PURA Compares Industrial Hemp Valuations To Mining Stocks When It Comes To Sustainability

16 February 2022 - 4:00AM

InvestorsHub NewsWire

Dallas, TX -- February 15, 2022 --

InvestorsHub NewsWire -- Puration, Inc. (USOTC:

PURA) today compared the mineral mining market to the

industrial hemp market in regard to the U.S. 2050 net zero carbon

emissions objective.

An article

published yesterday covering the impact on mineral mining from

the net zero objective, highlighted the increased demand for metals

required for electricity storage and transmission. The

increased demand from sustainability requirements is not yet

estimated into the potential stock valuations of mining

enterprises.

Similarly, PURA management contends, the

sustainability contributions of industrial hemp are not yet

estimated into the growth potential of industrial hemp and the

corresponding valuation of industrial hemp

enterprises.

Last year, PURA retooled its years of

experience with hemp to take on a much larger opportunity in 2022.

PURA has launched an initiative to expand the utilization of hemp

worldwide under the brand name Farmersville Hemp. PURA is building

a co-op of hemp growers and processors to raise market awareness

around the multitude of yet to be realized uses of hemp and build a

brand name to benefit all co-op participants under the name

Farmersville Hemp.

PURA management believes the recently

announced Hemp

Advancement Act of 2022, could substantially contribute to

PURA’s Farmersville Hemp Strategy.

The Act is intended to advance the

industrial hemp momentum initiated under the 2018 Farm

Bill.

PURA management is also eager to see the

upcoming USDA National Hemp

Report anticipated later this week on February

17th. PURA expects the report to have important

information to be utilized in the ongoing development of PURA’s

Farmersville Hemp strategy.

PURA recently

published a 2022 strategic overview detailing the company’s plan to grow

revenue and increase shareholder value by driving market wide

demand for the “multitude of yet to be realized uses of

hemp.”

PURA anticipates generating $1 million in

revenue in 2022 with the potential to reach $10 million in revenue

this year. The $10 million revenue opportunity is enhanced by

the progress of PURA’s co-op

partners.

PURA co-op partners include Alkame

Holdings, Inc. (USOTC:

ALKM), PAO Group, Inc. (USOTC:

PAOG), North American Cannabis Holdings, Inc. (USOTC:

USMJ), and UC Asset LP (OTCQX:

UCASU).

For more

information on Puration, visit http://www.purationinc.com

Disclaimer:

This News

Release contains forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. These

forward-looking statements involve known and unknown risks,

uncertainties and other important factors that could cause our

actual results, performance or achievements, or industry results,

to differ materially from any these statements. You are cautioned

not to place undue reliance on any those forward-looking

statements. Except as otherwise required by the federal securities

laws, we undertake no obligation to publicly update or revise any

forward-looking statements after the date of this news release.

None of such forward-looking statements should be regarded as a

representation by us or any other person that the objectives and

plans set forth in this News Release will be achieved or be

executed.

For More Information

Contact:

Puration,

Inc.

Brian Shibley,

info@aciconglomerated.com

(800)

861-1350

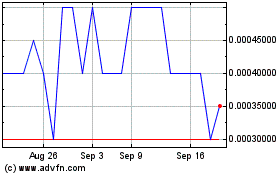

PAO (PK) (USOTC:PAOG)

Historical Stock Chart

From Oct 2024 to Nov 2024

PAO (PK) (USOTC:PAOG)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about PAO Group Inc (PK) (OTCMarkets): 0 recent articles

More PAO Group Inc (PK) News Articles