Current Report Filing (8-k)

17 May 2019 - 8:02PM

Edgar (US Regulatory)

|

|

|

|

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

|

|

|

|

|

FORM 8-K

|

|

CURRENT REPORT

|

|

|

|

|

|

PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

|

|

|

|

Date of Report (Date of earliest event reported)

|

May 16, 2019

|

|

|

|

(May 16, 2019)

|

|

|

|

|

|

|

|

|

|

|

|

|

Commission

|

|

Name of Registrants, State of Incorporation,

|

|

I.R.S. Employer

|

|

File Number

|

|

Address Of Principal Executive Offices and Telephone Number

|

|

Identification No.

|

|

|

|

|

|

|

|

001-32462

|

|

PNM Resources, Inc.

|

|

85-0468296

|

|

|

|

(A New Mexico Corporation)

|

|

|

|

|

|

414 Silver Ave. SW

|

|

|

|

|

|

Albuquerque, New Mexico 87102-3289

|

|

|

|

|

|

(505) 241-2700

|

|

|

|

|

|

|

|

|

|

001-06986

|

|

Public Service Company of New Mexico

|

|

85-0019030

|

|

|

|

(A New Mexico Corporation)

|

|

|

|

|

|

414 Silver Ave. SW

|

|

|

|

|

|

Albuquerque, New Mexico 87102-3289

|

|

|

|

|

|

(505) 241-2700

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 40.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 40.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

Registrant

|

Title of each class

|

Trading Symbol(s)

|

Name of exchange on which registered

|

|

PNM Resources, Inc.

|

Common Stock, no par value

|

PNM

|

New York Stock Exchange

|

Item 8.01

Other Events.

As previously disclosed, PNM Resources, Inc.’s wholly-owned subsidiary, Public Service Company of New Mexico (“PNM”) filed an appeal with the New Mexico Supreme Court (the “NM Supreme Court”) on September 30, 2016 regarding the New Mexico Public Regulation Commission (the “NMPRC”) order in PNM’s August 2015 general rate case filing (the “NM 2015 Rate Case”). On May 16, 2019, the NM Supreme Court rejected all but one of the matters PNM appealed and affirmed the NMPRC’s decision that disallowed recovery of the following items in the NM 2015 Rate Case:

|

|

|

|

•

|

A portion of the $163.3 million purchase price of 64.1 MW of capacity in Palo Verde Nuclear Generating Station (“PVNGS”) Unit 2 purchased by PNM in January 2016

|

|

|

|

|

•

|

The undepreciated costs of capitalized improvements made during the period that the 64.1 MW of PVNGS Unit 2 capacity was leased by PNM

|

|

|

|

|

•

|

The costs to install balanced draft technology at San Juan Generating Station Units 1 and 4

|

The NM Supreme Court ruled that the NMPRC’s decision to permanently disallow recovery of future decommissioning costs related to 64.1 MW of capacity purchased by PNM in January 2016 and 114.6 MW under extended PVNGS leases deprived PNM of its right to due process of law.

The NM Supreme Court’s ruling rejected items appealed by cross-appellants, thereby affirming PNM’s partial recovery of its purchase of 64.1 MW of capacity in PVNGS Unit 2, recovery of lease expense and operating costs associated with 114.6 MW of capacity under extended PVNGS leases, fuel costs under the coal supply agreement that serves the Four Corners Power Plant, and the inclusion of PNM’s “prepaid pension asset” in rate base. The ruling also rejected challenges to certain aspects of PNM’s rate design and of certain costs recovered under PNM’s fuel clause.

The NM Supreme Court’s ruling results in a non-cash post-tax write-off of approximately $104 million, comprised of approximately $148

million pre-tax write-off and approximately $44 million of income tax impacts.

The NM Supreme Court will remand the matter to the NMPRC to address the NMPRC’s disallowance of PNM’s recovery for future PVNGS decommissioning costs.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

PNM RESOURCES, INC.

|

|

|

PUBLIC SERVICE COMPANY OF NEW MEXICO

|

|

|

(Registrants)

|

|

|

|

|

|

|

|

Date: May 16, 2019

|

/s/ Joseph D. Tarry

|

|

|

Joseph D. Tarry

|

|

|

Vice President, Controller and Treasurer

|

|

|

(Officer duly authorized to sign this report)

|

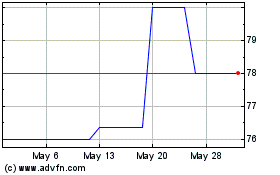

Public Service Company o... (PK) (USOTC:PNMXO)

Historical Stock Chart

From May 2024 to Jun 2024

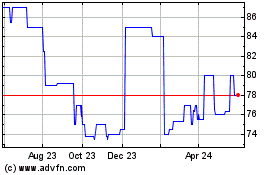

Public Service Company o... (PK) (USOTC:PNMXO)

Historical Stock Chart

From Jun 2023 to Jun 2024