Airport Shops Suffer 'Crisis' as Coronavirus Upends Travel --- Update

04 March 2020 - 5:23AM

Dow Jones News

By Esther Fung

Airport retail outlets have been a rare success story in the

slumping bricks-and-mortar world. Now, duty-free and other airport

shops are under siege from the coronavirus.

Airport terminal stores enjoy a captive audience, often one with

time on their hands. These retailers have become havens of high-end

shopping, with travelers buying luxury goods, liquor or perfume

often on a whim or as last-minute presents.

Travelers from Asia in particular have made duty-free shopping

sprees an essential part of their itinerary. Brands such as Estée

Lauder now have higher sales at major airports than in North

American department stores. L'Oréal SA said revenue at its travel

retail division, which occupies 9% of its global sales, rose 25%

last year, making the division one of the French cosmetic's

company's fastest-growing channels.

But these stores are being pummeled since the coronavirus

outbreak began, as foot traffic drops at airports popular with

international tourists. Airport retail at some of the major Asian

hubs has tumbled 60% to 70%, according to the Moodie Davitt Report,

a travel retail-intelligence service provider.

"This is the greatest crisis the travel retail sector has faced,

worse than [severe acute respiratory syndrome], the two Gulf wars

or various financial crises," said Martin Moodie, chairman of the

report. "That's largely driven by the fact that the Chinese

traveler has become the epicenter of the sector over recent years

and many retailers are worryingly reliant on them."

In a February survey of more than 1,000 international travelers

from the U.S., U.K., Australia and Asia who are regular duty-free

shoppers, more than one-third said they would spend less time in a

store, not make a purchase if they need to wait in line, and would

be less likely to touch or pick up items, according to U.K.-based

travel-research specialist Pi Insight.

"There's a high portion of travelers who want to go straight to

the departure gate," said Stephen Hillam, managing director at Pi

Insight.

Transport authorities in Singapore and Thailand began to offer

rent relief in February to retail, dining and service operators for

a period of six months to a year, to help defray costs and protect

jobs.

In Hong Kong, the airport authority said it is expanding an

earlier relief package first extended in September to help retail

and catering outlets, airlines, ground handling agents and other

support-service companies. In total, these relief measures,

including rent adjustments and concessions, are expected to reach

1.6 billion Hong Kong dollars (US$205 million).

Airport foot traffic in San Francisco fell 15% in February,

compared with a year earlier, and declined 20% at Los Angeles

International Airport, according to geolocation data platform Advan

Research.

At Terminal 1 of New York's John F. Kennedy International

Airport, food-court vendors and retailers such as Hudson News said

daily revenues have fallen as much as 50% in recent weeks as

passenger traffic has plunged. China Eastern Airlines, Air China,

Korean Air and Japan Airlines fly out of Terminal 1, making it the

worst-hit among the airport's terminals because flight suspensions

have been more concentrated there, said Vivian Shi, manager of Wok

& Roll, a vendor that sells Chinese food.

"Now we're making $1,000 to $2,000 a day, compared to $4,000 on

regular days and $8,000 on exceptionally good days," said Ms. Shi,

who has also reduced supplies and cut staff hours.

Mall landlord Unibail-Rodamco-Westfield SE, which operates

stores and restaurants at airports in Los Angeles, Chicago and New

York, said those outlets also face lower foot traffic. But the

company added that only one tenant, in New York, has requested

shorter hours, and none has asked for rent relief.

"Unless the crisis persists beyond six months, I think many

tenants will stay put and wait this out," said Manny Steiner,

founder of real-estate consulting firm Steiner Placemaking

Advisory.

Write to Esther Fung at esther.fung@wsj.com

(END) Dow Jones Newswires

March 03, 2020 13:08 ET (18:08 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

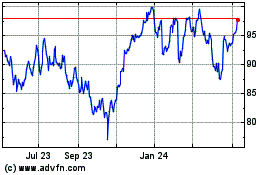

Loreal (PK) (USOTC:LRLCY)

Historical Stock Chart

From Dec 2024 to Jan 2025

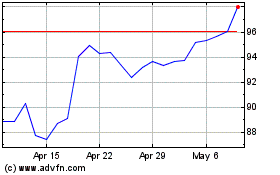

Loreal (PK) (USOTC:LRLCY)

Historical Stock Chart

From Jan 2024 to Jan 2025