Farmers & Merchants Bank of Long Beach (OTCBB: FMBL) today

reported financial results for the third quarter ended September

30, 2010.

“We continued to experience steady deposit growth in the third

quarter, as customers seek safety and access to liquidity during

this prolonged period of economic uncertainty,” said Henry Walker,

chief executive officer of Farmers & Merchants Bank of Long

Beach. “The historically low interest rate environment is

contributing to a highly competitive industry. Nevertheless,

Farmers & Merchants Bank’s deep roots in Southern California

and financial stability remain important distinguishing factors for

the communities we serve.”

Income Statement

For the 2010 third quarter, interest income decreased to $44.4

million from $48.0 million earned in the third quarter of 2009,

primarily due to the low interest rate environment. Interest income

for the nine-month period ended September 30, 2010 was $135.0

million, compared with $142.7 million reported for the same period

in 2009.

Interest expense for the 2010 third quarter declined to $2.9

million from $4.3 million in last year’s third quarter, again,

mostly related to the low interest rate environment. Interest

expense for the nine-month period ended September 30, 2010 declined

to $9.4 million from $14.6 million reported for the same period in

2009.

Net interest income for the 2010 third quarter decreased 4.9% to

$41.5 million from $43.6 million for the third quarter of 2010, and

declined 1.9% to $125.6 million for the first nine months of 2010

from $128.1 million for the same period in 2009.

The Bank’s provision for loan losses equaled $4.0 million for

the third quarter of 2010, compared with $8.7 million for the

preceding second quarter, and $7.7 million for the third quarter of

2009. Provision for loan losses totaled $19.5 million for the first

nine months of 2010 versus $25.7 million for the same period in

2009. The Bank’s allowance for loan losses as a percentage of loans

outstanding was 2.8% at September 30, 2010, compared with 3.0% at

June 30, 2010.

Non-interest income rose to $4.3 million for the 2010 third

quarter from $3.3 million in the third quarter a year ago.

Non-interest income was $11.2 million for the nine-month period

ended September 30, 2010, compared with $9.5 million for the same

period in 2009.

Non-interest expense for the 2010 third quarter was $22.2

million, versus $19.8 million for the same period last year.

Non-interest expense for the first nine months of 2010 was $57.7

million, compared with $60.3 million last year.

The Bank's net interest margin was 4.12% for the quarter ended

September 30, 2010 and 4.30% for the first nine months of 2010.

Net income for the 2010 third quarter increased to $12.7

million, or $96.66 per diluted share, from $11.4 million, or $87.35

per diluted share, in the year-ago period. The Bank’s net income

for the first nine months of 2010 rose to $37.7 million, or $287.90

per diluted share, from $30.6 million, or $233.51 per diluted

share, for the same period in 2009.

Balance Sheet

At September 30, 2010, net loans totaled $1.97 billion,

approximately the same when compared with the end of 2009. The

Bank’s deposits totaled $2.97 billion at the end of the 2010 third

quarter, compared with $2.84 billion at December 31, 2009.

Non-interest bearing deposits represented 33.4% of total deposits

at September 30, 2010, versus 31.6% of total deposits at December

31, 2009. Total assets increased to $4.26 billion at the close of

the 2010 third quarter, compared with $3.98 billion at the close of

the prior year.

At September 30, 2010, Farmers & Merchants Bank remained

“well-capitalized” under all regulatory categories, with a total

risk-based capital ratio of 27.19%, a Tier 1 risk-based capital

ratio of 25.93%, and a Tier 1 leverage ratio of 14.34%. The minimum

ratios for capital adequacy for a well-capitalized bank are 10.00%,

6.00% and 5.00%, respectively.

“The strength of our balance sheet reflects the importance we

place on maintaining strong liquidity and exercising the necessary

discipline to navigate challenging economic conditions,” said

Daniel Walker, president and chairman of the board. “Farmers &

Merchants Bank’s robust health aligns with our core principles to

uphold superior standards upon which customers know they can

depend.”

About Farmers & Merchants Bank of Long Beach

Farmers & Merchants Bank of Long Beach provides personal and

business banking services through 22 offices in Los Angeles and

Orange Counties. Founded in 1907 by C.J. Walker, the Bank

specializes in commercial and small business banking along with

business loan programs.

FARMERS & MERCHANTS BANK OF LONG BEACH Balance

Sheets (unaudited) (in thousands) Sept.

30, 2010 Dec. 31, 2009 Assets Cash and due

from banks: Noninterest-bearing balances $ 54,215 $ 46,402

Interest-bearing balances 130,230 123,491 Investment securities

1,954,613 1,709,983 Gross loans 2,030,500 2,025,586 Less allowance

for loan losses (56,882 ) (57,751 ) Less unamortized deferred loan

fees, net (382 ) (129 ) Net loans 1,973,236

1,967,706 Bank premises and equipment 50,925

52,783 Other real estate owned 25,193 19,600 Accrued interest

receivable 17,334 16,427 Other assets 57,139

44,377

Total assets $ 4,262,885

$ 3,980,769 Liabilities and stockholders'

equity Liabilities: Deposits: Demand, non-interest

bearing $ 990,797 $ 898,186 Demand, interest bearing 249,869

254,905 Savings and money market savings 701,484 626,320 Time

deposits 1,025,040 1,063,579 Total

deposits 2,967,190 2,842,990 Securities sold under agreements to

repurchase 668,004 544,566 Accrued interest payable and other

liabilities 12,225 6,348

Total

liabilities 3,647,419

3,393,904 Stockholders' Equity:

Common Stock, par value $20; authorized

250,000 shares; issued and outstanding 130,928 shares

2,619 2,619 Surplus 12,044 12,044 Retained earnings 592,545 563,099

Other comprehensive income 8,258 9,103

Total stockholders' equity 615,466

586,865 Total liabilities and stockholders'

equity $ 4,262,885 $

3,980,769

FARMERS & MERCHANTS BANK OF LONG BEACH Income

Statements (unaudited) (in thousands)

Three Months Ended Sept. 30, Nine Months Ended

Sept. 30, 2010 2009 2010

2009 Interest income: Loans $ 29,144 $ 30,452 $

87,132 $ 91,565 Securities held to maturity 11,709 12,777 35,796

36,768 Securities available for sale 3,320 4,544 11,355 13,985

Deposits with banks 204 179 689 370

Total interest income 44,377 47,952 134,972

142,688

Interest expense: Deposits 2,379 3,596 7,780

12,587 Securities sold under agreement to repurchase 520

727 1,595 2,008 Total interest expense

2,899 4,323 9,375 14,595 Net interest income

41,478 43,629 125,597 128,093

Provision for loan losses

4,000 7,700 19,450 25,700 Net int.

income after provision for loan losses 37,478 35,929

106,147 102,393

Non-interest income: Service

charges on deposit accounts 1,264 1,444 3,833 4,404 Gains on sale

of securities - - 870 - Merchant bankcard fees 328 331 923 893

Escrow fees 276 229 602 521 Other 2,382 1,321

4,985 3,652 Total non-interest income 4,250

3,325 11,213 9,470

Non-interest expense:

Salaries and employee benefits 9,845 10,010 30,535 30,133 FDIC and

other insurance expense 1,227 1,377 3,616 5,366 Occupancy expense

1,611 1,664 4,230 4,556 Equipment expense 1,309 1,240 3,757 3,739

Other real estate owned expense, net 5,564 3,210 6,819 8,625 Legal

and professional fees 734 579 1,747 1,659 Marketing and promotional

expense 784 389 2,312 1,402 Printing and supplies 187 226 613 727

Postage and delivery 288 310 856 984 Other 641 807

3,210 3,081 Total non-interest expense 22,190

19,812 57,695 60,272 Income before income tax

expense 19,538 19,442 59,665 51,591

Income tax expense

6,882 8,006 21,971 21,018

Net

income $ 12,656 $ 11,436 $

37,694 $ 30,573 Basic and diluted earnings per

common share $ 96.66 $ 87.35 $ 287.90 $ 233.51

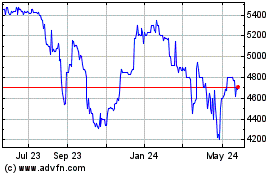

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Dec 2024 to Jan 2025

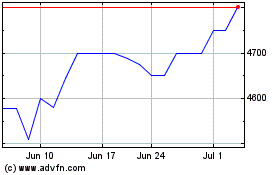

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Jan 2024 to Jan 2025