zhicheng Internet Technology Limited, the reason to continue the operating in Changsha is we had adapted to the business

environment and adjusted business strategy.

On

August 28, 2023, the existing officer resigned immediately. Accordingly, Mr. Xin Yang, serving as an officer, ceased to be the Company’s

Chief Financial Officer. On the effective date, Ms. Yibo Li consented to act as the new Chief Financial Officer of the Company.

EZAGOO

LIMITED and its subsidiaries are hereinafter referred to as the “Company”.

EZAGOO

LIMITED

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

NOTE

2 - GOING CONCERN UNCERTAINTIES

As

of March 31, 2024, the Company had working capital deficit of $3,185,649 and accumulated deficit of $4,833,579,

and had incurred a net loss of $94,665

and negative operating cashflows of $148,436 for the three months ended March 31, 2024. The continuation of the Company as a going

concern through March 31, 2024 is dependent upon improving profitability and the continuing financial support from its stockholders.

Management believes the existing shareholders or external financing will provide additional cash to meet the Company’s

obligations as they become due.

These

and other factors raise substantial doubt about the Company’s ability to continue as a going concern. These financial statements

do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts

and classification of liabilities that may result in the Company not being able to continue as a going concern.

NOTE

3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The

accompanying unaudited condensed consolidated financial statements reflect the application of certain significant accounting policies

as described in this note and elsewhere in the accompanying consolidated financial statements and notes.

●

Basis of consolidated presentation

These

condensed consolidated financial statements, accompanying notes, and related disclosures have been prepared pursuant to the rules and

regulations of the U.S. Securities and Exchange Commission (“SEC”). These accompanying condensed consolidated financial statements

have been prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”).

The Company’s fiscal year end is December 31. The Company’s financial statements are presented in U.S. dollars.

The

condensed consolidated financial statements include the accounts of EZAGOO LIMITED and its subsidiaries. All significant inter-company

balances and transactions within the Company have been eliminated upon consolidation.

●

Use of estimates

In

preparing these condensed consolidated financial statements, management makes estimates and assumptions that affect the reported amounts

of assets and liabilities in the balance sheets and revenues and expenses during the periods reported. Actual results may differ from

these estimates.

●

Reclassification

Certain

prior year amounts have been reclassified for consistency with the current year presentation. These reclassifications had no effect on

the reported results of operations.

●

Foreign currencies translation and re-measurement

Transactions

denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing

at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated

into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded

in the statements of operations and comprehensive income.

The

reporting currency of the Company is United States Dollars (“US$”) and the accompanying condensed financial statements have

been expressed in US$. In addition, the Company’s subsidiary in People’s Republic of China maintains its books and record

in its local currency, Chinese Yuan (“RMB”), which is functional currency as being the primary currency of the economic environment

in which the entity operates.

In

general, for consolidation purposes, assets and liabilities of its subsidiaries whose functional currency is not US$ are translated into

US$, in accordance with ASC Topic 830-30, “Translation of Financial Statement”, using the exchange rate on the balance sheet

date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation

of financial statements of foreign subsidiary are recorded as a separate component of accumulated other comprehensive income (loss) within

the statements of stockholders’ deficit.

Translation

of amounts from RMB into US$1 has been made at the following exchange rates for the respective periods:

SCHEDULE OF FOREIGN CURRENCY TRANSLATION OF EXCHANGE RATES

| | |

2024 | | |

2023 | |

| | |

As of and for the three months ended

March 31, | |

| | |

2024 | | |

2023 | |

| Period-end RMB: US$1 exchange rate | |

| 7.22 | | |

| 7.10 | |

| Period-average RMB: US$1 exchange rate | |

| 7.17 | | |

| 7.08 | |

| Period-end HK$: US$1 exchange rate | |

| 7.83 | | |

| 7.81 | |

| Period-average HK$: US$1 exchange rate | |

| 7.82 | | |

| 7.83 | |

| Foreign exchange rate | |

| 7.82 | | |

| 7.83 | |

●

Cash and cash equivalents

The

company considers all highly liquid instruments with a maturity of three months or less at the time of issuance to be cash equivalents.

Cash and cash equivalents consist of cash on hand, demand deposits placed with banks that located in US, the Hong Kong and mainland China.

EZAGOO

LIMITED

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

●

Property and equipment

Property and equipment are carried at cost less accumulated depreciation. Depreciation is provided over their estimated useful lives, using

the straight-line method. Estimated useful lives of the property and equipment are as follows:

SCHEDULE OF PLANT AND EQUIPMENT EXPECTED USEFUL LIVES

| Office

equipment |

3-5

years |

The

cost of maintenance and repairs is charged to expenses as incurred, whereas significant renewals and betterments are capitalized.

●

Lease

The

Company accounts for its leases in accordance with ASC 842 Leases. The Company leases office space. The Company concludes on whether

an arrangement is a lease at inception. This determination as to whether an arrangement contains a lease is based on an assessment as

to whether a contract conveys the right to the Company to control the use of identified property, plant or equipment for period of time

in exchange for consideration. Leases with an initial term of 12 months or less are not recorded on the balance sheet. The Company recognizes

these lease expenses on a straight-line basis over the lease term.

The

Company has assessed its contracts and concluded that its leases consist of only operating leases. Operating leases are included in right-of-use (ROU) assets, current portion of lease liabilities, and non-current portion of lease liabilities in the Company’s

consolidated balance sheets.

ROU

assets represent the Company’s right to use an underlying asset for the lease term and lease liabilities represent the Company’s

obligation to make lease payments arising from the lease. ROU assets and lease liabilities are recognized at commencement date

based on the present value of lease payments over the lease term. As most of the Company’s leases do not provide an implicit rate,

the Company determines an incremental borrowing rate based on the information available at commencement date in determining the present

value of lease payments. The Company’s incremental borrowing rate is a hypothetical rate based on its understanding of what its

credit rating would be. The ROU asset also includes any lease payments made and excludes lease incentives. Lease expense

for lease payments is recognized on a straight-line basis over the lease term.

●

Revenue recognition

The

Company assesses and follows the guidance of ASC 606, revenue from contracts with customers is recognized using the following five steps:

| |

1. |

Identify

the contract(s) with a customer; |

| |

|

a.

|

The

parties to the contract have approved the contract (in writing, orally, or in accordance with other customary business practices)

and are committed to perform their respective obligations. |

| |

|

b.

|

The

entity can identify each party’s rights regarding the services to be transferred. |

| |

|

c.

|

The

entity can identify the payment terms for the services to be transferred. |

| |

|

d.

|

The

contract has commercial substance (that is, the risk, timing, or amount of the entity’s future cash flows is expected to change

as a result of the contract). |

| |

|

e.

|

It

is probable that the entity will collect substantially all of the consideration to which it will be entitled in exchange for the

services that will be transferred to the customer. |

| |

2. |

Identify

the performance obligations in the contract; |

| |

|

a.

|

According

to the contract, the Company and Customer has to maintain the performance obligation, respectively. |

| |

|

b.

|

The

customer shall pay for the services and goods after signing of the contract and provide appropriate advertisement materials, and

the delivery address & contact information of the e-commerce order to the Company, the Company shall ensure the provided service

and delivered goods of the Customer according to the contract terms. |

| |

3. |

Determine

the transaction price; |

| |

|

a.

|

For

the e-commerce contract, the transaction price is explicitly stated in fixed amount in the contract. There is no variable consideration,

such as discounts, rebates, consideration payable to customer or noncash consideration. There was no price concession, and the Company

did not expect any price concession for the service performed during the periods ended March 31, 2024 and 2023. |

| |

|

b.

|

The

contract does not contain any elements that would cause consideration under the arrangement to be variable (Examples include discounts,

rebates, refunds, credits, incentives, tiered pricing, price guarantees, right of return, etc.). |

| |

|

c.

|

There

are no factors that exist whereby it is not probable that a significant reversal or revenues will not occur in the contract. |

| |

4. |

Allocate

the transaction price to the performance obligations in the contract; and |

| |

|

a.

|

There

were no multiple performance obligations to which the transaction price must be allocated, and each contract only has one performance

obligation. The standalone selling price is explicated stated in the contract. |

| |

5. |

Recognize

revenue when (or as) the entity satisfies a performance obligation. |

| |

|

a. |

Per

ASC 606, an entity shall recognize revenue when (or as) the entity satisfies a performance obligation by transferring a promised

good or service (that is, an asset) to a customer. An asset is transferred when (or as) the customer obtains control of that asset. |

| |

|

b. |

Revenue

is recognized when the advertising service is performed. According to the sample advertising and e-commerce contract, upon obtaining

the signed contract and order from the Customer, the service and goods’ period would be started. Therefore, the revenue is

recognized when the service and goods are completely provided and delivered at that point in time. |

EZAGOO

LIMITED

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

Under

Topic 606, revenues are recognized when the promised services and goods have been confirmed and transferred to the consumers in amounts

that reflect the consideration the customer expects to be entitled to in exchange for those services. The Company presents value added

taxes (“VAT”) as reductions of revenues. The Company recognizes revenues net of value added taxes (“VAT”) and

relevant charges.

During

the period ended March 31, 2024, the Company’s revenues were mainly generated from providing e-commerce trading of goods and products

on ZCZX WeChat Application that is subscribed from Weimob (微盟集团, HK02013) (“trading income” since

September 2022), providing e-commerce value-added service in LSM WeChat Application which is also subscribed from Weimob (微盟集团,

HK02013) (“commission income” since November 2022), and providing service of travel planning to customer (“service

income” since March 2024).

●

Cost of revenues

Cost

of revenue includes costs of goods sold and sales commissions expenses of e-commerce trading in ZCZX, the operating salaries for the

staffs who running the ZCZX and LSM, and the service of travel planning.

●

Imputed Interest

The

Company owned director and related parties some loans which are unsecured, interest-free with no fixed payment term, for working capital

purpose. Imputed interests were $0 and $27,489 for the periods ended March 31, 2024 and 2023, respectively.

●

Value-added taxes

Revenue

is recognized net of value-added taxes (“VAT”). The VAT is based on gross sales price and VAT rates applicable to the Company

is 13% of e-commerce trading income and 6% of commission income and service income for the periods ended March 31, 2024 and 2023. All

of the VAT returns filed by the Company’s subsidiaries in the PRC, have been and remain subject to examination by the PRC tax authorities

for five years from the date of filing. VAT payables are included in accrued liabilities.

●

Income taxes

The

Company followed the liability method of accounting for income taxes in accordance with ASC 740, Income Taxes, or ASC 740. Under this

method, deferred tax assets and liabilities are determined based on the difference between the financial reporting and tax bases of assets

and liabilities using enacted tax rates that will be in effect in the period in which the differences are expected to reverse. The Company

recorded a valuation allowance to offset deferred tax assets if based on the weight of available evidence, it is more-likely-than-not

that some portion, or all, of the deferred tax assets will not be realized. The effect on deferred taxes of a change in tax rate is recognized

in tax expense in the period that includes the enactment date of the change in tax rate.

The

Company accounted for uncertainties in income taxes in accordance with ASC 740. Interest and penalties related to unrecognizable tax

benefit recognized in accordance with ASC 740 are classified in the consolidated statements of comprehensive loss as income tax expense.

●

Earnings per share

The

Company computes earnings per share (“EPS”) in accordance with ASC Topic 260, “Earnings per share”. Basic EPS

is measured as the income or loss available to common shareholders divided by the weighted average common shares outstanding for the

period. Diluted EPS is similar to basic EPS but presents the dilutive effect on a per share basis of potential common shares (e.g., convertible

securities, options, and warrants) as if they had been converted at the beginning of the periods presented, or issuance date, if later.

Any potential common shares in 2024 and 2023 that have an anti-dilutive effect (i.e. those that increase income per share or decrease

loss per share) are excluded from the calculation of diluted EPS.

●

Commitments and contingencies

Liabilities

for loss contingencies arising from claims, assessments, litigation, fines and penalties and other sources are recorded when it is probable

that a liability has been incurred and the amount of the assessment can be reasonably estimated.

●

Related party transaction

A

related party is generally defined as (i) any person that holds 10% or more of the Company’s securities and their immediate families,

(ii) the Company’s management, (iii) someone that directly or indirectly controls, is controlled by or is under common control

with the Company, or (iv) anyone who can significantly influence the financial and operating decisions of the Company. A transaction

is considered to be a related party transaction when there is a transfer of resources or obligations between related parties.

Transactions

involving related parties cannot be presumed to be carried out on an arm’s-length basis, as the requisite conditions of competitive,

free market dealings may not exist. Representations about transactions with related parties, if made, shall not imply that the related

party transactions were consummated on terms equivalent to those that prevail in arm’s-length transactions unless such representations

can be substantiated.

EZAGOO

LIMITED

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

●

Recent accounting pronouncements

In December 2023, the FASB issued ASU 2023-09, Improvement to Income Tax Disclosure. This standard requires more

transparency about income tax information through improvements to income tax disclosures primarily related to the rate reconciliation

and income taxes paid information. This standard also includes certain other amendments to improve the effectiveness of income tax disclosures.

ASU 2023-09 is effective for public business entities, for annual periods beginning after December 15, 2024. For entities other than public

business entities, the amendments are effective for annual periods beginning after December 15, 2025.

Recently issued ASUs by the FASB, except for the ones mentioned above, are not expected to have a significant impact

on the Company’s consolidated results of operations or financial position. Other accounting standards that have been issued or proposed

by FASB that do not require adoption until a future date are not expected to have a material impact on the consolidated financial statements

upon adoption. The Company does not discuss recent pronouncements that are not anticipated to have an impact on or are unrelated to its

consolidated financial condition, results of operations, cash flows, or disclosures.

NOTE

4 - PROPERTY AND EQUIPMENT

| | |

March 31, 2024 | | |

December 31, 2023 | |

| Office equipment | |

$ | 42,332 | | |

$ | 42,332 | |

| Less: Accumulated depreciation | |

| (42,332 | ) | |

| (42,332 | ) |

| Property and equipment, net | |

$ | - | | |

$ | - | |

Depreciation

expense, classified as operating expenses, was $0 and $2,507 for the three months ended March 31, 2024 and 2023, respectively.

Accumulated

depreciation as of March 31, 2024 and December 31, 2023 were $42,332

and $42,332,

respectively. All the office equipment had fully depreciated at April 2023. Hence, the residual value of them were zero since then.

NOTE

5 - DEPOSITS, PREPAYMENTS AND OTHER RECEIVABLES

Deposits,

prepayments and other receivables consisted of the following:

SCHEDULE OF DEPOSITS, PREPAYMENTS AND OTHER RECEIVABLES

| | |

March 31, 2024 | | |

December 31, 2023 | |

| Deposits, prepayments and other receivables | |

$ | 38,607 | | |

$ | 28,763 | |

| Total deposits, prepayments and other receivables | |

$ | 38,607 | | |

$ | 28,763 | |

As

of March 31, 2024 and December 31, 2023, the balance of $38,607 and $28,763 were represented the outstanding prepayments which included

long-term prepayments of consultancy fee, and other costs’ prepayments of the subscription fees for Weibom Applications (ZXZC and

LSM).

NOTE

6 - ACCOUNTS PAYABLE

Accounts

payable consists of the following:

SCHEDULE OF ACCOUNT PAYABLE

| | |

March 31, 2024 | | |

December 31, 2023 | |

| Accounts payable | |

$ | 10,532 | | |

$ | 13,527 | |

| Total accounts payable | |

$ | 10,532 | | |

$ | 13,527 | |

As

of March 31, 2024 and December 31, 2023, our accounts payable of $10,532 and $13,527 were ZCZX’s e-commence costs payables to vendors,

respectively.

NOTE

7 – ACCRUED EXPENSES, OTHER PAYABLES AND DEPOSITS RECEIVED

Accrued

expenses, other payable and deposits received consisted of the following:

SCHEDULE OF ACCRUED EXPENSES, OTHER PAYABLE AND DEPOSITS RECEIVED

| | |

March 31, 2024 | | |

December 31, 2023 | |

| Accrued expenses | |

$ | 34,874 | | |

$ | 39,374 | |

| Other payables | |

| 47,921 | | |

| 78,108 | |

| Deposits received from customers | |

| 53,934 | | |

| 55,236 | |

| Total | |

$ | 136,729 | | |

$ | 172,718 | |

Accrued

expenses include the quarterly review fee & other accrued expenses. Other payables include the salaries payables. Deposits received

from customers include the advertisement service fee and the e-commerce trading fee paid in advance by customers.

EZAGOO

LIMITED

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

NOTE

8 – RELATED PARTIES

Amount

due from the related party consisted of the following:

SCHEDULE

OF DUE FROM RELATED PARTY

| | |

March 31, 2024 | | |

December 31, 2023 | |

| Related party I | |

$ | 138 | | |

$ | 141 | |

| Total amount due from the related party | |

$ | 138 | | |

$ | 141 | |

Related party I, Hunan Bright Lionrock Mountain Resort Limited,

is owned by related party J, Beijing Ezagoo Industrial Development Group Holding Limited, and related party G, Hunan

Kuaile Motors Camping Site Investment Development Ltd. with equity of 80%

and 20%,

respectively. As of March 31, 2024, and December 31, 2023, the amount of $138

and $141

due from the

related party I, respectively. It was rent deposit to

the related party with the lease period ended August 1, 2024.

Amount

due to the related parties consisted of the following:

SCHEDULE OF DUE TO RELATED PARTIES

| | |

March 31, 2024 | | |

December 31, 2023 | |

| | |

| | |

(Reclassified) | |

| Related party A | |

$ | 30,932 | | |

$ | 27,577 | |

| Related party B | |

| 348,870 | | |

| 354,921 | |

| Related party C | |

| 22,325 | | |

| 22,712 | |

| Related party D | |

| 512,038 | | |

| 520,747 | |

| Related party E | |

| 3,407 | | |

| 123,496 | |

| Related party G | |

| 251,004 | | |

| 255,358 | |

| Related party J | |

| 1,506,733 | | |

| 1,265,159 | |

| Related party K | |

| 37,395 | | |

| 38,044 | |

| Related party L | |

| 20,893 | | |

| 20,893 | |

| Related party M | |

| 331,096 | | |

| 336,840 | |

| Related party N | |

| 128,104 | | |

| 130,326 | |

| Related party O | |

| 113,569 | | |

| 115,540 | |

| Related party P | |

| - | | |

| 31,450 | |

| Total amount due to the related parties | |

$ | 3,306,366 | | |

$ | 3,243,063 | |

Related

Party A, Mr. Xiaohao Tan, the director of the Company. As of March 31, 2024, and December 31, 2023, advanced $30,932 and $27,577 to the

Company, which is unsecured, interest-free with no fixed payment term, for working capital purpose.

Related

party B is Changsha Boyi Zhicheng Management Consulting Co., Ltd. which is 100%

owned by their legal representative, Mr. Hui Du, but it’s still significant influence by the Company as of the date of this Report.

As of March 31, 2024, and December 31, 2023, related party B advanced $348,870

and $354,921

to the Company as working capital and to pay

administrative expenses, which is unsecured, interest-free with no fixed payment term, for working capital purpose.

Related

party C is Ms. Weihong Wan, Assistant and Secretary of Mr. Xiaohao Tan. Ms. Weihong Wan is a shareholder and Legal Company Representative

of related party E, related party K and related party O. As of March 31, 2024, and December 31, 2023, related party C advanced $22,325

and $22,712 to the Company as working capital and to pay administrative expenses, which is unsecured, interest-free with no fixed payment

term, for working capital purpose.

Related

party D is Ms. Qianwen Zhang, the wife of Mr. Xiaohao Tan. Ms. Qianwen Zhang is also the Legal Company Representative of related party

G. As of March 31, 2024, and December 31, 2023, related party D advanced $512,038

and $520,747 to the Company as working capital, which is unsecured, interest-free with no fixed payment term, for working capital purpose.

Related

party E is Changsha Kexibeier E-commerce Limited, its Legal Company Representative is Ms. Weihong Wan. As of March 31, 2024, and December

31, 2023, related party E advanced $3,407 and $123,496 to the Company as working capital, which is unsecured, interest-free with no fixed

payment term, for working capital purpose.

Related

party G is Kuaile Motors Camping Site Investment Development Limited. Mr. Xiaohao Tan and his wife, Ms Qianwen Zhang owned 86.95% and

8% of its equity, respectively. As of March 31, 2024, and December 31, 2023, related party G advanced $251,004 and $255,358 to the Company

as working capital and to pay administrative expenses, which is unsecured, interest-free with no fixed payment term, for working capital

purpose.

Related

party J is Beijing Ezagoo Industrial Development Group Holding Limited. Its two main equity owners are related party N and Mr. Xiaohao

Tan with equity of 71.85% and 21.42%, respectively. As of March 31, 2024, and December 31, 2023, related party J advanced $1,506,733

and $1,265,159 to the Company as working capital and to pay administrative expenses, which is unsecured, interest-free with no fixed

payment term, for working capital purpose.

EZAGOO

LIMITED

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

Related

party K is Ruiyin (Shenzhen) Financial Leasing Limited. Ms. Weihong Wan is the Legal Company

Representative of related party K. As of March 31, 2024, and December 31, 2023, related party K advanced $37,395

and $38,044

to the Company as working capital and to pay administrative expenses, which is unsecured, interest-free with no fixed payment term,

for working capital purpose.

Related

party L is Ezagoo B&R (HongKong) Industry Development Group Limited, which is 100% owned by Mr. Xiaohao Tan. As of March 31, 2024,

and December 31, 2023, related party L advanced $20,893 and $20,893 to the Company as working capital and to pay administrative expenses,

which is unsecured, interest-free with no fixed payment term, for working capital purpose.

Related

party M is Hunan Ezagoo Film Co., Limited, which 85% of its equity is owned by Mr. Xiaohao Tan. As of March 31, 2024, and December 31,

2023, the Company has $331,096 and $336,840 previous years’ advertising production cost payable to related party M, which is unsecured,

interest-free with no fixed payment term.

Related

party N is Hunan Wancheng Xingyi Industrial Development Co., Limited, which is 100% owned by Mr. Xiaohao Tan. As of March 31, 2024, and

December 31, 2023, related party N advanced $128,104 and $130,326 to the Company as working capital and to pay administrative expenses,

which is unsecured, interest-free with no fixed payment term, for working capital purpose.

Related

party O is Changsha Little Penguin Culture Communication Co., Limited, which 95% and 5% of its equity is owned by related party J and Mr. Xiaohao Tan, respectively. As of March 31, 2024, and December

31, 2023, related party N advanced $113,569 and $115,540 to the Company as working capital and to pay administrative expenses, which

is unsecured, interest-free with no fixed payment term, for working capital purpose.

Related

party P is Hunan Yuancheng Shengwang Marketing Co., Limited, which 82% of its equity is owned by Mr. Hui Du, the sole owner of related

party B, but it’s still significant influence by the Company as of the date

of this Report. As of March 31, 2024, and December 31, 2023, related party P advanced $0 and $31,450 to the Company as working capital

and to pay administrative expenses, which is unsecured, interest-free with no fixed payment term, for working capital purpose.

The

related parties’ transactions are shown as following

SCHEDULE OF DISCLOSURE OF RELATED PARTIES TRANSACTIONS

| | |

2024 | | |

2023 | |

| | |

Three months ended March 31, | |

| | |

2024 | | |

2023 | |

| Imputed interest expenses to director | |

$ | - | | |

$ | 297 | |

| Imputed interest expenses to related parties | |

| - | | |

| 27,199 | |

| Imputed interest income from related parties | |

| - | | |

| (7 | ) |

| Total imputed interest expenses, net | |

$ | - | | |

$ | 27,489 | |

| Office rental fees | |

$ | 6,725 | | |

$ | 7,050 | |

NOTE

9 - LEASE

As

of March 31, 2024, the Company has three separates lease agreements for the three office spaces in PRC with remaining lease

terms of from 4 months to 9 months

The

details lease terms are shown as followings:

SCHEDULE OF DETAILS OF LEASE TERM

| Lease agreement | |

Expiry Date | | |

Original

Lease Term | | |

The Remaining

Lease Term | |

| 1st Changsha office rent, related party | |

| Dec 31, 2024 | | |

| 2 years | | |

| 0.75 year | |

| 2nd Beijing office rent, related party | |

| Dec 31, 2024 | | |

| 1 year | | |

| 0.75 year | |

| 3rd Changsha office rent, related party | |

| Aug 1, 2024 | | |

| 1 year | | |

| 0.33 year | |

A

lease with an initial term of 12 months or less are not recorded on the balance sheet. The Company accounts for the lease and non-lease

components of its leases as a single lease component. Lease expense is recognized on a straight-line basis over the lease term.

EZAGOO

LIMITED

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

The

components of lease expense and supplemental cash flow information related to leases are as following:

SCHEDULE OF LEASE EXPENSE AND

SUPPLEMENTAL ASH FLOW INFORMATION RELATED TO LEASES

| | |

2024 | | |

2023 | |

| | |

Three months ended March 31, | |

| | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| Leases Cost (included in general and administration in the Company’s unaudited

condensed statement of operations) | |

| | | |

| | |

| Leases cost, related parties | |

$ | 6,725 | | |

$ | 4,171 | |

| Leases cost, non-related parties | |

| - | | |

| 44,380 | |

| Total lease cost | |

$ | 6,725 | | |

$ | 48,551 | |

| | |

| | | |

| | |

| Other Information | |

| | | |

| | |

| Cash paid for the amounts included in the measurement of lease liabilities, related parties | |

$ | - | | |

$ | - | |

| Cash paid for the amounts included in the measurement of lease liabilities, non-related parties | |

$ | - | | |

$ | 30,448 | |

| Weighted average remaining lease term, related party (in years) | |

| 0.75 | | |

| - | |

| Weighted average remaining lease term, non-related party (in years) | |

| - | | |

| 0.67 | |

| Average discount rate – operating leases | |

| 4.35 | % | |

| 4.35 | % |

The

supplemental balance sheet information related to leases is as following:

SCHEDULE OF SUPPLEMENTAL BALANCE SHEET INFORMATION RELATED TO LEASES

| | |

March 31, 2024 | | |

December 31, 2023 | |

| | |

(Unaudited) | | |

(Audited) | |

| Leases | |

| | | |

| | |

| Right-of-use assets, related parties | |

$ | 16,012 | | |

$ | 21,603 | |

| Total Right-of-use assets | |

$ | 16,012 | | |

$ | 21,603 | |

| | |

| | | |

| | |

| Lease liabilities - current portion, related parties | |

$ | 22,693 | | |

$ | 21,603 | |

| Total lease liabilities | |

$ | 22,693 | | |

$ | 21,603 | |

Maturities

of the Company’s lease liabilities are as following:

SCHEDULE OF MATURITIES OF LEASE LIABILITIES

| Period ending March 31, | |

| |

| 2024 | |

$ | 22,985 | |

| 2025 | |

| - | |

| Total lease payments | |

| 22,985 | |

| Less: Imputed interest/present value discount | |

| (292 | ) |

| Present value of lease liabilities | |

$ | 22,693 | |

Lease

expenses were $6,725 and $48,551 for the three months ended March 31, 2024 and 2023, respectively.

NOTE

10 – COMMON STOCK

As

of March 31, 2024 and December 31, 2023, the Company has 119,956,826 shares issued and outstanding. There are no shares of preferred

stock issued and outstanding.

NOTE

11 – ADDITIONAL PAID-IN CAPITAL

As

of March 31, 2024 and December 31, 2023, the Company has a total additional paid-in capital - capital contribution balance of $1,469,166

and $1,469,166, respectively.

NOTE

12 – SUBSEQUENT EVENTS

In

accordance with ASC Topic 855, “Subsequent Events”, which establishes general standards of accounting for and disclosure

of events that occur after the balance sheet date but before consolidated financial statements are issued, the Company has evaluated

all events or transactions that occurred up to May 15, 2024, the date the consolidated financial statements were available to issue.

Based upon this evaluation, the Company did not identify any subsequent events that would have required adjustment or disclosure in the

consolidated financial statements.

Item

2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The

information contained in this quarter report on Form 10-Q is intended to update the information contained in our Annual Report on Form

10-K for the year ended December 31, 2023 filed with the Securities and Exchange Commission on

April 8, 2024 (the “Form 10-K”) and presumes that readers have access to, and will have read, the “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and other information contained in such Form 10-K. The

following discussion and analysis also should be read together with our consolidated financial statements and the notes to the consolidated

financial statements included elsewhere in this Form 10-Q.

The

following discussion contains certain statements that may be deemed “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Such statements appear in a number of places in this Report, including, without limitation,

“Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These

statements are not guaranteed of future performance and involve risks, uncertainties and requirements that are difficult to predict or

are beyond our control. Forward-looking statements speak only as of the date of this quarterly report. You should not put undue reliance

on any forward-looking statements. We strongly encourage investors to carefully read the factors described in our Form 10-K in the section

entitled “Risk Factors” for a description of certain risks that could, among other things, cause actual results to differ

from these forward-looking statements. We assume no responsibility to update the forward-looking statements contained in this quarterly

report on Form 10-Q. The following should also be read in conjunction with the unaudited Financial Statements and notes thereto that

appear elsewhere in this report.

Company

Overview

Ezagoo

Limited (“the Company” or “EZAGOO”), was incorporated in the State of Nevada on May 9, 2018. During the period

ended March 31, 2024, the Company’s revenues were mainly generated from providing e-commerce trading of goods and products on ZCZX

WeChat Application that is subscribed from Weimob (微盟集团, HK02013) (“trading income” since September

2022), providing e-commerce value-added service in LSM WeChat Application which is also subscribed from Weimob (微盟集团,

HK02013) (“commission income” since November 2022), and providing service of travel planning to customer (“service

income” since March 2024).

Results

of Operation

For

the three months ended March 31, 2024 compared with the three and three months ended March 31, 2023

Revenue

| | |

Three months ended March 31, | |

| | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| REVENUES | |

$ | | | |

$ | | |

| Trading income of e-commerce business | |

| 25,839 | | |

| 27,562 | |

| Commission income of e-commerce business | |

| 13,464 | | |

| 48,674 | |

| Service income of travel planning | |

| 4,213 | | |

| - | |

| TOTAL REVENUES | |

$ | 43,516 | | |

$ | 76,236 | |

For

the three months ended March 31, 2024, the Company generated revenue of $43,516,

as compared to revenue of $76,236 for the three months ended March 31, 2023, reflecting a decrease of 32,720. Such decrease in revenues

was mainly reflected in less commission income that was generated from LSM as its sales order decreased. And we’ll focus on the

operation of the ZCZX and LSM WeChat applications.

Costs

of Revenues

Cost

of revenues is comprised of costs of goods sold and sales commission, salaries and related costs.

| |

● |

Costs

of goods sold and sales commission expenses of $29,024

and $25,628 for the three months ended March 31, 2024 and 2023, which

for the e-commerce trading of health and beauty products in ZCZX WeChat application. |

| |

|

|

| |

● |

Salaries

and related costs of $8,437 and $39,489 for the three months ended March 31, 2024 and 2023, respectively, which

are the compensation expenses for technical employees responsible for R&D, depreciation of computer, software’s and online

database expenses related to ZCZX & LSM WeChat applications. |

Operating

Expenses

Operating

expenses are generally included during our normal course of business, which we categorize as either sales and marketing expenses and

general & administrative expenses.

| |

● |

The

main component of our sales and marketing expenses of $34,400 and $19,980 for the three months ended March 31, 2024 and 2023, respectively,

are: |

| |

a. |

Compensation

expenses for employees engaged in sales and marketing, sales support, and certain customer service functions; |

| |

● |

The

main component of our general and administrative expenses of $101,826 and $215,453 for the three months ended March 31, 2024 and

2023, respectively, are: |

| |

a. |

Compensation

expenses for employees in finance, human resources, and other administrative support functions; |

| |

|

|

| |

b. |

Professional

services fees, including audit and consulting fee. |

| |

|

|

| |

c. |

Office

expenses, including rental and insurance fee. |

Net

Loss

The

net loss was $94,665 for the three months ended March 31, 2024, as compared to net loss of $251,752 for the three months ended March

31, 2023, reflecting an increasing of 157,087. Such increasing in net loss was mainly reflected the operating expenses are in control

by the Company during the periods ended March 31, 2024.

Liquidity

and Capital Resources

As

of March 31, 2024, we had working capital deficit of $3,185,649 as compared to working capital deficit of $3,153,392 as of December 31,

2023, reflecting an increase of 32,257. Such increasing in working capital deficit was mainly reflected in the funds advanced from related

parties for operating use. The Company’s net loss of $94,665 and $251,752 for the three months ended March 31, 2024 and 2023, respectively.

Cash

Flow from Operating Activities

For

the three months ended March 31, 2024, net cash used in operating activities was $148,436, compared to net cash used in operating activities

of $285,688 for the three months ended March 31, 2023, reflecting a decrease of $137,252 in cash outflows. Such decreasing was mainly

reflected in significant less accounts payable, other payables and customers advances during the periods ended March 31, 2024.

Cash

Flow from Investing Activities

For

the three months ended March 31, 2024 and 2023, net cash used in investing activities was $0 and $0, respectively.

Cash

Flow from Financing Activities

For

the three months ended March 31, 2024, net cash provided by financing activities was $132,145, as compared to net cash provided by financial

activities of $293,765 for the three months ended March 31, 2023, reflecting a decrease of $161,620 in cash inflows. Such decreasing

was mainly reflected in significant less funds advances from the related parties for operating use during the periods ended March 31,

2024.

Credit

Facilities

We

do not have any credit facilities or other access to bank credit.

Contractual

Obligations, Commitments and Contingencies

We

currently have three lease agreements in place with respect to office premises in Beijing and Changsha China to commence our business

operations.

Off-balance

Sheet Arrangements

As

of March 31, 2024, we have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future

effect on our financial condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital

expenditures or capital resources that are material to our stockholders.

Additional

Information

VIE

STRUCTURE AND ARRANGEMENTS

Foreign

ownership in companies providing media advertising services is subject to certain restrictions under PRC laws and regulations. To comply

with the PRC laws and regulations, we, through our wholly-owned subsidiary, Changsha Ezagoo Technology Limited (CETL), entered into a

set of contractual arrangements with Beijing Ezagoo Zhicheng Internet Technology Limited (BEZL) and includes its branch company, named