Mortgage Rates Rise Again as Fed Signals More Rate Increases

10 March 2023 - 4:29AM

Dow Jones News

By Will Feuer

Mortgage rates rose again after the Federal Reserve signaled

that it could more aggressively raise interest rates as it looks to

cool inflation, according to government-backed housing-finance

agency Freddie Mac.

In the week ending Thursday, the average rate on a 30-year

fixed-rate mortgage rose to 6.73% from 6.65% the prior week. A year

ago, the average rate was 3.85%.

The average 15-year rate rose to 5.95% from 5.89% last week,

Freddie Mac said. A year ago, the 15-year fixed-rate mortgage rate

averaged 3.09%.

"Mortgage rates continue their upward trajectory as the Federal

Reserve signals a more aggressive stance on monetary policy," said

Sam Khater, Freddie Mac's Chief Economist.

"Overall, consumers are spending in sectors that are not

interest-rate sensitive, such as travel and dining out. However,

rate-sensitive sectors, such as housing, continue to be adversely

affected," he said. "As a result, would-be home buyers continue to

face the compounding challenges of affordability and low

inventory."

Write to Will Feuer at Will.Feuer@wsj.com

(END) Dow Jones Newswires

March 09, 2023 12:14 ET (17:14 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

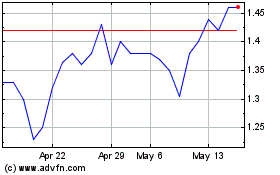

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about Federal Home Loan Mortgage Corporation (QB) (OTCMarkets): 0 recent articles

More Federal Home Loan Mortgage Corporation (QB) News Articles