0000091668false--02-29FY2024false0.010.01500000000.010.01100000001734000009070001080000000000498500032200000000916682023-03-012024-02-290000091668us-gaap:SubsequentEventMembersodi:BankOfAmericaMember2024-05-012024-05-210000091668us-gaap:SubsequentEventMember2024-05-012024-05-210000091668us-gaap:SubsequentEventMember2024-05-210000091668sodi:FinancialCovenantAgreementMember2023-03-012024-02-290000091668sodi:BusinessAcquisitionMembersodi:CommercialContractMember2021-04-012021-04-160000091668us-gaap:LeaseAgreementsMember2023-03-012024-02-290000091668us-gaap:ComputerEquipmentMember2023-03-012024-02-290000091668sodi:StellarIndustriesMember2022-03-012023-02-280000091668sodi:WuxiStreamtekMember2022-03-012023-02-280000091668sodi:PlatronicsSealsMember2022-03-012023-02-280000091668sodi:StellarIndustriesMember2023-03-012024-02-290000091668sodi:WuxiStreamtekMember2023-03-012024-02-290000091668sodi:PlatronicsSealsMember2023-03-012024-02-290000091668sodi:HoneywellMember2022-03-012023-02-280000091668sodi:UsiElectronicsMember2023-03-012024-02-290000091668sodi:UsiElectronicsMember2022-03-012023-02-280000091668sodi:L3HarrisMember2023-03-012024-02-290000091668sodi:RaytheonCompanyMember2023-03-012024-02-290000091668sodi:OtherMembersodi:NetSalesMember2022-03-012023-02-280000091668sodi:OtherMembersodi:NetSalesMember2023-03-012024-02-290000091668sodi:UnitedStatesGovernmentMembersodi:NetSalesMember2022-03-012023-02-280000091668sodi:UnitedStatesGovernmentMembersodi:NetSalesMember2023-03-012024-02-290000091668sodi:UnitedStateMember2022-03-012023-02-280000091668sodi:UnitedStateMember2023-03-012024-02-290000091668sodi:CanadaAndLatinAmericaMember2022-03-012023-02-280000091668sodi:CanadaAndLatinAmericaMember2023-03-012024-02-290000091668sodi:EuropeandAustraliaMember2022-03-012023-02-280000091668sodi:EuropeandAustraliaMember2023-03-012024-02-290000091668us-gaap:MachineryAndEquipmentMember2023-02-280000091668us-gaap:MachineryAndEquipmentMember2024-02-290000091668us-gaap:ComputerEquipmentMember2023-02-280000091668us-gaap:ComputerEquipmentMember2024-02-290000091668us-gaap:AutomobilesMember2023-02-280000091668us-gaap:AutomobilesMember2024-02-290000091668us-gaap:LeaseholdImprovementsMember2023-02-280000091668us-gaap:LeaseholdImprovementsMember2024-02-290000091668us-gaap:BuildingMember2024-02-290000091668us-gaap:BuildingMember2023-02-280000091668us-gaap:LandMember2023-02-280000091668us-gaap:LandMember2024-02-290000091668sodi:InventoriesFinishedGoodsMember2023-02-280000091668sodi:InventoriesWorkInProcessMember2023-02-280000091668sodi:InventoriesFinishedGoodsMember2024-02-290000091668sodi:InventoriesWorkInProcessMember2024-02-290000091668sodi:InventoriesRawMaterailMember2023-02-280000091668sodi:InventoriesRawMaterailMember2024-02-290000091668sodi:CustomerRelationshipslMember2023-03-012024-02-290000091668sodi:TrademarkslMember2023-03-012024-02-290000091668sodi:TrademarkslMember2024-02-290000091668sodi:CustomerRelationshipslMember2024-02-290000091668sodi:AcquisitionOfMicroEngineeringIncMember2023-03-012024-02-290000091668srt:ProFormaMember2023-03-012024-02-290000091668srt:ProFormaMember2022-03-012023-02-280000091668srt:ProFormaMembersodi:ConsiderationTransferredMemberus-gaap:AcquisitionRelatedCostsMember2024-02-290000091668srt:ProFormaMembersodi:ProvisionalFairValueOfAssetAndLiabilitiesMemberus-gaap:AcquisitionRelatedCostsMember2024-02-290000091668sodi:EsComponentsMember2023-03-012024-02-290000091668sodi:EsComponentsMember2022-03-012023-02-280000091668sodi:CustomerOneMember2023-02-280000091668sodi:CustomerTwoMember2023-02-280000091668sodi:CustomerTwoMember2022-03-012023-02-280000091668sodi:CustomerOneMember2022-03-012023-02-280000091668sodi:CustomerOneMember2023-03-012024-02-290000091668sodi:CustomerTwoMember2023-03-012024-02-290000091668sodi:CustomerOneMember2024-02-290000091668sodi:CustomerTwoMember2024-02-290000091668us-gaap:MachineryAndEquipmentMember2023-03-012024-02-290000091668us-gaap:LeaseholdImprovementsMember2023-03-012024-02-290000091668us-gaap:BuildingImprovementsMember2023-03-012024-02-290000091668us-gaap:BuildingMember2023-03-012024-02-290000091668sodi:CommonStocksMember2023-02-280000091668us-gaap:FairValueInputsLevel3Membersodi:CommonStocksMember2023-02-280000091668us-gaap:FairValueInputsLevel2Membersodi:CommonStocksMember2023-02-280000091668us-gaap:FairValueInputsLevel1Membersodi:CommonStocksMember2023-02-280000091668sodi:CommonStocksMember2024-02-290000091668us-gaap:FairValueInputsLevel3Membersodi:CommonStocksMember2024-02-290000091668us-gaap:FairValueInputsLevel2Membersodi:CommonStocksMember2024-02-290000091668us-gaap:FairValueInputsLevel1Membersodi:CommonStocksMember2024-02-290000091668us-gaap:RetainedEarningsMember2024-02-290000091668us-gaap:AdditionalPaidInCapitalMember2024-02-290000091668us-gaap:TreasuryStockCommonMember2024-02-290000091668us-gaap:CommonStockMember2024-02-290000091668us-gaap:TreasuryStockCommonMember2023-03-012024-02-290000091668us-gaap:RetainedEarningsMember2023-03-012024-02-290000091668us-gaap:AdditionalPaidInCapitalMember2023-03-012024-02-290000091668us-gaap:CommonStockMember2023-03-012024-02-290000091668us-gaap:RetainedEarningsMember2023-02-280000091668us-gaap:AdditionalPaidInCapitalMember2023-02-280000091668us-gaap:TreasuryStockCommonMember2023-02-280000091668us-gaap:CommonStockMember2023-02-280000091668us-gaap:TreasuryStockCommonMember2022-03-012023-02-280000091668us-gaap:RetainedEarningsMember2022-03-012023-02-280000091668us-gaap:AdditionalPaidInCapitalMember2022-03-012023-02-280000091668us-gaap:CommonStockMember2022-03-012023-02-2800000916682022-02-280000091668us-gaap:RetainedEarningsMember2022-02-280000091668us-gaap:AdditionalPaidInCapitalMember2022-02-280000091668us-gaap:TreasuryStockCommonMember2022-02-280000091668us-gaap:CommonStockMember2022-02-2800000916682022-03-012023-02-2800000916682023-02-2800000916682024-02-2900000916682024-07-1000000916682023-08-31iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended February 29, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______

Commission File No. 001-04978

SOLITRON DEVICES, INC. |

(Exact Name of Registrant as Specified in Its Charter) |

Delaware | | 22-1684144 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

901 Sansburys Way, West Palm Beach, Florida | | 33411 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (561) 848‑4311

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

None | | N/A | | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.01 par value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”, and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one) :

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

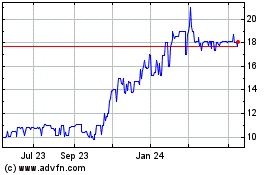

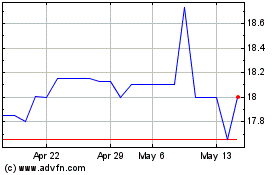

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of August 31, 2023, was $16,731,962 (based on the closing sales price of the registrant’s common stock on that date).

The number of shares of the registrant’s common stock, $0.01 par value, outstanding as of July 10, 2024, was 2,083,436.

Audit Firm Id | | Auditor Name: | | Auditor Location: |

00726 | | Whitley Penn LLP | | Dallas, TX |

Table of Contents

PART I

ITEM 1. BUSINESS

GENERAL

Solitron Devices, Inc., a Delaware corporation (the "Company" or "Solitron"), designs, develops, manufactures and markets solid‑state semiconductor components and related devices primarily for the military and aerospace markets. The Company manufactures a large variety of bipolar and metal oxide semiconductor ("MOS") power transistors, power and control hybrids, junction and power MOS field effect transistors ("Power MOSFETS"), field effect transistors and other related products. Most of the Company's products are custom made pursuant to contracts with customers whose end products are sold to the United States government. Other products, such as Joint Army/Navy ("JAN") transistors, diodes and Standard Military Drawings (“SMD”) voltage regulators, are sold as standard or catalog items.

The Company was incorporated under the laws of the State of New York in March 1959 and reincorporated under the laws of the State of Delaware in August 1987. For information concerning the Company’s financial condition, results of operations, and related financial data, you should review the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the “Financial Statements and Supplementary Data” sections of this Annual Report. You should also review and consider the risks relating to the Company’s business, operations, financial performance, and cash flows below under “Risk Factors.”

On September 1, 2023 the Company closed the acquisition of Micro Engineering Inc. (“MEI”). MEI specializes in solving design layout and manufacturing challenges for electronic components while maximizing efficiency and keeping flexibility to meet unique customer needs. Since 1980, the MEI team has been dedicated to overcoming obstacles to provide cost efficient and rapid results. MEI specializes in low to mid volume projects that require engineering dedication, quality systems and efficient manufacturing.

PRODUCTS

The Company designs, manufactures and assembles bipolar and MOS power transistors, power and control hybrids, junction and Power MOSFETs, field effect transistors and other related products.

Set forth below by principal product type are the percentage contributions to the Company's total sales of each of the Company's principal product lines for the fiscal years ended February 29, 2024 and February 28, 2023.

| | Percentage of Sales | |

| | FY 2024 | | | FY 2023 | |

Power Transistors | | | 31 | % | | | 17 | % |

Power MOSFETS | | | 25 | % | | | 35 | % |

Hybrids | | | 37 | % | | | 35 | % |

Field Effect Transistors | | | 5 | % | | | 9 | % |

Wafers / Dice | | | 2 | % | | | 4 | % |

Total | | | 100 | % | | | 100 | % |

The variation in the proportionate share of each product line for each period reflects changes emanating from a variety of sources including: demand, Congressional appropriations, the process and timing associated with awards of defense contracts, shifts in technology and consolidation of defense prime contractors. The Company’s microelectronic products can be classified as active electronic components. Active electronic components are those that control and direct the flow of electrical power by means of a control signal such as a voltage or current.

It is customary to subdivide active electronic components into those of a discrete nature and those which are non‑discrete. Discrete devices contain a single microelectronic element; and non-discrete devices consist of integrated circuits or hybrid circuits, which contain two or more elements, either active or passive, that are interconnected to make up an electrical circuit. An integrated circuit incorporates various active and passive elements into a single silicon chip. A hybrid circuit, on the other hand, comprises a number of individual components that are mounted onto a suitable surface material, interconnected by various means, and suitably encapsulated. Hybrid and integrated circuits can be analog or digital; presently, the Company manufactures analog components. The Company’s products are either standard devices, such as catalog type items (e.g., transistors and voltage regulators), or application‑specific devices, also referred to as custom or semi‑custom products. The latter are designed and manufactured to meet a customer’s particular requirements. For the fiscal years ended February 29, 2024 and February 28, 2023, respectively, approximately 95% and 89% of the Company’s sales have been of custom products, and the remaining 5% and 11%, respectively have been of standard or catalog products.

Approximately 72% of the semiconductor components produced by the Company are manufactured pursuant to approved Source Control Drawings (“SCD”) from the United States government and/or its prime contractors; the remainder are primarily JAN qualified products approved for use by the military. The Company’s semiconductor products are used as components of military, commercial, and aerospace electronic equipment, such as ground and airborne radar systems, power distribution systems, missiles, missile control systems, satellites, and space applications. The Company’s products have been used on the space shuttle and on the space missions to the moon, to Jupiter (on Galileo), and to Mars (on Global Surveyor and Mars Sojourner). For the fiscal years ended February 29, 2024 and February 28, 2023, approximately 72% and 81%, respectively, of the Company’s sales have been attributable to contracts with customers whose products are sold to the United States government. The remaining 28% and 19%, respectively of sales are for non-military, scientific and industrial applications, or to distributors where we do not have end user information.

Custom products are typically sold to the United States government and defense or aerospace companies, such as Raytheon Technologies Corporation, Lockheed Martin, L3Harris Technologies, General Electric Aviation, Honeywell International, and Northrop Grumman Systems Corporation, while standard products are sold to the same customer base and to the general electronic industry. The Company has standard and custom products available in all of its major product lines.

The following is a general description of the principal product lines manufactured by the Company.

Power Transistors

Power transistors are high current and/or high voltage control devices commonly used for active gain applications in electronic circuits. The Company manufactures a large variety of power bipolar transistors for applications requiring currents in the range of 0.1A to 300A or voltages in the range of 30V to 1000V. The Company employs over 60 types of silicon chips to manufacture over 500 types of power bipolar transistors and is currently expanding this line in response to increased market demand resulting from other companies’ departure from the military market. The Company also manufactures power diodes under the same military specification. The Company is qualified to deliver these products under MIL-PRF-19500 in accordance with JAN, JANTX and JANTXV. JAN, JANTX AND JANTXV denotes various quality military screening levels. The Company manufactures both standard and custom power transistors. Additionally, it manufactures power N‑Channel and P‑Channel MOSFET transistors and is continuously expanding that line in accordance with customers’ requirements.

The Company has been certified and qualified since 1968 under MIL-PRF-19500 (and its predecessor) standards promulgated by the Defense Supply Center Columbus (“DSCC”). These standards specify the uniformity and quality of bipolar transistors and diodes purchased for United States military programs. The purpose of the program is to standardize the documentation and testing for bipolar semiconductors for use in United States military and aerospace applications. Attainment of certification and/or qualification to MIL-PRF-19500 requirements is important since it is a prerequisite for a manufacturer to be selected to supply bipolar semiconductors for defense-related purposes. MIL-PRF-19500 establishes specific criteria for manufacturing construction techniques and materials used for bipolar semiconductors and assures that these types of devices will be manufactured under conditions that have been demonstrated to be capable of continuously producing highly reliable products. This program requires a manufacturer to demonstrate its products’ performance capabilities. A manufacturer receives certification once its Product Quality Assurance Program Plan is reviewed and approved by DSCC. A manufacturer receives qualification once it has demonstrated that it can build and test a sample product in conformity with its certified Product Quality Assurance Program Plan. The Company expects that its continued maintenance of MIL-PRF-19500 qualification will continue to improve its business posture by increasing product marketability. The Company continues to expand its power transistor product offering.

Hybrids

Hybrids are compact electronic circuits that contain passive and active components mounted on thick film printed substrates and encapsulated in appropriate packages. The Company manufactures thick film hybrids, which generally contain discrete semiconductor chips, integrated circuits, chip capacitors and thick film or thin film resistors. Most of the hybrids are of the high-power type and are custom manufactured for military and aerospace systems. Some of the Company’s hybrids include high power voltage regulators, power amplifiers, power drivers, boosters and controllers. The Company manufactures both standard and custom hybrids.

The Company has been certified (since 1990) and qualified (since 1995) under MIL-PRF-38534 Class H (and its predecessor) standards promulgated by the DSCC. These standards specify the uniformity and quality of hybrid products purchased for United States military programs. The purpose of the program is to standardize the documentation and testing for hybrid microcircuits for use in United States military and aerospace applications. Attainment of certification and/or qualification under MIL-PRF-38534 Class H requirements is important since it is a prerequisite for a manufacturer to be selected to supply hybrids for defense-related purposes. MIL-PRF-38534 Class H establishes definite criteria for manufacturing techniques and materials used for hybrid microcircuits and assures that these types of devices will be manufactured under conditions that have been demonstrated to be capable of continuously producing highly reliable products. This program requires a manufacturer to demonstrate its products’ performance capabilities. Certification is a prerequisite of qualification. A manufacturer receives certification once its Product Quality Assurance Program Plan is reviewed and approved by DSCC. A manufacturer receives qualification once it has demonstrated that it can build and test a sample product in conformity with its certified Product Quality Assurance Program Plan. The Company expects that its continued maintenance of MIL-PRF-38534 Class H qualification will continue to improve its business posture by increasing product marketability.

Voltage Regulators

Voltage regulators provide the power required to activate electronic components such as the integrated circuits found in all electronic devices from radar and missile systems to smart phones.

Power MOSFETs

Power MOSFETs perform the same function as bipolar transistors except that power MOSFETs are current controlled and bipolar transistors are voltage controlled. MOSFETs are popular due to their high input impedance, fast switching speed, and resistance to thermal runaway and secondary breakdown. Power MOSFETs are available in very high voltage and current ratings.

Field Effect Transistors

Field effect transistors are surface-controlled devices where conduction of electrical current is controlled by the electrical potential applied to a capacitively coupled control element. The Company manufactures about 30 different types of junction field effect transistor chips. They are used to produce over 350 different field effect transistor types. Most of the Company’s field effect transistors conform to standard Joint Electronic Device Engineering Council designated transistors, commonly referred to with standard 2N designation numbers. The Company continues to expand its field effect transistor product offering. The Company manufactures both standard and custom field effect transistors.

MANUFACTURING

The Company’s engineers design its transistors, diodes, field effect transistors and hybrids, as well as other customized products, based upon requirements established by customers, with the cooperation of the Company’s product and marketing personnel. The design of standard or catalog products is based on specific industry standards.

Each new design is first produced on a CAD/CAE (Computer Aided Design/Computer Aided Engineering) computer system. The design layout is then reduced to the desired geometry and transferred to silicon wafers in a series of steps that include photolithography, chemical or plasma etching, oxidation, diffusion and metallization. The wafers then go through a fabrication process. When the process is completed, each wafer contains a large number of silicon chips, each chip being a single transistor device or a single diode. The wafers are tested using a computerized test system prior to being separated into individual chips. The chips are then assembled in standard or custom packages, incorporated in hybrids or sold as chips to other companies. The chips are normally mounted inside a chosen package using eutectic, solder or epoxy die attach techniques, and then wire bonded to the package pins using gold or aluminum wires. Many of the packages are manufactured by the Company and, in most cases, the Company plates its packages with gold, nickel or other metals utilizing outside vendors to perform the plating operation. In the case of hybrids, design engineers formulate the circuit layout designs. Ceramic substrates are then printed with thick film gold conductors to form the interconnect pattern and with thick film resistive inks to form the resistors of the designed circuit. Semiconductor chips, resistor chips, capacitor chips and inductors are then mounted on the substrates and sequential wire bonding is used to interconnect the various components to the printed substrate, as well as to connect the circuit to the package's external pins.

In addition to Company-performed testing and inspection procedures, certain of the Company’s products are subject to source inspections required by customers (including the United States Government). In such cases, designated inspectors are authorized to perform a detailed on-premise inspection of each individual device prior to encapsulation in a casing or before dispatch of the finished unit to ensure that the quality and performance of the product meets the prescribed specifications.

ISO 9001 and AS9100

The Company is certified by NQA to AS 9100:2016 (sometimes previously referred to as AS 9100D) and ISO 9001:2015 standards. The certification is valid until September 2024 and was reissued on October 27, 2022 for the cycle starting September 8, 2021. The AS 9100 certification defines a Quality Management System that is oriented to the aerospace industry. It was released in 1999 by the European Association of Aerospace Industries along with the Society of Automotive Engineers. AS 9100 encompasses ISO 9001 requirements so the certification to AS 9100 standards includes ISO 9001 standards. It is broadly accepted or endorsed as a requirement for aerospace manufacturers among many Solitron customers.

MARKETING AND CUSTOMERS

During the fiscal year ended February 29, 2024, RTX (formerly Raytheon Technologies Corporation) accounted for approximately 35% of net sales, ConMed Linvatec 20% of net sales, and L3Harris 17% of net sales. No other customer accounted for ten percent or more of net sales. During the fiscal year ended February 28, 2023, RTX Corporation accounted for approximately 46% of net sales. No other customer accounted for ten percent or more of net sales. Nine of the Company’s customers accounted for approximately 89% of the Company’s net sales during the fiscal year ended February 29, 2024, as compared to nine customers accounting for 88% of net sales for the fiscal year ended February 28, 2023. It has been the Company’s experience that a large percentage of its sales have been attributable to a relatively small number of customers in any particular period. Due to mergers and acquisitions activity in general, and among large defense contractors in particular, the number of large customers will most likely continue to decline in number, but this does not necessarily mean that the Company will experience a decline in sales. As a result, the Company expects customer concentration to continue. The loss of any major customer without offsetting orders from other sources could have a material adverse effect on the business, financial condition and results of operations of the Company. See “Item 1A – Risk Factors” for more information.

Sales to foreign customers accounted for less than 1% of the Company’s net sales for the fiscal year ended February 29, 2024 as compared to 7% of the Company’s net sales for the fiscal year ended February 28, 2023. All sales to foreign customers are conducted utilizing exclusively U.S. dollars. See Note 12 of the financial statements for more information regarding export sales to customers.

BACKLOG

The Company’s order backlog, which consists of semiconductor and hybrid related open orders, was approximately $11,207,000 at February 29, 2024, as compared to $7,633,000 at February 28, 2023. Approximately 90% of the backlog is scheduled for delivery within twelve months. For the years ended February 29, 2024, and February 28, 2023, the entire backlog consisted of orders for electronic components.

The Company’s backlog as of any particular date may not be representative of actual sales for any succeeding period because lead times for the release of purchase orders depend upon the scheduling practices of individual customers. The delivery times of new or non-standard products can be affected by scheduling factors and other manufacturing considerations, variances in the rate of booking new orders from month to month and the possibility of customer changes in delivery schedules or cancellations of orders. Also, delivery times of new or non-standard products are affected by the availability of raw material, scheduling factors, manufacturing considerations and customer delivery requirements.

The rate of booking new orders varies significantly from month to month, mostly as a result of sharp fluctuations in the government budgeting and appropriation process. The Company has historically experienced somewhat decreased levels of bookings during the summer months, primarily as a result of such budgeting and appropriation activities. For these reasons, and because of the possibility of customer changes in delivery schedules or cancellations of orders, the Company’s backlog as of any particular date may not be indicative of actual sales for any succeeding period. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Bookings and Backlog.”

PATENTS

The Company previously owned 33 patents (all of which have since expired or have been allowed to lapse) relating to the design and manufacture of its products. To date, the expirations or lapses of these patents have not had a material adverse effect on the Company. The Company believes that engineering standards, manufacturing techniques and product reliability are more important to the successful manufacture and sale of its products than the expired or lapsed patents it held.

COMPETITION

The electronic component industry, in general, is highly competitive and has been characterized by price erosion, rapid technological changes and foreign competition. However, in the market segments in which the Company operates, while highly competitive and subject to the same price erosion, technological change has been relatively gradual and minimal. The Company believes that it is well regarded by its customers in the segments of the market in which competition is dependent less on price and more on product reliability, performance and service. Management believes, however, that to the extent the Company’s business is targeted at the military and aerospace markets, where there has been virtually no foreign competition, it is subjected to less competition than manufacturers of commercial electronic components. Additionally, the decline in military orders in programs the Company participates in and the shift in the requirement of the Defense Department whereby the use of Commercial Off The Shelf (“COTS”) components is encouraged over the use of high reliability components that the Company manufactures, prompting the number of competitors to decline, afford the Company the opportunity to increase its market share. In the non-military, non-aerospace markets, the Company is subject to greater price erosion and foreign competition.

The Company has numerous competitors across all of its product lines. The Company is not in direct competition with any other semiconductor manufacturer for an identical mixture of products; however, one or more of the major manufacturers of semiconductors manufacture some of the Company’s products. Other competitors in the military market include Infineon Technologies, Microsemi Corporation, Anaren, Inc., NEOTech and Sensitron Semiconductor. The Company competes principally on the basis of product quality, turn-around time, customer service and price. The Company believes that competition for sales of products that will ultimately be sold to the United States Government has intensified and will continue to intensify as United States defense spending on high reliability components continues to decrease and the Department of Defense pushes for implementation of its 1995 decision to purchase COTS standard products in lieu of products made in accordance with more stringent military specifications.

The Company believes that its primary competitive advantage is its ability to produce high quality products as a result of its years of experience, its sophisticated technologies and its experienced staff. The Company believes that its ability to produce highly reliable custom hybrids in a short period of time will give it a strategic advantage in attempting to penetrate high-end commercial markets and in selling military products complementary with those currently sold, as doing so would enable the Company to produce products early in design and development cycles.

The Company believes that it will be able to improve its capability to respond more quickly to customer needs and deliver products ahead of schedule.

HUMAN CAPITAL

At February 29, 2024, the West Palm Beach facility had 44 employees, 29 of whom were engaged in production activities, 2 in sales and marketing, 5 in executive and administrative capacities and 8 in technical and support activities. Of the 44 employees, 41 were full-time employees and 3 were part-time employees. The Apopka facility had 25 employees, 19 of whom were engaged in production activities, 3 in executive and administrative capacities and 3 in technical and support activities. Of the 25 employees, 23 were full-time employees and 2 were part-time employees.

The Company has never had a work stoppage, and none of its employees are represented by a labor organization. The Company considers its employee relations to be good.

SOURCES AND AVAILABILITY OF RAW MATERIAL

The Company purchases its raw materials from multiple suppliers and has a minimum of two suppliers for most of its material requirements. The largest supplier in the fiscal year ended February 29, 2024 was Ametek, representing 20% of total purchases. Other suppliers that represented more than 10% of total purchases were Wuxi Streamtek, which accounted for 19% of total purchases, and Stellar Industries, which accounted for 12% of total purchases. The largest supplier in the fiscal year ended February 28, 2023 was Platronics Seals, representing 21% of total purchases. Other suppliers that represented more than 10% of total purchases were Wuxi Streamtek, which accounted for 16% of total purchases, and Stellar Industries, which accounted for 15% of total purchases. Because of a diminishing number of sources for components and packages in particular, and the increase in the prices of raw silicon semiconductor wafers, precious metals and gold (used in the finish of the packages), the Company has been obliged to pay higher prices, which results in higher costs of goods sold. Most of the packages the Company uses are gold plated, thus they are subject to the volatility and cost fluctuations of gold.

EFFECT OF GOVERNMENT REGULATION

The Company has received DSCC approval to supply its products in accordance with MIL-PRF-19500 and Class H of MIL-PRF-38534. These qualifications are required of vendors to supply to the United States Government or its prime contractors. The Company expects that its continued maintenance of these qualifications will continue to improve its business posture by increasing product marketability. The Company is also certified in accordance with AS9100 which is a core requirement of most defense aerospace contracts. Certain product-specific regulatory and certification requirements and processes are described in more detail under “Item 1 – Business-Products” beginning on page 1.

RESEARCH AND DEVELOPMENT

During the fiscal years ended February 29, 2024 and February 28, 2023, the Company spent $32,440 and $65,000, respectively, of its own funds on research and development. The Company may decide to increase research and development expenditures in the future. The cost of designing custom products has historically been borne in full by the customer, either as a direct charge or is amortized in the unit price charged to the customer.

ENVIRONMENTAL REGULATION

While the Company believes that it has the environmental permits necessary to conduct its business and that its operations conform to current environmental regulations, increased public attention has been focused on the environmental impact of semiconductor manufacturing operations. The Company, in the conduct of its manufacturing operations, has handled and does handle materials that are considered hazardous, toxic or volatile under federal, state and local laws and, therefore, is subject to regulations related to their use, storage, discharge and disposal. No assurance can be made that the risk of accidental release of such materials can be completely eliminated. In the event of a violation of environmental laws, the Company could be held liable for damages and the costs of remediation. In addition, the Company, along with the rest of the semiconductor industry, is subject to variable interpretations and governmental priorities concerning environmental laws and regulations. The annual cost of complying with the regulations is minimal.

Environmental statutes have been interpreted to provide for joint and several liability and strict liability regardless of actual fault. There can be no assurance that the Company and its subsidiaries will not be required to incur costs to comply with, or that the operations, business or financial condition of the Company will not be materially adversely affected by current or future environmental laws or regulations.

AVAILABLE INFORMATION

We maintain a website at www.solitrondevices.com. Information contained on our website is not a part of this Annual Report on Form 10-K and the inclusion of our website address in this report is an inactive textual reference only.

ITEM 1A. RISK FACTORS

The following important business risks and factors, and those business risks and factors described elsewhere in this report or our other Securities and Exchange Commission filings, could cause our actual results to differ materially from those stated in our forward-looking statements, and which could affect the value of an investment in the Company. All references to “we”, “us”, “our” and the like refer to the Company.

Risks Related to our Business and Industry

We are subject to substantial customer concentration, and any loss of, or reduction of business from, one or more of our significant customers could hurt our business by reducing our revenues, profitability and cash flow.

During the fiscal year ended February 29, 2024, four customers accounted for approximately 75% of revenue. During the fiscal year ended February 28, 2023, five customers accounted for approximately 74% of revenue. The loss or financial failure of any significant customer or distributor, any reduction in orders by any of our significant customers or distributors, or the cancellation of a significant order could materially and adversely affect our business. Furthermore, due to continued industry consolidation, the loss of any one customer or significant order may occur with greater frequency and/or have a greater impact than we anticipate. We cannot guarantee that we will be able to retain long-term relationships or secure renewals of short-term relationships with our more substantial customers in the future.

Our complex manufacturing processes may lower yields and reduce our revenues.

Our manufacturing processes are highly complex, require advanced and costly equipment and are continuously being modified in an effort to improve yields and product performance. Minute impurities or other difficulties in the manufacturing process can lower yields. Our manufacturing efficiency will be an important factor in our future profitability, and we cannot assure you that we will be able to maintain our manufacturing efficiency or increase manufacturing efficiency to the same extent as our competitors.

In addition, as is common in the semiconductor industry, we have from time to time experienced difficulty in effecting transitions to new manufacturing processes. As a consequence, we may suffer delays in product deliveries or reduced yields. We may experience manufacturing problems in achieving acceptable yields or experience product delivery delays in the future as a result of, among other things, capacity constraints, upgrading or expanding our existing facility or changing our process technologies, any of which could result in a loss of future revenues. Our operating results could also be adversely affected by the increase in fixed costs and operating expenses related to increases in production capability if revenues do not increase proportionately.

Our ability to repair and maintain the aging manufacturing equipment we own may adversely affect our ability to deliver products to our customers’ requirements. We may be forced to expend significant funds in order to acquire replacement manufacturing equipment that may not be readily available, thus resulting in manufacturing delays.

Our business could be materially and adversely affected if we are unable to obtain qualified supplies of raw materials, parts and finished components on a timely basis and at a cost-effective price.

The Company relies on its relationships with certain key suppliers for its supply of raw materials, parts and finished components that are qualified for use in the end-products the Company manufactures. While the Company currently has favorable working relationships with its suppliers, it cannot be sure that these relationships will continue in the future. Additionally, the Company cannot guarantee the availability or pricing of raw materials. The price of qualified raw materials can be highly volatile due to several factors, including a general shortage of raw materials, an unexpected increase in the demand for raw materials, disruptions in the suppliers’ business and competitive pressure among suppliers of raw materials to increase the price of raw materials. In particular, the Company has experienced from time to time increases in the prices of raw silicon semiconductor wafers, copper, and precious metals (gold and silver). Suppliers may also choose, from time to time, to extend lead times or limit supplies due to a shortage in supplies. Additionally, some of the Company’s key suppliers of raw materials may have the capability of manufacturing the end products themselves and may therefore cease to supply the Company with its raw materials and compete directly with the Company for the manufacture of the end-products. Any interruption in availability of these qualified raw materials may impair the Company’s ability to manufacture its products on a timely and cost-effective basis. If the Company must identify alternative sources for its qualified raw materials, it would be adversely affected due to the time and process required in order for such alternative raw materials to be qualified for use in the applicable end-products. Any significant price increase in the Company’s raw materials that cannot be passed on to customers or a shortage in the supply of raw materials could have a material adverse effect on the Company’s business, financial condition or results of operations.

Our acquisition of MEI may subject us to risks and unintended negative consequences.

The acquisition of MEI may present challenges to us and our management, including the integration of MEI’s operations and personnel we retained, and other risks including unanticipated liabilities, unanticipated costs, and a diversion of our management’s attention. Any failure to identify or appropriately quantify a liability in our due diligence process could result in the assumption of unanticipated liabilities arising from the prior operations of MEI, some of which may not be adequately reserved and may not be covered by indemnification obligations.

While we believe that the acquisition of MEI can benefit our business including due to the comparable and complementary nature of its business with our own, there can be no guarantee that the perceived benefits of the acquisitions will be realized. The success of these acquisitions may be negatively impacted, by, among other things:

| · | Challenges in integrating MEI’s business and personnel into our operations, including in maintaining the employee and customer bases of MEI following the acquisition; |

| · | Failure to achieve the anticipated results or benefits from the acquisition, including entering into contracts with third parties and improved brand recognition and reputation due to having expanded product offerings and capabilities; |

| · | Diversion of management’s attention and resources from operational and other matters or potential disruptions in connection with our existing business; |

| · | Difficulties incorporating or fostering the growth of MEI’s operations and the personnel we retained with our existing business; |

| · | Risks and liabilities arising from MEI’s prior operations, such as performance, operational, product liability or workforce or other compliance or tax issues, some of which we may not have discovered or accurately estimated during our due diligence and may not be covered by indemnification obligations; and |

| · | Additional financial reporting and accounting challenges. |

We cannot assure you that we will successfully integrate or manage MEI’s business in a manner which results in the benefits sought, or avoids unanticipated negative consequences, which may materially adversely impact our business and an investment in us.

We may be unable to successfully execute our acquisition strategy, which may have adverse impacts on our growth and your investment.

We plan to continue to seek potential acquisitions and strategic partnerships to grow and enhance our existing business, operating capabilities and market presence. Although we plan to identify and pursue suitable acquisition and partnership candidates that complement our business, there is no guarantee any suitable candidates will be identified. We may incur substantial costs in searching for and conducting due diligence on potential candidates that do not result in a successful acquisition or partnership opportunity. If we do acquire a suitable candidate through an acquisition, there can be no assurances that we can successfully complete the integration process of the acquired business without substantial costs, delays, disruptions, or other operational or financial problems, including due to the potential risks described in the immediately preceding risk factor. Any failure or inability to detect liabilities and risks during the due diligence failure, and a resulting assumption of unknown liabilities could materially adversely affect our results of operations and financial position. Further, in searching for suitable acquisition or partnership candidates, our management’s attention may be diverted from operational and other matters that may lead to potential disruptions in our existing business. Accordingly, we cannot assure you that we will successfully complete any transactions of the nature described above, and any completed transaction could negatively impact our business, results of operation, and financial condition, which may negatively impact your investment.

If the inflationary pressures in the United States and elsewhere where we operate continue, we could experience reduced margins and lose future business.

While the current inflationary pressures have not materially affected our margins, and inflation in the U.S. has declined in response to increased interest rates which began in 2022, we could become subject to adverse inflationary pressures on the raw materials, labor and other goods and services we utilize in our operations. Supply chain shortages or delays can further cause problems in our manufacturing and sale of products, including by contributing to pricing pressures experienced by us. To the extent we increase prices in the future to account for increases in operating costs arising from inflation or otherwise, such action could result in reduced demand for our products, and/or customer loss. Similarly, rising labor costs in the U.S. may further tighten margins.

Our inventories may become obsolete and other assets may be subject to risks.

The life cycles of some of our products depend heavily upon the life cycles of the end products into which our products are designed. Products with short life cycles require us to manage closely our production and inventory levels. Inventory may also become obsolete because of adverse changes in end-market demand. We may in the future be adversely affected by obsolete or excess inventories which may result from unanticipated changes in the estimated total demand for our products or the estimated life cycles of the end products into which our products are designed. The asset values determined under Generally Accepted Accounting Principles for inventory and other assets each involve the making of material estimates by us, many of which could be based on mistaken assumptions or judgments.

Environmental regulations could require us to incur significant costs.

In the conduct of our manufacturing operations, we have handled and do handle materials that are considered hazardous, toxic or volatile under federal, state and local laws and, therefore, are subject to regulations related to their use, storage, discharge and disposal. No assurance can be made that the risk of accidental release of such materials can be completely eliminated. In the event of a violation of environmental laws, we could be held liable for damages and the cost of remediation and, along with the rest of the semiconductor industry, we are subject to variable interpretations and governmental priorities concerning environmental laws and regulations. Environmental statutes have been interpreted to provide for joint and several liability and strict liability regardless of actual fault. There can be no assurance that we will not be required to incur costs to comply with, or that our operations, business or financial condition will not be materially affected by current or future environmental laws or regulations.

Our business is highly competitive and increased competition could reduce gross profit margins and the value of an investment in our Company.

The semiconductor industry, and the semiconductor product markets specifically, are highly competitive. Competition is based on price, product performance, quality, turn-around time, reliability and customer service. The gross profit margins realizable in our markets can differ across regions, depending on the economic strength of end-product markets in those regions. Even in strong markets, price pressures may emerge as competitors attempt to gain more market share by lowering prices, which may in turn force us to lower prices or lose existing business which we may be unable to replace in whole or in part. Competition in the various markets in which we participate comes from companies of various sizes, many of which are larger and have greater financial and other resources than we have and thus can better withstand adverse economic or market conditions. In addition, companies not currently in direct competition with us may introduce competing products in the future.

Our operating results may decrease due to the decline of profitability or other adverse developments in the semiconductor industry.

Intense competition and a general slowdown in the demand for military-rated semiconductors worldwide have resulted in decreases in the profitability of many of our products. In 2023, the demand and sales for semiconductors worldwide saw a significant decline. We expect that profitability for many of our products will continue to decline in the future, and/or fluctuate in an unpredictable manner. A decline in profitability for our products, if not offset by reductions in the costs of manufacturing these products, increased volumes, increases in the profitability of our other products, or the development and introduction of new products that are more profitable, would result in decreasing our profitability and could have a material adverse effect on our business, financial condition and results of operations.

We may not achieve the intended effects of our business strategy which could adversely impact our business, financial condition and results of operations.

In recognition of the changes in global geopolitical affairs and in United States military spending, we have for a number of years attempted to increase sales of our products for non-military, scientific and industrial niche markets, such as medical electronics, machine tool controls, satellites, telecommunications networks and other market segments in which purchasing decisions are generally based primarily on product quality, long-term reliability and performance, rather than on product price. We are also attempting to offer additional products to the military markets that are complementary to those we currently sell to the military markets. We cannot assure you that these efforts will be successful and, if they are, that they will have the intended effects of increasing profitability. Furthermore, as we attempt to shift our focus to the sale of products having non-military, non-aerospace applications, we will be subject to greater price erosion and foreign competition.

Our inability to introduce new products could result in decreased revenues and loss of market share to competitors; new technologies could also reduce the demand for our products.

Rapidly changing technology and industry standards, along with frequent new product introductions, characterize the semiconductor industry. Our success in these markets depends on our ability to design, develop, manufacture, assemble, test, market and support new products and enhancements on a timely and cost-effective basis. There can be no assurance that we will successfully identify new product opportunities and develop and bring new products to market in a timely and cost-effective manner or those products or technologies developed by others will not render our products or technologies obsolete or noncompetitive. A fundamental shift in technology in our product markets could have a material adverse effect on us. Changes in technology may reduce the demand for the products we offer. For example, new or developing technologies could displace the military or aerospace equipment and activities to which our product offerings relate, and improvements in existing technology may allow competitors to enhance their products or produce them in a more cost-effective manner and in turn pose a threat to our market share. Alternatively, our customers could perform more manufacturing processes internally, including due to acquisitions with others in our or their industry, which would cause our business to suffer. In light of the fact that many of our competitors have substantially greater revenues than us and that we have not spent significant funds on research and development in recent years, we may not be able to accomplish the foregoing, which might have a material adverse effect on the Company, our business, prospects, financial condition or results of operations.

The nature of our products exposes us to potentially significant product liability risk.

Our business exposes us to potential product liability risks that are inherent in the manufacturing and marketing of high-reliability electronic components for critical applications. No assurance can be made that our product liability insurance coverage is adequate or that present coverage will continue to be available at acceptable costs, or that a product liability claim would not materially and adversely affect our business, prospects, financial condition or results of operations.

We depend on the recruitment and retention of qualified personnel and our failure to attract and retain such personnel could seriously harm our business.

Due to the specialized nature of our business, our future performance is highly dependent on the continued services of our key engineering personnel and executive officers. Our prospects depend on our ability to attract and retain qualified engineering, manufacturing, marketing, sales and management personnel for our operations as well as conduct appropriate succession planning for our executive officers. Competition for personnel is intense, and we may not be successful in attracting or retaining qualified personnel. Our failure to compete for these personnel could seriously harm our business, prospects, results of operations and financial condition.

Failure to protect our proprietary technologies or maintain the right to use certain technologies may negatively affect our ability to compete.

We rely heavily on our proprietary technologies. Our future success and competitive position may depend in part upon our ability to obtain or maintain protection of certain proprietary technologies used in our principal products. We do not have patent protection on any aspects of our technology, and certain of our technology was previously protected by patents that have since expired or lapsed. Our reliance upon protection of some of our technology as “trade secrets” will not necessarily protect us from the use by other persons of our technology, or their use of technology that is similar or superior to that which is embodied in our trade secrets. Others may be able to independently duplicate or exceed our technology in whole or in part, or otherwise gain access to proprietary aspects of our products and processes, notwithstanding our efforts to protect these aspects of our business. We may not be successful in maintaining the confidentiality of our technology, dissemination of which could have material adverse effects on our business. In addition, litigation may be necessary to determine the scope and validity of our proprietary rights.

Obtaining or protecting our proprietary rights may require us to defend claims of intellectual property infringement by our competitors. We could become subject to lawsuits in which it is alleged that we have infringed or are infringing upon the intellectual property rights of others with or without our prior awareness of the existence of those third-party rights, if any.

If any infringements, real or imagined, exist, arise or are claimed in the future, we may be exposed to substantial liability for damages and may need to obtain licenses from the patent owners, discontinue or change our processes or products or expend significant resources to develop or acquire non-infringing technologies. We may not be successful in such efforts, or such licenses may not be available under reasonable terms. Our failure to develop or acquire non-infringing technologies or to obtain licenses on acceptable terms or the occurrence of related litigation itself could have material adverse effects on our operating results, financial condition and cash flows.

We cannot guarantee that we will have sufficient capital resources to make necessary investments in manufacturing technology and equipment.

The semiconductor industry is capital intensive. Semiconductor manufacturing requires a regular upgrading of process technology to remain competitive, as new and enhanced semiconductor processes are developed which permit smaller, more efficient and more powerful semiconductor devices. We maintain certain of our own manufacturing, assembly and test facilities, which have required and will continue to require significant investments in manufacturing technology and equipment, especially for new technologies we develop. We are also attempting to add the appropriate level and mix of capacity to meet our customers' future demand. There can be no assurance that we will have sufficient capital resources to make necessary investments in manufacturing technology and equipment. Although we believe that anticipated cash flows from operations and existing cash reserves will be sufficient to satisfy our future capital expenditure requirements, we cannot guarantee that this will be the case or that alternative sources of capital or credit will be available to us on favorable terms or at all.

We may make substantial investments in plant and equipment that may become impaired or obsolete.

Some of our investments in plant and equipment support particular technologies, processes or products, and may not be applicable to other or newer technologies, processes or products. Also, the ability to relocate and qualify equipment for our operations, whether within our Company or to and from third party contractors could be time consuming and costly. To the extent we invest in more equipment, or a mix of equipment, than we can use efficiently, experience low plant or equipment utilization due to reduced demand or adverse market conditions, our plant or equipment becomes older or outmoded, or we are not able to efficiently recover and/or utilize equipment on loan at third party contractors, we may incur significant costs or impairment charges that could materially adversely affect our results of operation and financial condition.

While we attempt to monitor the creditworthiness of our customers, we may be at risk due to the adverse financial condition of one or more customers.

We have established procedures for the review and monitoring of the creditworthiness of our customers and/or significant amounts owing from customers. Despite our monitoring and procedures, especially in the current macroeconomic situation, we may find that, despite our efforts, one or more of our customers become insolvent or face bankruptcy proceedings. Such events could have an adverse effect on our operating results if our receivables applicable to that customer become uncollectible in whole or in part, or if our customers' financial situation result in reductions in whole or in part of our ability to continue to sell our products or services to such customers at the same levels or at all.

Our international operations expose us to material risks, including risks under U.S. export laws.

A portion of our revenue is derived from foreign sources. Revenues from foreign markets as a percentage of total revenues may be substantial or higher in future periods as we attempt to diversify our business and seek new sources of revenue. Our involvement in foreign markets exposes us to certain risks. Among others, these risks include: changes in, or impositions of, legislative or regulatory requirements, including tax laws in the United States and in the countries in which we manufacture or sell our products; trade restrictions; transportation delays; work stoppages; economic and political instability; crime; kidnapping; war; terrorism; and fluctuating foreign currency and prices and exchange rates. Additionally, in certain jurisdictions where we use third party contractors, the legal systems do not provide effective remedies to us when the contractor has breached its obligation or otherwise fails to perform.

In addition, it is more difficult in some foreign countries to protect our products or intellectual property rights to the same extent as is possible in the United States. Therefore, the risk of piracy or misuse of our technology and product may be greater in these foreign countries. Although we have not experienced any material adverse effect on our operating results as a result of these and other factors, such factors could have a material adverse effect on our financial condition and operating results in the future.

If we fail to comply with anti-bribery, anti-corruption, anti-money laundering laws, and similar laws, or allegations of such failure, it could have a material adverse effect on our business, financial condition and operating results.

We are subject to various anti-bribery, anti-corruption, anti-money laundering laws, including the U.S. Foreign Corrupt Practices Act of 1977 (the “FCPA”), the U.S. Travel Act, and the USA PATRIOT Act. In addition, to the extent we operate or do business in foreign jurisdictions, we are or may become subject to similar or corresponding laws and regulations in those jurisdictions. Anti-corruption and anti-bribery laws have been enforced aggressively in recent years and are interpreted broadly to generally prohibit companies, their employees, agents, representatives, business partners, and third-party intermediaries from authorizing, offering, or providing, directly or indirectly, improper payments or benefits to recipients in the public or private sector.

We, our employees, agents, representatives, business partners and third-party intermediaries may have direct or indirect interactions with officials and employees of government agencies or state-owned or affiliated entities and may be held liable for the corrupt or other illegal activities of these employees, agents, representatives, business partners or third-party intermediaries even if we do not explicitly authorize such activities.

These laws also require that we keep accurate records and maintain internal controls and compliance procedures designed to prevent any such actions. While we have policies and procedures to address compliance with such laws, we cannot assure you that none of our employees, agents, representatives, business partners or third-party intermediaries will take actions in violation of our policies and applicable law, for which we may be ultimately held responsible. In addition, we may be held liable for violations committed of the FCPA or similar foreign laws by companies that we acquire.

Any alleged or actual violation of the FCPA or other applicable anti-bribery, anti-corruption laws, and anti-money laundering laws could result in whistleblower complaints, investigations, enforcement actions, fines and other criminal or civil sanctions, adverse media coverage, loss of export privileges, or suspension or termination of government contracts. Responding to any investigation or enforcement action would require significant attention of our management and resources, including significant defense costs and other professional fees. Failure to comply with anti-bribery, anti-corruption, anti-money laundering laws, and similar laws, or allegations of such failure, could therefore have a material adverse effect on our business, results of operations, financial condition and future prospects.

Compliance with regulations regarding the use of "conflict minerals" could limit the supply and increase the cost of certain metals used in manufacturing our products.

Pursuant to Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, the Securities and Exchange Commission (the “SEC”) promulgated disclosure rules for manufacturers of products containing certain minerals which are mined from the Democratic Republic of Congo and adjoining countries. These "conflict minerals" are commonly found in metals used in the manufacture of semiconductors. Manufacturers are also required to disclose their efforts to prevent the sourcing of such minerals and metals produced from them. While certain aspects of these rules continue to be litigated and a ruling by the Federal Court of Appeals for the D.C. Circuit has led to further uncertainty regarding the SEC’s enforcement of the rule, the disclosure rules, as modified by the ruling, went into effect in 2014. The implementation of these regulations may limit the sourcing and availability of some of the metals used in the manufacture of our products. The regulations may also reduce the number of suppliers who provide conflict-free metals and may affect our ability to obtain products in sufficient quantities or at competitive prices. Finally, some of our customers may elect to disqualify us as a supplier if we are unable to verify that the metals used in our products are free of conflict minerals.

Risks Related to Government Contracts and Policies

We are dependent on government contracts, which are subject to termination, price renegotiations and regulatory compliance, which can increase the cost of doing business and negatively impact our revenues.

All of our contracts with the United States Government and its prime contractors contain customary provisions permitting termination at any time at the convenience of the United States Government or its prime contractors upon payment to us for costs incurred plus a reasonable profit. Certain contracts are also subject to price renegotiations in accordance with United States Government sole source procurement provisions. Nevertheless, we cannot assure you that the foregoing government contracting risks will not materially and adversely affect our business, prospects, financial condition or results of operations. Furthermore, we cannot assure you that we would be able to procure new government contracts to offset any revenue losses incurred due to early termination or price renegotiation of existing government contracts.

Our government business is also subject to specific procurement regulations, which increase our performance and compliance costs. These costs might increase in the future, reducing our margins. Failure to comply with procurement regulations could lead to suspension or debarment, for cause, from government subcontracting for a period of time. Among the causes for debarment are violations of various statutes, including those related to procurement integrity, export control, government security regulations, employment practices, protection of the environment, and accuracy of records. The termination of a government contract or relationship as a result of any of these violations would have a negative impact on our reputation and operations and could negatively impact our ability to obtain future government contracts.

Changes in government policy or economic conditions could negatively impact our results.

A large portion of the Company’s sales are to military and aerospace markets which are subject to the business risk of changes in governmental appropriations and changes in national defense policies and priorities.

Our results may also be affected by changes in trade, monetary and fiscal policies, laws and regulations, or other activities of U.S. and non-U.S. governments, agencies and similar organizations. Furthermore, our business, prospects, financial condition and results of operations may be adversely affected by the shift in the requirement of the United States Department of Defense policy toward the use of standard industrial components over the use of high reliability components that we manufacture. Our results may also be affected by social and economic conditions, which impact our sales, including in markets subject to ongoing political hostilities, such as regions of the Middle East.

Changes in Defense related programs and priorities could reduce the revenues and profitability of our business.

We depend on the U.S. government and its suppliers for a substantial portion of our business, and changes in government defense spending and priorities could have consequences on our financial position, results of operations and business. U.S. government contracts are subject to uncertain levels of funding and timing, as well as termination. The funding of U.S. government programs is subject to congressional appropriations, which are made on a fiscal year basis even for multi-year programs. Consequently, programs are often only partially funded initially and may not continue to be funded in future years. We may also experience significant changes in our operating profit margins as a result of variations in sales, changes in product mix, price competition for orders and costs associated with the introduction of new products.

The U.S. federal government is presently in discussions regarding increasing its debt ceiling, and is constantly evaluating its budget in general, either of which could result in the adoption of changes in current government spending programs, trends or practices in a manner which adversely affects us or our customers or industry. For example, in recent years the U.S. has experienced an increased focus among policymakers and other stakeholders towards climate change and other environmental/social/governance, or “ESG,” initiatives and away from traditionally more highly prioritized budgetary items such as military and defense programs. If the U.S. federal government elects to reduce spending on programs on which our business depends, our business, and your investment in us, could be materially adversely affected.

General Risks

Because of continued conflicts abroad, as well as high inflation and increased Federal Reserve interest rates in response, the effect on the capital markets and the economy is uncertain, and we may have to deal with a recessionary economy and economic uncertainty including possible adverse effects upon our business and industry.

Our operations and those of third party customers and suppliers on which we depend are or may become subject to widescale risks beyond our control, including the continued conflicts in the Ukraine and Middle East affecting the global and United States economies, continued inflation, higher Federal Reserve interest rates, substantial increases in the prices of various raw materials, goods and services, and declines in the capital markets. While this has initially caused increased defense spending by the United States and other countries, the extent and duration of these events and their impact are at best uncertain, and continuation may result in adverse consequences to us, third parties on which we rely, our industry or the economy in general. The U.S. economy may experience a recession with uncertain and potentially severe impacts upon public companies and us. We cannot predict how this will affect the market for solid‑state semiconductor components and related devices, but the impact may be adverse. For example, if our customers are no longer able to pay us on existing contracts or are unwilling or unable to enter into new contracts for our products due to an economic downturn, our operating results would be materially adversely impacted.

Security breaches and other disruptions could compromise the integrity of our information and expose us to liability, which would cause our business and reputation to suffer.

We routinely collect and store sensitive data, including intellectual property and other proprietary information about our business and that of our customers, suppliers and business partners. The secure processing, maintenance and transmission of this information is critical to our operations and business strategy. Despite our security measures, our information technology and infrastructure may be vulnerable to attacks by hackers or breached due to employee error, malfeasance or other disruptions. Any such breach could compromise our networks and the information stored there could be accessed, publicly disclosed, lost or stolen. Any such access, disclosure or other loss of information could result in legal claims or proceedings and liability under laws that protect the privacy of personal information. It could also result in regulatory penalties, disrupt our operations and the services we provide to customers, damage our reputation and cause a loss of confidence in our products and services, which could adversely affect our business/operating margins, revenues and competitive position.

Our failure to remediate the material weaknesses in our internal control over financial reporting or our identification of any other material weaknesses in the future may adversely affect the accuracy and timing of our financial reporting.

We are responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Rule 13a-15(f) and Rule 15d-15(f) under the Securities Exchange Act of 1934 (the “Exchange Act”). A material weakness is defined as a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented or detected on a timely basis.

We have implemented remediation measures and we are in the process of identifying any additional appropriate remediation measures. There is the potential that our remediation efforts may not be successful. Until our remediation plan is fully implemented, our management will continue to devote significant time and attention to these efforts. If we fail to complete our remediation plan in a timely fashion, or at all, or if our remediation plan is inadequate or we encounter difficulties in the implementation or maintenance of our internal control over financial reporting or disclosure controls and procedures, there will continue to be an increased risk that we will be unable to timely file future periodic reports with the SEC. In addition, any failure to implement our remediation plan or any difficulties we encounter with our remediation plan could result in additional material weaknesses or deficiencies in our internal control or future material misstatements in our annual or interim financial statements. Further, if any other material weakness or deficiency in our internal control over financial reporting exists and goes undetected, our financial statements could contain material misstatements that, when discovered in the future, could cause us to fail to meet our future reporting obligations. Moreover, our failure to remediate the material weaknesses identified in this Form 10-K or the identification of additional material weaknesses, could adversely affect our stock price and investor confidence.

Natural disasters, like hurricanes, or occurrences of other natural disasters whether on our production facility, in the United States or internationally may affect the markets in which our common stock trades, the markets in which we operate and our profitability.