UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

| SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the fiscal year ended December 31, 2014 |

| |

| OR |

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

| SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the transition period from ________________ to ________________ |

Commission file number: 000-50417

RBC LIFE SCIENCES, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Nevada | | 91-2015186 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

2301 Crown Court, Irving, Texas | | 75038 |

(Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: 972-893-4000

Securities registered pursuant to Section 12(b) of the Act: None

|

| |

Securities registered pursuant to Section 12(g) of the Act: | Common Stock, $0.001 par value |

| (Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No R.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No R.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes R No o.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes R No o.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | |

Large accelerated filer o | | Accelerated filer o |

Non-accelerated filer o | (Do not check if a smaller reporting company) | Smaller reporting company R |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No R.

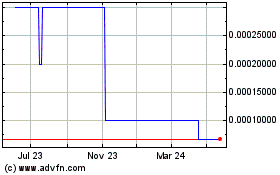

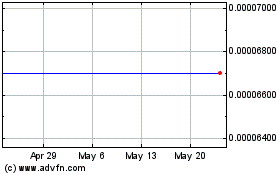

Aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2014: $1,053,433

Number of shares of common stock outstanding as of March 9, 2015: 2,212,350

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement to be used in connection with its 2015 Annual Meeting of Shareholders are incorporated by reference into Part III of this report.

FORWARD LOOKING STATEMENTS

The statements included in this report, other than statements of historical or present facts, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical or present facts, that address activities, events, outcomes and other matters that we plan, expect, intend, assume, believe, budget, predict, forecast, project, estimate or anticipate (and other similar expressions) will, should or may occur in the future are forward-looking statements. Forward-looking statements generally can be identified by the use of forward-looking terminology such as, but not limited to, “may”, “will”, “expect”, “intend”, “estimate”, “anticipate” or “believe”. These forward-looking statements are based on management's current belief, based on currently available information, as to the outcome and timing of future events. Although we believe that the expectations and assumptions reflected in the forward-looking statements are reasonable, they involve risks and uncertainties that are difficult to predict and, in many cases, beyond our control. Our forward-looking statements speak only as of the date on which this report was filed with the SEC. We expressly disclaim any obligation to issue any updates or revisions to our forward-looking statements, even if subsequent events cause our expectations to change regarding the matters discussed in those statements. Over time, our actual results, performance or achievements will likely differ from the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements, and such differences might be significant and materially adverse to our shareholders.

We may experience variations in our actual results, performance or achievements from quarter to quarter and/or year to year as a result of factors that include the following:

| |

• | The level of recruiting and retention of our associates in the North America and Southeast Asia markets and territories served by our licensees; |

| |

• | Variations in the level of business activity generated by our key customers; |

| |

• | The opening of new markets; |

| |

• | The timing and efficacy of company-sponsored events, promotions and other marketing and sales initiatives; |

| |

• | New product introductions; |

| |

• | The negative impact of new regulations or changes in existing regulations domestically and/or internationally that may limit or restrict the sale of certain products; |

| |

• | The integration and operation of new information technology systems; |

| |

• | The inability to introduce new products or the introduction of new products by competitors; |

| |

• | Entry into one or more of our markets by competitors; |

| |

• | General conditions in the nutritional supplement industry, the network marketing industry and the wound care industry; and |

| |

• | General economic conditions globally and/or in markets where we or our licensees conduct business. |

As a result of these and other risks and uncertainties, sales, expenses, and results of operations could vary significantly in the future, and period-to-period comparisons should not be relied upon as indications of future performance. The foregoing list of risks and uncertainties may not contain all of the risks and uncertainties that could affect us. Please consider our forward-looking statements in light of these risks and uncertainties as you read this report.

TABLE OF CONTENTS

|

| | |

| | PAGE |

| | |

PART I | | |

Item 1. | Business | |

Item 2. | Properties | |

Item 3. | Legal Proceedings | |

Item 4. | Mine Safety Disclosures | |

| | |

PART II | | |

Item 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

Item 6. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

Item 7. | Financial Statements and Supplementary Data | |

Item 8. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

Item 8A. | Controls and Procedures | |

Item 8B. | Other Information | |

| | |

PART III | | |

Item 9. | Directors, Executive Officers and Corporate Governance | |

Item 10. | Executive Compensation | |

Item 11. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Item 12. | Certain Relationships and Related Transactions, and Director Independence | |

Item 13. | Principal Accountant Fees and Services | |

| | |

PART IV | | |

Item 14. | Exhibits and Financial Statement Schedules | |

| | |

SIGNATURES | |

PART I

Overview

RBC Life Sciences, Inc., a Nevada corporation formed in 1999 (along with its subsidiaries, sometimes hereinafter referred to collectively as “we”, “our”, the “Company” or “RBC”), is principally engaged in the marketing and distribution of nutritional supplements and personal care products (collectively “Nutritional Products”) through subsidiaries in North America and Southeast Asia. This product line is marketed under the “RBC Life” brand name and may be broadly categorized as: (i) wellness products, (ii) fitness products and (iii) skin care products. The product line includes herbal formulas, vitamins, minerals, antioxidants and skin, hair and body care products.

We market Nutritional Products in North America, Southeast Asia and Australia through a network of independent distributors that we refer to as "Associates." We also market Nutritional Products in certain international markets through license arrangements. The licensees are third parties who are granted exclusive rights to distribute Nutritional Products in their respective territories and, for the most part, distribute these products through an independent network of Associates in the licensed territory.

Associates are independent contractors who purchase products for personal use, purchase products for resale to retail customers and sponsor other individuals as Associates. Associates can derive compensation both from the direct sales of products and from sales generated by sponsored Associates. The marketing effort of our Associates involves person-to-person communication of information related to our products and the system by which our products are sold. We believe this feature makes network marketing a more effective means of marketing our products than in-store retail sales where there is little or no direct explanation of product benefits. Network marketing provides financial opportunity to a broad cross-section of people, including those seeking to simply supplement other income as well as those who desire a full-time home-based business.

In addition to Nutritional Products, we also market a line of wound care products (“Medical Products”) through a U.S. subsidiary under the "MPM Medical" brand name. Medical Products are primarily distributed in the U.S. to hospitals, nursing homes, clinics and pharmacies through traditional medical/surgical supply dealers and pharmaceutical distributors. These products are used to prevent and treat wounds, and manage pain associated with wounds in the acute care, long-term care and oncology markets.

Our principal offices are located at 2301 Crown Court, Irving, Texas 75038. We can be reached by phone at 972-893-4000, by fax at 972-893-4111 and by email at webmaster@rbclifesciences.com. Our corporate information can be accessed at www.rbclifesciences.com or www.mpmmedicalinc.com.

Industry Overview

Nutritional Products. In the Nutritional Products business segment, we compete in two industries: nutrition and direct selling. The nutrition industry is highly fragmented and very competitive. Companies in this industry manufacture and distribute products generally intended to maintain and/or enhance the body's health and general well-being. Products manufactured and distributed include (i) nutritional supplements, (ii) natural and organic foods, (iii) functional foods and (iv) natural and organic personal care and household products. The majority of our net sales in this segment are sales of nutritional supplements.

According to the latest data published by the Nutrition Business Journal (“NBJ”) with respect to the global nutrition industry, global nutrition industry sales increased 7% to $347 billion in 2012. Of that $347 billion, nutritional supplements contributed $97 billion, while natural and organic foods contributed $101 billion, functional foods $112 billion, and natural and organic personal care and household products $37 billion. In 2012, total sales of nutritional supplements in our largest markets, the U.S, Russia/Eastern Europe and Asia grew 7%, 10% and 12%, respectively. NBJ projected that sales of nutrition supplements in 2013 would grow by 8% in the U.S., 10% in Russia/Eastern Europe and 12% in Asia.

We believe that there are a number of demographic, health care and lifestyle trends that continue to drive the growth of the nutrition industry, including:

| |

• | The aging population, particularly the baby-boomer generation, combined with consumers' tendency to purchase more nutritional supplements as they age; |

| |

• | The general public's heightened awareness and understanding of the connection between diet and health, and its interest in healthier lifestyles and more proactive approaches in managing health care needs; |

| |

• | Rising health care costs that lead many consumers to take preventive measures, including alternative medicines and nutritional supplements; and |

| |

• | The publication of research findings supporting the positive health effects of certain nutritional supplements. |

Nutritional products are distributed through various market participants, which include the following:

| |

• | Mass market retailers, including mass merchandisers, drug stores, supermarkets, and discount stores; |

| |

• | Natural health food retailers; |

| |

• | Health care professionals and practitioners; and |

Our primary distribution model is a network marketing system, which is a common form of direct selling. According to the latest data available from the World Federation of Direct Selling Associations (the "WFDSA"), the direct selling industry generated approximately $179 billion in worldwide retail sales in 2013, an increase of 8% over 2012, with approximately 96 million independent distributors. WFDSA statistics show that the U.S. continues to be the largest individual market for direct sales in the world while the Asia/Pacific region is the largest and fastest growing region. According to the Direct Selling Association (“DSA”), the U.S. member association of the WFDSA, the U.S. generated approximately $33 billion in retail sales in 2013, an increase of 6% over 2012, with approximately 17 million independent distributors. DSA statistics show that wellness products, which include nutritional supplements, comprised the largest product sales category and accounted for approximately 28% of 2013 U.S. retail sales while personal care products accounted for approximately 16%.

Medical Products. In the Medical Products business segment, we compete in the wound care industry. Industry participants in this multi-billion dollar market are companies of all sizes that manufacture and distribute a wide range of products related to the treatment and prevention of wounds. Products manufactured and distributed in this industry include:

| |

• | Wound management products such as adhesive bandages and gauze; |

| |

• | Wound closure products such as staples, various clips and sutures; |

| |

• | Advanced wound care products, which are represented by a variety of moist wound healing dressings such as alginate dressings, film dressings, foam dressings, hydrocolloid dressings and hydrogel dressings; |

| |

• | Active wound healing products such as skin replacements, collagen dressings and growth factors; |

| |

• | Debriding products including various cleansers; and |

| |

• | Pressure relief devices such as beds, mattress overlays and other support devices. |

Wounds requiring treatment can be either acute or chronic. Industry data indicates that acute wounds comprise a large majority of all wounds. These are wounds that follow the normal process of healing and generally include burns, traumatic wounds and surgical incisions. Chronic wounds are wounds that do not heal within a normally expected time frame under standard care and generally include venous, arterial, pressure and diabetic ulcers. The increasing prevalence of chronic wounds is driven by the large and growing elderly, diabetic and obese populations as these groups are more likely to suffer from conditions that compromise circulation, which is a primary cause of chronic wounds.

Our Medical Products generally fall into the advanced wound care and debriding product categories. These products are primarily used in the prevention and treatment of chronic wounds.

Competitive Strengths

Product Portfolio. We have developed a line of high-quality health products based on the demands of the industries in which we operate. Our product lines feature proprietary products, newly developed products and products that have been available for many years. We regularly review and, if necessary, improve our product formulations based on new scientific data, market demands and regulatory changes to ensure our product portfolio remains current and attractive to our customers, and satisfies regulatory requirements.

In-house Manufacturing. We manufacture certain proprietary raw materials for our exclusive use, including the key raw material used in certain of our top-selling products, Microhydrin® and Microhydrin Plus®, which are Nutritional Products. Together, these products accounted for 9% of consolidated net sales and 12% of Nutritional Products sales in 2014. We believe that our ability to manufacture these proprietary raw materials is a competitive advantage for us because it

allows us to better protect our proprietary technology and know-how, and better manage the quality of and costs associated with the production of our key raw materials.

Science-based Product Development. We emphasize science-based product development in the fields of nutrition and wound care. We have developed substantially all of our products utilizing scientific data as the basis of product formulation, including published research, in-house and third-party research and sponsored research. We maintain an on-going research and development effort that includes in-house personnel as well as third-party advisers, including medical professionals.

Operating Flexibility. Other than the production of certain proprietary raw materials, we contract the production of all our products to third-party contract manufacturers. This arrangement allows us to minimize capital expenditures, benefit from specialized expertise provided by the contract manufacturer and maintain operating overhead in line with sales. We have found the marketplace for quality contract manufacturers to be competitive and attractive. We have established an internal quality system, including the use of in-house quality control laboratories and personnel, to monitor the performance of our third-party manufacturers to ensure they maintain a high quality of service.

Experienced Management Team. Our management team includes individuals with expertise in various managerial disciplines including nutrition, wound care, international business development, marketing, sales, operations, quality assurance, finance and information technology.

Business Strategy

We seek to grow our business by pursuing the following strategies:

Expand Network Marketing into New Markets. We believe that significant growth opportunities for our Nutritional Products exist in new international markets. Before initiating sales in a new market, we consider a number of factors including anticipated demand for our products, market size, receptiveness to network marketing, and the market entry process, which includes consideration of possible regulatory restrictions on our products or our network marketing system. To the extent possible, we expect to seamlessly integrate our Associate compensation plan in each new market to allow Associates to receive commissions for global—not merely local—product sales. We believe the seamless integration of the Associate compensation plan significantly enhances our ability to expand internationally.

To test acceptance in the Southeast Asia market of our products and network marketing program, during 2010, we began selling selected Nutritional Products in certain countries in Southeast Asia, under a not-for-resale (“NFR”) program. The NFR program allows consumers in NFR markets to sign up as customers, purchase products, refer others to our network marketing program and receive commissions. Based on the results of our efforts under the NFR program, we opened an office in Taiwan in 2011 that was followed in July 2013, March 2014 and July 2014 by the opening of offices in Hong Kong, Malaysia and Indonesia, respectively. We also conduct our network marketing business in Singapore through the Malaysia office and continue to market our products in Brunei under the NFR program that began in 2010. The NFR program was expanded to include Australia in 2013, and we expect to open new offices in Southeast Asia in 2015.

Attract and Retain Network Marketing Associates. We believe that the network marketing model is the most effective way to sell our Nutritional Products. Our objective is to increase sales in this channel by increasing the attraction, recruitment, retention and productivity of our Associates. We seek to accomplish these objectives by (i) providing training and support to new and existing Associates through various means, including the sponsorship of meetings and events and providing sales tools and resources at low or no cost, (ii) maintaining effective communications with Associates, (iii) introducing new and/or improved products and (iv) providing financial incentives through the Associate compensation plan. In order to upgrade our ability to communicate with and train our Associates while also offering more effective sales tools and business information support, in late 2013, we contracted to implement a new computer system to support the network marketing business. We expect the new computer system to be deployed in the first quarter of 2015. Following deployment of the new computer system, we plan to upgrade our website and implement new training programs designed to increase the leadership and training skills of field Associates who are actively working to grow their distributorships. In addition to these initiatives, we also award our top performing Associates with an all-expenses paid trip to our annual Leadership Event. These conferences provide significant incentive to our Associates to grow their sales organizations while also serving to improve Associate retention.

Exploit New Product Opportunities; Develop New and Improved Products. As a distributor of health products, we believe that it is vital to continually evaluate ways to improve existing products and to introduce new and innovative products. We believe that our product line must remain current to effectively compete with other companies in our industry and to retain the interest and attention of our Associates. Accordingly, our marketing and sales activities emphasize products

in our line that have strong scientific support and are uniquely identified with us such as Stem-Kine®, Microhdyrin and Microhydrin Plus, Vitaloe®, OliViva®, Organic Spirulina, Neurobright®, Colo-Vada Plus®, HydraCel® and 24 Seven, each of which is described in further detail below under the caption "Products." Our product development activities center around the development and introduction of science-based products in response to newly released clinical and other scientific data, new technology and customer preferences.

We plan to use our existing resources and, to the extent we deem prudent, invest additional resources, to identify opportunities for new and improved products, and we expect to introduce new and improved products in 2015.

Expand Medical Products in Existing and New Markets. We believe there is significant opportunity to increase net sales of our Medical Products in the U.S. and international markets. We have developed and continue to develop new market opportunities in the U.S. based on our expertise in the wound care market. During 2015, we expect to (i) continue to enhance our product offering, (ii) provide specialized wound care training and other support to our field sales force and (iii) increase the body of clinical data supporting the safety and efficacy of our products. In addition, we continue to work with third parties to facilitate the expansion of Medical Products distribution into international markets, primarily focusing on Central and South America and the Caribbean.

Leverage and Expand our Relationship with CCI. Our largest customer is Coral Club International, Inc. (“CCI”), which is a licensee that distributes our Nutritional Products. Net sales to CCI accounted for approximately 38% of consolidated net sales in 2014. In August 2014, the Company entered into a two-year exclusive distributorship agreement with CCI. This Agreement replaced the ten-year exclusive distributorship agreement between the parties that automatically renewed for a one-year term following expiration of the initial term in July 2014. Pursuant to the new agreement, CCI’s exclusive territory now includes Russia and other countries located primarily in Europe and Central Asia, which represents an expansion of the territory set forth in the former agreement. Under the former agreement, CCI distributed products in a territory comprised mainly of Russia and Eastern Europe.

Our objective is to support CCI in this territory by supplying CCI with new products and providing operational and regulatory support. We will continue to implement initiatives to accomplish these objectives and seek other ways to facilitate growth in CCI's territory.

Products

The Nutritional Products segment, which accounted for 78% and 75% of consolidated net sales in 2014 and 2013, respectively, markets nutritional supplements and personal care products under the "RBC Life" brand name. The Medical Products segment markets wound care products under the "MPM Medical" brand name. For additional information related to these industry segments, please see Note N to the Company's consolidated financial statements included elsewhere in this report.

Nutritional Products. We currently market a line of approximately 100 nutritional supplements and personal care products, including herbs, vitamins and minerals, as well as natural skin, hair and body care products. These products may be broadly categorized as: (i) wellness products, (ii) fitness products and (iii) skin care products. Featured products include:

| |

• | Stem-Kine – dietary supplement shown in published human clinical studies to nutritionally enable bone marrow and other stem cell-producing tissues, which form the natural repair and renewal system of the body, to increase their production of stem cells; |

| |

• | Microhydrin and Microhydrin Plus – powerful, broad-spectrum antioxidants; |

| |

• | VitAloe – a blend of research-backed ingredients designed to support the immune system and nutrients that support the growth of healthy bacteria in the digestive tract. |

| |

• | OliViva – made from freshly harvested olive leaves, an antioxidant beverage that supports the immune system, increases energy and supports the cardiovascular system; |

| |

• | Organic Spirulina – sold separately in powder and tablet forms as well as in combination with other ingredients, a nutritious algae that provides a complete range of vital nutrients and a higher percentage of easily digested protein than meat; |

| |

• | NeuroBright – introduced in August 2009 and patented in January 2013, this product supports healthy brain function and enhances energy and acuity; |

| |

• | Colo-Vada Plus – an effective 14-day colon cleansing program that has been widely used for more than 20 years; |

| |

• | HydraCel – a product that improves the quality of drinking water by reducing surface tension for increased hydration and making water more alkaline; |

| |

• | 24 Seven – a daily multivitamin/mineral supplement; |

| |

• | Immune 360® – a product to nourish and support the function of the immune system; and |

| |

• | Aloe Gelee – a Aloe-based, non-sticky gel that provides the soothing and moisturizing benefits of real Aloe vera gel and other natural botanicals. |

Our top-selling products are Stem-Kine, which accounted for approximately 12% and 8% of consolidated net sales in 2014 and 2013, respectively, and Microhydrin and Microhydrin Plus, which collectively accounted for approximately 9% and 11% of consolidated net sales in 2014 and 2013, respectively. No other product accounted for more than 10% of our sales. With the exception of Stem-Kine, our finished products are produced according to our specifications and/or formulas; Stem-Kine is produced in accordance with the formula owned by its developer. In all cases, however, our finished products are produced by manufacturers and suppliers that we do not control. We maintain quality control of our products through the quality systems we have established, which include the use of in-house laboratories as well as the manufacturing and laboratory facilities of our third-party suppliers. We believe our manufacturing and distribution practices are in compliance with current good manufacturing practice regulations established by the FDA.

We produce and market Stem-Kine in accordance with an arrangement with the developer that permits the Company to manufacture and distribute both domestically and internationally. Under the original license agreement between the Company and the developer, we were granted certain exclusive marketing rights in the U.S. and all countries where our products were sold by us or our licensees at that time, except that the licensor retained the right to sell Stem-Kine to licensed health care practitioners in the U.S. The Company's exclusive rights under this agreement ended December 31, 2014. The Company and the developer are currently in negotiations, and have reached general agreement, regarding the terms of a new exclusivity arrangement that is better aligned with the current business strategies of each party. Although no assurance can be given, the Company expects to enter into a new licensing agreement with the developer during 2015.

Substantially all of our product line has been developed utilizing scientific data as the basis of product formulation. Scientific data includes published research, in-house and third-party research and sponsored research. Most of our product formulations feature one or more of the following key ingredients:

| |

• | Silica mineral hydride, a nutritional antioxidant manufactured by us using our proprietary formula and process and used as an ingredient in the formulation of nutritional supplement and personal care products; |

| |

• | Organic Spirulina sourced from the highest quality producers, sold as a stand-alone product and combined as an ingredient in many other nutritional supplement formulations; and |

| |

• | Organic Aloe vera and certain aloe vera extracts specially processed to retain the benefits found in a fresh aloe vera leaf. These ingredients are used in the formulations of nutritional supplements, an aloe vera beverage and topical personal care products. |

Our in-house manufacturing facility produces certain key raw materials for our product line. Through this facility and our own proprietary manufacturing processes, we ensure the quality of those key raw materials used in our product line. We provide raw materials manufactured by us to third-party manufacturers for their use in producing our finished products. Our proprietary raw materials represent key ingredients used in certain top-selling products including Microhydrin, Microhydrin Plus, NeuroBright and HydraCel.

Medical Products. As is the case with our Nutritional Products, substantially all of our Medical Products were developed utilizing scientific data as the basis of product formulation. Our Medical Products are produced according to our specifications and/or formulas by manufacturers and suppliers that we do not control. We maintain quality control of our products through the quality systems we have established, which include the use of in-house laboratories as well as the manufacturing and laboratory facilities of our third-party suppliers.

We currently market a line of over 35 wound care products. Certain wound care products, which accounted for approximately 84% of Medical Products sales in 2014, are for the treatment and healing of wounds such as pressure ulcers, leg ulcers, cuts, burns and abrasions. These products include cleansers, dressings, hydrogels, collagen, calcium alginates, moisture barriers, antimicrobials and a unique hydrogel wound dressing with Lidocaine. Our other wound care products, which represented approximately 16% of Medical Products sales in 2014, are designed to reduce destruction to skin and tissue caused by radiation, and to reduce pain and itching in the skin and the internal mucosa caused by radiation reactions or reactions to certain cancer medications.

Manufacturing and Product Sourcing

We manufacture certain proprietary raw materials used in the production of many of our Nutritional Products. Included in the raw materials we produce is silica mineral hydride, the key ingredient used in production of certain of our top-selling

products including Microhydrin and Microhydrin Plus. These raw materials are manufactured according to proprietary formulations and processes developed by us for our exclusive use. Our manufacturing operations are conducted at our headquarters located in Irving, Texas. We believe our current manufacturing operations have sufficient capacity to meet current and projected demand.

We source raw materials to manufacture Stem-Kine from its developer, which produces these raw materials in accordance with its own proprietary formulas and specifications. We supply these raw materials to a third-party manufacturer that produces the finished product in accordance with the formula and specifications of the developer. We believe that the developer is a high-quality raw material supplier and is capable of meeting our current and projected demand.

With regard to our finished products, we contract with third-party manufacturers and suppliers, such as Progressive Laboratories, Inc., Strukmyer, LLC, Merical Vita-Pak, Inc. and Pacific Nutritional, Inc., to produce the products according to the specifications and/or formulas provided to them. This strategy provides operating flexibility with minimum investment and helps us to control operating costs. We believe that our manufacturers and suppliers are high-quality and are capable of meeting our current and projected demand over the next several years. We do not have long-term supply contracts with any of these manufacturers or suppliers. Most of our products can be manufactured by a number of contract manufacturers at competitive prices.

Sales by Geographic Area

For information related to sales by geographic region for the years ended December 31, 2014 and 2013, please see Note N to the Company's consolidated financial statements included elsewhere in this report.

Independent Distributor Network

Overview. We distribute Nutritional Products in North America and certain countries in Southeast Asia through a network of independent distributors that we refer to as “Associates.” In using this distribution model, we sell substantially all of our Nutritional Products in these markets through individuals who are not our employees. Our Associates generally purchase products from us for personal consumption or for resale to consumers. The concept of network marketing is based on the strength of personal recommendations that frequently come from friends, neighbors, relatives and close associates. We believe that network marketing is an effective method of distribution because it allows person-to-person interaction about our products and business, which is not readily available through other distribution channels.

Our sales in these markets are dependent upon the number and productivity of our Associates. Growth in sales is dependent upon the sponsorship of new Associates and retention of existing Associates. We had approximately 16,700 and 11,100 active Associates at December 31, 2014 and 2013, respectively. We consider an Associate active if he/she has placed an order within the previous 12 months.

In Brunei and Australia, the Company sells certain Nutritional Products under our NFR program. The NFR program allows consumers in NFR markets to sign up as customers, purchase products, refer others to our network marketing program and receive commissions. The principle difference between an NFR program customer and an Associate is that an Associate may resell the products that they purchase from us whereas NFR program customers cannot. However, an NFR program customer can sponsor a new NFR program customer, who is then able to purchase products directly from us. Because of the similarities between Associates and NFR program customers, we consider an NFR program customer to be equivalent to an Associate.

We do not have any significant accounts receivable from our Associates because they are required to pay for purchases prior to shipment. Associates pay for products primarily by credit card, although orders can also be paid with cash, direct account withdrawal, money orders or checks. We are not dependent upon the sales of any individual Associate, the loss of whom would have a material adverse effect on our business.

Associates. A person who wishes to become an Associate must complete an application under the sponsorship of an existing Associate. Upon the Company's acceptance of the application, the new Associate then becomes part of the sponsoring Associate's organization. New Associates sign a written contract and agree to adhere to policies and procedures that govern the activities of Associates. Associates are independent contractors and not our employees. An Associate has the right to purchase products at wholesale, sponsor new Associates and earn compensation in accordance with the Associate compensation plan. While some Associates sell products and recruit new Associates on a full-time basis, most engage in these activities on a part-time basis or only purchase our products for personal consumption.

Sponsoring. We develop and sell sales materials and tools for use by our Associates, who have the primary responsibility for recruiting and educating new Associates with respect to our products, the Associate compensation plan and how to build a successful distributorship. Because new Associates are linked to their sponsor, sponsorship of new Associates creates multiple levels in the network marketing structure. Persons that an Associate sponsors are referred to as “downline” or sponsored Associates.

Sponsoring activities are not required of Associates and we do not pay any commissions for the act of sponsoring new Associates, although commissions are paid based on the product sales of downline Associates. Because of the financial incentives provided to those who succeed in building an Associate network that purchases and resells products, we believe that many of our Associates attempt, with varying degrees of effort and success, to sponsor new Associates.

Compensation. Our Associate compensation plan provides several opportunities for Associates to earn compensation. We believe our compensation plan provides financial rewards comparable to those offered by other compensation plans in the industry. There are generally two ways in which our Associates earn compensation:

| |

• | Through retail markups on sales of products purchased at wholesale; and |

| |

• | Through a series of commissions on product sales generated by the Associate and his or her downline Associates. |

Commissions are based on the total monthly sales by the Associate and his or her downline organization. As an Associate's business expands from successfully sponsoring new Associates into the business, who in turn expand their own businesses, an Associate can earn higher commissions. Most commissions are paid to Associates monthly.

Support. Associates are encouraged to assume responsibility for training and motivating other Associates within their respective downline organizations and to conduct meetings for potential new Associates. Associates can purchase sales and training materials from us, and they generally assume the costs of advertising and marketing our products to their customers, as well as the direct cost of sponsoring and training new Associates.

In addition to the development of sales and training materials for use by our Associates, we also periodically sponsor and conduct local, regional and international Associate events and training seminars. Attendance at these sessions is voluntary, although our experience indicates that the most effective and successful Associates are those that participate in training activities. These live events are supplemented by regular e-mail communications, materials available on our website and corporate conference calls.

We use the Internet to support our Associates and enhance communication with them. Through our website and various social media applications, Associates can obtain and share information about us and our products. They can also obtain other current information such as new product announcements, descriptions of product specials and sales promotions and other marketing and training materials. In addition, Associates have the ability to sponsor new Associates and to place orders through their "back office," which is a secured area of our website that requires a user name and password to access. To help our Associates effectively manage their businesses, we allow them to obtain a wide range of information related to their downline organization directly from our database, which can be accessed through their back office.

In order to increase the effectiveness of our website, social media outreach and Associate back office, in late 2013, we contracted to implement a new computer system to support the network marketing business. We expect the new computer system to be deployed in the first quarter of 2015. Following deployment of the new computer system, we plan to upgrade our website and Associate back office, and implement new training programs and communication tools designed to increase the leadership and training skills of field Associates who are actively working to grow their distributorships.

Compliance. On occasion, Associates fail to adhere to our Associate policies and procedures. We systematically review reports of alleged Associate misconduct. Infractions of the policies and procedures are reviewed by a compliance committee that determines what disciplinary action may be warranted in each case. If we determine that an Associate has violated any of our Associate policies and procedures, we may take a number of disciplinary actions. For example, we may terminate the Associate's purchase and distribution rights completely or impose sanctions, such as warnings or probation. We may also withdraw or deny awards, suspend privileges, withhold commissions until specific conditions are satisfied or take other appropriate actions at our discretion.

Returns. Our product return policy allows retail customers to return the unused portion of any product to the Associate who sold them the product for a full cash refund. We reimburse the Associate with a replacement product or a credit on account upon receipt of proper documentation and the return of the remaining product.

Nutritional Products returned by Associates that are unused and resalable are refunded up to one year from the date of purchase at 100% of the sales price less a 10% restocking fee and commissions paid. Returned product that is damaged during shipment to the customer is 100% refundable. Return of product that is not damaged at the time of receipt by the Associate may result in cancellation of the Associate’s distributorship according to the terms of the Associate agreement. For the years 2014 and 2013, returns were less than 1% of Nutritional Products sales.

Licensees

We have entered into exclusive license arrangements for distribution of our Nutritional Products in certain international markets. Under these arrangements, the licensees purchase products from us for distribution in their territories. Most of our sales under these arrangements are to CCI, which accounted for 99% of total licensee sales in 2014 and 2013 and 38% and 46% of consolidated net sales in 2014 and 2013, respectively. Under arrangements with other licensees, our products are also distributed in other international markets including Western Europe and United Arab Emirates.

In August 2014, the Company entered into a two-year exclusive distributorship agreement with CCI. This Agreement replaced the ten-year exclusive distributorship agreement between the parties that automatically renewed for a one-year term following expiration of the initial term in July 2014. Pursuant to the new agreement, CCI’s exclusive territory now includes Russia and other countries located primarily in Europe and Central Asia, which represents an expansion of the territory set forth in the former agreement. Under the former agreement, CCI distributed products in a territory comprised mainly of Russia and Eastern Europe. Also under the former agreement, in consideration of the grant of certain rights, CCI paid the Company a monthly royalty calculated as a percentage of its sales of the Company's products. Under the new agreement, in lieu of a royalty, the prices at which products are sold to CCI were marked up as of the effective date of the agreement to include the royalty so that no additional royalty is due upon the sale of the Company's products by CCI. In accordance with the terms of both the new agreement and previous agreement, CCI is required to pay a deposit at the time it places an order and then pay the balance when products are segregated in our warehouse for its account. Under the new agreement, CCI is required to pay a 25% deposit with each order. Under the previous agreement, CCI was required to pay a 50% deposit with each order.

Pursuant to these arrangements, the licensees, who are unaffiliated third parties, are granted exclusive rights to sell our products in their respective territories, which is generally accomplished through network marketing. The independent distributor networks of licensees using the network marketing distribution model have similar characteristics to our Associate network, and the distributors are compensated through a similar compensation plan as that used by us for our Associates. All of the license agreements with our licensees require the licensees to purchase minimum annual amounts from us in order to retain their exclusive rights.

Medical Products Distribution

Sales force. At December 31, 2014 and 2013, the MPM Medical sales force consisted of seven full-time sales representatives and one manufacturer representative assigned to specific geographic territories within the U.S.

Distribution. We distribute our wound care products primarily in the U.S. to hospitals, nursing homes, clinics, pharmacies and home health care agencies through a traditional, nationwide network of medical/surgical supply dealers and pharmaceutical distributors. Our sales force calls on the customers that use our wound care products, as well as the dealers and distributors through whom our customers purchase these products.

One medical/surgical dealer accounts for a significant portion of Medical Products sales. This dealer distributes our Medical Products and provides services primarily to nursing homes, and obtains reimbursement for the price of products from Medicare. This dealer accounted for 45% and 44% of Medical Products net sales in 2014 and 2013, respectively.

On February 27, 2012, we were notified that this dealer filed a voluntary petition for protection under Chapter 11 of the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the Central District of California in Santa Ana, California on February 24, 2012. According to its bankruptcy petition, this dealer filed its petition as the most effective means of stabilizing its finances as it resolves a reimbursement guidelines dispute with Medicare, which the dealer believes is improperly withholding payments. The petition states that this dealer relies on Medicare payments for more than 90% of its revenue and that Medicare had suspended payments to the dealer. In a press release issued by the dealer at the time of the filing, the dealer stated that the Chapter 11 filing will allow it to continue operating without interruption while it resolves its payment dispute with Medicare as expeditiously as possible. As of December 31, 2013, this dealer owed to the Company approximately $240,000 in pre-petition accounts receivable. In July 2014, pursuant to an arrangement approved by the Bankruptcy Court, this pre-petition accounts receivable balance was paid in full. We continue to fill this dealer's post-petition orders, with payments received in accordance with our normal terms.

Third-Party Reimbursement. Most of our Medical Products are purchased by health care providers for use on patients in their care. In most cases, these health care providers obtain reimbursement for the cost of our products from various third-party payers, including Medicare, Medicaid, private insurance plans and managed care organizations. In response to national attention focused on health care, significant health care reform initiatives have been adopted and others have been proposed that may affect the availability and amount of third-party reimbursements. Also, in an effort to control rising health care costs, there have been, and may continue to be, proposals by legislators, regulators and third-party payers to curb these costs. We believe that presently available third-party reimbursement is adequate to support the market for our products; however, continued demand for our Medical Products is partially dependent upon the extent of available reimbursement for these products.

Returns. Generally, unused Medical Products may be returned up to six months from the date of purchase for a refund equal to 100% of the sales price less a 25% restocking fee. Returned product that was damaged during shipment to the customer is 100% refundable. For the years 2014 and 2013, returns were less than 2% of Medical Products sales.

Trademarks, Patents or Other Intellectual Property

We have trademark registrations in the U.S. and certain foreign jurisdictions of the Company name, RBC Life Sciences®; our Nutritional Product brand name, RBC Life®; our logo and certain key product names including Microhydrin®, Colo-Vada Plus®, Immune 360® and OliViva®. We also have trademark registrations in the U.S. of certain other key product and product ingredient names such as NeuroBright®, Microhydrin® Plus, HydraCel, Regenecare®, OraMagic®, RadiaPlex® and NormlShield®. In addition, we have trademark applications pending in the U.S. and certain foreign jurisdictions for other key trade dress used by us. As long as we continue to renew our trademarks when necessary, the trademark protection provided by them is perpetual. We also rely on common law trademark rights to protect our unregistered trademarks. Common law trademark rights do not provide the same level of protection as afforded by a U.S. federal registration of a trademark. Also, common law trademark rights are limited to the geographic area in which the trademark is actually used. These trademarks are useful in achieving brand recognition within our industries.

In January 2013, we were granted US Patent 8357422 for "Neurobright", which is a unique dietary supplement formulation that nutritionally supports cognitive function, learning and remembering. The basis for the patent was an 18-month controlled animal study conducted by Dr. Tres Thompson of the School of Behavioral and Brain Sciences at the University of Texas at Dallas. The study showed that Neurobright increased both cognitive function and psychomotor abilities in animals.

We utilize proprietary formulations and manufacturing processes to produce certain raw materials, which are principal ingredients in our leading products. We have not filed for patent protection related to all of our proprietary formulations or manufacturing processes. Therefore, there can be no assurance that another company will not replicate one or more of our products.

The developer of Stem-Kine has filed a patent application in the U.S. that covers compositions of matter, uses and formulations associated with Stem-Kine. There can be no assurance that this patent will be issued, that it will exclude competitors or provide us with competitive advantages or that others have not or will not develop similar products.

Seasonality

Our business is not subject to significant seasonal fluctuations. However, as a practical matter, CCI, whose principal office is located in Moscow, generally limits its shipping orders during the winter months due to unfavorable weather conditions.

Inventory Requirements, Backlogs

Distributors of our Nutritional Products, except for licensees, and distributors of our Medical Products generally do not maintain large inventories of our products. They depend on us to maintain our inventory at a level that will allow us to fill their orders or the orders of their customers, as the case may be, as they are placed. We generally ship orders within 24 to 72 hours after we receive them so there is no significant backlog of orders related to these distribution channels.

We do not maintain inventory in anticipation of product orders from our licensees. Under the terms of our license agreements, the licensee is generally required to make a cash deposit at the time the purchase order is placed with the balance due when products are available to fulfill the order. The licensees must generally allow a minimum of two to three months for delivery. In addition, under our agreement with CCI, we store products for CCI in our warehouse and then ship them at a later date to locations designated by CCI in accordance with its business needs. As part of this agreement, CCI accepts ownership of and pays for the products as they are segregated in our warehouse for CCI’s account. However, we do not recognize sales

until the products are shipped. Therefore, we define backlog as purchase orders received by us that are accompanied by the requisite deposit, plus the purchase price of CCI products that are stored in our warehouse pending shipment. Backlog fluctuates depending on licensee ordering patterns and the timing of CCI’s shipping requests. Backlog was approximately $3,654,000 and $6,298,000 at December 31, 2014 and 2013, respectively. We expect substantially all of the backlog at December 31, 2014 to be filled during 2015.

Industry/Competitors

We market our Nutritional Products in a highly competitive industry both domestically and internationally. We compete against companies that sell heavily advertised products through retail stores as well as other network marketing companies. Many of our competitors are significantly larger than we are, have far greater financial resources and have broader name recognition.

In the distribution of Nutritional Products, we compete with retail outlets, such as health food stores, supermarkets and department stores, and other network marketing companies. We endeavor to compete successfully by offering a wide selection of products that incorporate proprietary technology, are science-based and have a reputation for high quality. We believe that our products possess features and provide benefits that are desired by consumers looking for natural health products. We place a high degree of emphasis on new product development to ensure our product line remains current with developing trends in our industry and new scientific evidence. We generally do not attempt to compete based on price, although price is a consideration. Prices are justified through product quality and benefits and, to the extent possible, the proprietary ingredients and unique formulations.

We also compete against other network marketing companies for the time, attention and commitment of new and current Associates. The pool of individuals interested in the business opportunities presented by network marketing tends to be limited in each market and is reduced to the extent other network marketing companies successfully recruit these individuals into their businesses. Our ability to remain competitive depends, in significant part, on our success in sponsoring and retaining Associates. We endeavor to compete successfully by offering unique and effective products at prices competitive with other network marketing companies, a rewarding Associate compensation plan and attractive Associate support programs.

Our Medical Products also face heavy competition. In the wound care product market, we compete against a number of companies, most of which are significantly larger, have far greater financial resources and have broader name recognition. As with our Nutritional Products, we place a high degree of emphasis on new product development to ensure our product line remains current with developing trends and new scientific evidence. We endeavor to compete by offering a range of high quality products, which are unique and effective, at competitive prices.

Research and Development

From time to time, we have contracted with scientists at universities, medical colleges and private research organizations to conduct pilot studies to evaluate the safety and functions of our products. Most of these studies have been conducted to evaluate the safety and functions of Microhydrin or Microhydrin-based formulations. We have also engaged several studies to evaluate the efficacy of certain of our wound care products distributed to the oncology market. Amounts expended by us to fund these studies have not been significant.

We enhance our product line through the development of new products and the improvement of existing products. New product ideas are derived from a number of sources, including in-house personnel with significant experience in product formulation and development, medical and nutrition professionals, trade publications, scientific and health journals, product suppliers and other third parties. Prior to introducing new products, we investigate product formulations to ensure that they are backed by sound scientific research and are in compliance with applicable regulations.

Governmental Regulations

General. In both our U.S. and foreign markets, we are affected by extensive laws, governmental regulations, administrative determinations, court decisions and similar constraints. Such laws, regulations and other constraints exist at the federal, state or local levels in the U.S. and at all levels of government in foreign jurisdictions, including regulations pertaining to: (1) the formulation, manufacturing, packaging, labeling, distribution, importation, sale and storage of our products; (2) product claims and advertising, including direct claims and advertising by us, as well as claims and advertising by distributors, for which we may be held responsible; (3) our network marketing program; and (4) transfer pricing and similar regulations that affect the level of U.S. and foreign taxable income and customs duties.

We cannot predict the nature of any future laws, regulations, interpretations or applications that may be administered by any federal, state, local or foreign regulatory authority, nor can we determine what effect additional governmental regulations or administrative orders, when and if promulgated, would have on our business in the future. They could include, however, requirements that adversely affect our ability to market existing products or introduce new or improved products, or continue to use our existing network marketing program. Any or all of these requirements could have a material adverse effect on our business, financial condition and results of operations.

Products. One or more of the following agencies in the U.S. regulates the formulation, manufacture, packaging, labeling, advertising, distribution and sale of our products: the Food and Drug Administration (“FDA”); the Federal Trade Commission (“FTC”); the Consumer Product Safety Commission; the U.S. Department of Agriculture; the Environmental Protection Agency; and various agencies of the states and foreign countries into which our products are shipped or sold.

We market food, dietary supplements, cosmetics, over-the-counter drug products and medical devices. In the U.S., the FDA regulates our products under the Federal Food, Drug, and Cosmetic Act (“FDCA”) and related regulations. To ensure compliance with the FDCA and FDA regulations, the FDA has numerous enforcement tools, including the ability to issue warning letters, initiate product seizures and injunctions, order product withdrawals and recalls and pursue fines and criminal penalties.

The majority of our products are classified as dietary supplements, which are defined in the FDCA as products intended to supplement the diet that contain one or more of certain dietary ingredients, such as vitamins, minerals, herbs or botanicals, amino acids and other dietary substances used to supplement diets. The FDCA has been amended several times with respect to dietary supplements, most significantly by the Nutrition Labeling and Education Act of 1990 and the Dietary Supplement Health and Education Act of 1994 (“DSHEA”). This legislation governs the formulation, manufacturing, marketing and sale of dietary supplements, including the content and presentation of health-related information included on the labels or labeling of dietary supplements. We believe DSHEA generally provides a favorable regulatory climate to consumers and the dietary supplement industry.

The FDCA permits dietary supplement products to include truthful, non-misleading and substantiated statements of nutritional support, which are claims that the products affect the structure or function of the body. These claims are often referred to as “structure/function” claims. A dietary supplement that includes a structure/function claim on its labeling is required to include a disclaimer stating that the FDA has not evaluated the claim, and the manufacturer must notify the FDA of the use of such claim. The FDCA requires that manufacturers possess substantiation demonstrating that structure/function claims made for dietary supplements are truthful and not misleading. The FDA distinguishes structure/function claims, which do not require prior FDA approval, and claims that a product is intended to prevent, treat, cure, mitigate or diagnose disease, otherwise known as “drug claims,” which do require prior FDA approval. We believe we possess competent and reliable scientific evidence to support structure/function claims made for our dietary supplement products and we do not make drug claims for any of our dietary supplements.

In June 2007, as authorized by DSHEA, the FDA adopted good manufacturing practice regulations (“GMPs”) specifically for dietary supplements, which regulations are applicable to those who manufacture, package, label or hold dietary supplements. These GMPs are designed to ensure, among other things, that dietary supplement products are not adulterated with contaminants or impurities, and are labeled to accurately reflect the active ingredients and other ingredients in the products. Under these regulations, we are responsible for complying with GMPs applicable to the activities in which we engage, i.e. the holding and distribution of dietary supplements. We believe our practices are in compliance with these GMPs, but there can be no assurance that our operations or the manufacturing and distribution practices of our suppliers will be in compliance in all respects at all times.

In December 2006, Congress passed the Dietary Supplement and Nonprescription Drug Consumer Protection Act, which amended the FDCA and became effective in December 2007. These regulations, among other things, require companies that manufacture, pack or distribute nonprescription drugs or dietary supplements to report serious adverse events allegedly associated with their products to the FDA and institute recordkeeping requirements for all adverse events whether serious or non-serious. We believe that we have the necessary systems in place to comply with these regulations.

Some of the products marketed by us are considered conventional foods and are currently labeled as such. Within the U.S., this category of products is subject to the federal Nutrition, Labeling and Education Act of 1990 ("NLEA"), and regulations promulgated under the NLEA. The NLEA regulates health claims, ingredient labeling and nutrient content claims characterizing the level of a nutrient in the product. The ingredients added to conventional foods must either be generally recognized as safe by experts or be approved as food additives under FDA regulations.

The Food Safety Modernization Act (FSMA), enacted in 2011, for which the FDA is promulgating rules, is also applicable to some of the Company's products and will require the development of a food safety plan and the implementation of preventative measures to protect against food contamination. Dietary supplements manufactured in accordance with GMP's, and foods manufactured in accordance with the low acid food regulations, are exempt.

Most of our Medical Products are regulated under the FDCA as medical devices. Under the FDCA, medical devices are classified into one of three classes—Class I, Class II or Class III—depending on the degree of risk associated with each medical device and the extent of control needed to ensure safety and effectiveness. The class to which a device is assigned determines, among other things, the type of premarket submission or application required for marketing. Device classification depends on the intended use of the device and upon a product's indications for use. Most of our medical devices are classified as Class I, and we do not now nor do we intend to market any Class III medical devices.

Class I devices are those for which safety and effectiveness can be assured by adherence to a set of regulatory guidelines called General Controls. General Controls are the only level of controls that apply to Class I devices and include provisions of the FDCA pertaining to adulteration, misbranding, device registration and listing, premarket notification, banned devices, notification and repair/replacement/refund, records and reports, restricted devices, and GMPs. Class II devices are those for which General Controls alone are insufficient to provide reasonable assurance of its safety and effectiveness and there is sufficient information to establish Special Controls the FDA deems necessary to provide such assurance. Special Controls may include special labeling requirements, mandatory performance standards and post market surveillance. Most Class I devices are exempt from premarket notification (510(k)) requirements, and while a few Class II devices are exempt, most Class II devices require 510(k) premarket notification. A 510(k) premarket notification requires demonstration of substantial equivalence to another legally U.S. marketed device. Substantial equivalence means that the new device is at least as safe and effective as the predicate device. The process of obtaining a 510(k) clearance typically can take several months to a year or longer and may involve the submission of limited clinical data supporting assertions that the product is substantially equivalent to an already approved device or to a device that was on the market before the enactment of the Medical Device Amendments of 1976. We believe that our medical devices are manufactured and marketed in accordance with these statutory requirements and the FDA’s related regulations.

In foreign markets, prior to commencing operations and prior to making or permitting sales of our products, we may be required to obtain an approval, license or certification from the relevant country’s ministry of health or comparable agency. Where a formal approval, license or certification is not required, we nonetheless seek a favorable opinion of knowledgeable experts regarding our compliance with applicable laws. Prior to entering a new market in which a formal approval, license or certificate is required, we work extensively with local authorities in order to obtain the requisite approvals. The approval process generally requires us to present each product and product ingredient to appropriate regulators and, in some instances, arrange for testing of products by local technicians for ingredient analysis. The approvals may be conditioned on reformulation of our products, or may be unavailable with respect to some products or some ingredients. We are currently seeking of approval to market certain products in certain Southeast Asia markets. While we can provide no assurance, we expect these approvals to granted within the next twelve months. A requirement that we reformulate a product or the inability to introduce some products or ingredients into a particular market may have an adverse effect on sales. We must also comply with product labeling and packaging regulations that vary from country to country. Our failure to comply with these regulations can result in a product being temporarily or permanently removed from sale in a particular market.

Prior to importing and distributing our products in international markets, our licensees are generally required to obtain approvals, licenses, or certifications from a country's ministry of health or comparable agency. Applications to request these approvals may require the submission of significant amounts of information related to product manufacturing processes and ingredients, which in many cases we must provide. After submission of the applications, final approvals may be conditioned on reformulation of our products for the market or may be withheld with respect to certain products or product ingredients. Licensees are also required to comply with local product labeling and packaging regulations that vary from country to country.

Advertising of products in the U.S. is subject to regulation by the FTC under the FTC Act. The FTC Act prohibits unfair methods of competition and unfair or deceptive acts or practices in or affecting commerce. The FTC Act also provides that the dissemination of any false advertisement pertaining to drugs or foods, which would include dietary supplements, is an unfair or deceptive act or practice. Under the FTC’s substantiation doctrine, an advertiser is required to have a “reasonable basis” for all objective product claims before the claims are made. Advertising of our products is also regulated by state and local authorities under the various state consumer protection and consumer fraud acts. We believe that we have the necessary documentation to support our advertising and promotional claims.

In October 2009, the FTC issued new Guides Concerning the Use of Endorsements and Testimonials in Advertising ("Guides"). These new Guides significantly extend the scope of potential liability associated with the use of testimonials, endorsements and new media methods, such as blogging, in advertising. As of the December 1, 2009 effective date of the Guides, advertisers are required either to substantiate that the experiences conveyed by testimonials or endorsements represent typical consumer experiences with the advertised product or clearly and conspicuously disclose the typical consumer experience with the advertised product.

Network Marketing. Our network marketing program is subject to laws and regulations in each country in which we operate. Certain foreign jurisdictions require network marketing operations to be licensed by a designated government agency prior to commencement. Generally laws and regulations governing network marketing programs are directed at ensuring that product sales ultimately are made to consumers and that advancement within a sales organization is based on sales of the enterprise's products, rather than investments in the organization or other non-retail sales-related criteria. These laws include anti-pyramiding, securities, lottery, referral selling, anti-fraud and business opportunity statutes, regulations and judicial decisions. In addition to federal regulation by the FTC in the U.S., each state has enacted its own “Little FTC Act” to regulate sales and advertising. We actively strive to comply with all applicable state, federal and foreign laws and regulations affecting this distribution channel. We believe that our network marketing system satisfies the standards and case law defining a legal marketing system; however, the regulatory and legal requirements concerning network marketing systems do not include “bright line” rules and are inherently fact-based.

Transfer Pricing. In the U.S. and other countries, we are subject to transfer pricing and other tax regulations designed to ensure that appropriate levels of income are reported as earned by our U.S. or foreign entities and are taxed accordingly. In addition, our operations are subject to regulations designed to ensure that appropriate levels of customs duties are assessed on the importation of our products. We have adopted transfer pricing arrangements with respect to our foreign operations that we believe are in compliance with all applicable transfer pricing laws. If the U.S. Internal Revenue Service or the taxing authorities of any other jurisdiction were to successfully challenge these arrangements or require changes in our transfer pricing practices, we could be required to pay higher taxes and our results of operations would be adversely affected if our foreign tax credit was limited on our U.S. federal income tax return. There can be no assurance that we will continue to be found to be operating in compliance with transfer pricing laws, or that those laws will not be modified, which as a result, may require changes in our operating procedures.

Employees

As of December 31, 2014 and 2013, we had 89 and 76 employees, respectively, all but one of whom were full time employees. We do not foresee a significant change in the number of our employees during 2015.

Additional Available Information

We are subject to the informational requirements of the Securities Exchange Act of 1934 (the "Exchange Act"), and, accordingly, file reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). We make available free of charge through our website at www.rbclifesciences.com, as soon as reasonably practicable after such material is electronically filed with the SEC, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports. This information may also be obtained from the SEC’s on-line database located at www.sec.gov, which contains material regarding issuers that file electronically with the SEC. You may also obtain copies of any of our reports filed with, or furnished to, the SEC, free of charge, at the SEC’s public reference room at 100 F Street, NE, Washington, DC 20549 on official business days during the hours of 10:00 am to 3:00 pm. Information regarding the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

We own an approximately 119,000 square foot facility that houses our executive offices, manufacturing and laboratory facilities and warehousing and distribution operations. This facility is located in Irving, Texas, and is subject to a deed of trust as collateral on a term loan with a balance of approximately $1.1 million as of December 31, 2014. We use this facility for both the Nutritional Products and Medical Products business segments.

We also lease facilities in various countries in Southeast Asia that house administrative offices and warehousing and distribution operations related to the Nutritional Products business segment as follows:

Taiwan. We lease facilities in Taipei, Taiwan at an annual rental of approximately $91,000. The lease agreement on this facility expires on April 30, 2016.

Hong Kong. We assumed responsibility for lease payments on a facility in Hong Kong at an annual rental of approximately $157,000. The lease agreement on this facility expires on May 16, 2016.

Malaysia. We lease facilities in Kuala Lumpur, Malaysia at an annual rental of approximately $48,000. The lease agreement on this facility expires on March 1, 2017.

Indonesia. We lease facilities in Jakarta, Indonesia at an annual rental of approximately $57,000. The lease agreement on this facility expires on June 1, 2016.

We believe these facilities are suitable and adequate in relation to our present and immediate future needs although we may consider relocating to other facilities if we determine that relocating better fits the long term interest of the Company.

| |

Item 3. | Legal Proceedings. |