Current Report Filing (8-k)

03 October 2020 - 6:05AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported): October 1, 2020

QUEST

PATENT RESEARCH CORPORATION

(Exact

Name of Registrant as Specified in Charter)

|

Delaware

|

|

33-18099-NY

|

|

11-2873662

|

(State

or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer

Identification No.)

|

|

411

Theodore Fremd Ave., Suite 206S, Rye, NY

|

|

10580-1411

|

|

(Address

of Principal Executive Offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code (888) 743-7577

Check

the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement

communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement

communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act: None

Indicate

by a check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule

12b-2 of the Securities Exchange Act of 1934.

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement

Pursuant

to a securities purchase agreement dated October 22, 2015 between the Company, certain of its subsidiaries and United Wireless

Holdings, Inc. (“United Wireless”), the Company issued its 10% secured convertible promissory notes due September

30, 2020 to United Wireless. The securities purchase agreement and related agreements are described in the Company’s annual

report on Form 10-K for the year ended December 31, 2019.

The

notes are currently held by Intelligent Partners, LLC (“Intelligent Partners”), as transferee of United Wireless.

Intelligent Partners is an affiliate of United Wireless. At September 30, 2020, promissory notes in the aggregate principal amount

of $4,672,810 were outstanding and, at September 30, 2020, accrued interest on the notes was $117,780. The notes became due by

their terms on September 30, 2020, and the Company did not make any payment on account of principal of and interest on the notes.

On

October 1, 2020, the Company entered into a standstill agreement with Intelligent Partners pursuant to which:

|

|

●

|

Intelligent

Partners agreed that, provided that the Company pays Intelligent Partners $117,780 of

accrued interest on the note by October 2, 2020, for a period commencing on October 1,

2020 until the earlier of (i) October 22, 2020 or (ii) the date of any action by any

person (other than Intelligent Partners and its affiliates) relating to the assertion

of a breach or default by the Company or any of its subsidiaries under any agreement

to which the Company or any of its subsidiaries is a party (the “Standstill Period”),

Intelligent Partners and any person acting on behalf of Intelligent Partners will forebear

from taking any action to enforce any of the rights they have or may have under the Agreements

between the Company and Intelligent Partners or under applicable law or otherwise in

respect of or arising out of the failure by the Company to pay the principal on the notes

on the maturity date thereof or as a result of any defaults or alleged defaults by the

Company or any subsidiary of the Company under any of the agreement between the Company

and Intelligent Partners or under any applicable law or otherwise.

|

|

|

●

|

During

the Standstill Period, the Company and Intelligent Partners will seek to negotiate a

mutually agreeable restructure agreement which provides for restructure of the Company’s

obligations under the notes and a modification of its obligations under the Company’s

Agreements with Intelligent Partners.

|

On

October 1, 2020, the Company made the $117,780 payment to Intelligent Partners. The Company intends to negotiate in good faith

with respect to a restructuring of its obligations to Intelligent Partners. However, the Company cannot give any assurance that

it will be successful in negotiating a restructure. In the event the Company is not able to negotiate a restructure, it may not

be able to continue in business and may be necessary for the Company to seek protection under the Bankruptcy Act.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

QUEST

PATENT RESEARCH CORPORATION

|

|

|

(Registrant)

|

|

|

|

|

Date:

October 2, 2020

|

|

/s/ Jon C. Scahill

|

|

|

By:

|

Jon C. Scahill

|

|

|

Title:

|

Chief Executive Officer

|

2

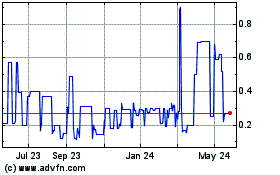

Quest Patent Research (QB) (USOTC:QPRC)

Historical Stock Chart

From Oct 2024 to Nov 2024

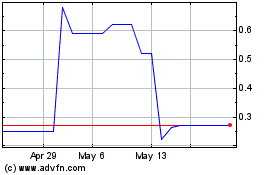

Quest Patent Research (QB) (USOTC:QPRC)

Historical Stock Chart

From Nov 2023 to Nov 2024