Generali Board Challengers Pledge Higher Growth in Rival Plan

25 March 2022 - 10:44PM

Dow Jones News

By Ed Frankl

The rivals to Generali SpA's current board promised higher

growth and more cash for mergers and acquisitions through broad

cost-cutting as they presented an alternative strategic plan for

Italy's largest insurer.

The list of challengers, drawn up by leading shareholder

Francesco Gaetano Caltagirone, includes former Goldman Sachs banker

and current chairman of Italian insurer Revo SpA Claudio Costamagna

as chairman and the head of Generali's Austria & Central and

Eastern Europe unit Luciano Cirina.

In a statement ahead of the presentation of its strategy, dubbed

"Awakening the Lion" after Generali's logo of the lion of Trieste,

Mr. Costamagna and Mr. Cirina complained of sluggish growth under

current chief executive Philippe Donnet, and that the company has

lagged continental rivals AXA SA, Zurich Insurance AG and Allianz

SE.

The rival team is pledging net income of 4.2 billion euros

($4.62 billion) in 2024, with compound annual growth in earnings

per share of 14%, and cumulative available cash generation of

around EUR9.5 billion-10.5 billion over 2022-24.

It says it will achieve this by cutting costs overall by around

EUR600 million, restructuring geographic presence, improving

operating performances in individual countries, and using more

technology and data.

It also plans to maximize potential cash available for M&A

up to about EUR7 billion through "efficient use of leverage."

At a December strategy day, Mr. Donnet proposed EPS growth of

6%-8% and net cash generation of more than EUR8.5 billion in

2022-24.

The rival team also alleges the company has concentrated

"excessive powers on the CEO over time" and complain of the

"significant influence" of the main shareholder Mediobanca SpA.

In a statement, a Generali spokesman told Dow Jones Newswires:

"Under the leadership of Mr. Donnet, the group has successfully

executed two strategic plans that have led to the best performance

ever last year."

Generali also said that since Mr. Donnet's first investor day in

2016 its performance compared with peers' has beaten rivals in

terms of shareholder return and share price.

Tensions at the top of the company have spilled out in recent

days when Mr. Cirina was suspended by Generali on Wednesday after

being included in Mr. Caltagirone's rival slate of nominations for

the company's board.

Mr. Caltagirone is joined in his quest to unseat the current

board by Leonardo Del Vecchio, the billionaire chair of eyewear

titan EssilorLuxottica, setting themselves--Generali's second- and

third-largest investors--against the insurer's top shareholder,

Mediobanca.

Investors will decide at the company's AGM on April 29 whether

to vote for Donnet's continued leadership or change direction.

Write to Ed Frankl at edward.frankl@dowjones.com

(END) Dow Jones Newswires

March 25, 2022 07:29 ET (11:29 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

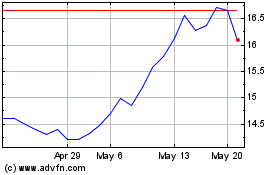

Mediobanca Banca Di Cred... (PK) (USOTC:MDIBY)

Historical Stock Chart

From Nov 2024 to Dec 2024

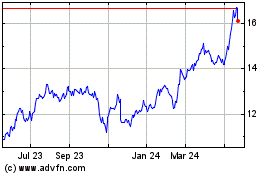

Mediobanca Banca Di Cred... (PK) (USOTC:MDIBY)

Historical Stock Chart

From Dec 2023 to Dec 2024