NetworkNewsWire Editorial Coverage: Increasing global demand

countered by a worldwide shortage have made zinc a red-hot

commodity, and mining companies are racing to cash-in on the

shortage. Companies like Kootenay Zinc Corporation

(CSE:ZNK) (OTCQB:KTNNF) (Kootenay Zinc

Profile), Nevsun Resources Ltd.

(NSU), Ivanhoe Mines LTD. (IVPAF),

Teck Resources Limited (TECK) and Hudbay

Minerals Inc. (HBM) are working to address the world’s

current zinc shortage and take advantage of the subsequent rise in

zinc prices.

The imbalanced market, in part, is fueled by the 2016 shutdown

of various zinc mines in China (which is both the world’s biggest

zinc producer and its biggest zinc consumer) and the dwindling ore

supply of major zinc mines. While zinc prices sagged in 2015, the

base metal was a top performer out of the 22 raw materials tracked

by the Bloomberg Commodity Index. Goldman Sachs the following year

called zinc “the bullish exception in the metals space," and

predicted that a deeper shortage would send zinc prices as high as

$2,500 per metric ton in 2017. Zinc outpaced expectations, however,

and as of May 2017, the price of the mineral reached $2,628 per

metric ton. It’s obvious to see why Jeff Currie, head of

Commodities Research at Goldman Sachs Global, in a Bloomberg

interview (1) said zinc is his No. 1 commodities pick

for 2017.

So, what does this mean for zinc mining companies throughout the

world? It means an opportunity to profit in a huge way—particularly

for companies that can find the best zinc deposits with the

shortest ramp-up time, or those with the ability to expand their

existing zinc reserves.

Among these frontrunners is Kootenay Zinc

Corporation, a mineral exploration and development

company based in Vancouver, BC. Kootenay Zinc is engaged in

discovering large-scale sedimentary-exhalative (SEDEX) zinc

deposits and is currently focused on its Sully Property, which is

located just 18 miles from the historic Sullivan Mine. The Sullivan

Mine was in operation for approximately 100 years and was one of

the world’s biggest SEDEX silver, zinc and lead deposits, boasting

production that, at today’s prices, would be valued at US $49

billion. An exciting factor for Kootenay Zinc is that its Sully

Project could be, subject to positive drill data, of similar size

to the Legendary Sullivan —an exciting prospect, indeed.

The Sully Project shares geologic features with the Sullivan

Mine, and the sedimentary rocks hosting the Sullivan Mine are also

present at Sully, representing different environments of the same

basin. Geological data thus far suggests Kootenay Zinc’s Sully

Project share the same stratigraphic level at which the Sullivan

Mine was deposited and appears to coincide with the Sully Project’s

East gravity anomaly. A subtle lead-zinc soil anomaly may reflect

leakage up faults and dispersion through thick till and alluvium

from a deposit that is entirely buried, and a Cominco airborne

geophysical survey has shown two N-S trending magnetic anomalies

underground that are up to nearly 2 miles long (1.86) and about

0.62 of a mile apart at the Sully Project. They are near-coincident

with the gravity anomalies.

Drilling at the Sully Project, to date, has been a near

miss—which means a strike could be close at hand. Initial surveying

at Sully indicated a shallow mass was only narrowly missed by

drilling in 2004, and work performed since that time indicated the

target was deep. Downhole temperature and magnetic field readings

in 2014 indicated the target may have been missed by as little as

100 meters. Geochemical data shows anomalous zinc and lead in the

soil, which is possible leakage on structures related to the East

mass. New gravity data have confirmed and better defined the mass.

The next step for Kootenay Zinc is to target this East mass, and

the company has commenced a drilling program.

Diverse activities being pursued by Nevsun Resources

(NSU) also include zinc mining operations, with production

coming from its Bisha copper-zinc mine in Eritrea. The Bisha Mine

is a high-grade open pit mine with nine years of reserve life, and

it generates revenues from both zinc and copper concentrates. In

the middle portion of 2016, Nevsun Resources expanded its flotation

capacity to produce zinc concentrates in addition to copper

concentrates from primary ore.

Nevsun Resources earlier this week named Peter G. Kukielski as

its new CEO, effective May 12, replacing the retiring Cliff Davis.

According to the press release, Kukielski has more than 30 years of

diverse international experience in the mining industry which will

support the company’s strategies to advance its projects.

Ivanhoe Mines (IVPAF) is also chasing zinc and

has been at work modernizing and upgrading its Kipushi Mine located

in the Central African Copperbelt in preparation to restart

commercial production there. Between 1924 and 1993, the Kipushi

Project produced about 60 million tonnes grading 11 percent zinc

and 7 percent copper. The company is in the midst of a projected

two-year construction period with a relatively fast ramp-up to a

projected steady-state production of 530,000 tonnes per year of

zinc concentrate. A preliminary economic assessment was conducted

in May 2016, and a pre-feasibility study is underway to refine the

PEA’s findings and to optimize the redevelopment schedule of the

mine. Both the PEA and PFS are focused on the mining of Kipushi’s

Big Zinc Deposit, which has approximately 10.2 million tonnes of

Measured and Indicated Mineral Resources grading 34.9 percent

zinc—more than twice the Measured and Indicated Mineral Resources

of the world’s next-highest-grade zinc project.

Another company positioned to capitalize on the current world

zinc shortage is Teck Resources (TECK). Teck is

the third-largest producer of mined zinc on earth and operates one

of the largest fully integrated zinc and lead smelting and refining

facilities in the world. The company produces zinc and zinc alloys

in slab and jumbo form and is capable of producing about 295,000

tonnes of refined zinc annually. Teck also produces zinc

concentrate from its Red Dog Operations, located in Alaska, and

from its Pend Oreille Operations, located in Washington State,

marketing its zinc concentrate throughout the world. Additionally,

the company’s concentrate team buys concentrate from other mines,

which are then processed at Teck’s Trail Operations metallurgical

complex in British Columbia.

Hudbay Minerals (HBM) is also cashing in on the

global zinc shortage with output from its 777 Mine and its Lalor

Mine. The company operates a zinc plant, located in Flin Flon,

Manitoba, which produces special high-grade metal from zinc

concentrate in three cast shapes. This plant is one of six chief

zinc producers in North America, and the plant’s capacity is

expected to be fully utilized by domestic concentrates produced by

the 777 and Lalor mines. In the first quarter of 2017, Hudbay said

higher copper and zinc prices enabled the company to increase

growth profit over the previous quarter. Its Manitoba operations

produced 30,6000 tonnes of zinc as a result of higher zinc grades

at 777 and Lalor, as well as higher zinc recoveries.

The broader portrait is that due to the closure of a number of

big mines, zinc hit a record shortage in 2016, with inventories

shrinking to 286,000 metric tons, according to the International

Lead and Zinc Study Group (2). As the deficit continues

to widen, zinc is trading at its highest level in more than eight

years and is forecast to continue its climb. As the value of zinc

continues to increase, investors should take a closer look at the

companies racing to advance their projects to meet rising

demand.

Editorial Sources:

(1) Bloomberg: http://nnw.fm/IYc53

(2) MetalMiner: http://nnw.fm/Ysa29

For more information on Kootenay Zinc visit: Kootenay Zinc

(CSE:ZNK) (OTCQB:KTNNF)

About NetworkNewsWire

NetworkNewsWire (NNW) is an information service that provides to

users (1) access to our news aggregation and syndication servers,

(2) enhanced press release services, and (3) a full array of social

communication solutions. As a multifaceted financial news and

content distribution company with an extensive team of contributing

journalists and writers, NNW is uniquely positioned to best serve

private and public companies that desire to reach a wide audience

of investors, consumers, journalists and the general public. NNW

has an ever-growing distribution network of more than 5,000 key

syndication outlets across the country. By cutting through the

overload of information in today's market, NNW brings its clients

unparalleled visibility, recognition and brand awareness. NNW is

where news, content and information converge.

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW are a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer's filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer's securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains "forward-looking statements" within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. "Forward-looking statements" describe future expectations,

plans, results, or strategies and are generally preceded by words

such as "may", "future", "plan" or "planned", "will" or "should",

"expected," "anticipates", "draft", "eventually" or "projected".

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company's annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertake no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

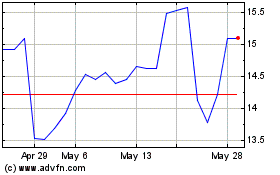

Ivanhoe Mines (QX) (USOTC:IVPAF)

Historical Stock Chart

From Dec 2024 to Jan 2025

Ivanhoe Mines (QX) (USOTC:IVPAF)

Historical Stock Chart

From Jan 2024 to Jan 2025