European Companies Plan Flurry of Buybacks -- At a Glance

25 February 2023 - 12:58AM

Dow Jones News

By Christian Moess Laursen

Stock buybacks continued in the U.K. and across Europe this

week, with at least ten companies announcing plans to repurchase

shares. Here is a look at companies that announced buybacks this

week:

-- U.K. bank Lloyds Banking Group PLC said Wednesday that it

intends to launch a 2.0-billion pounds ($2.40 billion) share

buyback. On Thursday, the lender said the buyback would start next

week and end Dec. 29.

-- Eni SpA, an Italian oil-and-gas major, said Thursday it would

launch a 2.2 billion-euro ($2.33 billion) share buyback in 2023,

equivalent to around 4.5% of shares in issue at the current share

price, following shareholder approval in May.

-- Stellantis NV, the European car maker that owns the Jeep and

Dodge brands, said Wednesday it approved a buyback program of up to

EUR1.5 billion to be executed in open market by the end of

2023.

-- French insurer AXA SA said Thursday it launched a

share-buyback program of up to EUR1.1 billion, expected to be

completed by year end.

-- German reinsurer Munich Re AG said Wednesday that it plans to

buy back shares worth up to EUR1 billion, and that the program will

run from May 6 to next year's annual general meeting, at the

latest.

-- Wolters Kluwer NV, a Dutch provider of professional

information services, said Wednesday that it intends to buy back up

to EUR1 billion in shares during 2023, matching its buybacks in

2022.

-- U.K.-listed InterContinental Hotels Group PLC, which owns the

Crowne Plaza and Holiday Inn hotel brands, said Tuesday that it was

launching a $750 million share buyback program over the course of

2023.

-- French construction-materials company Compagnie de

Saint-Gobain SA said Thursday it would allocate EUR400 million to

buybacks this year.

-- Howden Joinery Group PLC, a U.K.-listed maker of kitchen and

joinery products, said Thursday that it launched a GBP50 million

share buyback. Last year, the company completed a GBP250 million

share buyback.

-- Danish biotechnology company Genmab AS said Wednesday that it

is initiating a share buy-back program to buy up to 220,000 shares

starting on Feb. 23 and to end on March 31. In August, the company

completed a buyback of 835.3 million Danish kroner ($118.9 million)

for 342,500 shares.

-- This week's stock-repurchase announcements come after a

string of companies said they would launch buyback programs earlier

in the earnings season, including French bank BNP Paribas SA,

German luxury car maker Mercedes-Benz Group AG, British energy

giant Shell PLC and Danish pharmaceutical company Novo Nordisk

AS.

Write to Christian Moess Laursen at christian.moess@wsj.com

(END) Dow Jones Newswires

February 24, 2023 08:43 ET (13:43 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

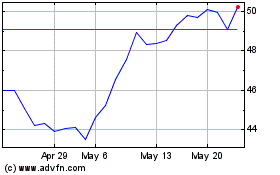

Muenchener Rueckversiche... (PK) (USOTC:MURGY)

Historical Stock Chart

From Nov 2024 to Dec 2024

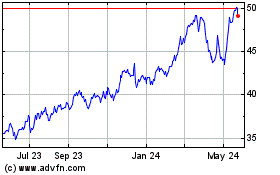

Muenchener Rueckversiche... (PK) (USOTC:MURGY)

Historical Stock Chart

From Dec 2023 to Dec 2024