Current Report Filing (8-k)

11 March 2023 - 9:16AM

Edgar (US Regulatory)

0001500123

false

0001500123

2023-03-10

2023-03-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report: March 10, 2023

ITEM 9 LABS CORP.

(Exact name of registrant as specified in its charter)

| Delaware |

|

000-54730 |

|

96-0665018 |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| of incorporation) |

|

|

|

|

4802 E Ray Road, Suite 23,

Phoenix,

AZ 85044

(Address of principal executive offices and zip code)

1-833-867-6337

(Registrant’s telephone number, including area

code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a -12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d -2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e -4(c))

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company. ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Item 2.04 |

Triggering Events That Accelerate or Increase a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement. |

On March 1, 2023, Item 9

Labs Corp., a Delaware corporation (the “Company”), and each of its wholly owned subsidiaries, 938287AZ,

LLC (“938287AZ”), and 750 NV LLC, each an Arizona limited liability company

(“750 NV”) (collectively, the Company, 938287AZ and 750 NV are referred to as the “Borrower”),

received written notice from Pelorus Fund REIT, LLC, a Delaware limited liability

company (“Pelorus”) that an event of default has occurred with respect to those certain Construction Loan and Security

Agreement’s dated as of August 25, 2021 (the “Loan Agreements”) by and between 750 NV and Pelorus and 938287AZ

and Pelorus (the “Pelorus Notice”). The Pelorus Notice provides that the notice was transmitted to supplement a

prior default notice dated September 21, 2022, and sets forth certain Events of Default under the Loan Agreements.

The Pelorus Notice states Pelorus,

in its sole discretion, may (i) refuse make any additional loans or financial accommodations of any kind to the Borrower, (ii) implement

the Default Rate retroactively to August 19, 2021 and a late charge, and (iii) use the Fund Control Reserve as set forth in Section 2.6.11

of the Loan Agreement. Pursuant to the Pelorus Notice and Loan Agreements, Pelorus has made a protective advance of $2,536,589.51 (the

“AZ Protective Advances”) and $399,087.80 (the “NV Protective Advances”) in order to remove certain

Mechanic’s Lien Liens from the Mortgaged Properties (as defined in the Loan Agreements) and prevent the imposition of additional

Liens on the Mortgaged Properties and/or the Collateral. The AZ Protective Advances and NV Protective Advances will be added to the Secured

Obligations as provided in the Loan Agreement.

The Pelorus Notice indicates that Pelorus reserves

all of its rights under the Loan Agreement. On March 7, 2023, Pelorus demanded payment in full of $17,860,174.

The Company previously disclosed the Loan Agreements

are in default in a Form 10-Q filed with the SEC on February 14, 2023 and Form 10-K for year ended September 30, 2022 filed with the SEC

on January 13, 2023.

The foregoing description of the Loan Agreements are

not complete and is qualified in its entirety by reference to the full text of the Loan Agreements, a copy of which were filed as Exhibit

10.1 and 10.2 to the Company’s Current Report on Form 8-K filed with the SEC on August 31, 2021, which report is incorporated herein

by reference.

| Item 9.01. |

Financial Statements and Exhibits |

(d) Exhibits.

*Previously Filed August 31, 2021

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ITEM 9 LABS CORP. |

| |

|

|

| Dated:

March 10, 2023 |

By: |

/s/ Robert Mikkelsen |

| |

|

Robert Mikkelsen |

| |

|

Chief Financial Officer |

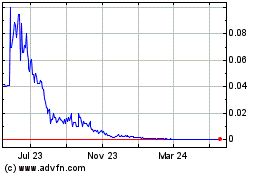

Item 9 Labs (CE) (USOTC:INLB)

Historical Stock Chart

From Dec 2024 to Jan 2025

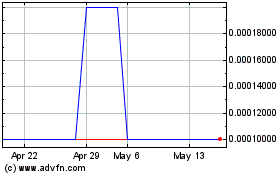

Item 9 Labs (CE) (USOTC:INLB)

Historical Stock Chart

From Jan 2024 to Jan 2025