Current Report Filing (8-k)

12 June 2021 - 6:32AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 11, 2021 (June 1, 2021)

GUSKIN GOLD CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

333-171636

|

|

27-1989147

|

|

(State of other jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of incorporation)

|

|

|

|

Identification No.)

|

4500 Great America Parkway, PMB 38, Ste 100

Santa Clara, CA 95054

(Address of principal executive offices,

Zip Code)

(408) 766-1511

(Registrant’s telephone number, including

area code)

Securities registered pursuant to Section 12(b)

of the Act:

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

|

|

None

|

|

|

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

GUSKIN GOLD CORP.

Form 8-K

Current Report

ITEM 1.01

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On June 10, 2021, the Board

of Directors of Guskin Gold Corp., (the “Company”) ratified entry into a Joint Venture & Partnership Agreement (the “JV

Agreement”) with Africa Exploration & Minerals Group Limited, a company incorporated in Ghana (the “AEMG”), dated

June 1, 2021, which sets forth the terms and conditions of a joint venture and partnership (the “Partnership”) between AEMG

and the Company relating to precious metal, minerals and mining exploration activities in the Country of Ghana. Additionally, AEMG granted

to the Company an exclusive option to earn and acquire up to a 50% ownership interest in certain project, properties and concession located

in the Country of Ghana in which AEMG has an interest (the “Ghana Option Interest”). The initial project that the Parties

shall endeavor to undertake pursuant to the Partnership is approximately 1 square km or 247 acres of land, (which is approximately 61.75

Ghana acers) of the Shewn Edged Pink Concession (the “Concession”). The Parties intend this to be an unincorporated contractual

joint venture in respect of the exploration, development, exploitation and operation of the Concession. Each additional project relating

to the Ghana Option Interest, and agreed to be made part of, and undertaken by the Partnership, shall be governed by individual “Operating

Agreements” setting forth the terms and conditions relating to each project specifically.

The specific terms and conditions

relating to the operations of the Concession are set forth in that certain Operating Agreement (“Operating Agreement”), which

is attached to the JV Agreement as Schedule A.

The Company has formed a wholly

owned subsidiary incorporated in Ghana and duly authorized to conduct business in precious metals and in mining activities in Ghana named

Guskin Gold Ghana #1 Limited. All operations relating to the Concession will be undertaken by Guskin Gold Ghana #1 Limited.

As consideration for the Partnership

and the Ghana Option Interest, the Company shall advance to AEMG, or other parties as directed by AEMG, and as mutually agreed to by the

Parties, a financing (“Financing”) in the aggregate of Five Hundred Thousand ($500,000) dollars, to be remitted in accordance

with a work program and budget. Such funds advanced as part of the Financing shall not be considered a capital contribution relating to

the operations of the Partnership but shall be a debt due from the operations of the Partnership to the Company which shall be repaid

from proceeds derived from operations, or upon the dissolution and liquidation of the operation. Additionally, the Company shall issue

an aggregate 2,000,000 restricted common shares the Company’s common stock, at a per share valuation of $0.25 per share (the “Shares”).

Such Shares shall be earned and issued based on reaching and completion of certain milestones, which are fully set forth in the JV Agreement

and Operating Agreement.

The Company and AEMG, agreed

to a Due Diligence Period of forty-five (45) days from the date of execution of JV Agreement for the Parties to conduct relevant due diligence

relating to each Party and the Concessions. To this end Company management has traveled to Ghana to perform physical inspection of the

Concession and other relevant due diligence. As per the terms and conditions of the Operating Agreement, it will Close automatically without

any action from either Party upon the expiration of the Due Diligence Period, unless a Party hereto notifies the other, in writing, that

they do not intend to Close the Operating Agreement and move forward with the transactions outlined therein.

The foregoing description

of the JV Agreement and Operating Agreement (as Schedule A to the JV Agreement) do not purport to be complete and are qualified in their

entirety by reference to the full text of both documents which are attached hereto as Exhibit 10.1 (the Operating Agreement is Schedule

A to the JV Agreement) and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

On June 11, 2021, the Company

and AEMG, issued a joint press release announcing the execution of the JV Agreement and the Operating Agreement. The full text of the

press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information furnished

under this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for the

purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

Item 9.01 Financial Statements and Exhibits

Financial Statements:

None

Exhibits:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

June 11, 2021

|

GUSKIN GOLD CORP.

|

|

|

|

|

|

/s/ Naana Asante

|

|

|

Name: Naana Asante

|

|

|

Title: Chief Executive Officer

|

3

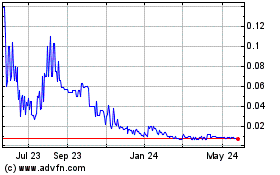

Guskin Gold (CE) (USOTC:GKIN)

Historical Stock Chart

From Oct 2024 to Nov 2024

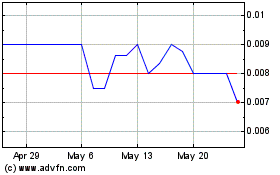

Guskin Gold (CE) (USOTC:GKIN)

Historical Stock Chart

From Nov 2023 to Nov 2024