IJJ Corporation Announced the Reduction of Authorized Shares by 500,000,000

13 March 2015 - 12:45AM

IJJ Corporation (OTC:IJJP.PK) today announces that its Board of

Directors has completed a reduction in authorized common shares by

Five-hundred Million (500,000,000).

President and CEO, Clifford Pope, states, "In keeping with our

commitment to our loyal shareholders, IJJ Corporation has reduced

its authorized shares by Five-hundred Million (500,000,000),

effective Wednesday, March 11, 2015. This action reduces our

authorized shares from Three Billion (3,000,000,000) to Two Billion

Five-hundred Million (2,500,000,000) shares."

IJJ Corp has recently announced an agreement for the redemption

of 395,838,451 free trading shares to be retired to the treasury.

These reductions will contribute toward bringing substantial value

to the company, far exceeding the current shares that are issued.

The new share structure reductions will be updated on OTC Markets

after the Nevada Secretary of State and the Transfer Agent complete

their appropriate Administrative processes. After these changes

have been executed, the complete share structure will be as

indicated:

Authorized Shares will be - 2,500,000,000 shares

Outstanding Shares will be - 1,819,307,525 shares

Restricted Shares will be - 395,838,451 shares

Float Shares will be: - 1,423,469,074 shares

IJJ Corp had previously announced its original court-ordered

amount of stock for the Medical Marijuana expansion projects was

not to exceed 2,094,857,143 shares of common stock. That number was

itself reduced to not exceed 1,020,867,796 shares. The final action

taken reduces the number of shares to 625,029,345 that will be used

to support the marijuana expansion projects.

Currently only 138,383,928 of the 625,029,345 IJJ Corp shares

have been issued and placed into the market. No more than 30% of

shares per Property Interest Exchange (PIE) Recipient are allowed

to be placed into the market at any given time to support the

marijuana expansion product. The company is preparing to update

shareholders on the distribution of funds going toward the

marijuana expansion program.

"IJJ Corp's targeted capitalization program aims to expand our

company's partnership business directive without doing a reverse

split while IJJ Corp remains debt free. We realize that trying to

raise capital using the 504 exemption, convertible debentures, or

any toxic dilutive forms of financing are unacceptable methods for

generating working capital for the company," states Clifford Pope,

President, and CEO of IJJ Corporation.

IJJ Corp's transfer agent is Transfer Online. It is the Transfer

Online policy to not release share structure information to

shareholders requesting such an update. IJJ Corp will keep regular

share structure updates on

its www.cannabisheadliners.com website and on its OTC

Markets Profile.

About IJJ Corporation:

IJJ Corp is a full service business and management-consulting

group promoting the union of companies to achieve their goals. Our

mission is focused on both Public and Private Business

professionals to increase resources designed to help organizations

succeed through partnerships and growth objectives.

Forward-looking statement

This press release contains statements, which may constitute

"forward-looking statements" within the meaning of the Securities

Act of 1933 and the securities Exchange Act of 1934, as amended by

the Private Securities Litigation Reform Act of 1995. Those

statements include statements regarding the intent, belief or

current expectations of the Company and members of its management

as well as the assumptions on which such statements are based.

Prospective investors are cautioned that any such forward-looking

statements are not guarantees of future performance and involve

risks and uncertainties, and that actual results may differ

materially from those contemplated by such forward-looking

statements. Investors are cautioned that due to the Company's

acquisition of the right to receive income from marijuana farming

operations, an investment in this Company is extraordinarily risky,

involving a multiplicity of extreme risks, that in some respects

exceed that of any legal investment in the history of investing,

particularly given the conflict of laws and the potential

consequences of that conflict, including very substantial legal

risk of federal prosecution, penalty and imprisonment, as marijuana

is still classified federally as a Schedule 1 narcotic.

CONTACT: info@ijjc.com

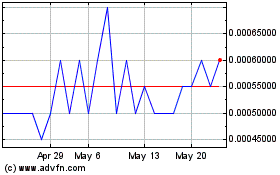

IJJ (PK) (USOTC:IJJP)

Historical Stock Chart

From Dec 2024 to Jan 2025

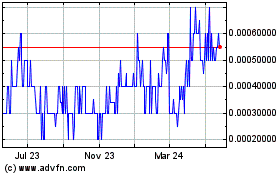

IJJ (PK) (USOTC:IJJP)

Historical Stock Chart

From Jan 2024 to Jan 2025