UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

SUNHYDROGEN,

INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

26-4298300 |

| (State

or other jurisdiction of |

|

(I.R.S.

Employer |

| incorporation or organization) |

|

identification No.) |

10

E. Yanonali, Suite 36

Santa Barbara, CA 93101

(Address

of principal executive offices) (Zip Code)

SunHydrogen,

Inc. 2022 Equity Incentive Plan

(Full

title of the plan)

Timothy

Young

10

E. Yanonali, Suite 36

Santa Barbara, CA 93101

(Name

and address of agent for service)

(805)

966-6566

(Telephone

number, including area code, of agent for service)

Copies

to:

Gregory

Sichenzia, Esq.

Sichenzia

Ross Ference LLP

1185

Avenue of the Americas, 31st Floor

New

York, New York 10036

Phone:

212- 930-9700

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated

filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

☐

PART

I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

This

Registration Statement relates to two separate prospectuses.

Section

10(a) Prospectus: Items 1 and 2, from this page, and the documents incorporated by reference pursuant to Part II, Item 3 of this

prospectus, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act of 1933, as amended (the “Securities

Act”).

Reoffer

Prospectus: The material that follows Item 2, up to but not including Part II of this Registration Statement, of which the reoffer

prospectus is a part, constitutes a “reoffer prospectus,” prepared in accordance with the requirements of Part I of Form

S-3 under the Securities Act. Pursuant to Instruction C of Form S-8, the reoffer prospectus may be used for reoffers or resales of shares

of common stock which are deemed to be “control securities” or “restricted securities” under the Securities Act

that have been acquired by the selling stockholders named in the reoffer prospectus.

Item

1. Plan Information

The

documents containing the information specified in Part I of Form S-8 will be sent or given to each recipient (the “Recipient”)

of a grant under the Plan in accordance with Rule 428(b)(1) under the Securities Act of 1933, as amended (the “Securities Act”). In

accordance with the rules and regulations of the Securities and Exchange Commission (the “Commission” or the “SEC”)

and the instructions to Form S-8, such documents are not being filed with the Commission either as part of this Registration Statement

or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act. Such documents and the documents incorporated

by reference into this Registration Statement pursuant to Item 3 of Part II of this Registration Statement, taken together, constitute

a prospectus that meets the requirements of Section 10(a) of the Securities Act.

Item

2. Registrant Information and Employee Plan Annual Information.

SunHydrogen,

Inc. will provide to each Recipient a written statement advising of the availability of documents incorporated by reference in Item 3

of Part II of this Registration Statement (which documents are incorporated by reference in this Section 10(a) prospectus) and of documents

required to be delivered pursuant to Rule 428(b) under the Securities Act without charge and upon written or oral request by contacting:

SunHydrogen,

Inc.

10

E. Yanonali, Suite 36

Santa

Barbara, CA 93101

Attention:

Corporate Secretary

Telephone:

(805) 966-6566

REOFFER

PROSPECTUS

SunHydrogen,

Inc.

153,000,000

Shares of Common Stock

This

reoffer prospectus relates to the sale of 153,000,000 shares of our common stock that may be offered and resold from time to time by

the selling stockholders identified in this prospectus for their own account. It is anticipated that the selling stockholders will offer

shares for sale at prevailing prices on the OTC Pink on the date of sale. We will receive no part of the proceeds from sales made under

this reoffer prospectus. The selling stockholders will bear all sales commissions and similar expenses. Any other expenses incurred by

us in connection with the registration and offering and not borne by the selling stockholders will be borne by us.

The

shares of common stock have been issued pursuant to awards granted under the SunHydorgen, Inc. 2022 Equity Incentive Plan. This reoffer

prospectus has been prepared for the purposes of registering the shares under the Securities Act of 1933, as amended (the “Securities

Act”) to allow for future sales by selling stockholders on a continuous or delayed basis to the public without restriction.

The

selling stockholders and any brokers executing selling orders on their behalf may be deemed to be “underwriters” within the

meaning of the Securities Act, in which event commissions received by such brokers may be deemed to be underwriting commissions under

the Securities Act.

Our common stock is quoted on the OTC Pink under

the symbol “HYSR”. The last reported sale price of our common stock on the OTC Pink on December 15, 2022, was $0.029 per share.

Investing

in our common stock involves risks. See “Risk Factors” on page 2 of this reoffer prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is December 19, 2022.

TABLE

OF CONTENTS

NO

PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS, OTHER THAN THOSE CONTAINED IN THIS PROSPECTUS, IN

CONNECTION WITH THE OFFERING MADE HEREBY, AND, IF GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON AS HAVING

BEEN AUTHORIZED BY THE COMPANY OR ANY OTHER PERSON. NEITHER THE DELIVERY OF THIS PROSPECTUS NOR ANY SALE MADE HEREUNDER SHALL UNDER ANY

CIRCUMSTANCES CREATE ANY IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF THE COMPANY SINCE THE DATE HEREOF. THIS PROSPECTUS

DOES NOT CONSTITUTE AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY ANY SECURITIES OFFERED HEREBY BY ANYONE IN ANY JURISDICTION

IN WHICH SUCH OFFER OR SOLICITATION IS NOT AUTHORIZED OR IN WHICH THE PERSON MAKING SUCH OFFER OR SOLICITATION IS NOT QUALIFIED TO DO

SO OR TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE SUCH OFFER OR SOLICITATION.

This

Reoffer Prospectus may be supplemented from time to time to add, update or change information. To the extent that a statement contained

in a prospectus supplement modifies or supersedes any statement contained in this Reoffer Prospectus, it will be deemed to be modified

or superseded for purposes of this Reoffer Prospectus and will be deemed to constitute a part of this Reoffer Prospectus only as

so modified. Any statement so superseded will be deemed not to constitute a part of this Reoffer Prospectus.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus carefully, including the

section entitled “Risk Factors” before deciding to invest in our common stock. In this prospectus, unless otherwise noted,

“SunHydrogen,” “Company,” “we,” “us,” and “our,” refers to SunHydrogen, Inc.,

a Nevada corporation.

Overview

At

SunHydrogen, we are developing a breakthrough, low-cost technology to make renewable hydrogen using sunlight and any source of water,

including seawater and wastewater. The only byproduct of hydrogen fuel is pure water, unlike hydrocarbon fuels such as oil, coal and

natural gas that release carbon dioxide and other contaminants into the atmosphere when used. By optimizing the science of water electrolysis

at the nano-level, our low-cost nanoparticles mimic photosynthesis to efficiently use sunlight to separate hydrogen from water, ultimately

producing environmentally friendly renewable hydrogen. Using our low-cost method to produce renewable hydrogen, we intend to enable a

world of distributed hydrogen production for renewable electricity and hydrogen fuel cell vehicles.

Corporate

Information

Our

principal executive offices are located at 10 E. Yanonali, Suite 36, Santa Barbara, CA 93101. Our telephone number is (805) 966-6566.

We maintain an Internet website at www.sunhydrogen.com. The information contained on, connected to or that can be accessed via our website

is not part of this prospectus. We have included our website address in this prospectus as an inactive textual reference only and not

as an active hyperlink.

About

This Offering

This

offering relates to the resale by the selling stockholders of up to 153,000,000 shares of common stock issued pursuant to the SunHydrogen,

Inc. 2022 Equity Incentive Plan.

RISK

FACTORS

Investing

in our common stock involves a high degree of risk. Before making an investment decision, you should consider carefully the risks, uncertainties

and other factors described in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent quarterly reports

on Form 10-Q and current reports on Form 8-K that we have filed or will file with the SEC, which are incorporated by reference into this

prospectus.

Our

business, affairs, prospects, assets, financial condition, results of operations and cash flows could be materially and adversely affected

by these risks. For more information about our SEC filings, please see “Additional Information Available to You”.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference herein contain forward-looking statements. All statements, other than statements

of historical fact, including statements regarding our strategy, future operations, future financial position, future revenues, projected

costs, prospects, plans and objectives of management, are forward-looking statements. The words “anticipate,” “believe,”

“continue,” “should,” “estimate,” “expect,” “intend,” “may,”

“plan,” “project,” “will,” and similar expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain these identifying words.

We

may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place

undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations

disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included and incorporated

by reference in this prospectus that we believe could cause actual results or events to differ materially from the forward-looking statements

that we make. See the section entitled “Risk Factors” herein for more information. You should consider these factors and

other cautionary statements made in this prospectus and in the documents we incorporate by reference as being applicable to all related

forward-looking statements wherever they appear in the prospectus and in the documents incorporated by reference. We do not assume any

obligation to update any forward-looking statements, except as may be required under applicable law.

USE

OF PROCEEDS

We

will not receive any proceeds from the sale of shares of common stock offered by the selling stockholders.

SELLING

STOCKHOLDERS

This prospectus relates to the offering by the

selling stockholders of up to 153,000,000 shares of common stock. All of such shares have been issued pursuant to awards granted under

the Company’s 2022 Equity Incentive Plan.

The

following table sets forth, based on information provided to us by the selling stockholders or known to us, the name of each selling

stockholder, the nature of any position, office or other material relationship, if any, which the selling stockholder has had, within

the past three years, with us or with any of our predecessors or affiliates, and the number of shares of our common stock beneficially

owned by the selling stockholder before this offering. The number of shares owned are those beneficially owned, as determined under

the rules of the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under these

rules, beneficial ownership includes any shares of common stock as to which a person has sole or shared voting power or investment power

and any shares of common stock which the person has the right to acquire within 60 days through the exercise of any option, warrant or

right, through conversion of any security or pursuant to the automatic termination of a power of attorney or revocation of a trust, discretionary

account or similar arrangement. None of the selling stockholders is a broker-dealer or an affiliate of a broker-dealer. Percentage of

ownership is based on 4,602,997,884 shares of common stock outstanding on December 15, 2022.

We

have assumed all shares of common stock reflected on the table will be sold from time to time in the offering covered by this prospectus. Because

the selling stockholders may offer all or any portions of the shares of common stock listed in the table below, no estimate can be given

as to the amount of those shares of common stock covered by this prospectus that will be held by the selling stockholders upon the termination

of the offering.

| Selling Stockholder |

|

Number of

Shares

Beneficially

Owned

Before Offering |

|

|

Number of Shares

Offered |

|

|

Number of Shares

Beneficially Owned

After Offering |

|

|

Percentage of

Shares Beneficially

Owned After

Offering |

|

| Timothy Young(1) |

|

|

233,812,947 |

(2) |

|

|

100,000,000 |

|

|

|

133,812,947 |

|

|

|

2.8 |

% |

| Woosuk Kim(3) |

|

|

50,000,000 |

|

|

|

50,000,000 |

|

|

|

0 |

|

|

|

- |

|

| Mark Richardson(4) |

|

|

6,081,552 |

(5) |

|

|

3,000,000 |

|

|

|

3,081,552 |

|

|

|

* |

|

| (1) | The

selling stockholder is chief executive officer, acting chief financial officer, and director

of the Company. |

| (2) | Includes

125,812,947 shares underlying options. |

| (3) | The

selling stockholder is chief operating officer and director of the Company. |

| (4) | The

selling stockholder is a director of the Company. |

| (5) | Includes

3,081,552 shares underlying options. |

PLAN

OF DISTRIBUTION

Timing

of Sales

The

selling stockholders may offer and sell the shares covered by this prospectus at various times. The selling stockholders will act independently

of our company in making decisions with respect to the timing, manner and size of each sale.

To

our knowledge, no selling stockholder has any agreement or understanding, directly or indirectly, with any person to resell the shares

of common stock covered by this prospectus.

Offering

Price

The

sales price offered by the selling stockholders to the public may be:

| 1. | the

market price prevailing at the time of sale; |

| 2. | a

price related to such prevailing market price; or |

| 3. | such

other price as the selling stockholders determine from time to time. |

Manner

of Sale

The

shares of common stock may be sold by means of one or more of the following methods:

| 1. | a

block trade in which the broker-dealer so engaged will attempt to sell the shares of common

stock as agent, but may position and resell a portion of the block as principal to facilitate

the transaction; |

| 2. | purchases

by a broker-dealer as principal and resale by that broker-dealer for its account pursuant

to this prospectus; |

| 3. | ordinary

brokerage transactions in which the broker solicits purchasers; |

| 4. | through

options, swaps or derivatives; |

| |

5. |

in transactions to cover

short sales; |

| |

6. |

privately negotiated transactions;

or |

| |

7. |

in a combination of any

of the above methods. |

The

selling stockholders may sell their shares of common stock directly to purchasers or may use brokers, dealers, underwriters or agents

to sell their shares of common stock. Brokers or dealers engaged by the selling stockholders may arrange for other brokers or dealers

to participate. Brokers or dealers may receive commissions, discounts or concessions from the selling stockholders, or, if any such broker-dealer

acts as agent for the purchaser of shares of common stock, from the purchaser in amounts to be negotiated immediately prior to the sale.

The compensation received by brokers or dealers may, but is not expected to, exceed that which is customary for the types of transactions

involved.

Broker-dealers

may agree with a selling stockholder to sell a specified number of shares of common stock at a stipulated price per common share, and,

to the extent the broker-dealer is unable to do so acting as agent for a selling stockholder, to purchase as principal any unsold shares

of common stock at the price required to fulfill the broker-dealer commitment to the selling stockholder.

Broker-dealers

who acquire shares of common stock as principal may thereafter resell the shares of common stock from time to time in transactions, which

may involve block transactions and sales to and through other broker-dealers, including transactions of the nature described above, on

The OTC Pink or otherwise at prices and on terms then prevailing at the time of sale, at prices then related to the then-current market

price or in negotiated transactions. In connection with resales of the shares of common stock, broker-dealers may pay to or receive from

the purchasers of shares commissions as described above.

If

the selling stockholders enter into arrangements with brokers or dealers, as described above, we are obligated to file a post-effective

amendment to this registration statement disclosing such arrangements, including the names of any broker-dealers acting as underwriters.

The

selling stockholders and any broker-dealers or agents that participate with the selling stockholders in the sale of the shares of common

stock may be deemed to be “underwriters” within the meaning of the Securities Act. In that event, any commissions received

by broker-dealers or agents and any profit on the resale of the shares of common stock purchased by them may be deemed to be underwriting

commissions or discounts under the Securities Act.

Sales

Pursuant to Rule 144

Any

shares of common stock covered by this prospectus which qualify for sale pursuant to Rule 144 under the Securities Act may be sold under

Rule 144 rather than pursuant to this prospectus.

Regulation M

The

selling stockholders must comply with the requirements of the Securities Act and the Exchange Act in the offer and sale of the common

stock. In particular we will advise the selling stockholders that the anti-manipulation rules of Regulation M under the Exchange

Act may apply to sales of shares of common stock in the market and to the activities of the selling stockholders and their affiliates.

Regulation M under the Exchange Act prohibits, with certain exceptions, participants in a distribution from bidding for, or purchasing

for an account in which the participant has a beneficial interest, any of the securities that are the subject of the distribution.

Accordingly,

during such times as a selling stockholder may be deemed to be engaged in a distribution of the common stock, and therefore be considered

to be an underwriter, the selling stockholder must comply with applicable law and, among other things:

| |

1. |

may not engage in any stabilization

activities in connection with our common stock; |

| |

2. |

may not cover short sales

by purchasing shares while the distribution is taking place; and |

| |

3. |

may not bid for or purchase

any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Exchange

Act. |

In

addition, we will make copies of this prospectus available to the selling stockholders for the purpose of satisfying the prospectus delivery

requirements of the Securities Act.

State

Securities Laws

Under

the securities laws of some states, the shares of common stock may be sold in such states only through registered or licensed brokers

or dealers. In addition, in some states the shares of common stock may not be sold unless the shares have been registered or qualified

for sale in the state or an exemption from registration or qualification is available and is complied with.

Expenses

of Registration

We

are bearing all costs relating to the registration of the common stock. The selling stockholders, however, will pay any commissions or

other fees payable to brokers or dealers in connection with any sale of the common stock.

LEGAL

MATTERS

The

validity of the common stock has been passed upon by Sichenzia Ross Ference LLP, New York, New York.

EXPERTS

INCORPORATION

OF CERTAIN DOCUMENTS by Reference

The

Securities and Exchange Commission, or SEC, allows us to incorporate by reference certain of our publicly filed documents into this prospectus,

which means that such information is considered part of this prospectus. Information that we file with the SEC subsequent to the date

of this prospectus will automatically update and supersede this information. We incorporate by reference the documents listed below and

any future filings made with the SEC under all documents subsequently filed by us pursuant to Section 13(a), 13(c), 14 or 15(d) of the

Exchange Act until the selling stockholders have sold all of the shares offered hereby or such shares have been deregistered.

| ● | our

Annual Report on Form 10-K for the year ended June 30, 2022 filed with the SEC on October

7, 2022; |

| ● | our

Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2022 filed with

the SEC on November 7, 2022; |

| ● | the

description of our common stock contained in the our Registration Statement on Form 8-A filed

with the SEC on June 14, 2011 (File No. 000-54437), including any amendment or report filed

for the purpose of updating such description. |

Notwithstanding

the foregoing, information furnished under Items 2.02 and 7.01 of any Current Report on Form 8-K, including the related exhibits, is

not incorporated by reference in this Registration Statement.

Disclosure

Of Commission Position On Indemnification

For

Securities Act Liabilities

Neither

our Articles of Incorporation nor Bylaws prevent us from indemnifying our officers, directors and agents to the extent permitted under

the Nevada Revised Statute (“NRS”). NRS Section 78.7502 provides that a corporation shall indemnify any director, officer,

employee or agent of a corporation against expenses, including attorneys’ fees, actually and reasonably incurred by him in connection

with any defense to the extent that a director, officer, employee or agent of a corporation has been successful on the merits or otherwise

in defense of any action, suit or proceeding referred to in Section 78.7502(1) or 78.7502(2), or in defense of any claim, issue or matter

therein.

NRS

78.7502(1) provides that a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened,

pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, except an action by or in

the right of the corporation, by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is

or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint

venture, trust or other enterprise, against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement

actually and reasonably incurred by him in connection with the action, suit or proceeding if he: (a) is not liable pursuant to NRS 78.138;

or (b) acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation,

and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful.

NRS

Section 78.7502(2) provides that a corporation may indemnify any person who was or is a party or is threatened to be made a party to

any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason

of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation

as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses,

including amounts paid in settlement and attorneys’ fees actually and reasonably incurred by him in connection with the defense

or settlement of the action or suit if he: (a) is not liable pursuant to NRS 78.138; or (b) acted in good faith and in a manner which

he reasonably believed to be in or not opposed to the best interests of the corporation. Indemnification may not be made for any claim,

issue or matter as to which such a person has been adjudged by a court of competent jurisdiction, after exhaustion of all appeals there

from, to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent that the court

in which the action or suit was brought or other court of competent jurisdiction determines upon application that in view of all the

circumstances of the case, the person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper.

NRS

Section 78.747 provides that except as otherwise provided by specific statute, no director or officer of a corporation is individually

liable for a debt or liability of the corporation, unless the director or officer acts as the alter ego of the corporation. The court

as a matter of law must determine the question of whether a director or officer acts as the alter ego of a corporation.

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us

pursuant to the foregoing provisions, we have been informed that, in the opinion of the SEC, such indemnification is against public policy

as expressed in the Securities Act and is therefore unenforceable. In the event that a claim for indemnification against such liabilities

(other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant

in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection

with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question whether such indemnification by us is against public policy as expressed hereby

in the Securities Act and we will be governed by the final adjudication of such issue.

Additional

Information Available to You

We

are subject to the reporting requirements of the Exchange Act and file annual, quarterly and current reports, proxy statements and other

information with the SEC. These reports, proxy statements and other information are available at the SEC’s website at http://www.sec.gov.

This

prospectus is only part of a registration statement on Form S-8 that we have filed with the SEC under the Securities Act and therefore

omits certain information contained in the registration statement. The registration statement is available at the SEC’s website.

We

also maintain a website at www.sunhydrogen.com, through which you can access our SEC filings. The information set forth on our website

is not part of this prospectus.

PART

II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item

3. Incorporation of Documents by Reference.

SunHydrogen,

Inc. (the “Company,”, “we,” “us”, or “our”) hereby incorporates by reference into this

Registration Statement the documents listed below. In addition, all documents subsequently filed by the Company pursuant to Sections

13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), prior to the filing of

a post-effective amendment which indicates that all securities offered have been sold or which deregisters all securities then remaining

unsold, shall be deemed to be incorporated by reference into this Registration Statement and to be a part hereof from the date of filing

of such documents, provided that, information furnished under Item 2.02 or Item 7.01 of Form 8-K and all exhibits related to such items

will not be deemed to be incorporated by reference herein.

| ● | our

Annual Report on Form 10-K for the year ended June 30, 2022 filed with the SEC on October

7, 2022; |

| ● | our

Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2022 filed with

the SEC on November 7, 2022; |

| ● | the

description of our common stock contained in the our Registration Statement on Form 8-A filed

with the SEC on June 14, 2011 (File No. 000-54437), including any amendment or report filed

for the purpose of updating such description. |

Item

4. Description of Securities.

Not

applicable.

Item

5. Interests of Named Experts and Counsel.

Not

applicable.

Item

6. Indemnification of Directors and Officers.

Neither

our Articles of Incorporation nor Bylaws prevent us from indemnifying our officers, directors and agents to the extent permitted under

the Nevada Revised Statute (“NRS”). NRS Section 78.7502 provides that a corporation shall indemnify any director, officer,

employee or agent of a corporation against expenses, including attorneys’ fees, actually and reasonably incurred by him in connection

with any defense to the extent that a director, officer, employee or agent of a corporation has been successful on the merits or otherwise

in defense of any action, suit or proceeding referred to in Section 78.7502(1) or 78.7502(2), or in defense of any claim, issue or matter

therein.

NRS

78.7502(1) provides that a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened,

pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, except an action by or in

the right of the corporation, by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is

or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint

venture, trust or other enterprise, against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement

actually and reasonably incurred by him in connection with the action, suit or proceeding if he: (a) is not liable pursuant to NRS 78.138;

or (b) acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation,

and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful.

NRS

Section 78.7502(2) provides that a corporation may indemnify any person who was or is a party or is threatened to be made a party to

any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason

of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation

as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses,

including amounts paid in settlement and attorneys’ fees actually and reasonably incurred by him in connection with the defense

or settlement of the action or suit if he: (a) is not liable pursuant to NRS 78.138; or (b) acted in good faith and in a manner which

he reasonably believed to be in or not opposed to the best interests of the corporation. Indemnification may not be made for any claim,

issue or matter as to which such a person has been adjudged by a court of competent jurisdiction, after exhaustion of all appeals there

from, to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent that the court

in which the action or suit was brought or other court of competent jurisdiction determines upon application that in view of all the

circumstances of the case, the person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper.

NRS

Section 78.747 provides that except as otherwise provided by specific statute, no director or officer of a corporation is individually

liable for a debt or liability of the corporation, unless the director or officer acts as the alter ego of the corporation. The court

as a matter of law must determine the question of whether a director or officer acts as the alter ego of a corporation.

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us

pursuant to the foregoing provisions, we have been informed that, in the opinion of the SEC, such indemnification is against public policy

as expressed in the Securities Act and is therefore unenforceable. In the event that a claim for indemnification against such liabilities

(other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant

in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection

with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question whether such indemnification by us is against public policy as expressed hereby

in the Securities Act and we will be governed by the final adjudication of such issue.

Item

7. Exemption from Registration Claimed.

Not

Applicable.

Item

8. Exhibits.

Item 9.

Undertakings.

The

undersigned registrant hereby undertakes:

| (1) | To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| (i) | To

include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| (ii) | To

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in

volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation

of Registration Fee” table in the effective registration statement; |

| (iii) | To

include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any

material change to such information in the registration statement; |

Provided,

however, that paragraphs (1)(i), and (1)(ii) do not apply if the Registration Statement is on Form S-8 and if the information required

to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by

the Registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference

in the registration statement.

| (2) | That,

for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to

be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof. |

| (3) | To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination

of the offering. |

| (4) | That,

for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant

to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s

annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration

statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof. |

| (5) | That,

for the purpose of determining liability under the Securities Act of 1933 to any purchaser: |

| (A) | Each

prospectus filed by a Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date

the filed prospectus was deemed part of and included in the registration statement; and |

| (B) | Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on

Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of

providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration

statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of

sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and

any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating

to the securities in the registration statement to which the prospectus relates, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof. Provided, however , that no statement made in a registration statement

or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into

the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of

sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was

part of the registration statement or made in any such document immediately prior to such effective date. |

| (6) | That,

for the purpose of determining liability of a Registrant under the Securities Act of 1933 to any purchaser in the initial distribution

of the securities, each undersigned Registrant undertakes that in a primary offering of securities of an undersigned Registrant pursuant

to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities

are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to

the purchaser and will be considered to offer or sell such securities to such purchaser: |

| (i) | Any

preliminary prospectus or prospectus of an undersigned Registrant relating to the offering required to be filed pursuant to Rule 424; |

| (ii) | Any

free writing prospectus relating to the offering prepared by or on behalf of an undersigned Registrant or used or referred to by an undersigned

Registrant; |

| (iii) | The

portion of any other free writing prospectus relating to the offering containing material information about an undersigned Registrant

or its securities provided by or on behalf of an undersigned Registrant; and |

| (iv) | Any

other communication that is an offer in the offering made by an undersigned Registrant to the purchaser. |

Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons

of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities

and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred

or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is

asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless

in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication

of such issue.

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized,

in the City of Santa Barbara, State of California, on December 19, 2022.

| SunHydrogen, Inc. |

|

| |

|

| By: |

/s/

Timothy Young |

|

| |

Timothy Young |

|

| Its: |

Chief Executive Officer & Acting Chief Financial

Officer |

|

| |

(Principal executive, financial and accounting officer) |

Each

person whose signature appears below constitutes and appoints Timothy Young as his true and lawful attorney in fact and agent, with full

powers of substitution and resubstitution, for him and in his name, place and stead, in any and all capacities, to sign any or all amendments

(including post effective amendments) to the Registration Statement, and to file the same, with all exhibits thereto, and all documents

in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent, each acting alone,

full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises,

as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorney-in-fact

and agent, each acting alone, or his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed below by the following persons in the

capacities and on the dates indicated.

| /s/

Timothy Young |

|

December 19, 2022 |

Timothy

Young

Chief

Executive Officer,

Acting

Chief Financial Officer and Director

(Principal executive, financial and accounting officer) |

|

|

| |

|

|

| /s/

Mark J. Richardson |

|

December 19, 2022 |

Mark J. Richardson

Director |

|

|

| |

|

|

| /s/

Woosuk Kim |

|

December 19, 2022 |

Woosuk

Kim

Director |

|

|

II-5

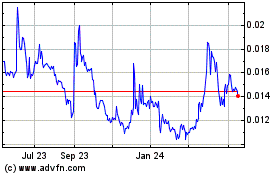

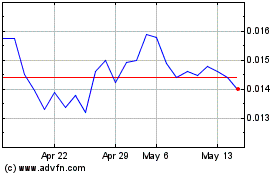

SunHydrogen (QB) (USOTC:HYSR)

Historical Stock Chart

From Nov 2024 to Dec 2024

SunHydrogen (QB) (USOTC:HYSR)

Historical Stock Chart

From Dec 2023 to Dec 2024