Table of Contents

Filed Pursuant to Rule 253(g)(1)

File No. 024-12157

Greene Concepts, Inc.

700,000,000 Units

Each Unit Consisting of 3 Shares of Common Stock

and 2 Warrants to Purchase

One Share Each of Common Stock Exercisable at

$0.01 Per Warrant

This Post-Qualification Offering Circular Amendment

No. 3 (the “PQA”) amends the Offering Circular of Greene Concepts, Inc., a New York corporation (“we” or the

“Company”), dated March 30, 2023, and qualified on April 3, 2023, Post-Qualification Offering Circular Amendment No. 1 dated

October 23, 2023, and Post-Qualification Offering Circular Amendment No. 2 dated January 26, 2024, and qualified on February 28, 2024,

as may be amended and supplemented from time to time, to: (a) extend the expiration date of this offering to October 11, 2025; (b) add

200,000,000 Units, for a revised maximum of 700,000,000 Units; and (c) revise the offering price of the 424,666,667 Units that remain

unsold (the “Remaining Units”) to $0.002 per Remaining Unit.

We are offering 700,000,000 units of our securities

(the “Units” or the “Offered Units”), with each Unit consisting of 3 Shares of Common Stock, par value $0.0001

(the “Common Stock”), and 2 warrants (each a “Warrant”) to purchase one share each of Common Stock (each, a “Warrant

Share”) exercisable at $0.01 per Warrant, of which 275,333,333 Units have been sold for cash in the total amount of $1,112,000

and of which 424,666,667 Units, the Remaining Units, are being offered at a fixed price $0.002 per Remaining Unit. The Units are

being offered by our company on a best-efforts basis with no minimum offering required, pursuant to Tier 1 of Regulation A of the United

States Securities and Exchange Commission (the “SEC”).

Through the sale of the Offered Units, the Company

is offering a maximum of 3,500,000,000 shares of Common Stock, including the Warrant Shares. Once a Unit is purchased by an investor,

such investor may separately transfer the Common Stock and the Warrant comprising the Units, at such investor’s discretion. The

Warrants are exercisable upon purchase. Once the Units offered by the Company are qualified by the SEC, the Common Stock and Warrants

comprising the Units, including the Warrant Shares, will have been qualified.

Please be advised that due to the ownership

of super voting rights by our management team in the form of Preferred Shares, your voting rights as a common shareholder will be substantially

limited.

No Escrow

The proceeds of this offering will not be placed

into an escrow account. We will offer the Units, including the Remaining Units, on a best-efforts basis. As there is no minimum offering,

upon the acceptance of any subscription received pursuant to this PQA, the Company shall immediately deposit said proceeds into the bank

account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds.

Subscriptions are irrevocable and the purchase

price is non-refundable as expressly stated in this PQA. All proceeds received by the Company from subscribers for this Offering will

be available for use by the Company upon acceptance of subscriptions for the Units, including the Remaining Units, by the Company.

The Company, by determination of the Board of

Directors, in its sole discretion, may issue the Units, including the Remaining Units, in this offering for cash, promissory notes, services,

and/or other consideration without notice to subscribers. The aggregate offering price will be based on the price at which the Units are

offered for cash. Any portion of the aggregate offering price or aggregate sales attributable to cash received in a foreign currency will

be translated into United States currency at a currency exchange rate in effect on, or at a reasonable time before, the date of the sale

of the Offered Units. If Offered Units are not sold for cash, the aggregate offering price or aggregate sales will be based on the value

of the consideration as established by bona fide sales of that consideration made within a reasonable time, or, in the absence of sales,

on the fair value as determined by an accepted standard. Valuations of non-cash consideration will be reasonable at the time made.

This offering commenced on April 3, 2023, and

will terminate as indicated herein. This offering will be a continuous offering pursuant to Rule 251(d)(3)(i)(F).

This Offering will be conducted on a “best-efforts”

basis by our company, which means our officers will use their commercially reasonable best efforts in an attempt to offer and sell the

Units. Our officers will not receive any commission or any other remuneration for these sales. In offering the Units, including the Remaining

Units, on our behalf, the officers will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities

Exchange Act of 1934, as amended.

This PQA shall not constitute an offer to sell

or the solicitation of an offer to buy, nor shall there be any sales of these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful, prior to registration or qualification under the laws of any such state.

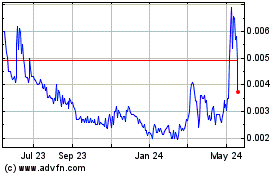

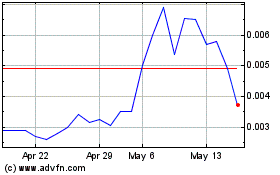

Our

Common Stock is traded in the OTCMarket Pink Open Market under the stock symbol “INKW.”

On October 22, 2024, the closing price of our Common Stock was $0.00205 per share.

Investing in our Common Stock involves a

high degree of risk. See “Risk Factors” beginning on page 4 for a discussion of certain risks that

you should consider in connection with an investment in our Common Stock.

Title

of class of

Securities offered |

|

Total

Number

of Units

Offered |

|

Number

of

Units Sold

to Date |

|

Proceeds

to

Company

to Date(1) |

|

Number

of

Remaining

Units to

Be Sold |

|

Price

to

Public of

Remaining

Units to

Be Sold |

|

Proceeds

to

Company

from

Remaining

Units(1) |

|

Commissions(2) |

|

Total

Proceeds

to

Company(3) |

| Units(4) |

|

700,000,000 |

|

275,333,333 |

|

$1,112,000 |

|

424,666,667 |

|

$0.002 |

|

$849,333 |

|

$-0- |

|

$1,961,333 |

(1) Does not reflect payment of expenses of this

offering, which are estimated to be $100,000 and which include, among other things, legal fees, accounting costs, reproduction expenses,

due diligence, marketing, consulting, administrative services other costs of Blue Sky compliance, and actual out-of-pocket expenses incurred

by our company selling the Offered Units.

(2) Our company is offering the Offered Units

without an underwriter and will not pay any commissions for the sale of Offering Units in this offering.

(3) Assuming the sale of all 424,666,667 Remaining Units; does not

include the exercise of any Warrants. See “Use of Proceeds.”

Investing in the Offered Units involves risks. Greene Concepts,

Inc. currently has limited operations, limited income, and limited assets, is in unsound financial condition, and you should not invest

unless you can afford to lose your entire investment. See “Risk Factors” beginning on page 4. Neither the Securities and

Exchange Commission nor any state securities commission has approved or disapproved of the Offered Units or determined if this PQA is

truthful or complete. Any representation to the contrary is a criminal offense.

Our Board of Directors used its business judgment

in establishing the offering price of $0.002 per Remaining Unit. The offering price per share bears no relationship to our book

value or any other measure of our current value or worth.

No sale may be made to you in this offering

if the aggregate purchase price you pay is more than 10% of the greater of your annual income or your net worth. Different rules apply

to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds,

we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

THIS PQA DOES NOT CONSTITUTE AN OFFER OR SOLICITATION

IN ANY JURISDICTION IN WHICH SUCH AN OFFER OR SOLICITATION WOULD BE UNLAWFUL. NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR

TO MAKE ANY REPRESENTATIONS CONCERNING THE COMPANY OTHER THAN THOSE CONTAINED IN THIS PQA, AND IF GIVEN OR MADE, SUCH OTHER INFORMATION

OR REPRESENTATION MUST NOT BE RELIED UPON.

THE U.S. SECURITIES AND EXCHANGE COMMISSION

DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE

ACCURACY OR COMPLETENESS OF ANY PQA OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION

WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

This PQA is following the offering circular format

described in Part II (a)(1)(ii) of Form 1-A.

Post-Qualification Amendment Offering Circular

No. 3 dated October 14, 2024.

TABLE OF CONTENTS

THIS PQA MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE.

We are offering to sell, and seeking offers to

buy, our securities only in jurisdictions where such offers and sales are permitted. You should rely only on the information contained

in this PQA offering circular. We have not authorized anyone to provide you with any information other than the information contained

in this PQA. The information contained in this PQA is accurate only as of its date, regardless of the time of its delivery or of any sale

or delivery of our securities. Neither the delivery of this PQA nor any sale or delivery of our securities shall, under any circumstances,

imply that there has been no change in our affairs since the date of this PQA. This PQA will be updated and made available for delivery

to the extent required by the federal securities laws.

SUMMARY

This summary highlights information contained

elsewhere in this PQA. This summary does not contain all of the information that you should consider before deciding to

invest in our securities. You should read this entire PQA carefully, including the “Risk Factors” section, our

historical financial statements and the notes thereto, each included elsewhere herein.

Our Company

Overview

Our company name is Greene Concepts, Inc. We are

headquartered in Marion, North Carolina. We are a New York corporation that was incorporated on August 18, 1952 and previously operated

as Tech-OHM Resistor Corporation, Tech-OHM Electronics, Inc., International Citrus Corporation, Princeton Commercial Holdings, Inc., Eurowind

Energy, Inc., First Petroleum and Pipeline Inc., and Luke Entertainment, Inc. Since our inception, we have operated different businesses

under these different names before changing our name to Greene Concepts, Inc. and engaging in our current business line. Through our wholly-owned

subsidiary, Mammoth Ventures Inc., (“Mammoth”), we are now a bottling and beverage company committed to providing the world

with high quality, healthy, and enhanced beverage choices. Our beverage and bottling facility is located in Marion, North Carolina. The

facility is a 55,000 square foot bottling and beverage plant that is located within the boundaries of the Pisgah National Forest. The

bottling facility has as its water sources a combination of seven (7) spring and artesian wells that are fed from a natural aquifer that

is located deep below the Pisgah National Forest. We are focused on producing spring and artesian water, Additionally, we expect that

Mammoth will act as a third-party producer and bottler of "white label" beverage and water products. White label bottling services

are provided for clients that desire to market their own product formulations, brand name and labeling while outsourcing the production

and bottling of their products to Mammoth.

Before acquiring Mammoth on February 6, 2019,

we operated our legacy business, which was the manufacture and distribution of a line of 25 high quality consumer focused inkjet kits.

On April 30, 2019, our board of directors made a determination to wind down our legacy business and to transition into the beverage and

bottling business.

On February 6, 2019, we entered into a Stock Purchase

Acquisition Agreement and Merger Agreement and Promissory Note Agreement with BNL Capital LLC (“BNL Capital”). Pursuant to

the terms of the agreement, BNL Capital agreed to sell 100% of the outstanding shares of Mammoth to us for a purchase price of $1,350,000.

Mammoth acquired certain assets of the defunct business formerly referred to as “North Cove Springs Bottling and Beverage,”

which includes the Marion, North Carolina bottling facility and related assets. We financed the acquisition through a secured promissory

note in the amount of $1,350,000 in favor of BNL Capital. The promissory note was secured by 100% of the outstanding shares of Mammoth

that are owned by our company. See “Description of Business – Terms of Acquisition of Mammoth Ventures, Inc.” for a

description of the terms of our acquisition of Mammoth.

On March 5, 2021, the Company paid $200,000 to

BNL Capital to satisfy the remaining obligations owed to BNL Capital. BNL Capital also cancelled 7,500,000 shares of Series A Preferred

Stock of the Company owned by BNL Capital.

Upon acquiring Mammoth, we began the process of

performing required maintenance to revitalize all the equipment and facility infrastructure in order to relaunch production at the plant.

At the time of the acquisition all of the plant equipment was in good condition although the equipment had not operated for several years

and it did require a thorough inspection and light maintenance to assure proper operation when the bottling lines are relaunched. At the

time of the acquisition, we hired, Kenneth Porter, a 30+ year veteran of the beverage and bottling industry, as plant manager to oversee

operations as well as the revitalization and expected relaunch of the facility.

The Food and Drug Administration, or FDA, requires

adherence to current good manufacturing practice (“CGMP”), regulations for the processing and bottling of bottled drinking

water, which includes facility inspection and documentation of corrective measures and reporting requirements, as well as new requirements

for hazard assessments and food safety, or HACCP, plans mandated by the Food Safety and Modernization Act (“FSMA”). Final

preparations for inspection are underway, including building and facility maintenance such as pressure washing, painting, general cleaning,

and minor building repairs.

In addition to complete cleaning and maintenance

of the 55,000 square foot facility, standard operating policies and procedures must be documented in accordance with federal legislation.

This documentation includes conducting and reporting of microbial testing of source water and any finished product, which must be completed

prior to initiating filling and packaging of bottles for shipment from our production lines.

As of April 6, 2020, the Company’s, through

its wholly owned subsidiary Mammoth, production facility is fully operational after the Company spent 16 months restoring the production

facility in Marion, North Carolina (the “Marion Facility”). The Marion Facility currently has the capacity to produce 192

million bottles or 8 million cases annually (with current equipment). The Marion Facility has space for additional capacity.

On February 17, 2021, Mammoth paid off all mortgage

liens and obligations for the Marion Facility, equipment and property and has received a certificate of satisfaction from the lien holder.

The certificate of satisfaction is being filed with the McDowell County Registry of Deeds which will remove all liens or encumbrances

from the Marion Facility deed.

On or about June 14, 2021, the Company amended

its Certificate of Incorporation to increase the number of authorized shares to ten billion (10,000,000,000) and create the Series B Convertible

Preferred Stock with one thousand (1,000) shares authorized. Each share of Series B Convertible Preferred Stock will be convertible into

one hundred million (100,000,000) shares of the Corporation’s common stock.

The Company has launched its CBD infused drink

“Happy Mellow” beverage. The product is produced by our co-packers.

Disaster recovery efforts led by the federal government

through Federal Emergency Management Agency, state government emergency response programs, and city or county emergency response programs

require entities to be registered and cleared thru the System for Award Management (SAM). The Company successfully completed validation

requirements and currently is awaiting issuance of Commercial and Government Entity Codes (“CAGE codes”). CAGE codes are unique

identifier assigned to suppliers to various government or defense agencies and provide a standardized method of identifying a given facility

at a specific location. Greene Concepts Inc. expedited application efforts in order to become registered and available to provide assistance

for any disaster or emergency relief efforts. The Company’s Marion bottling facility is a strategically important asset by possessing

a total of seven (7) operational wells. The Marion Facility is located within the Pisgah National Forest with an enormous source of pure

spring water accessed from the aquifer located deep below the national forest. While the bottling facility can operate at full capacity

with a single primary well the Company’s facility has the unique strategic advantage of having six additional operational wells

as backup in the unlikely event of any system failures with the primary or any other well.

Corporate Information

Our principal executive offices are located at

13195 U.S. Highway 221 N, Marion, North Carolina, 28752 and our telephone number is (844) 889-2837. We maintain a website at www.greeneconcepts.com.

Information available on our website is not incorporated herein.

The offering

| Securities being offered: |

|

We

are offering 700,000,000 units of our securities (the Units), with each Unit consisting of 3 Shares of Common Stock, par value $0.0001

(the Common Stock), and 2 warrants (the Warrants) to purchase one share each of Common Stock (the Warrant Shares) exercisable at

$0.01 per Warrant, of which 275,333,333 Units have been sold for cash in the total amount of $1,112,000 and of which 424,666,667

Units (the Remaining Units) are being offered at a fixed price $0.002 per Remaining Unit. |

| |

|

|

| Minimum subscription: |

|

There is no minimum subscription. |

| |

|

|

| Shares outstanding before the offering: |

|

As of the date of this PQA, there are 2,940,667,506 shares of Common Stock

issued and outstanding, 888,390 shares of Preferred Class A Stock issued and outstanding and 60 shares of Preferred Class B Stock issued

and outstanding. |

| |

|

|

Shares outstanding after the offering:(1) |

|

Assuming

the sale of all of the Remaining Units and the exercise of all Warrants

included in the Units, including in the Remaining Units, there will be 5,064,000,841 shares of Common Stock issued and outstanding, 888,390

shares of Preferred Class A Stock issued and outstanding and 60 shares of Preferred Class B Stock issued and outstanding. |

| |

|

|

Number of Warrants to be

outstanding after the offering:

|

|

Assuming the sale of all of the Remaining Units, there will 1,400,000,000 Warrants

issued and outstanding.

|

| |

|

|

Number of shares of Common

Stock underlying the Units:

|

|

A total of 2,100,000,000 shares of Common Stock are included in the Offered

Units, including the Remaining Units, and an additional 1,400,000,000 shares of Common Stock underlie the Warrants, if the maximum amount

of Offered Units are sold and all the Warrants are exercised. The total number of shares of our common stock outstanding assumes that

the maximum number of units each containing shares of our common stock and warrants is sold in this offering and that all the warrants

are exercised.

|

| |

|

|

| Price per unit: |

|

$0.002 |

| |

|

|

| Maximum offering amount: |

|

We are offering a total 700,000,000 Offered Units, including the 424,666,667

Remaining Units, at $0.002 per Unit, for a total of $1,961,333 in proceeds from sales of the Offered Units, with up

to an additional $14,000,000 in proceeds from the exercise of Warrants (See “Distribution”). We

will not raise more than $15,961,333 in gross proceeds in this offering. |

| |

|

| Best efforts offering: |

|

The Offered Units are being offered on a “best efforts”

basis through our Chief Executive Officer, Leonard M. Greene, who will not receive any discounts or commissions for selling the Offered

Units. There is no minimum number of Offered Shares that must be sold in order to close this offering. |

| |

|

|

| Restrictions on investment amount: |

|

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(c) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov. |

| |

|

|

| No Escrow account: |

|

We

have not engaged an escrow agent for this offering. Funds invested will be deposited directly into our company’s operating account

and immediately available for our use. |

| |

|

|

| Termination of the offering: |

|

This

offering commenced on April 3, 2023, and will terminate at the earlier

of: (1) the date on which all of the Remaining Shares have been sold, (2) October 11, 2025, or (3) the date on which this offering is

earlier terminated by us in our sole discretion. |

| |

|

|

| Use of proceeds: |

|

If we

sell all of the Offered Units, including the Remaining Units, and assuming the exercise of all of the Warrants, our net proceeds in

this offering (after our estimated offering expenses) will be approximately $$15,472,967-15,961,333. We will use these net proceeds for working

capital and other general corporate purposes. (See “Use of Proceeds”). |

| |

|

| Market for our Common Stock: |

|

Our Common Stock is currently quoted on the OTC Pink Market under the trading symbol “INKW”. |

| |

|

|

| Risk factors: |

|

Investing in our securities involves risks. See the section entitled “Risk Factors” in this PQA and other information included in this PQA for a discussion of factors

you should carefully consider before deciding to invest in our Offered Units. |

RISK FACTORS

Investing in our shares involves a significant

degree of risk. In evaluating our company and an investment in the shares, careful consideration should be given to the following risk

factors, in addition to the other information included in this PQA. Each of these risk factors could materially adversely affect our

business, operating results or financial condition, as well as adversely affect the value of an investment in our shares. The following

is a summary of the most significant factors that make this offering speculative or substantially risky. We are still subject to all

the same risks that all companies in our industry, and all companies in the economy, are exposed to. These include risks relating to

economic downturns, political and economic events and technological developments (such as cyber-security). Additionally, early-stage

companies are inherently riskier than more developed companies. You should consider general risks as well as specific risks when deciding

whether to invest.

Risks Related to our Business, Operating Results and Industry

We

have a history of operating losses and there is a substantial doubt about our ability to continue as a going concern.

For the

fiscal years ended July 31, 2024 and 2023, we reported net losses of $241,886 (unaudited) and $1,399,672 (unaudited), respectively, and

negative cash flow from operating activities of $732,897 (unaudited) and $1,313,051 (unaudited), respectively. We anticipate that we will

continue to report losses and negative cash flow. As a result of these net losses and cash flow deficits, as well as our dependence

on private equity and financings, there is a substantial doubt about our ability to continue as a going concern.

Our consolidated financial

statements do not include any adjustments that might result from the outcome of this uncertainty. These adjustments would likely include

substantial impairment of the carrying amount of our assets and potential contingent liabilities that may arise if we are unable to fulfill

various operational commitments. In addition, the value of our securities, including common stock issued in this offering, would be greatly

impaired. Our ability to continue as a going concern is dependent upon generating sufficient cash flow from operations and obtaining

additional capital and financing, including funds to be raised in this offering. If our ability to generate cash flow from operations

is delayed or reduced and we are unable to raise additional funding from other sources, we may be unable to continue in business even

if this offering is successful. For further discussion about our ability to continue as a going concern and our plan for future liquidity,

see “Management’s Discussion and Analysis of Financial Condition and Results of Operations-Ability to Continue as a Going

Concern.”

We will need additional financing to execute

our business plan which we may not be able to secure on acceptable terms, or at all.

We will require additional financing in the near

and long term to fully execute our business plan. Our success depends on our ability to raise such additional financing on reasonable

terms and on a timely basis. Conditions in the economy and the financial markets may make it more difficult for us to obtain necessary

additional capital or financing on acceptable terms, or at all. If we cannot secure sufficient additional financing, we may be forced

to forego strategic opportunities or delay, scale back or eliminate further development of our goals and objectives, operations and investments

or employ internal cost savings measures.

In order for us to compete and grow, we

must attract, recruit, retain and develop the necessary personnel who have the needed experience.

Recruiting and retaining highly qualified personnel

is critical to our success. These demands may require us to hire additional personnel and will require our existing management personnel

to develop additional expertise. We face intense competition for personnel. The failure to attract and retain personnel or to develop

such expertise could delay or halt the sales and licensing of our product. If we experience difficulties in hiring and retaining personnel

in key positions, we could suffer from delays in our development, loss of customers and sales and diversion of management resources, which

could adversely affect operating results. Our future consultants and advisors may be employed by third parties and may have commitments

under consulting or advisory contracts with third parties that may limit their availability to us.

Quality management plays an essential role

in determining and meeting customer requirements, preventing defects, improving our products and services and maintaining the integrity

of the data that supports the safety and efficacy of our products.

Our future success depends on our ability to maintain

and continuously improve our quality management program. An inability to address a quality or safety issue in an effective and timely

manner may also cause negative publicity, a loss of customer confidence in us or our current or future products, which may result in the

loss of sales and difficulty in successfully launching new products. In addition, a successful claim brought against us in excess of available

insurance or not covered by indemnification agreements, or any claim that results in significant adverse publicity against us, could have

an adverse effect on our business and our reputation.

Our success depends on the services of our Chief Executive Officer,

the loss of whom could disrupt our business.

We depend to a large extent on the

services of our CEO, Mr. Leonard Greene. Given his knowledge and experience, he is important to our future prospects and development as

we rely on his expertise in developing our business strategies and maintaining our operations. The loss of the service of Mr. Greene and

the failure to find timely replacements with comparable experience and expertise could disrupt and adversely affect our business.

Our current CEO and Director, Leonard

Greene beneficially owns approximately 33% of the outstanding shares of Series B Preferred Stock, which accounts for approximately 26.6% of the total voting

rights of the Common Stock. The holders of the Series B Preferred Stock control, as a group, 80.0% of the voting rights of all shareholders.

As a result, the holders of the Series B Preferred Stock have substantial voting power in all matters submitted to our stockholders for

approval including:

| |

· |

Election of our board of directors; |

| |

|

|

| |

· |

Removal of any of our directors; |

| |

|

|

| |

· |

Amendment of our Certificate of Incorporation or bylaws; |

| |

|

|

| |

· |

Adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us. |

Leonard Greene, the Company’s Chief

Executive Officer and member of the Company’s Board of Directors own approximately 33% of the Company’s Series B Preferred

Stock. Each share of Series B Preferred stock is entitled to one hundred million (100,000,000) votes per share on all matters to be voted

at any annual or special meeting of the shareholders of the Corporation or action by written consent of shareholders. The Series B Preferred

Stockholders together control 80.0% of the voting rights of all shareholders. As a result, the Series B Preferred Stockholders have substantial

voting power in all matters submitted to our stockholders. The Series B Preferred Stockholders together are able to substantially influence

all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. In

addition, the future prospect of sales of significant amounts of shares held by them could affect the market price of our Common Stock

if the marketplace does not orderly adjust to the increase in shares in the market and the value of your investment in our company may

decrease. The Series B Preferred Holders’ stock ownership may discourage a potential acquirer from making a tender offer or otherwise

attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over

our stock price.

Although dependent on certain key personnel,

we do not have any key person life insurance policies on any such people.

We are dependent on Leonard Greene in order to

conduct our operations and execute our business plan, however, we have not purchased any insurance policies with respect to him in the

event of his death or disability. Therefore, if Leonard Greene dies or becomes disabled, we will not receive any compensation to assist

with his absence. The loss of Leonard Greene could negatively affect us and our operations.

We face significant

competition for our beverage and bottling business.

The commercial beverage and bottling industry

is highly competitive and we compete with a number of other companies that provide similar products. Our ability to compete successfully

in the commercial beverage industry and to manage our planned growth will depend primarily upon the following factors:

| · | maintaining continuity in our management and

key personnel; |

| · | ability to react to competitive product and pricing

pressures; |

| · | the strength of our brand; |

| · | the ability to expand into specialized bottling,

including carbonated beverages, unique sizes and shapes; |

| · | increasing the productivity of our future sales

employees; |

| · | effectively marketing and selling our products; |

| · | acquiring new customers for our products; |

| · | ability to respond to complaints if necessary;

|

| · | developing and improving our operational, financial

and management controls; |

| · | developing and improving our information reporting

systems and procedures; and |

| · | the design and functionality of our products. |

Many of our competitors

have greater financial, technical, product development, marketing and other resources than we do. These organizations may be better known

than we are and may have more customers or users than we do. We cannot provide assurance that we will be able to compete successfully

against these organizations, which may lead to lower customer satisfaction, decreased demand for our solutions, loss of market share or

reduction of operating profits.

Changes in the non-alcoholic beverage business

environment and retail landscape could adversely impact our financial results.

The non-alcoholic beverage business environment

is rapidly evolving as a result of, among other things, changes in consumer preferences, including changes based on health and nutrition

considerations and obesity concerns; shifting consumer tastes and needs; changes in consumer lifestyles; and competitive product and pricing

pressures. In addition, the non-alcoholic beverage retail landscape is very dynamic and constantly evolving, not only in emerging and

developing markets, where modern trade is growing at a faster pace than traditional trade outlets, but also in developed markets, where

discounters and value stores, as well as the volume of transactions through e-commerce, are growing at a rapid pace. If we are unable

to successfully adapt to the rapidly changing environment and retail landscape, our share of sales, volume growth and overall financial

results could be negatively affected.

A failure to introduce new products or product

extensions into new marketplaces successfully could prevent us from achieving long-term profitability.

We compete in an

industry characterized by rapid changes in consumer preferences, so our ability to continue developing new products to satisfy our consumers'

changing preferences will determine our long-term success. A failure to introduce new products or product extensions into new marketplaces

successfully could prevent us from achieving long-term profitability. In addition, customer preferences are also affected by factors other

than taste, such as the publicity. If we do not adjust to respond to these and other changes in customer preferences, our sales may be

adversely affected. In addition, a failure to obtain any required regulatory approvals for our proposed products could have a material

adverse effect on our business, operating results and financial condition.

Our business is sensitive to public perception.

If any product proves to be harmful to consumers or if scientific studies provide unfavorable findings regarding their safety or effectiveness,

then our image in the marketplace would be negatively impacted.

Our results of operations may be significantly

affected by the public's perception of our company and similar companies. Our business could be adversely affected if any of our products

or similar products distributed by other companies proves to be harmful to consumers or if scientific studies provide unfavorable findings

regarding the safety or effectiveness of our products or any similar products. If our products suffer from negative consumer perception,

it is likely to adversely affect our business and results of operations.

Consumers may have preconceptions about

the health benefits of spring water; such health benefits are not guaranteed or proven.

Health benefits of spring water are not guaranteed

and have not been proven. Although we do not market our products as having any potential health benefits, there is a consumer perception

that drinking spring water has beneficial health effects. Consequently, negative changes in consumers' perception of the benefits of spring

water or negative publicity surrounding spring water may result in loss of market share or potential market share and hence, loss of your

investment. We are also prohibited from touting unconfirmed health benefits in our advertising and promotional activities for the products,

both directly and indirectly through claims made by third-party endorsers when those endorsers have a material connection to our company.

Water scarcity and poor quality could negatively

impact our production costs and capacity.

Water is the main ingredient in our products.

It is also a limited resource, facing unprecedented challenges from overexploitation, increasing pollution, poor management, and climate

change. As demand for water continues to increase, as water becomes scarcer, and as the quality of available water deteriorates, we may

incur increasing production costs or face capacity constraints that could adversely affect our profitability or net operating revenues

in the long run.

Adverse weather conditions could reduce

the demand for our products.

The sales of our products are influenced to some

extent by weather conditions in the markets in which we operate. Unusually cold or rainy weather during the summer months may have a temporary

effect on the demand for our products and contribute to lower sales, which could have an adverse effect on our results of operations for

such periods.

Product contamination or tampering or issues

or concerns with respect to product quality, safety and integrity could adversely affect our business, reputation, financial condition

or results of operations.

Product contamination or tampering, the failure

to maintain high standards for product quality, safety and integrity, including with respect to raw materials and ingredients obtained

from suppliers, or allegations (whether or not valid) of product quality issues, mislabeling, misbranding, spoilage, allergens, adulteration

or contamination with respect to products in our portfolio may reduce demand for such products, and cause production and delivery disruptions

or increase costs, each of which could adversely affect our business, reputation, financial condition or results of operations. If any

of the products in our portfolio are mislabeled or become unfit for consumption or cause injury, illness or death, or if appropriate resources

are not devoted to product quality and safety (particularly as we expand our portfolio into new categories) or to comply with changing

food safety requirements, we could decide to, or be required to, recall products or withdraw from the marketplace and/or we may be subject

to liability or government action, which could result in payment of damages or fines, cause certain products in our portfolio to be unavailable

for a period of time, result in destruction of product inventory, or result in adverse publicity (whether or not valid), which could reduce

consumer demand and brand equity. Moreover, even if allegations of product contamination or tampering or suggestions that our products

were not fit for consumption are meritless, the negative publicity surrounding assertions against us or products in our portfolio or processes

could adversely affect our reputation or brands. Our business could also be adversely affected if consumers lose confidence in product

quality, safety and integrity generally, even if such loss of confidence is unrelated to products in our portfolio. Any of the foregoing

could adversely affect our business, reputation, financial condition or results of operations. In addition, if we do not have adequate

insurance, if we do not have enforceable indemnification from suppliers, bottlers, distributors or other third parties or if indemnification

is not available, the liability relating to such product claims or disruption as a result of recall efforts could materially adversely

affect our business, financial condition or results of operations.

We regularly evaluate potential expansion

into international markets, and any expansion into such international operations could subject us to risks and expenses that could adversely

impact our business, financial condition and results of operations.

To date, we have not undertaken substantial commercial

activities outside of the United States. We have evaluated, and continue to evaluate, potential expansion into certain other international

markets. If and when we seek to expand internationally in the future, our sales and operations would be subject to a variety of risks,

including fluctuations in currency exchange rates, tariffs, import restrictions and other trade barriers, unexpected changes in legal

and regulatory requirements, longer accounts receivable payment cycles, potentially adverse tax consequences, and difficulty in complying

with foreign laws and regulations, as well as U.S. laws and regulations that govern foreign activities. Economic uncertainty in some of

the geographic regions in which we might operate could result in the disruption of commerce and negatively impact our operations in those

areas. Also, if we choose to pursue international expansion efforts, it may be necessary or desirable to contract with third parties,

and we may not be able to enter into such agreements on commercially acceptable terms or at all. Further, such arrangements may not perform

to our expectations, and we may be exposed to various risks as a result of the activities of our partners.

The forecasts of market growth included

in this PQA may prove to be inaccurate, and even if the markets in which we compete achieve the forecasted growth, we cannot assure you

our business will grow at similar rates, if at all.

Growth forecasts are subject to significant uncertainty and are based

on assumptions and estimates that may not prove to be accurate. The forecasts contained in this PQA may prove to be inaccurate. Even if

these markets experience the forecasted growth described in this PQA, we may not grow our business at similar rates, or at all. Our growth

is subject to many factors, including our success in implementing our business strategy, which is subject to many risks and uncertainties.

Accordingly, the forecasts of market growth included in this PQA should not be taken as indicative of our future growth.

Reductions in future sales of our products

will have an adverse effect on our profitability and ability to generate cash to fund our business plan.

The following factors, among others, could affect

future market acceptance and profitability of our products:

| · | the introduction of additional competitive or

alternative beverage products or white label bottlers; |

| · | changes in consumer preferences among commercial

beverages products; |

| · | changes in awareness of the environmental impact

of commercial beverages products; |

| · | the level and effectiveness of our sales and

marketing efforts; |

| · | any unfavorable publicity regarding our products

or services; |

| · | any unfavorable publicity regarding our future

brands; |

| · | litigation or threats of litigation with respect

to our future products or services; |

| · | the price of our products or services compared

to those of our competitors; |

| · | price increases resulting from rising commodity

costs; |

| · | regulatory developments affecting the manufacturing

or marketing of our products; |

| · | any changes in government policies and practices

related to our products; and |

Adverse developments with respect to the manufacturing

or sale of our products would significantly reduce our net sales and profitability and have a material adverse effect on our ability to

maintain profitability and achieve our business plan.

We will rely on other companies to provide

materials for our products.

We will depend on suppliers, co-packers, and

subcontractors to meet our contractual obligations to our future customers and conduct our operations. Our ability to meet our obligations

to our customers may be adversely affected if suppliers or subcontractors do not provide the agreed-upon supplies or perform the agreed-upon

services in compliance with customer requirements and in a timely and cost-effective manner. Likewise, the quality of our future products

may be adversely impacted if companies from whom we acquire such items do not provide materials which meet required specifications and

perform to our and our customers’ expectations. Our distributors and suppliers may be less likely than us to be able to quickly

recover from natural disasters and other events beyond their control and may be subject to additional risks such as financial problems

that limit their ability to conduct their operations. The risk of these adverse effects may be greater in circumstances where we may

rely on only one or two distributors or suppliers for a particular material.

We plan to source certain materials from a number of third-party

suppliers and, in some cases, single-source suppliers.

Although we believe that alternative suppliers

will be available, the loss of any of our future material suppliers could adversely affect our results of operations and financial condition.

Our inability to preserve the expected economics of these agreements could expose us to significant cost increases in future years.

Substantial disruption to a future distributors’

or suppliers’ manufacturing facilities could occur.

A disruption in production at a future distributors’

or suppliers’ manufacturing facilities could have an adverse effect on our business. The disruption could occur for many reasons,

including fire, natural disasters, weather, water scarcity, manufacturing problems, disease, strikes, transportation or supply interruption,

government regulation, cybersecurity attacks or terrorism. Alternative facilities with sufficient capacity or capabilities may not be

available, may cost substantially more or may take a significant amount of time to start production, each of which could negatively affect

our business and results of operations.

Increased costs could affect our company.

An increase in the cost of raw materials could

affect our profitability. Commodity and other price changes may result in unexpected increases in the cost of raw materials and other

materials used by us. We may also be adversely affected by shortages of raw materials. In addition, energy cost increases could result

in higher transportation, freight and other operating costs. We may not be able to increase our prices to offset these increased costs

without suffering reduced volume, sales and operating profit, and this could have an adverse effect on your investment.

Any disruption in our information systems

could disrupt our future operations and could adversely impact our business and results of operations.

We plan to depend on various information systems

to support our customers’ requirements and to successfully manage our business, including managing orders, supplies, accounting

controls and payroll. Any inability to successfully manage the procurement, development, implementation or execution of our information

systems and back-up systems, including matters related to system security, reliability, performance and access, as well as any inability

of these systems to fulfill their intended purpose within our business, could have an adverse effect on our business and results of operations.

Such disruptions may not be covered by our future business interruption insurance, which is insurance that we plan to, but have not yet,

obtained.

Manufacturing or design defects, unanticipated

use of our products, or inadequate disclosure of risks relating to the use of the products can lead to injury or other adverse events.

These events could lead to recalls or safety alerts

relating to our products (either voluntary or required by governmental authorities) and could result, in certain cases, in the removal

of a product from the market. Any recall could result in significant costs as well as negative publicity that could reduce demand for

our products. Personal injuries relating to the use of our products can also result in product liability claims being brought against

us. In some circumstances, such adverse events could also cause delays in new product approvals. Similarly, negligence in performing our

services can lead to injury or other adverse events.

We will need to increase brand awareness.

Due to a variety of factors, our opportunity to

achieve and maintain a significant market share may be limited. Developing and maintaining awareness of our brand name, among other factors,

is critical. Further, the importance of brand recognition will increase as competition in our market increases. Successfully promoting

and positioning our brand, products and services will depend largely on the effectiveness of our marketing efforts. Therefore, we may

need to increase our financial commitment to creating and maintaining brand awareness. If we fail to successfully promote our brand name

or if we incur significant expenses promoting and maintaining our brand name, it would have a material adverse effect on our results of

operations.

Our future advertising and marketing efforts

may be costly and may not achieve desired results.

We plan to incur substantial expense in connection

with our advertising and marketing efforts. Although we plan to target our advertising and marketing efforts on current and potential

customers who we believe are likely to be in the market for the products we plan to sell, we cannot assure you that our advertising and

marketing efforts will achieve our desired results. In addition, we will periodically adjust our advertising expenditures in an effort

to optimize the return on such expenditures. Any decrease in the level of our advertising expenditures, which may be made to optimize

such return could adversely affect our sales.

We expect our future intellectual property

rights will be critical to our success, and the loss of such rights may materially adversely affect our business.

We expect to own trademarks as we launch new products

in the future. We expect that these trademarks will be very important to our business. We may also own copyright in, and to, the content

on the packaging of our products. We view these future intellectual property rights as very important to our potential success and plan

to protect such intellectual property through registration and enforcement actions. However, there can be no assurance that other parties

will not infringe or misappropriate our future trademarks, copyrights and similar proprietary rights. If we lose some or all of our future

intellectual property rights, our business may be materially adversely affected.

We plan to obtain insurance that may not

provide adequate levels of coverage against claims.

We have obtained commercial product liability

insurance that covers us for up to $1,400,000 in overall damages and $1,000,000 per occurrence. This policy also covers us for general

liability for up to $500,000 for damages to equipment and property. However, there are types of losses we may incur that cannot be insured

against or that we believe are not economically reasonable to insure. Such losses could have a material adverse effect on our business

and results of operations.

Changes in laws and regulations relating

to beverage containers and packaging could increase our costs and reduce demand for our products.

We expect that our initial products will involve

non-refillable recyclable containers in the United States. Legal requirements have been enacted in various jurisdictions in the United

States and overseas requiring that deposits or certain eco-taxes or fees be charged in connection with the sale, marketing and use of

certain beverage containers. Other proposals relating to beverage container deposits, recycling, tethered bottle caps, eco-tax and/or

product stewardship have been introduced in various jurisdictions in the United States and overseas, and we anticipate that similar legislation

or regulations may be proposed in the future at local, state and federal levels, both in the United States and elsewhere. Consumers' increased

concerns and changing attitudes about solid waste streams and environmental responsibility and the related publicity could result in the

adoption of such legislation or regulations. If these types of requirements are adopted and implemented on a large scale in any of the

major markets in which we operate, they could affect our costs or require changes in our distribution model, which could reduce our net

operating revenues and profitability.

Significant additional labeling or warning

requirements or limitations on the marketing or sale of our products may inhibit sales of affected products.

Various jurisdictions may seek to adopt significant

additional product labeling or warning requirements or limitations on the marketing or sale of our products as a result of what they contain

or allegations that they cause adverse health effects. If these types of requirements become applicable to one or more of our major products

under current or future environmental or health laws or regulations, they may inhibit sales of such products.

For example, under one such law in California,

known as Proposition 65, if the state has determined that a substance causes cancer or harms human reproduction, a warning must be provided

for any product sold in the state that exposes consumers to that substance, unless the exposure falls under an established safe harbor

level. If we were required to add Proposition 65 warnings on the labels of one or more of our beverage products produced for sale in California,

the resulting consumer reaction to the warnings and possible adverse publicity could negatively affect our sales both in California and

in other markets.

We are subject to income taxes as well as

non-income-based taxes, such as payroll, sales, use, value-added, net worth, property and goods and services taxes, in the U.S.

Significant judgment is required in determining

our provision for income taxes and other tax liabilities. In the ordinary course of our business, there are many transactions and calculations

where the ultimate tax determination is uncertain. Although we believe that our tax estimates are reasonable: (i) there is no assurance

that the final determination of tax audits or tax disputes will not be different from what is reflected in our income tax provisions,

expense amounts for non-income-based taxes and accruals and (ii) any material differences could have an adverse effect on our financial

position and results of operations in the period or periods for which the determination is made.

We are not subject to Sarbanes-Oxley regulations

and lack the financial controls and safeguards required of public companies.

We do not have the internal infrastructure necessary,

and are not required, to complete an attestation about our financial controls that would be required under Section 404 of the Sarbanes-Oxley

Act of 2002. There can be no assurances that there are no significant deficiencies or material weaknesses in the quality of our financial

controls. We expect to incur additional expenses and diversion of management’s time when it becomes necessary to perform the system

and process evaluation, testing and remediation required to comply with the management certification and auditor attestation requirements.

Risks Related to this Offering and Ownership

of our Securities

The

outstanding shares of our Series B Preferred Stock represent potential significant future dilution in ownership of our Common Stock, including

the shares of Common Stock included in the Units and the Warrant Shares.

The

outstanding shares of Series B Preferred Stock are convertible, at any time, into six billion shares of our Common Stock. At such time

as these shares of Series B Preferred Stock are converted into shares of Common Stock, holders of our Common Stock, including the shares

of Common Stock included in the Units and the Warrant Shares, will incur significant dilution in their ownership of our company. The effect

of the conversion rights of the Special 2021 Series A Preferred Stock is that upon conversion, were such conversion to occur immediately

following the sale of all Offered Units and the issuance of all Warrant Shares, the then-holder(s) of the Series B Preferred Stock, as

a group, will be issued a number of shares of common stock equal to approximately 57% of the then-outstanding issued and outstanding shares

of our Common Stock, as measured after such conversion. We are unable to predict the effect that any such conversion event would have

on the market price of our Common Stock. (See “Dilution – Ownership Dilution”).

We have not engaged a third-party

bank or financial institution to act as escrow agent. Your funds will be deposited directly into our operating account. Since there is

no minimum amount required to be raised by us before we can accept funds, there is no guarantee that any funds other than your own will

be invested in this offering.

We have not currently engaged a third-party

bank or financial institution to act as escrow agent. Your funds will be placed in our general corporate bank account and immediately

available for our use. We are not required to raise any minimum amount in this offering before we may utilize the funds received in this

offering. Potential investors should be aware that there is no assurance that any monies beside their own will be invested in this offering.

We will be subject to penny stock

regulations and restrictions and you may have difficulty selling shares of our Common Stock.

The SEC has adopted regulations which generally

define so-called “penny stocks” to be an equity security that has a market price less than $5.00 per share or an exercise

price of less than $5.00 per share, subject to certain exemptions. We anticipate that our Common Stock will become a “penny

stock”, and we will become subject to Rule 15g-9 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or the “Penny Stock Rule.” This rule imposes additional sales practice requirements on broker-dealers that sell such securities

to persons other than established customers. For transactions covered by Rule 15g-9, a broker-dealer must make a special suitability determination

for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. As a result, this rule may

affect the ability of broker-dealers to sell our securities and may affect the ability of purchasers to sell any of our securities in

the secondary market.

For any transaction involving a penny stock, unless

exempt, the rules require delivery, prior to any transaction in a penny stock, of a disclosure schedule prepared by the SEC relating to

the penny stock market. Disclosure is also required to be made about sales commissions payable to both the broker-dealer and the registered

representative and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price

information for the penny stock held in the account and information on the limited market in penny stock.

We do not anticipate that our Common Stock will

qualify for exemption from the Penny Stock Rule. In any event, even if our Common Stock were exempt from the Penny Stock Rule, we would

remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in

a distribution of penny stock, if the SEC finds that such a restriction would be in the public interest.

This offering is being conducted on a self-underwritten

“best efforts” basis and we may not be able to execute our growth strategy if the $6 million maximum is not sold.

If you invest in the Common Stock and less than

all of the offered shares are sold, the risk of losing your entire investment will be increased. We are offering our Common Stock on a

self-underwritten “best efforts” basis, and we can give no assurance that all of the offered Common Stock will be sold. If

less than $6 million of Common Stock shares offered are sold, we may be unable to fund all the intended uses described in this PQA from the net proceeds anticipated from this offering without obtaining funds from alternative sources or using working capital

that we generate. Alternative sources of funding may not be available to us at what we consider to be a reasonable cost, and the working

capital generated by us may not be sufficient to fund any uses not financed by offering net proceeds. No assurance can be given to you

that any funds will be invested in this offering other than your own.

This is a fixed price offering and the fixed

offering price may not accurately represent the current value of us or our assets at any particular time. Therefore, the purchase price

you pay for our shares may not be supported by the value of our assets at the time of your purchase.

This is a fixed price offering, which means that

the offering price for our shares is fixed. Therefore, the fixed offering price established for our shares may not be supported by

the current value of our company or our assets at any particular time.

We may, in the

future, issue additional shares of Common Stock, which would reduce investors’ percent of ownership and may dilute our share value.

Our certificate of incorporation authorizes the

issuance of 10,000,000,000 shares of Common Stock and 20,000,000 shares of Preferred Stock. As of the date of this PQA,

we had 2,940,667,506 shares of Common Stock outstanding. The future issuance of Common Stock, including in this offering and including

the Warrant Shares, may result in substantial dilution in the percentage of our Common Stock held by our then existing shareholders. We

may value any Common Stock issued in the future on an arbitrary basis. The issuance of Common Stock for future services or acquisitions

or other corporate actions may have the effect of diluting the value of the shares held by our investors and might have an adverse effect

on any trading market for our Common Stock.

We have broad discretion in the use of the

net proceeds from this offering, and our use of the offering proceeds may not yield a favorable return on your investment.

We intend

to use the net proceeds of this offering for working capital. However, our management has broad discretion over how these proceeds

are to be used and based on unforeseen technical, commercial or regulatory issues could spend the proceeds in ways with which you may

not agree. Moreover, the proceeds may not be invested effectively or in a manner that yields a favorable or any return, and consequently,

this could result in financial losses that could have a material adverse effect on our business, financial condition and results of operations.

We have never paid cash dividends on our

stock and we do not intend to pay dividends for the foreseeable future.

We have paid no cash dividends on any class of

our stock to date and we do not anticipate paying cash dividends in the near term. For the foreseeable future, we intend to retain any

earnings to finance the development and expansion of our business, and we do not anticipate paying any cash dividends on our stock. Accordingly,

investors must be prepared to rely on sales of their shares after price appreciation to earn an investment return, which may never occur.

Investors seeking cash dividends should not purchase our shares. Any determination to pay dividends in the future will be made at the

discretion of our board of directors and will depend on our results of operations, financial condition, contractual restrictions, restrictions

imposed by applicable law and other factors our Board deems relevant.

Certain provisions of our certificate of

incorporation may make it more difficult for a third party to effect a change-of-control.

Our certificate of incorporation authorizes our

board of directors to issue up to 20,000,000 shares of Preferred Stock. The Preferred Stock may be issued in one or more series, the terms

of which may be determined at the time of issuance by our board of directors without further action by the stockholders. These terms may

include voting rights including the right to vote as a series on particular matters, preferences as to dividends and liquidation, conversion

rights, redemption rights and sinking fund provisions. The issuance of any Preferred Stock could diminish the rights of holders of existing

shares, and therefore could reduce the value of such shares.

In addition, specific rights granted to future

holders of Preferred Stock could be used to restrict our ability to merge with, or sell assets to, a third party. The ability of our board

of directors to issue Preferred Stock could make it more difficult, delay, discourage, prevent or make it costlier to acquire or effect

a change-in control, which in turn could prevent our stockholders from recognizing a gain in the event that a favorable offer is extended

and could materially and negatively affect the market price of our Common Stock.

Market for Warrants

There is currently no market through which

the Warrants may be sold. The Company does not plan to apply to list the Warrants on the Nasdaq Stock Market or other nationally recognized

trading system, including the QTCQB. There can be no assurance that an active or liquid trading market will develop for the Warrants

after the Offering, or if developed, that such a market will be sustained.

Holders of Warrants have no rights as

a shareholder.

Until a holder of Warrants acquires warrant

shares upon exercise of Warrants, such holder will have no rights with respect to the warrant shares underlying such Warrants. Upon exercise

of such Warrants, such holder will be entitled to exercise the rights of a common shareholder only as to matters for which the record

date occurs after the exercise date.

Risks Related to Controlled Substances

Risks Related to the Regulation of Our

Business and Products

We and our co-packers and suppliers

are subject to extensive governmental regulation and may be subject to enforcement if we are not in compliance with applicable requirements.

We and our co-packers and suppliers are subject

to a broad range of federal, state, and local laws and regulations that govern, among other issues, the testing, development, production,

distribution, marketing, and post-market reporting of foods, including those that contain CBD. These include laws administered by the

U.S. Food and Drug Administration (“FDA”), the U.S. Federal Trade Commission (“FTC”), the U.S. Department of

Agriculture (“USDA”), and other federal, state, and local regulatory authorities. Because we market products that are regulated

as food, we and the companies that co-pack our products are subject to the requirements of the Federal Food, Drug, and Cosmetic Act (“FDCA”)

and regulations promulgated thereunder by the FDA. The statute and regulations govern, among other things, the production, composition,

ingredients, packaging, labeling, and safety of beverages. The FDA requires that facilities that produce food products comply with a

range of requirements, including hazard analysis and preventative controls regulations, current good manufacturing practices (“cGMPs”),

and supplier verification requirements. Production facilities are subject to periodic inspection by federal, state, and local authorities.

If we cannot successfully contract with co-packers for our products and if they cannot conform to our specifications and the strict regulatory

requirements of the FDA and applicable state and local laws, they may be subject to adverse inspectional findings or enforcement actions,

which could materially impact our ability to market our products, could result in their inability to continue to co-pack for us, or could

result in a recall of our products that have already been distributed. If the FDA or other regulatory authority determines that we or

they have not complied with the applicable regulatory requirements, our business, financial condition, and results of operations may

be materially adversely impacted. If we do not comply with labeling requirements, including making unlawful claims about our products,

we could be subject to public warning letters and possible further enforcement actions (which other companies distributing CBD products

have faced).

Failure by us, our co-packers, or our suppliers

to comply with applicable laws and regulations or to obtain and maintain necessary permits, licenses, and registrations relating to our

operations could subject us to administrative and civil penalties, including fines, injunctions, recalls or seizures, warning letters,

restrictions on the production or marketing of our products, or refusals to permit the import or export of products, as well as potential

criminal sanctions, any or all of which could result in increased operating costs resulting in a material effect on our operating results

and business.

The FDA has stated that it interprets

the FDCA to prohibit the sale of food products that contain CBD. The FDA is currently evaluating a potential regulatory pathway for CBD

products pursuant to its current authority; but, unless and until such changes are promulgated, the FDA and other federal and state regulatory

authorities could take enforcement action to prevent us from marketing beverages with CBD, which could adversely impact our business,

financial condition, and results of operations or cause us to halt product sales altogether.

Although hemp and CBD are no longer controlled

substances subject to regulation by the U.S. Drug Enforcement Agency (the “DEA”), the FDA has stated publicly that it is

nonetheless unlawful under the FDCA to introduce food containing CBD into interstate commerce. The FDCA prohibits the introduction or

delivery for introduction into interstate commerce of any food that contains an approved drug or a drug for which substantial clinical

investigations have been instituted and made public, unless a statutory exemption applies. The FDA has publicly stated its conclusion

that none of the statutory exceptions has been met for CBD.

On May 31, 2019, the FDA held a public hearing

to obtain scientific data and information about the safety, production, product quality, marketing, labeling, and sale of products containing

cannabis or cannabis-derived compounds (such as CBD) to provide the FDA with information as it considers policy options related to the

regulation of these products, particularly in light of the changes to the legal status of hemp enacted in the Agriculture Improvement

Act of 2018 (the “2018 Farm Bill”). The FDA has also formed an internal working group to evaluate the potential pathways

to market for CBD products, which could include seeking statutory changes from Congress or promulgating new regulations. If legislative

action is necessary, such legislative changes could take years to finalize and may not include provisions that would enable us to produce,

market, and/or sell our CBD products, and the FDA could similarly take years to promulgate new regulations. Additionally, while the FDA’s

enforcement focus to date has primarily been on CBD products that are associated with therapeutic claims, the agency has recently issued

warning letters to companies that market CBD products without such claims. There is an unquantifiable risk that the FDA could take enforcement

action against us, our co-packers, or our suppliers, or those marketing similar products to us, which could limit or prevent us from

marketing our products and have a material adverse impact on our business, financial condition, and results of operations. While the

FDA announced on March 5, 2020 that it is currently evaluating a risk-based enforcement policy for CBD to provide more clarity to the

industry and the public while the agency takes potential steps to establish a clear regulatory pathway, it remains unclear whether or

when the FDA will ultimately issue such an enforcement policy.

Moreover, local, state, federal, and international

CBD, hemp, and cannabis laws and regulations are rapidly changing and subject to evolving interpretations, which could require us to

incur substantial costs associated with compliance requirements or alteration of certain aspects of our business plan in the event that

our CBD products become subject to new restrictions. In addition, violations of these laws, or allegations of such violations, could

disrupt our business and result in a material adverse effect on our operations. It is also possible that regulations may be enacted in

the future that will be directly applicable to our products. We cannot predict the nature of any future laws, regulations, interpretations,

or applications, nor can we determine what effect additional governmental regulations or administrative policies and procedures, when

and if promulgated, could have on our activities in the hemp and CBD industry. The constant evolution of laws and regulations may require

us to incur substantial costs associated with legal and compliance fees and ultimately require us to alter our business plan.

Our products contain CBD derived from

hemp. The 2018 Farm Bill enacted a number of changes to the legal status of hemp and hemp products, including removal from the statutory

list of controlled substances. However, implementation of the 2018 Farm Bill is ongoing, and there is still significant uncertainty regarding

the legal status of hemp and hemp-based products under U.S. law.

Our products that contain CBD are subject