0001165320

GB SCIENCES INC

false

--03-31

FY

2024

0

41,230

0

0

0.0001

0.0001

950,000,000

950,000,000

406,071,028

406,071,028

381,872,561

381,872,561

8

12

2

15

41

6

8

8

12

3

3

3

3

3

3

3

3

0.03

0.03

0.01

0.03

0.01

3

1

1

1

5

1

5

5

7

1,150,000

0.05

0

1

false

false

false

false

00011653202023-04-012024-03-31

iso4217:USD

00011653202023-09-30

xbrli:shares

00011653202024-08-30

thunderdome:item

00011653202024-03-31

00011653202023-03-31

0001165320us-gaap:NonrelatedPartyMember2024-03-31

0001165320us-gaap:NonrelatedPartyMember2023-03-31

0001165320us-gaap:RelatedPartyMember2024-03-31

0001165320us-gaap:RelatedPartyMember2023-03-31

0001165320gblx:NotesConvertibleNotesPayableAndLineOfCreditMember2024-03-31

0001165320gblx:NotesConvertibleNotesPayableAndLineOfCreditMember2023-03-31

0001165320us-gaap:ConvertibleDebtMember2024-03-31

0001165320us-gaap:ConvertibleDebtMember2023-03-31

iso4217:USDxbrli:shares

00011653202022-04-012023-03-31

0001165320us-gaap:CommonStockMember2022-03-31

0001165320us-gaap:AdditionalPaidInCapitalMember2022-03-31

0001165320us-gaap:RetainedEarningsMember2022-03-31

00011653202022-03-31

0001165320us-gaap:CommonStockMember2022-04-012023-03-31

0001165320us-gaap:AdditionalPaidInCapitalMember2022-04-012023-03-31

0001165320us-gaap:RetainedEarningsMember2022-04-012023-03-31

0001165320us-gaap:CommonStockMember2023-03-31

0001165320us-gaap:AdditionalPaidInCapitalMember2023-03-31

0001165320us-gaap:RetainedEarningsMember2023-03-31

0001165320us-gaap:CommonStockMember2023-04-012024-03-31

0001165320us-gaap:AdditionalPaidInCapitalMember2023-04-012024-03-31

0001165320us-gaap:RetainedEarningsMember2023-04-012024-03-31

0001165320us-gaap:CommonStockMember2024-03-31

0001165320us-gaap:AdditionalPaidInCapitalMember2024-03-31

0001165320us-gaap:RetainedEarningsMember2024-03-31

xbrli:pure

0001165320srt:SubsidiariesMemberus-gaap:PatentsMembercountry:US2024-03-31

0001165320srt:SubsidiariesMemberus-gaap:PatentsMemberus-gaap:NonUsMember2024-03-31

0001165320srt:SubsidiariesMembergblx:PatentsAllowedMemberus-gaap:NonUsMember2024-03-31

0001165320srt:SubsidiariesMembergblx:PatentsPendingMembercountry:US2024-03-31

0001165320srt:SubsidiariesMembergblx:PatentsPendingMemberus-gaap:NonUsMember2024-03-31

00011653202018-03-31

00011653202018-04-08

00011653202019-08-14

00011653202019-08-15

00011653202023-03-08

00011653202023-03-09

0001165320us-gaap:PatentsMembercountry:US2023-12-31

0001165320us-gaap:PatentsMemberus-gaap:NonUsMember2023-12-31

0001165320us-gaap:PatentsMembercountry:US2024-03-31

0001165320us-gaap:PatentsMemberus-gaap:NonUsMember2024-03-31

0001165320gblx:PatentsAllowedMemberus-gaap:NonUsMember2024-03-31

0001165320us-gaap:PatentsMember2023-04-012024-03-31

0001165320us-gaap:PatentsMember2022-04-012023-03-31

0001165320gblx:The0PercentNotePayableDatedOctober232017Memberus-gaap:ConvertibleNotesPayableMember2024-03-31

0001165320gblx:The6PercentNotePayableDueNovember302018Memberus-gaap:ConvertibleNotesPayableMember2024-03-31

0001165320gblx:The6PercentNotesPayableDueJanuary182022Memberus-gaap:ConvertibleNotesPayableMember2024-03-31

0001165320gblx:The6PercentNotesPayableDueJuly12022Memberus-gaap:ConvertibleNotesPayableMember2024-03-31

0001165320gblx:The6PercentNotePayableDatedSeptember302023Memberus-gaap:ConvertibleNotesPayableMember2024-03-31

0001165320gblx:The6PercentConvertibleNotePayableDatedDecember312023Memberus-gaap:ConvertibleNotesPayableMember2024-03-31

0001165320gblx:PromissoryNoteMember2024-03-31

0001165320gblx:The6ConvertibleNotePayableDueJuly302026Memberus-gaap:ConvertibleDebtMember2024-03-31

0001165320gblx:TheSecond6ConvertibleNotePayableDueJuly302026Memberus-gaap:ConvertibleDebtMember2024-03-31

0001165320gblx:The6ConvertibleNotePayableDueJanuaryToFebruary2027Memberus-gaap:ConvertibleDebtMember2024-03-31

0001165320gblx:The0PercentNotePayableDatedOctober232017Memberus-gaap:ConvertibleDebtMember2023-03-31

0001165320gblx:The6PercentNotePayableDueNovember302018Memberus-gaap:ConvertibleNotesPayableMember2023-03-31

0001165320gblx:The6PercentNotesPayableDueJanuary182022Memberus-gaap:ConvertibleNotesPayableMember2023-03-31

0001165320gblx:The6PercentNotesPayableDueJuly12022Memberus-gaap:ConvertibleDebtMember2023-03-31

0001165320gblx:The6PercentNotePayableDatedSeptember302023Memberus-gaap:ConvertibleDebtMember2023-03-31

0001165320gblx:The6ConvertibleNotePayableDueDecember312023Memberus-gaap:ConvertibleDebtMember2023-03-31

0001165320gblx:PromissoryNoteMember2023-03-31

0001165320gblx:ProductionLicenseMembergblx:NevadaMedicalMarijuanaProductionLicenseAgreementMember2017-10-23

0001165320gblx:CultivationLicenseMembergblx:NevadaMedicalMarijuanaProductionLicenseAgreementMember2017-10-23

0001165320gblx:NevadaMedicalMarijuanaProductionLicenseAgreementMember2017-10-232017-10-23

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:PromissoryNoteMember2017-10-23

utr:Y

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:PromissoryNoteMember2017-10-232017-10-23

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:PromissoryNoteMember2021-12-31

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:MembershipInterestPurchaseAgreementForSaleOfInterestInGBSciencesNopahLLCMembergblx:PromissoryNoteMember2020-08-10

0001165320gblx:AccountsPayableDueToAffiliateOfThePurchaserMembergblx:GBSciencesNopahLLCMember2021-12-142021-12-14

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:PromissoryNoteMember2022-03-04

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:PromissoryNoteMember2022-03-042022-03-04

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:PromissoryNoteMember2024-03-31

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:PromissoryNoteMember2023-03-31

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:PromissoryNoteMember2023-04-012024-03-31

0001165320gblx:March2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMember2017-03-31

0001165320gblx:March2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMemberus-gaap:CommonStockMember2017-03-012017-03-31

0001165320gblx:March2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMemberus-gaap:CommonStockMember2017-03-31

0001165320gblx:WarrantsIssuedInMarch2017ConvertibleNoteOfferingMember2017-03-012017-03-31

0001165320gblx:WarrantsIssuedInMarch2017ConvertibleNoteOfferingMember2017-03-31

0001165320gblx:March2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMember2017-05-31

0001165320gblx:March2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMember2017-03-012017-05-31

0001165320gblx:March2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMemberus-gaap:CommonStockMember2017-03-012017-05-31

0001165320gblx:WarrantsIssuedInMarch2017ConvertibleNoteOfferingMember2017-03-012017-05-31

0001165320gblx:WarrantsIssuedInMarch2017ConvertibleNoteOfferingMember2017-05-31

0001165320gblx:July2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMember2017-07-31

0001165320gblx:July2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMemberus-gaap:CommonStockMember2017-07-012017-07-31

0001165320gblx:July2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMemberus-gaap:CommonStockMember2017-07-31

0001165320gblx:WarrantsIssuedInMarch2017AndJuly2017ConvertibleNoteOfferingsMember2017-07-012017-07-31

0001165320gblx:WarrantsRelatedToJuly2017ConvertibleNoteOfferingMember2017-07-31

0001165320gblx:July2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMember2017-07-012017-07-31

0001165320gblx:July2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMember2017-12-31

0001165320gblx:July2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMember2017-07-012017-12-31

0001165320gblx:July2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMemberus-gaap:CommonStockMember2017-07-012017-12-31

0001165320gblx:WarrantsRelatedToJuly2017ConvertibleNoteOfferingMember2017-07-012017-12-31

0001165320gblx:WarrantsRelatedToJuly2017ConvertibleNoteOfferingMember2017-12-31

0001165320gblx:MarchAndJuly2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMember2022-03-31

0001165320gblx:WarrantsIssuedInMarch2017AndJuly2017ConvertibleNoteOfferingsMember2021-04-012022-03-31

0001165320gblx:WarrantsIssuedInSeptember302023ConvertibleNoteOfferingMember2022-03-31

0001165320gblx:MarchAndJuly2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleDebtMember2021-04-012022-03-31

0001165320gblx:MarchAndJuly2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleDebtMember2022-03-31

0001165320gblx:MarchAndJuly2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleDebtMember2023-04-012024-03-31

0001165320gblx:MarchAndJuly2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleDebtMember2022-04-012023-03-31

0001165320gblx:MarchAndJuly2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleDebtMember2024-03-31

0001165320gblx:MarchAndJuly2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleDebtMember2023-03-31

0001165320us-gaap:ConvertibleDebtMember2022-01-202022-01-20

0001165320us-gaap:ConvertibleDebtMember2022-01-20

0001165320us-gaap:ConvertibleDebtMember2023-04-012024-03-31

0001165320us-gaap:ConvertibleDebtMember2022-04-012023-03-31

0001165320gblx:The6ConvertibleNoteOfferingDatedDecember2020Member2020-12-18

0001165320gblx:ThreeInvestorsMembergblx:The6ConvertibleNoteOfferingDatedDecember2020Member2020-12-18

0001165320gblx:ThreeInvestorsMembergblx:The6ConvertibleNotePayableMaturityJanuary312021ToJuly12022Member2020-12-18

0001165320gblx:ThreeInvestorsMembergblx:The6ConvertibleNotePayableMatureInDecember2023Member2020-12-18

0001165320gblx:The6PercentConvertibleNotePayableIssuedWithInMoneyConversionFeaturesMember2020-04-012020-12-18

0001165320gblx:The6PercentConvertibleNotePayableIssuedWithInMoneyConversionFeaturesMember2020-12-18

0001165320gblx:The6PercentConvertibleNotePayableIssuedWithInMoneyConversionFeaturesMember2021-04-012022-03-31

0001165320gblx:The6PercentConvertibleNotePayableIssuedWithInMoneyConversionFeaturesMember2022-03-31

0001165320gblx:The6ConvertibleNoteOfferingDatedDecember2020Member2022-03-31

0001165320gblx:The6ConvertibleNoteOfferingDatedDecember2020Member2023-11-13

0001165320gblx:ConvertibleDebtConvertedToCommonSharesOutoftheMoneyMembergblx:The6ConvertibleNoteOfferingDatedDecember2020Member2023-11-12

0001165320gblx:ConvertibleDebtConvertedToCommonSharesOutoftheMoneyMembergblx:The6ConvertibleNoteOfferingDatedDecember2020Member2023-11-13

0001165320gblx:The6PercentNotePayableDueJune302026Member2023-04-012024-03-31

0001165320gblx:The6ConvertibleNotePayableDueJuly102026Member2023-04-012024-03-31

0001165320gblx:The6ConvertibleNoteOfferingDatedDecember2020Member2023-04-012024-03-31

0001165320gblx:The6ConvertibleNoteOfferingDatedDecember2020Member2022-04-012023-03-31

0001165320gblx:The6ConvertibleNoteOfferingDatedDecember2020Member2024-03-31

0001165320gblx:The6ConvertibleNoteOfferingDatedDecember2020Member2023-03-31

0001165320gblx:The6ConvertibleNotePayableDueJanuaryToFebruary2027Member2024-02-07

0001165320gblx:The6ConvertibleNotePayableDueJanuaryToFebruary2027Member2024-01-222024-02-07

0001165320gblx:WarrantsIssuedWithConvertibleNoteOfferingMember2024-02-07

0001165320gblx:WarrantsIssuedWithConvertibleNoteOfferingMember2024-01-222024-02-07

0001165320us-gaap:TaxYear2018Member2023-04-012024-03-31

0001165320us-gaap:TaxYear2021Member2023-04-012024-03-31

0001165320gblx:WarrantsIssuedToInvestorMember2023-04-012024-03-31

0001165320gblx:WarrantsIssuedToInvestorMember2024-03-31

0001165320gblx:WarrantsAtExercisePriceOf010Member2023-04-012024-03-31

0001165320gblx:WarrantAtExercisePriceOf006Member2023-04-012024-03-31

0001165320gblx:WarrantAtExercisePriceOf004Member2023-04-012024-03-31

0001165320gblx:WarrantsMember2023-04-012024-03-31

0001165320us-gaap:PrivatePlacementMember2022-05-092022-05-09

0001165320us-gaap:PrivatePlacementMember2022-05-09

0001165320gblx:WarrantsIssuedToInvestorsInPrivatePlacementsMember2022-05-09

0001165320gblx:WarrantsIssuedToInvestorsInPrivatePlacementsMember2022-09-30

0001165320us-gaap:PrivatePlacementMember2022-09-092022-09-09

0001165320us-gaap:PrivatePlacementMember2023-04-012024-03-31

0001165320gblx:WarrantsIssuedToInvestorsInPrivatePlacementsMember2023-04-012024-03-31

0001165320gblx:WarrantsIssuedToInvestorsInPrivatePlacementsMember2024-03-31

0001165320gblx:CompensationWarrantsMember2023-04-012024-03-31

0001165320gblx:CompensationWarrantsMember2024-03-31

0001165320gblx:CompensationWarrantsMemberus-gaap:MeasurementInputExercisePriceMember2022-12-31

0001165320srt:MinimumMember2022-04-012023-03-31

0001165320srt:MaximumMember2022-04-012023-03-31

0001165320srt:MinimumMember2023-04-012024-03-31

0001165320srt:MaximumMember2023-04-012024-03-31

0001165320us-gaap:RestrictedStockMembergblx:GBSciencesInc2007AmendedStockOptionPlanMember2008-02-06

0001165320us-gaap:EmployeeStockOptionMembergblx:The2014EquityCompensationPlanMember2015-06-30

0001165320gblx:GbSciencesInc2018StockPlanMember2018-10-25

0001165320gblx:The2021EquityIncentivePlanMember2021-09-17

0001165320gblx:The2021EquityIncentivePlanMember2023-03-31

0001165320us-gaap:EmployeeStockOptionMember2022-08-252022-08-25

0001165320us-gaap:ShareBasedPaymentArrangementEmployeeMember2023-04-012024-03-31

0001165320us-gaap:ShareBasedPaymentArrangementNonemployeeMember2023-04-012024-03-31

0001165320srt:ExecutiveOfficerMember2023-04-012024-03-31

0001165320gblx:SharebasedPaymentArrangementOptionsAndWarrantsMember2023-04-012024-03-31

0001165320gblx:SharebasedPaymentArrangementOptionsAndWarrantsMember2022-04-012023-03-31

0001165320us-gaap:RestrictedStockMember2023-04-012024-03-31

0001165320us-gaap:RestrictedStockMember2022-04-012023-03-31

0001165320us-gaap:EmployeeStockOptionMember2023-04-012024-03-31

0001165320us-gaap:EmployeeStockOptionMember2022-04-012023-03-31

0001165320us-gaap:ShareBasedPaymentArrangementEmployeeMember2021-03-31

0001165320us-gaap:ShareBasedPaymentArrangementEmployeeMember2021-04-012022-03-31

0001165320us-gaap:ShareBasedPaymentArrangementEmployeeMember2022-03-31

0001165320us-gaap:ShareBasedPaymentArrangementEmployeeMember2022-04-012023-03-31

0001165320us-gaap:ShareBasedPaymentArrangementEmployeeMember2023-03-31

0001165320us-gaap:ShareBasedPaymentArrangementEmployeeMember2024-03-31

0001165320us-gaap:ShareBasedPaymentArrangementNonemployeeMember2021-03-31

0001165320us-gaap:ShareBasedPaymentArrangementNonemployeeMember2021-04-012022-03-31

0001165320us-gaap:ShareBasedPaymentArrangementNonemployeeMember2022-03-31

0001165320us-gaap:ShareBasedPaymentArrangementNonemployeeMember2022-04-012023-03-31

0001165320us-gaap:ShareBasedPaymentArrangementNonemployeeMember2023-03-31

0001165320us-gaap:ShareBasedPaymentArrangementNonemployeeMember2024-03-31

0001165320us-gaap:PurchaseCommitmentMember2024-03-31

0001165320srt:ChiefExecutiveOfficerMember2024-03-31

0001165320srt:ChiefExecutiveOfficerMember2023-04-012024-03-31

0001165320gblx:PresidentAndDirectorMember2024-03-31

0001165320gblx:NevadaSubsidiariesMember2020-03-242020-03-24

0001165320gblx:TecoSubsidiariesMember2020-03-242020-03-24

0001165320gblx:TecoSubsidiariesMember2020-03-24

0001165320gblx:GBSciencesNopahLLCMember2019-11-272019-11-27

0001165320gblx:GBSciencesNopahLLCMember2020-08-102020-08-10

0001165320gblx:GBSciencesNopahLLCMember2020-08-102020-08-10

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:PromissoryNoteMember2020-08-10

0001165320gblx:AccountsPayableDueToAffiliateOfThePurchaserMembergblx:GBSciencesNopahLLCMember2021-12-312021-12-31

0001165320gblx:GBSciencesNopahLLCMember2021-12-312021-12-31

0001165320gblx:GBSciencesNopahLLCMember2021-04-012021-12-31

0001165320gblx:GBSciencesNopahLLCMember2021-12-31

0001165320gblx:GBSciencesNopahLLCMember2022-03-31

0001165320gblx:GBSciencesNopahLLCMember2021-04-012022-03-31

0001165320gblx:GBSciencesNopahLLCMember2021-04-112022-03-31

0001165320gblx:GBSciencesNopahLLCMember2023-03-27

0001165320gblx:GBSciencesNopahLLCMember2023-03-272023-03-27

0001165320gblx:GBSciencesNopahLLCMember2023-04-012024-03-31

0001165320gblx:ConvertiblePromissoryNoteMembersrt:ScenarioForecastMember2024-07-012024-07-01

0001165320gblx:ConvertiblePromissoryNoteMembersrt:ScenarioForecastMember2024-07-01

0001165320us-gaap:WarrantMembersrt:ScenarioForecastMember2024-07-012024-07-01

0001165320us-gaap:WarrantMembersrt:ScenarioForecastMember2024-07-01

0001165320gblx:NevadaSubsidiariesMember2023-04-012024-03-31

Table of Contents

FORM 10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended March 31, 2024

| ☐ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT |

For the transition period from __________ to ___________

Commission file number: 000-55462

GB SCIENCES, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 59-3733133 |

| (State or other Jurisdiction of | (IRS Employer I.D. No.) |

| Incorporation or Organization) | |

9205 W. Russell Road, Suite 240

Las Vegas, Nevada 89148

Phone: (866) 721-0297

(Address and telephone number of

Principal executive offices)

Securities registered under Section 12 (b) of the Exchange Act:

| Title of each class | | Name of each exchange on which registered |

| None | | None |

Securities registered under Section 12(g) of the Exchange Act:

| Common Stock $.0001 Par Value | |

| Title of Class | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer", "accelerated filer", "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.).

| | Large accelerated filer ☐ | Accelerated filer ☐ |

| | Non-accelerated filer ☐ | Smaller reporting company ☑ |

| | | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act). Yes ☐ No ☑

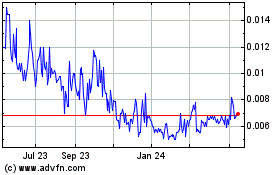

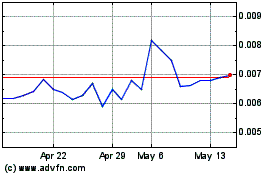

The aggregate market value of the voting stock held by non-affiliates of the registrant computed by reference to the price at which the common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter, that being September 30, 2023, was approximately $4 million.

Total shares outstanding on August 30, 2024, were 407,071,028

Documents Incorporated by Reference

None

GB SCIENCES, INC.

FORM 10-K

TABLE OF CONTENTS

PART I

DISCLOSURE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K of GB Sciences, Inc., a Nevada corporation and its subsidiaries (the “Company”), contains “forward-looking statements,” as defined in the United States Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “could”, “expects”, “plans”, “intends”, “anticipates”, believes”, “estimates”, “predicts” or “continue”, which list is not meant to be all-inclusive, and other such negative terms and comparable technology. These forward-looking statements, include, without limitation, statements about market opportunity, strategies, competition, expected activities and expenditures as we pursue business our plan, and the adequacy of available cash reserves. Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Actual results may differ materially from the predictions discussed in these forward-looking statements. The economic environment within which we operate could materially affect actual results. Additional factors that could materially affect these forward-looking statements and/or predictions include among other things:

(i) product demand, market and customer acceptance of any or all of the Company’s products, equipment and other goods,

(ii) ability to obtain financing to expand its operations,

(iii) ability to attract and retain qualified personnel,

(iv) the results, cost and timing of our preclinical studies and clinical trials, including any delays to such clinical trials relating to enrollment or site initiation, as well as the number of required trials for regulatory approval and the criteria for success in such trials,

(v) our dependence on third parties in the conduct of our preclinical studies and clinical trials,

(vi) legal and regulatory developments in the United States and foreign countries, including any actions or advice that may affect the design, initiation, timing, continuation, progress or outcome of clinical trials or result in the need for additional clinical trials,

(vii) the results of our preclinical studies and earlier clinical trials of our product candidates may not be predictive of future results and we may not have favorable results in our ongoing or planned clinical trials,

(viii) the difficulties and expenses associated with obtaining and maintaining regulatory approval of our product candidates, and the indication and labeling under any such approval,

(ix) our plans and ability to develop and commercialize our product candidates,

(x) successful development of our commercialization capabilities, including sales and marketing capabilities, whether alone or with potential future collaborators,

(xi) the size and growth of the potential markets for our product candidates, the rate and degree of market acceptance of our product candidates and our ability to serve those markets,

(xii) the success of competing therapies and products that are or become available,

(xiii) our ability to limit our exposure under product liability lawsuits, shareholder class action lawsuits or other litigation,

(xiv) our ability to obtain and maintain intellectual property protection for our product candidates,

(xv) our ability to obtain and maintain third-party manufacturing for our product candidates on commercially reasonable terms,

(xvi) delays, interruptions or failures in the manufacture and supply of our product candidates,

(xvii) the performance of third parties upon which we depend, including third-party contract research organizations, or CROs, contract manufacturing organizations, or CMOs, contractor laboratories and independent contractors,

(xviii) the timing and outcome of current and future legal proceedings,

(xix) our ability to maintain proper functionality and security of our internal computer and information systems and prevent or avoid cyberattacks, malicious intrusion, breakdown, destruction, loss of data privacy or other significant disruption,

(xx) the adequacy of capital reserves and liquidity including, but not limited to, access to additional borrowing capacity,

(xxi) the extent to which health epidemics and other outbreaks of communicable diseases, including the ongoing COVID-19 pandemic, could disrupt our operations or materially and adversely affect our business and financial conditions, and

(xxii) general industry and market conditions and growth rates, unexpected natural disasters, and other factors, which we have little or no control: and any other factors discussed in the Company’s filings with the Securities and Exchange Commission (“SEC”).

You should refer to Part I Item 1A. “Risk Factors” of this Annual Report on Form 10-K for a discussion of material factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Annual Report on Form 10-K will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

You should read this Annual Report on Form 10-K and the documents that we reference in this Annual Report on Form 10-K and have filed as exhibits to this Annual Report on Form 10-K completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

ITEM 1. DESCRIPTION OF BUSINESS

Unless the context indicates otherwise, all references to “GB” and “GB Sciences” refers solely to GB Sciences, Inc., a Nevada corporation, and all references to “the Company,” “we”, “us” or “our” in this Annual Report refers to GB Sciences and its consolidated subsidiaries.

Overview

GB Sciences, Inc. (“the Company”, “GB Sciences”, “we”, “us”, or “our”) is a plant-inspired, biopharmaceutical research and development company creating patented, disease-targeted formulations of cannabis- and other plant-inspired therapeutic mixtures for the prescription drug market through its wholly owned Canadian subsidiary, GbS Global Biopharma, Inc. (“GBSGB”).

Through GBSGB, the Company is engaged in the research and development of plant-inspired medicines, with virtual operations in North America and Europe. GBSGB’s assets include a portfolio of intellectual property containing both proprietary plant-inspired formulations and our AI-enabled drug discovery platform, as well as critical research contracts and key supplier arrangements. The Company’s intellectual property portfolio, which is held by GBSGB, contains eight U.S. and twelve foreign patents issued, two foreign patents allowed, as well as fifteen U.S. and forty-one foreign patent-pending applications.

Within the past year, the number of issued patents owned by the Company has increased significantly. Prior to March 30, 2023, the company had six U.S. and eight foreign patents issued for the protection of its plant-inspired drug formulations in the U.S. and global markets. As of now, the Company has eight U.S. and twelve foreign patents issued, as well as two foreign patents allowed (issuing soon). Our continued success in having our patents granted validates our novel strategy of protecting simplified ratio-controlled mixtures of natural compounds that treat diseases for which there is a great need for more effective therapies.

The Company has received interest in and is reviewing options for monetizing its proprietary PhAROS™ drug discovery platform. PhAROS™, which stands for Phytomedical Analytics for Research Optimization at Scale, is an AI-enabled drug discovery tool that harnesses the therapeutic potential of plant-based medicines from within the 12 major traditional medical systems (TMS) in the world. PhAROS™, can discover and predict entirely new drug candidates from within these TMS in the form of proprietary minimum essential mixtures that are simplified but informed by the much more complex original plant-based materials. The Company’s innovative technology uses machine learning to describe how multi-component plant-based medicines have been effective as therapies for thousands of years and, more importantly, to predict new and better possible drug candidates using generative AI. PhAROS™ not only captures what has worked in the past, but also improves upon traditional medical formulations by identifying novel simple mixtures of active ingredients that work synergistically together to treat human diseases. These novel mixtures often include components from different plants growing on different continents in different TMS that may never before have been used together. PhAROS™ goes beyond looking at what has worked within plant-based medicines in the past, to predicting the efficacies of entirely new formulations that have not existed anywhere except within the digital world of generative AI. The Company has patent applications under review in the U.S. and globally to protect its PhAROS™ drug discovery platform. The Company’s PhAROS™ platform is both novel and patent-pending. Prior art searches performed by the World Intellectual Property Organization (WIPO) demonstrated the novelty of the Company’s approach to using a neural-network based machine learning process to describe, categorize, and predict novel multi-component drug candidates based on a unique data base containing searchable tabulations of plant-based therapies from over a dozen traditional medical systems. In addition, Gb Sciences is working collaboratively with other parties to utilize a similar digital strategy that leverages data science, AI and ML for informed drug discovery and innovative human health solutions.

The Company’s intellectual property covers a range of over 65 medical conditions, from which five drug development programs are in the preclinical stage of drug development including our formulations for Parkinson’s disease ("PD"), chronic pain, cytokine release syndrome, stress/anxiety/depression, and cardiovascular therapeutic programs. The primary focus for the development of the Company’s lead program this year has been in evaluating suitable development partners that will assist us in preparing its cannabinoid-based formulas for the treatment of the motor symptoms of Parkinson's disease for a first-in-human clinical trial. Talks with multiple potential licensing partners are ongoing and remain promising to help support the development of our Parkinson’s disease therapy. Depending on the results of ongoing preclinical studies for our other therapy programs, the Company intends to move our drug development forward towards clinical trials for its proprietary treatments for chronic pain, stress/anxiety, and cytokine release syndrome therapies after PD.

In the period from March 30, 2023 to now, the Company received positive results from five different preclinical trials. These important studies support the viability of its novel therapeutic programs. In July of 2023, the Company announced that they have successfully completed a dose response study in rodents at the University of Lethbridge that supports the Company’s cannabinoid-based therapy for Parkinson’s disease. The study has established dose ranges and the corresponding times to onset and duration of action in a rodent model, which helps to establish the correct dosing of the Company’s cannabinoid-containing Parkinson’s formulations for a first-in-human trial. In addition to the dosage range findings, this study demonstrated that the Company’s Parkinson’s disease formulations were well tolerated, and there were no adverse effects. As the second most common neurodegenerative disease, the market for Parkinson’s disease (PD) treatments is expected to grow to $12.8 billion by 2028.

During the period from March 30, 2023 to now, the Company’s formulations for chronic pain, anxiety and depression have been evaluated in preclinical animal studies with researchers at the National Research Council (NRC) Canada. Drug candidates originally identified by PhAROS™ have now been validated in these preclinical animal studies at the NRC. Two preclinical studies at the University of Seville were completed this year. One evaluated the effectiveness of our extended-release formulas for chronic pain and showed positive results in preclinical cell models. The other validated the stability (shelf-life) of these nanoparticle-based and extended-release formulas for chronic pain. This shelf-life study demonstrated significant stability under defined storage conditions.

Previously, the Company received positive preclinical proof-of-concept data supporting its complex mixtures for the treatment of Cytokine Release Syndrome, and its lead candidates will be optimized based on late-stage preclinical studies at Michigan State University. Proof-of-concept studies in animals that support our heart disease formulations have been successfully completed at the University of Hawaii. The Company runs a lean drug development program through GBSGB and takes effort to minimize expenses, including personnel, overhead, and fixed capital expenses through strategic partnerships with Universities and Contract Research Organizations (“CROs”). Our productive research and development network includes distinguished universities, hospitals, and Contract Research Organizations.

We were incorporated in the State of Delaware on April 4, 2001, under the name “Flagstick Venture, Inc.” On March 28, 2008, stockholders owning a majority of our outstanding common stock approved changing our then name “Signature Exploration and Production Corp.” as our business model had changed.

On April 4, 2014, we changed our name from Signature Exploration and Production Corporation to Growblox Sciences, Inc. Effective December 12, 2016, the Company amended its Certificate of Corporation pursuant to shareholder approval, and the Company’s name was changed from Growblox Sciences, Inc. to GB Sciences, Inc.

Effective April 8, 2018, Shareholders of the Company approved the change in corporate domicile from the State of Delaware to the State of Nevada and increase in the number of authorized capital shares from 250,000,000 to 400,000,000. Effective August 15, 2019, Shareholders of the Company approved an increase in authorized capital shares from 400,000,000 to 600,000,000. Effective March 09, 2023, Shareholders of the Company approved an increase in authorized capital shares from 600,000,000 to 950,000,000.

Business Strategy

Drug Discovery and Development of Novel Cannabis- and Other Plant-Inspired Therapies

Through its wholly owned Canadian subsidiary, GBS Global Biopharma, Inc. ("GBSGB"), the Company has conducted ground-breaking research embracing the rational design of plant-inspired medicines led by Dr. Andrea Small-Howard, the Company’s Chief Executive Officer, Interim Chief Financial Officer and Chairman of the Board. In the early days, Small-Howard and Dr. Helen Turner, Vice President of Innovation and Dean of the Natural Sciences and Mathematics Department at Chaminade University, posited that minimum essential mixtures of plant-based ingredients would provide more targeted and effective treatments for specific disease conditions than either single ingredient or whole plant formulations. They started with cannabis-based drug discovery and developed a rapid screening and assaying system that tested thousands of combinations of cannabinoids and terpenes in vitro against cell-based models of disease. This process identified precise mixtures of cannabinoids and terpenes, many of which contained no THC, to treat categories of disease conditions, including neurological disorders, inflammation, heart disease, metabolic syndrome, and chronic neuropathic pain. More recently, a similar approach has been applied to the discovery and validation of therapies informed by plants described in a variety of Traditional Medical Systems. These rich discovery efforts have yielded new preclinical programs; for example, our anxiety and depression formulations that contain minimum essential mixtures of compounds derived from plants in the Piper plant family, such as kava.

In 2014, the Company developed its first rapid screening and assaying system which tested thousands of combinations of cannabinoids and terpenes against cell-based models of diseases. This process has been refined over the years and now has identified precise mixtures of cannabinoids and terpenes, many of which contained no THC, to treat categories of disease conditions, including neurological disorders, inflammation, heart disease, metabolic syndrome, chronic and neuropathic pain. Through GBSGB, the Company has filed for patent protection on these plant-inspired, minimum essential mixtures, and they are validating them in disease-specific animal models in preparation for human trials.

The Company’s current drug discovery process combines: 1) PhAROS™: Phytomedical Analytics for Research Optimization at Scale for the prediction of minimum essential mixtures from plant-based materials, and 2) HTS: high throughput screening to refine and validate plant-inspired, minimum essential mixtures in well-established cell and animal models of diseases. This combined approach to drug discovery increases research efficiency and accuracy reducing the time from ideation to patenting from 7 years to 1.5 years.

The Company now uses its PhAROS™ Drug Discovery Platform to ‘pre-validate’ therapeutic mixtures. PhAROS can both prioritize and eliminate some potential combinations, which reduces time and resources used in the discovery period. PhAROS™ can also be used to identify and predict the efficacy of novel plant-inspired, minimum essential mixtures for specific diseases in silico, which are then tested by screening in cell and animal models. Screening of plant-inspired mixtures for drug discovery involves the testing of specific combinations of plant chemicals from many naturally occurring plants and the use of live models for these diseases that have been well established by other researchers. The Company refines the potential therapeutic mixtures pre-validated by PhAROS™ to optimize their effectiveness using cell and animal models. Based on data from disease-specific assays, therapeutic formulations are refined during the HTS screening process by removing compounds that do not act synergistically with the others in the mixtures. The goal is to identify minimum essential mixtures (MEM) that retain the efficacy of the whole plant extracts, but with the manufacturing and quality control advantages of single ingredient pharmaceutical products.

Recently, the Company has received positive preclinical results supporting the efficacy of its proprietary formulas designed for the treatment of stress and anxiety, which were obtained as a part of its preclinical study of kava-inspired formulations for the treatment of anxiety or depression. The Company is addressing the growing need for anxiety and depression medications with non-psychedelic kava-based formulations. As mental health disorders increasingly impact global populations, Gb Sciences is developing psychotropic but non-psychedelic treatments for anxiety and depression that compete with the emerging billion-dollar psychedelic companies. Gb Sciences’ psychotropic kava-inspired formulas enhance mood, but they do not have potentially unwanted psychedelic side-effects. The National Research Council of Canada (“NRC”) tested the Company’s proprietary, psychotropic plant-based formulas for the treatment of depression and anxiety. For these novel psychotropic drug candidates, the Company used their AI-enabled PhAROS™ platform to identify new ingredients to improve upon an initial formulation for anxiety based on traditional medicine. The original plant mixture was derived from the kava plant, but some elements of kava are thought to cause liver toxicity. PhAROS™ identified ingredients from the Piper plant family as a substitute for the functionality of the ingredients in question without the potentially adverse safety profiles of those original ingredients. The Piper plant family includes pepper plants that are used worldwide in traditional medicines. The Company’s novel psychotropic formulations have been tested in preclinical trials at the Zebrafish Toxicology, Genomics and Neurobiology Lab at the NRC, led by Dr. Lee Ellis, Research Officer and Team Lead. This study has yielded multiple potential therapies for stress and anxiety. Some of those novel therapies are single ingredients, but more of them are either combination therapies containing two ingredients or three ingredients that work better when combined than alone. One of the striking things about this study is the very high hit rate of positive results from these drug candidates that were discovered using PhAROS™. These potential therapies have now been included in our growing intellectual property portfolio.

The U.S. Patent and Trademark Office allows complex mixtures to be claimed as Active Pharmaceutical Ingredients ("APIs"). Through GBSGB, the Company has eight issued patents, plus 15 patents-pending protecting plant-derived complex mixtures and minimum essential mixtures that act as therapeutic agents for specific disease categories, as described below. The Company also has twelve issued foreign patents, two foreign patents that are allowed; as well as forty-one foreign patent-pending applications. Our continued success in having our patents granted validates our novel strategy of protecting simplified ratio-controlled mixtures of natural compounds that treat diseases for which there is a great need for more effective therapies.

Within the past year, the number of issued patents owned by the Company has increased significantly. Prior to March 30, 2023, the company had six U.S. and eight foreign patents issued for the protection of its plant-inspired drug formulations in the U.S. and global markets. As of now, the Company has eight U.S. and twelve foreign patents issued, as well as two foreign patents allowed (issuing soon). Two of our domestic and six of the Company’s foreign patents for plant-based treatments of serious disorders were allowed or issued in different countries, expanding our patent protections as follows.

On June 28, 2023, the Israeli patent was issued on the Company’s Cannabinoid- Containing Complex Mixtures for the treatment of Parkinson’s disease. On April 24, 2024, the Company’s European patent was issued for its Cannabinoid-Containing Complex Mixtures for the treatment of Parkinson’s disease. On April 24, 2024, the Company received the Notice of Allowance for its Hong Kong (HK) Patent for its Cannabinoid-Containing Complex Mixtures for Parkinson’s disease. On May 4, 2024, an additional US Patent was issued by the USPTO for the Company’s Cannabinoid-Containing Complex Mixtures with refined formulations to be used in the treatment of Parkinson’s disease. On September 27, 2023, the European Patent was issued protecting the Company’s Cannabinoid-Containing Complex Mixtures for the treatment of Mast Cell Activation Syndrome (MCAS). MCAS is a severe immunological condition in which mast cells inappropriately and excessively release inflammatory mediators, resulting in a range of severe chronic hyperinflammatory symptoms and life-threatening anaphylaxis attacks. On April 24, 2024, the Company received the Notice of Allowance for its Hong Kong (HK) Patent for GbS’ Cannabinoid-Containing Complex Mixtures for the treatment of MCAS. On September 7th of 2023, the Australian patent was issued for the Company’s Myrcene-Containing Complex Mixtures (MCCM) for use in the treatment of pain related to arthritis, shingles, irritable bowel syndrome, sickle cell disease, and endometriosis. On April 2, 2024, the Company’s second patent issuance by the USPTO protects the use of its MCCM in the treatment of cardiac hypertrophy, overactive bladder, and refractory chronic cough.

On February 3, 2023, GB Sciences’ first foreign patent protecting its proprietary cannabinoid-based formulations for Parkinson’s disease was issued in China. China is an increasingly important pharmaceutical market with cultural acceptance of plant-based formulations, which is a good fit for GB Sciences’ drug candidates. The global market for treatments of Parkinson’s disease is projected to grow to $8.8 billion by the year 2026, and new therapies to address Parkinson’s disease symptoms are greatly needed. On February 20, 2023, the Japanese patent was issued for the use of GbS’ Cannabinoid-Containing Complex Mixtures in the treatment of Parkinson’s disease. On February 10, 2023, the Japanese (JP) Patent was issued, protecting the Company’s Cannabinoid-Containing Complex Mixtures for the treatment of Mast Cell Activation Syndrome (MCAS). On March 2, 2023, the Israeli (IL) Patent was issued, protecting our Cannabinoid-Containing Complex Mixtures for the treatment of MCAS. On March 30, 2023, the Australian (AU) Patent was issued, protecting our Cannabinoid-Containing Complex Mixtures for the treatment of MCAS.

In 2021, our growing intellectual property portfolio was augmented with additional patent-protections for our PhAROS™ drug discovery platform that were filed in July of 2021 and in October of 2021. The Company, through GBSGB, also filed for protection of new PhAROS™ discovered, non-cannabis formulations in July of 2021. In September of 2021, the Company filed a patent application for the Company’s improved DCR-MEM formulations for our PD therapeutic program. These new patent applications expanded upon the solid foundation of intellectual property developed over the past six years.

In 2020, the three patents which protect formulations for the Company’s lead therapeutic programs were issued by the USPTO. The issuance of U.S. Patent No. 10,653,640 entitled "Cannabinoid-Containing Complex Mixtures for the Treatment of Neurodegenerative Diseases" on May 19, 2020 protects methods of using the Company’s proprietary cannabinoid-containing complex mixtures (CCCM™) for treating Parkinson’s Disease. This was an important milestone in the development of these vitally important therapies and validates GBSGB’s drug discovery platform. In the US alone, the combined direct and indirect costs associated with Parkinson’s disease are estimated at $52 billion, and new therapies to address Parkinson’s disease symptoms are greatly needed. This was also the first time that a US patent has been awarded for a cannabis-based complex mixture defined using this type of drug discovery method. The first US patent for PD therapies validated our drug discovery platform and strengthened our intellectual property portfolio of unique CCCM’s™, each targeting one of up to 60 specific clinical applications.

The issuance of the Company’s second and third US patents for active pharmaceutical ingredients that are complex mixtures identified by our biotech platform further confirmed that the Company’s pharmaceutical compositions can be patent protected for use as biopharmaceutical and nutraceutical products. The US Patent entitled “Myrcene-Containing Complex Mixtures Targeting TRPV1” protects methods of using our proprietary MEMs for the treatment of pain disorders related to arthritis, shingles, irritable bowel syndrome, sickle cell disease, and endometriosis. In the US alone, chronic pain represents an estimated health burden of between $560 and $650 billion dollars, and an estimated 20.4% of U.S. adults suffer from chronic pain that significantly decreases their quality of life. Despite the widespread rates of addiction and death, opioids remain the standard of care treatment for most people with chronic pain. The Company believes that it is important to create safer, less addictive alternatives to opioids for the treatment of chronic pain disorders, like GBSGB’s myrcene-containing MEMs.

The Company's third issued US Patent entitled "Cannabinoid-Containing Complex Mixtures for the Treatment of Mast-Cell-Associated or Basophil-Mediated Inflammatory Disorders" protects methods of using the Company’s proprietary MEMs for treating Mast Cell Activation Syndrome (MCAS). MCAS is a severe immunological condition in which mast cells inappropriately and excessively release inflammatory mediators, resulting in a range of severe chronic hyperinflammatory symptoms and life-threatening anaphylaxis attacks. Receiving this patent for the treatment of MCAS using our MEMs is an important milestone in the development of this urgently needed medicine. There is no single recommended treatment for MCAS patients. Instead, they attempt to manage MCAS symptoms primarily by avoiding ‘triggers’ and using rescue medicines for their severe hyperinflammatory attacks. Therefore, MCAS patients need new therapeutic options to control their mast cell related symptoms, and our MEMs were designed to simultaneously control multiple inflammatory pathways within mast cells as a comprehensive treatment option. The Company is strategically targeting MCAS for two additional reasons. By focusing on a rare disease with no known cure, our company can apply for the U.S. Food and Drug Administration’s expedited approval process, which allows clinically successful treatments to get to market both quicker and more cost effectively. Gaining approval from the US FDA for the entire anti-inflammatory market would be extremely time consuming and cost prohibitive. Demonstrating that our MEMs are safe for the treatment of MCAS would favorably position our Company for clinical testing of these MEMs as potential treatments for other related inflammatory disorders, such as inflammatory bowel disease, thereby widening the target market and drastically shortening the development cycle and costs.

The Company’s fourth US Patent was issued on March 1, 2022 for a cannabinoid-containing mixture designed to treat cardiac hypertrophy, often present in advanced heart disease. Gb Sciences’ newly issued patent also covers the use of these receptor-targeted formulations for the treatment of TRPV1-receptor associated hearing loss and urinary cystitis. Despite multiple categories of prescription heart medications on the market, heart disease remains the leading cause of death in the United States for people of most racial and ethnic groups. Alternative therapeutic approaches are still needed, especially for the treatment of advanced heart disease. The market for prescription heart disease medications is predicted to rise to $64 billion dollars in the US by 2026, with future market growth fueled by innovative new therapeutic approaches.

Drug Development Progress

In the period from March 30, 2023 to now, the Company has received positive results from five different preclinical trials. These important studies support the viability of its novel therapeutic programs. In June of 2023, the Company received the final report from its colleagues at the University of Lethbridge, which contained the results and conclusions from its completed dose response study in rodents that supports the Company’s cannabinoid-based therapy for Parkinson’s disease. During the period from March 30, 2023 to now, the Company’s formulations for chronic pain, anxiety and depression have been evaluated in preclinical animal studies with researchers at the National Research Council (NRC) Canada. Drug candidates originally identified by PhAROS™ have now been validated in these preclinical animal studies at the NRC. Two preclinical studies at the University of Seville were completed this year. One evaluated the effectiveness of our extended-release formulas for chronic pain and showed positive results in preclinical cell models. The other validated the stability (shelf-life) of these nanoparticle-based extended-release formulas for chronic pain and this study demonstrated significant stability under defined storage conditions. Previously, the Company received positive preclinical proof-of-concept data supporting its complex mixtures for the treatment of Cytokine Release Syndrome, and its lead candidates will be optimized based on late-stage preclinical studies at Michigan State University. Proof-of-concept studies in animals that support our heart disease formulations have been successfully completed at the University of Hawaii.

For its lead program in PD therapeutics, the Company’s primary focus for this year has been in evaluating suitable development partners that will assist us in preparing the lead program for a first-in-human clinical trial testing the Company’s treatment for the motor symptoms of Parkinson's disease. Talks with multiple potential licensing partners are ongoing and remain promising to help support the development of its Parkinson’s disease therapy. In July of 2023, the Company announced that they have successfully completed a preclinical, dose response study in rodents at the University of Lethbridge that supports the Company’s cannabinoid-based therapy for Parkinson’s disease. The study has established dose ranges and the corresponding times to onset and duration of action in a rodent model, which helps to establish the correct dosing of the Company’s cannabinoid-containing Parkinson’s formulations for a first-in-human trial. In addition to the dosage range findings, this study demonstrated that the Company’s Parkinson’s disease formulations were well tolerated, and there were no adverse effects. These important preclinical results will be included in the Company’s Investigational New Drug ("IND") application with the US FDA to enter human clinical trials as soon as possible. New therapies to address Parkinson’s disease symptoms are needed to help those afflicted with this debilitating disease. The combined direct and indirect costs associated with Parkinson’s disease are estimated at $52 billion in the U.S. alone.

In August of 2023, we successfully completed a stability study validating the clinical prototypes for our top three performing cannabinoid-containing Parkinson’s formulations with Catalent Pharma, Inc. based on incorporating our proprietary cannabinoid formulations for Parkinson’s disease into Catalent Pharma’s proprietary Zydis® delivery system. Catalent Pharma’s Zydis® delivery system is an Orally Disintegrating Tablet format (“ODT”) that should be ideal for delivering our cannabinoid-ratio controlled formulations to Parkinson’s patients. More than 50% of Parkinson’s patients have trouble swallowing, but the Zydis® format delivers the active ingredients into the mouth by dispersion without needing water or the ability to swallow. To ready the Company’s Parkinson’s disease therapies for a first-in-human trial, the initial clinical prototypes of our Defined Cannabinoid Ratio-Minimum Essential Mixtures (DCR-MEM) have been formulated by Catalent Pharma using Catalent’s Zydis® Orally Disintegrating Tablet technology and they have passed a stability test within the desired range for shelf-life. As mentioned above, the ODT format was selected for the PD formulas because it dissolves on the tongues of patients without the need to swallow for ease of use in patients with PD, who often have difficulties with swallowing. Previously, the Company has completed two proof-of-concept studies for its MEM. Now, the Company has completed both the Stability Study and a Feasibility Study that has produced the clinical prototypes for its DCR-MEM. The Company selected Catalent for the delivery of their PD therapies due to Catalent’s prior experience in working on US FDA-approved, cannabinoid-containing drugs, their Schedule I drug manufacturing facilities, their familiarity with US FDA and international regulatory and manufacturing requirements, their expertise in tackling formulation challenges, and their ability to achieve the stability and dosing necessary for these novel therapeutic mixtures. In addition to its Zydis® technology, Catalent has early drug development services and additional oral drug delivery solutions available for the efficient delivery of the Company's proprietary APIs. The Company has identified a Contract Research Organization that will perform the required testing to support our IND filing. In the IND application for our novel Parkinson’s disease therapy, this testing data will be combined with the Chemistry Manufacturing and Controls (CMC) data prepared by Catalent Pharma and our proof-of-concept data (National Research Council Canada and the University of Lethbridge).

For its chronic pain program, the Company is testing its proprietary Minimum Essential Mixtures (MEM) for chronic pain both as encapsulated, time-released nanoparticles, as well as in non-encapsulated forms of these therapeutic mixtures in an animal model at the NRC in Halifax, Nova Scotia. In preparation for human clinical trials, our standard MEM and the nanoparticle-encapsulated, time-released MEM are currently being compared in an animal model that demonstrates their potential effectiveness at treating chronic pain. The early results from this preclinical research project look very promising. Data from these preclinical animal studies have demonstrated that the proprietary nanoparticle delivery method significantly increases the stability of the active terpenes within these formulas relative to the non-encapsulated active ingredients. Terpenes are small aromatic compounds, which are very volatile. The nanoparticles both act as a ‘molecular cage’ preventing the active terpene molecules from floating away and the time-release aspects of the proprietary nanoparticle delivery allow for prolonged activity, which is ideally suited for treating chronic pain.

For our chronic pain nanoparticles, two preclinical studies were completed this year at the University of Seville in Spain. One evaluated the effectiveness of our nanoparticle-encapsulated, extended-release formulas for chronic pain and showed positive results in preclinical cell models. The other study completed at the University of Seville validated the stability (shelf-life) of these nanoparticle-based extended-release formulas for chronic pain. This shelf-life study demonstrated significant stability under defined storage conditions. These results were especially important as having an effective and stable delivery system is incredibly important in the delivery of the active ingredients, and it makes these active ingredients much more suitable for the treatment of chronic pain by extending the stability of the molecule and ensuring continuous delivery overtime, which would be nearly impossible if trying to use the volatile terpenes in their non-encapsulated form. The reason that terpenes are so prevalent in the beauty and fragrance industry is because they naturally become airbourne; however, our nanoparticle-based delivery makes these reactive molecules more suitable for therapeutic usage.

Previously, the Company has received positive proof-of-concept data from a human immune cell model supporting the efficacy of their proprietary MEM designed for the suppression of cytokine release syndromes (CRS) while preserving key anti-viral immune responses. Based on this positive proof-of-concept data, the Company has patent-pending applications entitled “CANNABINOID-CONTAINING COMPLEX MIXTURES FOR THE TREATMENT OF CYTOKINE RELEASE SYNDROME WHILE PRESERVING KEY ANTI-VIRAL IMMUNE REACTIONS”. The best performing MEM from this patent application will be further developed in preparation for clinical studies to evaluate their anti-inflammatory potential in the treatment of long COVID-19 patients contending with Cytokine Release Syndrome (CRS) and associated hyperinflammatory conditions, such as macrophage activation syndrome (MAS) and acute respiratory distress syndrome (ARDS). The Company’s proof-of-concept study was performed at Michigan State University using a state-of-the-science human immune model. In the Company’s proof-of-concept study, immune cells from human donors were co-cultured together in one of four treatment groups: untreated (no inflammatory stimulus), inflammatory stimulus, control (inflammatory stimulus + vehicle from cannabinoid mixtures), or pre-treatment with the cannabinoid mixture + inflammatory stimulus. Then a panel of cytokines and inflammatory markers was measured from each of these treatment groups from different immune cell types within the co-cultured cells at four time points to determine whether the Company’s MEMs were able to alter the levels of pro-inflammatory cytokines or other inflammatory agents. The Company’s CRS formulations showed potential for the selective inhibition of pro-inflammatory processes in response to viral- and bacterial-triggered hyperinflammation in a human immune cell model. These positive proof-of-concept results support the potential for some of these mixtures to accomplish our therapeutic goals, but, ultimately, clinical trial results will determine whether they are efficacious. The next step is to further develop our plant-inspired drugs and eventually bring them to human trials so that the use of well-defined cannabinoid mixtures in clinical practice can become a reality.

As mentioned above, the Company has announced that our kava-inspired formulas for anxiety have achieved statistically significant efficacy in animal proof-of-concept studies. Gb Sciences is now preparing its non-psychedelic, kava-based anxiety formulations to treat the growing global need for stress and anxiety relief. The NRC of Canada has tested our proprietary, psychotropic plant-based formulas for the treatment of stress and anxiety in preclinical animal studies. The Company has leveraged its patent-pending PhAROS™ (Phytomedical Analytics for Research Optimization at Scale) platform to identify these combinations of plant compounds for novel drug candidates to treat depression and anxiety. These are the company’s first non-cannabis formulations to achieve proof-of-concept efficacy in preclinical animal studies. For these novel psychotropic drug candidates, the Company used the PhAROS™ platform to identify new ingredients to improve upon an initial formulation for anxiety based on traditional medicine. The original plant mixture was derived from the kava plant, but some elements of kava are thought to cause liver toxicity. PhAROS™ identified ingredients from the Piper plant family as a substitute for the functionality of the ingredients in question without the potentially adverse safety profiles of those original ingredients. The Piper plant family includes pepper plants that are used worldwide in traditional medicines. The Global Anxiety Disorder and Depression Treatment Market size is forecast to reach USD $19.81 Billion by 2028 according to Reports & Data.

Favorable Research Updates from our university collaborators reveal the promise in our discovery programs including: 1) the Company’s Cannabis Metabolomics Project with both Chaminade University of Honolulu, Hawaii and the University of Athens, Greece, and 2) the expansion of the capabilities of our PhAROS™ drug discovery platform in collaboration with Chaminade University of Honolulu.

Intellectual Property

GBSGB retained Fenwick & West, a Silicon Valley based law firm focusing on life sciences and high technology companies with a nationally top-ranked intellectual property practice, to develop strategies for the protection of the Company's intellectual property. The status of the intellectual property portfolio is as follows. Unless otherwise indicated, all patents listed below are assigned to the Company's wholly-owned subsidiary, GBS Global Biopharma, Inc.

Eight USPTO & Twelve Foreign Patents Issued; Two Foreign Patents Allowed*

*Notice of Allowances received which confirms patent protection on claim set

Title: CANNABINOID-CONTAINING COMPLEX MIXTURES FOR THE TREATMENT OF NEURODEGENERATIVE DISEASES (002 Patent Family)

| U.S. Patent Number: US10653640B2 |

Issued: May 19, 2020 |

| Expiration date: October 10, 2037 |

Inventors: Andrea Small-Howard et al. |

| Chinese Patent Number: CN109963595B |

Issued: Feb 3, 2023 |

| Expiration date: October 10, 2037 |

Inventors: Andrea Small-Howard et al. |

| Japanese Patent Number: JP7225103B2 |

Issued: Feb 20, 2023 |

| Expiration date: October 10, 2037 |

Inventors: Andrea Small-Howard et al. |

| Israeli Patent Application: IL265902 |

Issued: June 28, 2023 |

| Expiration date: October 10, 2037 |

Inventors: Andrea Small-Howard et al. |

| European Patent: EP17800639.1 |

Issued: April 24, 2024 |

| Expiration date: October 10, 2037 |

Inventors: Andrea Small-Howard et al. |

| Hong Kong Patent: HK620200023336 |

Allowed: April 24, 2024 |

| Expiration date: October 10, 2037 |

Inventors: Andrea Small-Howard et al. |

| U.S. Patent Application No.: 16/844,713 |

Allowed: August 19, 2023 |

| Expiration date: October 10, 2037 |

Inventors: Andrea Small-Howard et al. |

On May 19, 2020, U.S. Patent protection was granted for GbS’ Cannabinoid-Containing Complex Mixtures for the treatment of Parkinson’s disease. On February 3, 2023, the Chinese Patent was issued for GbS’ Cannabinoid- Containing Complex Mixtures for the treatment of Parkinson’s disease. On February 20, 2023, the Japanese patent was issued for the use of GbS’ Cannabinoid-Containing Complex Mixtures in the treatment of Parkinson’s disease. On June 28, 2023, the Israeli patent was issued on GbS’ Cannabinoid- Containing Complex Mixtures for the treatment of Parkinson’s disease. On April 24, 2024, GbS’ European patent was issued for GbS’ Cannabinoid- Containing Complex Mixtures for the treatment of Parkinson’s disease. On April 24, 2024, GbS received the Notice of Allowance for its Hong Kong (HK) Patent for GbS’ CCCM for Parkinson’s disease. On May 4, 2024, an additional US Patent was issued by the USPTO for GbS’ Cannabinoid-Containing Complex Mixtures with refined formulations to be used in the treatment of Parkinson’s disease. These patents claim benefit of U.S. Patent Application number 62/406,764 that was originally filed October 11, 2016.

Title: MYRCENE-CONTAINING COMPLEX MIXTURES TARGETING TRPV1 (005 Patent Family)

| U.S. Patent Number US10709670B2 |

Issued: July 14, 2020 |

| Expiration date: May 22, 2038 |

Inventors: Andrea Small-Howard, et al. |

| Australian Patent: AU2018273194B2 |

Issued: September 7, 2023 |

| Expiration date: May 22, 2038 |

Inventors: Andrea Small-Howard et al. |

| US Patent Application: US20200390721A1 |

Allowed: March 9, 2023 |

| Expiration date: May 22, 2038 |

Inventors: Andrea Small-Howard et al. |

As of July 14, 2020, GbS’ Myrcene-Containing Complex Mixtures (MCCM) are protected in the US for use in the treatment of pain related to arthritis, shingles, irritable bowel syndrome, sickle cell disease, and endometriosis. On September 7th of 2023, the Australian patent was issued for GbS’ Myrcene-Containing Complex Mixtures (MCCM) for use in the treatment of pain related to arthritis, shingles, irritable bowel syndrome, sickle cell disease, and endometriosis. On April 2, 2024, the second patent issuance by the USPTO protects the use of GbS’ MCCM in the treatment of cardiac hypertrophy, overactive bladder, and refractory chronic cough. These patents claim benefit of U.S. Patent Application number 62/509,546 that was originally filed May 22, 2017.

Title: CANNABINOID-CONTAINING COMPLEX MIXTURES FOR THE TREATMENT OF MAST CELL-ASSOCIATED OR BASOPHIL-MEDIATED INFLAMMATORY DISORDERS (003 Patent Family)

| U.S. Patent Number US10,857,107B2 |

Issued: December 8, 2020 |

| Expiration date: January 31, 2038 |

Inventors: Andrea Small-Howard et al. |

| JP Patent Number: JP7225104B2 |

Issued: February 10, 2023 |

| Expiration date: January 31, 2038 |

Inventors: Andrea Small-Howard et al. |

| IL Patent Number: IL268211B |

Issued: March 2, 2023 |

| Expiration date: January 31, 2038 |

Inventors: Andrea Small-Howard et al. |

| AU Patent Number: AU2018215200B2 |

Issued: March 30, 2023 |

| Expiration date: January 31, 2038 |

Inventors: Andrea Small-Howard et al. |

| European Patent Application: EP3576724A1 |

Issued: September 27, 2023 |

| Expiration date: January 31, 2038 |

Inventors: Andrea Small-Howard et al. |

| HK Patent Application: HK62020008641.6 |

Allowed: September 27, 2023 |

| Expiration date: January 31, 2038 |

Inventors: Andrea Small-Howard et al. |

On December 8, 2020, U.S. Patent protection was granted for GbS’ Cannabinoid-Containing Complex Mixtures for the treatment of Mast Cell Activation Syndrome (MCAS). On February 10, 2023, the Japanese (JP) Patent was issued, protecting GbS’ Cannabinoid-Containing Complex Mixtures for the treatment of MCAS. On March 2, 2023, the Israeli (IL) Patent was issued, protecting GbS’ Cannabinoid- Containing Complex Mixtures for the treatment of MCAS. On March 30, 2023, the Australian (AU) Patent was issued, protecting GbS’ Cannabinoid-Containing Complex Mixtures for the treatment of MCAS. On September 27, 2023, the European Patent (EP) was issued protecting GbS’ Cannabinoid-Containing Complex Mixtures for the treatment of MCAS. On September 27, 2023, GbS received the Notice of Allowance for its Hong Kong (HK) Patent for GbS’ Cannabinoid-Containing Complex Mixtures for the treatment of MCAS. These patents claim benefit of U.S. Patent Application number 62/453,161 originally filed February 1, 2017.

Title: TRPV1 ACTIVATION-MODULATING COMPLEX MIXTURES OF CANNABINOIDS AND/OR TERPENES (006 Patent Family)

| U.S. Patent Number US11260044B2 |

Issued: May 1, 2022 |

| Expiration date: May 22, 2039 |

Inventors: Andrea Small-Howard, et al. |

U.S. Patent coverage was granted for CBGA-containing mixtures used for the treatment of TRPV1-associated heart disease, renal cystitis, and hearing loss. This patent claims benefit of U.S. Patent Application Nos. 62/674,843 filed May 22, 2018; 62/769,743 filed November 20, 2018; and 62/849,719 filed May 17, 2019.

Title: METHODS AND COMPOSITIONS FOR PREVENTION AND TREATMENT OF CARDIAC HYPERTROPHY (050 Patent Family)

| U.S. Patent Number: US9084786B2 |

Issued: July 21, 2015 |

| U.S. Patent Number: US10137123B2 |

Issued: November 27, 2018 |

| European Union Patent Number: EP2635281B1 |

Issued: March 14, 2018 |

| Hong Kong Patent Number: HK14102182.8B1 |

Issued: March 14, 2018 |

| Inventor: Alexander Stokes |

Assignee: University of Hawai’i |

GBSGB has sublicensed these two issued USPTO patents and two issued international patents for the prevention and treatment of heart failure due to cardiac hypertrophy through therapeutic regulation of TRPV1 from Makai Biotechnology, LLC.

Title: METHOD FOR PRODUCING A PHARMACEUTICAL COMPOSITION OF POLYMERIC NANOPARTICLES FOR TREATING NEUROPATHIC PAIN CAUSED BY PERIPHERAL NERVE COMPRESSION (008 Patent Family)

Spanish Patent: ES2582287 Issued: September 29, 2017

Expiration: February 9, 2035

Inventors: Martin Banderas, Lucia; Fernandez Arevalo, Mercedes; Berrocoso, Dominguez, Esther; and Mico Segura, Juan Antonio

Assignees: Universidad de Sevilla, Universidad de Cadiz, and Centro de Investigacion Biomedica En Red

Exclusive worldwide license held by GbS Global Biopharma, Inc. Claims benefit of Spanish Patent Application no. P201500129 (Pub. No. ES 2582287).

GBSGB holds the exclusive worldwide rights to commercialize the issued Spanish patent-protected, cannabinoid-containing, time-released, oral nanoparticles for the treatment of neuropathic pain.

Pending Patents

In addition to the issued patents listed above, GBSGB's intellectual property portfolio includes a total of fifteen USPTO and forty-one international patents pending:

| Title |

|

Jurisdiction |

|

Application Number |

|

Other International Applications Filed |

|

Continuation of |

| CANNABINOID-CONTAINING COMPLEX MIXTURES FOR THE TREATMENT OF NEURODEGENERATIVE DISEASES |

|

US |

|

USPTO US18/663,034

PCT/US2017/055989 |

|

AU, CA, CN, EP, JP, HK (allowed) |

|

US16/844,713, US15/729,565 CN202310039015.8A JP2023058599A |

| CANNABINOID-CONTAINING COMPLEX MIXTURES FOR THE TREATMENT OF MAST CELL-ASSOCIATED OR BASOPHIL-MEDIATED INFLAMMATORY DISORDERS |

|

US |

|

USPTO 17/065,400

PCT/US2018/016296 |

|

CA, CN, HK (allowed) |

|

US15/885,620 |

| MYRCENE-CONTAINING COMPLEX MIXTURES TARGETING TRPV1 |

|

US |

|

USPTO 16/878,295

PCT/US2018/033956 |

|

CA, CN, JP |

|

US15/986,316 US16/878,295 |

| TRPV1 ACTIVATION-MODULATING COMPLEX MIXTURES OF CANNABINOIDS AND/OR TERPENES |

|

US |

|

USPTO 16/420,004 PCT/US2019/033618 |

|

AU, CA |

|

US17/576,485 |

| THERAPEUTIC NANOPARTICLES ENCAPSULATING TERPENOIDS AND/OR CANNABINOIDS |

|

US |

|

USPTO 16/686,069

PCT/ES2019/070765 |

|

AU, CA, CN, EP, HK, IL |

|

|

| TREATMENT OF PAIN USING ALLOSTERIC MODULATOR OF TRPV1 |

|

US |

|

USPTO 16/914,205

PCT/US2020/039989 |

|

AU, CA, CN, EP, HK, IL, JP |

|

|

| CANNABINOID-CONTAINING COMPLEX MIXTURES FOR THE TREATMENT OF CYTOKINE RELEASE SYNDROME WHILE PRESERVING KEY ANTI-VIRAL IMMUNE REACTIONS |

|

US |

|

USPTO 17/406,035

PCT/US2021/046584 |

|

AU, CA, IL |

|

|

| IN SILICO META-PHARMACOPEIA ASSEMBLY FROM NON-WESTERN MEDICAL SYSTEMS USING ADVANCED DATA ANALYTIC TECHNIQUES TO IDENTIFY AND DESIGN PHYTOTHERAPEUTIC STRATEGIES |

|

US |

|

USPTO 17/501,498

PCT/US2021/055056 |

|

CA, EP, KR, TW |

|

|

| METHODS AND COMPOSITIONS FOR PREVENTION AND TREATMENT OF CARDIAC HYPERTROPHY |

|

US/EU |

|

EPO 3,348,267 |

|

IN, CN |

|

|

| METHOD FOR PRODUCING A PHARMACEUTICAL COMPOSITION OF POLYMERIC NANOPARTICLES FOR TREATING NEUROPATHIC PAIN CAUSED BY PERIPHERAL NERVE COMPRESSION |

|

WIPO/PCT |

|

WIPO 2016/128591

PCT/ES2016/000016 |

|

EU, CA |

|

|

| CANNABINOID-CONTAINING FORMULATIONS FOR PARKINSONIAN MOVEMENT DISORDERS |

|

US |

|

USPTO 17/955,425 PCT/US2022/077190 |

|

BR, CA, EP |

|

|

| PHYTOCHEMICAL FORMULATIONS FOR TREATING STRESS AND ANXIETY |

|

US |

|

USPTO18/602,012 PCT/US2023/032021 |

|

Continuation from USPTO 18/242,512 |

|

|

| METHODS AND COMPOSITIONS FOR THE IDENTIFICATION OF NOVEL THERAPEUTIC APPROACHES TO MIGRAINE USING THE PHAROS IN SILICO DRUG DISCOVERY PLATFORM |

|

US |

|

Incorporated into USPTO 17/501,498

PCT/US2021/055056 |

|

|

|

|

| METHOD AND COMPOSITIONS FOR THE PHYTOMEDICAL COMPONENT SUPPLY CHAIN DECISION SUPPORT USING THE PHAROS IN SILICO DRUG DISCOVERY PLATFORM |

|

US |

|

Incorporated into USPTO 17/501,498

PCT/US2021/055056 |

|

|

|

|

| METHODS AND COMPOSITIONS FOR NOVEL PAIN THERAPIES TARGETED TO SPECIFIC PAIN SUBTYPES IDENTIFIED USING THE PHAROS IN SILICO DRUG DISCOVERY PLATFORM |

|

US |

|

Incorporated into USPTO 17/501,498

PCT/US2021/055056 |

|

|

|

|

| METHODS AND COMPOSITIONS DEVELOPMENT OF NOVEL THERAPEUTICS BASED ON PIPER SPECIE-CONTAINING PHYTOMEDICINES FOR ANXIETY AND ASSOCIATED DISORDERS USING THE PHAROS IN SILICO DRUG DISCOVERY PLATFORM |

|

US |

|

Incorporated into USPTO 17/501,498

PCT/US2021/055056 |

|

|

|

|

| METHODS AND COMPOSITIONS FOR DECONVOLUTION OF COMPLEX PHYTOMEDICAL FORMULAE FOR CANCER TO IDENTIFY TARGETED STRATEGIES FOR CANCER PAIN AND CYTOTOXIC THERAPEUTIC CANDIDATES USING THE PHAROS IN SILICO DRUG DISCOVERY PLATFORM |

|

US |

|

Incorporated into USPTO 17/501,498

PCT/US2021/055056 |

|

|

|

|

Partnering Strategy