Wyndham Upped to Outperform - Analyst Blog

27 February 2013 - 4:55AM

Zacks

On Feb 22, we upgraded our recommendation on Wyndham

Worldwide Corp. (WYN) to Outperform from Neutral on the

back of better-than-expected fourth-quarter 2012 results and

increased guidance for 2013.

Why the Upgrade?

Wyndham continued its strong momentum in the fourth quarter of 2012

beating the Zacks Consensus Estimates for both earnings and

revenues. In fact the hotelier outperformed the Zacks Consensus

Estimates for both earnings and revenues in all four quarters of

2012.

Buoyed by its strong operating performance, Wyndham raised its

revenue, earnings and earnings before interest, taxes, depreciation

and amortization (EBITDA) guidance for full-year 2013. Higher

revenue per available room (RevPAR) and unit growth in its latest

guidance also indicate the company’s inherent strength.

With the economy beginning to improve gradually, the company has

started to generate room-rate gains in the domestic upscale and

mid-scale segments without compromising on occupancy.

Wyndham derives a substantial chunk of revenues from its vacation

ownership or timeshare business, which has solid long-term

potential. Moreover, the company has a market leading position in

vacation rental business.

Wyndham is currently on an acquisition spree. In order to further

strengthen its existing vacation rental portfolio, Wyndham sealed

three bolt-on acquisitions -- two beach resorts in the U.S. and one

in United Kingdom in 2012. The company has acquired about 31

European rental brands since 2000.

We expect the company to benefit from its shift to a greater

fee-for-service-based business, solid free cash flow generation,

increased global travel demand and international expansion as

well.

Other Stocks to Consider

Others players in the same industry, which look attractive at

current levels include Sands China Ltd. (SCHYY)

carrying a Zacks Rank #1 (Strong Buy) and Choice Hotel

International (CHH) and Intercontinental Hotels

Group plc (IHG) carrying a Zacks Rank #2 (Buy).

CHOICE HTL INTL (CHH): Free Stock Analysis Report

INTERCONTL HTLS (IHG): Free Stock Analysis Report

SANDS CHINA LTD (SCHYY): Get Free Report

WYNDHAM WORLDWD (WYN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

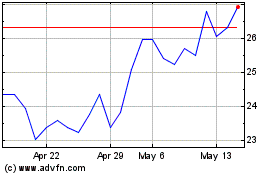

Sands China (PK) (USOTC:SCHYY)

Historical Stock Chart

From Jan 2025 to Feb 2025

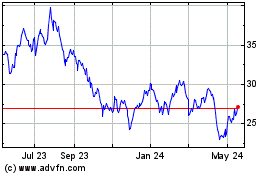

Sands China (PK) (USOTC:SCHYY)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about Sands China Ltd (PK) (OTCMarkets): 0 recent articles

More Sands China (PC) News Articles